Arches National Park

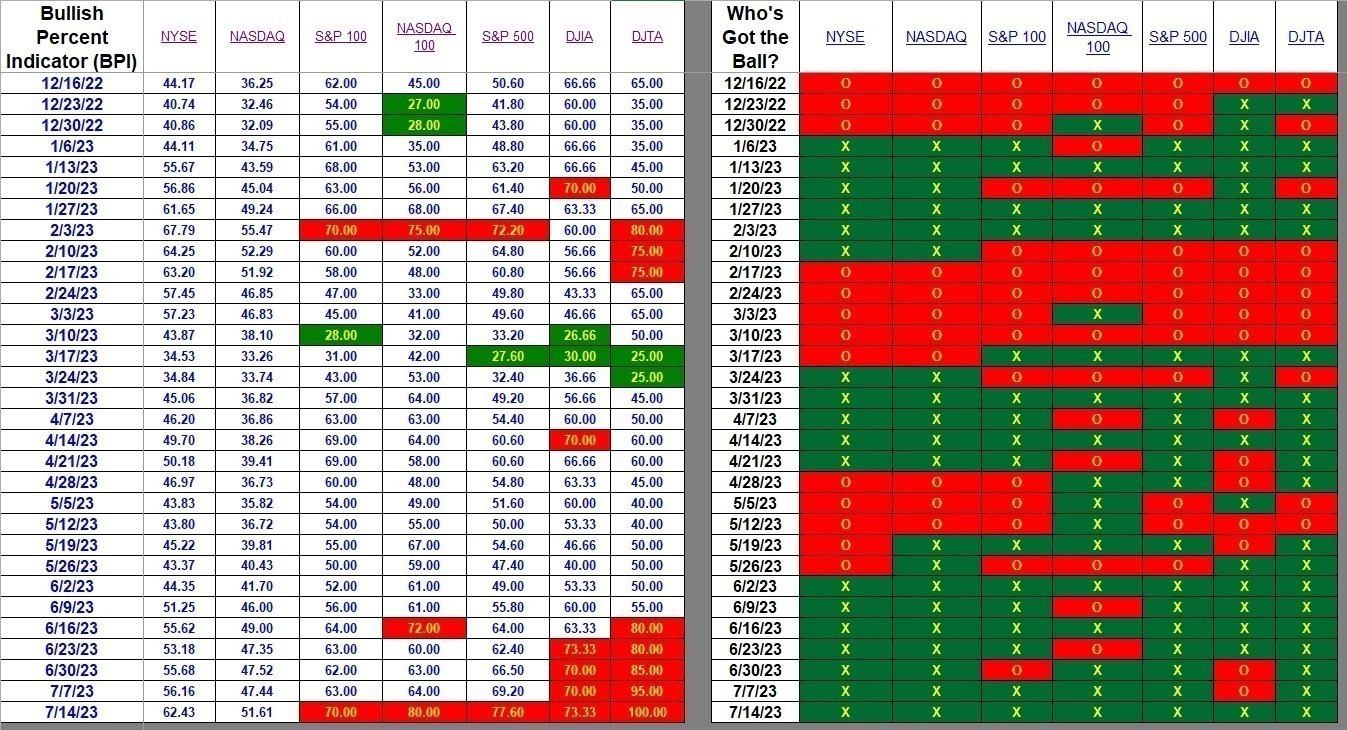

Investors employing the Sector BPI Plus model will find useful information in the follow Bullish Percent Indicator data. Looking at the index information we see a U.S. stock market driven by large-cap stocks. Small- and mid-cap stocks are strengthening, but have yet to fully participate in the upward trend.

Be sure to check out the percentage changes in the Sector section or the second screenshot.

Index BPI

The two broad indexes, NYSE and NASDAQ continue to hover around the 50% to 60% mark or what is an average market. Neither bearish or bullish. Not so for large-cap stocks as the five indexes containing larger companies are off to the races. All are overbought indicating a lot of strength in big companies. This upward trend is having a positive impact on VOO and SPY or the S&P 500 companies.

Sector BPI

New sectors moving into the overbought zone are: Energy and Financial. This week I set Trailing Stop Loss Orders (TSLOs) for VDE and VFH as I use Vanguard ETFs in the Sector BPI portfolios. TSLOs were already in place for the other overbought sectors.

Check out the Technology column. A Sector BPI investor would have purchased VGT back on 12/30/22 and then set a 3% TSLO on 1/27/23. The VGT holding was most likely sold in late winter of 2023 only to see another overbought signal return on 5/19/2023. This movement is an example of missing out on the second rise in Technology. This is exactly the reason for adding Dual Momentum™ type ETFs to the existing Sector BPI investment quiver.

At a minimum, add VTI, VEU, and BND to the sector investment quiver. I broaden the additions to include: VTI, ESGV, VOO, SPY, VEA, VWO, BND, AGG, and SHV. Investor applying the Sector BPI Plus model need not go to this “overlapping” extreme if you prefer to keep it simple.

Note: The ITA blog is now free to all who register as a Guest. Give me 24 to 48 hours to move you from Guest up to Platinum so you can see more of the blog.

Questions and Comments are always welcome so drop your ideas into the Comment section provided with each blog post.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.