Baltimore Crab Sculpture

Bullish Percent Indicators experienced few changes this week as it was a rather quiet period for U.S. Equities. Several Sector BPI Plus portfolios are up for review this week so I’ll be alert to any changes that might occur within the Sector BPI portion of the BPI spreadsheet.

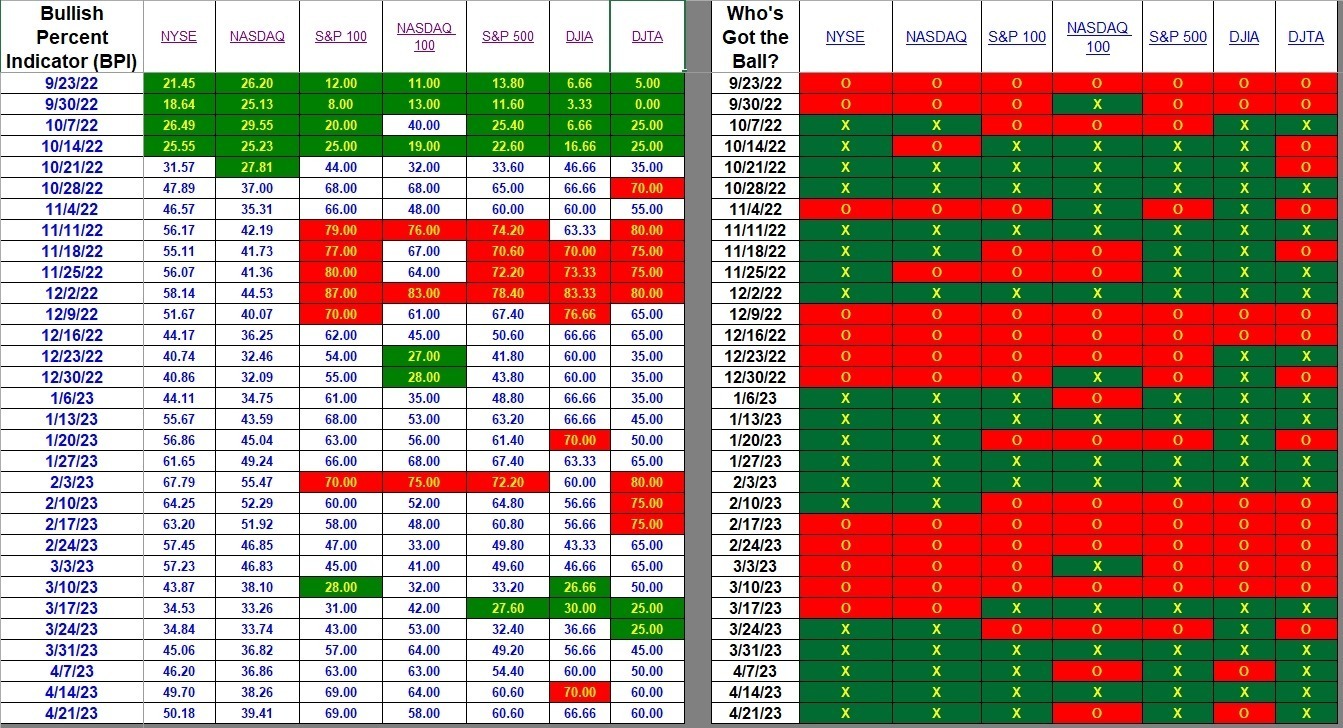

Index BPI

No indexes are either oversold or overbought. Most indexes lie close to the 50% level or what I think of as a fair valued stock market. The NASDAQ 100 and Dow Jones Industrial Average (DJIA) dropped from bullish to bearish. That is likely the result of one or two tech stocks moving into bearish territory.

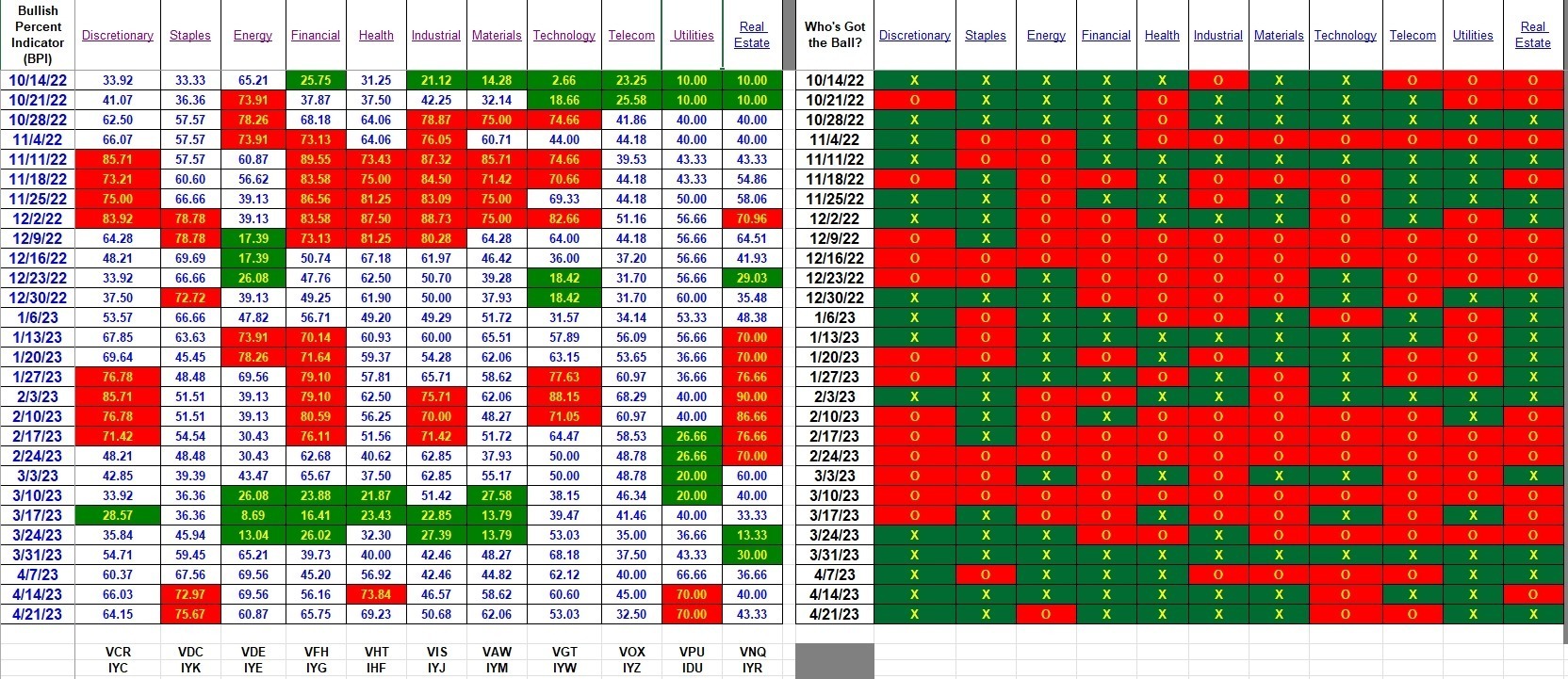

Sector BPI

The following data table is the one we use for guiding our Sector BPI Plus portfolio decision making. If you are holding Staples (VDC or IYK) or Utilities (VPU or IDU) in any of your portfolios, place a 3% TSLO under the holding. None of the ITA portfolios hold Staples, but all hold Utilities (VPU). TSLOs were set at least one week ago when the sector moved into the overbought zone.

VHT holdings also are under a 3% TSLO setting. One sector to watch this week is Financial (VFH) as a Buy order was placed several weeks ago and this sector is approaching the overbought zone. When it looks like one or more sectors move to 30% bullish or below or 70% bullish or above, I update the BPI spreadsheet and send out a notification. This is generally done in the context of a Sector BPI portfolio update.

Explaining the Hypothesis of the Sector BPI Model

Carson Portfolio Update: 18 November 2022

New members would do well to educate themselves when it comes to the Sector BPI Plus model. This week I’ll be reporting on several portfolios that are managed using this model. To see which portfolio are coming up for review, check the middle footer below.

The ITA blog is now free to all who register as a Guest. After registering, wait for me to upgrade you to the Platinum level so you are able to see nearly all parts of the blog. Share this URL with family and friends. [ https://itawealth.com ]

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

I’m still holding VDE as I decided to test the notation of how close to 70% is OK to sell. Correct me if I’m wrong but I don’t think the BPI ever got above the 69.56%. Right now that leaves me about at 0 profit. I guess this is getting into the “weeds” of BPI:^ )

Bob W.

Bob,

Correct. Energy (VDE) never made it into the overbought zone. Close, but never there. If memory serves, it never made it during the week.

Lowell

Notice: Health (VHT) moved back into the overbought zone so if you have not placed a 3% TSLO under VHT, I highly recommend you do so this morning. This recommendation is for those using the Sector BPI model with one or more portfolios.

Lowell

Lowell

I think VOX is a good ETF for the Communication Service sector. However the chart above also shows IYZ as a choice. IYZ has a negative Morningstar rating plus its portfolio is much different than VOX . Morningstar shows IYZ holding the following: Cisco 17%, Version 14% Comcast 14% AT&T 4.5% .On the other hand VOX has META 15%, GoogA 13% GoolC 11%, Disney 6%

Bottom line not sure IYZ is the correct Ishare for this Sector.

Bob

Bob P,

IYZ is classified as a communications ETF. IYZ and VOX do not track together when checked on Finance-Yahoo due to different holdings.

Lowell