Japanese Garden

Despite a strong day or two this week, Bullish Percent Indicators paint a slightly weak outcome for U.S. Equities. This is the case for both the broad indexes as well as the individual market sectors.

The call for a Buy in Utilities a week ago is paying off as readers will see in the second table.

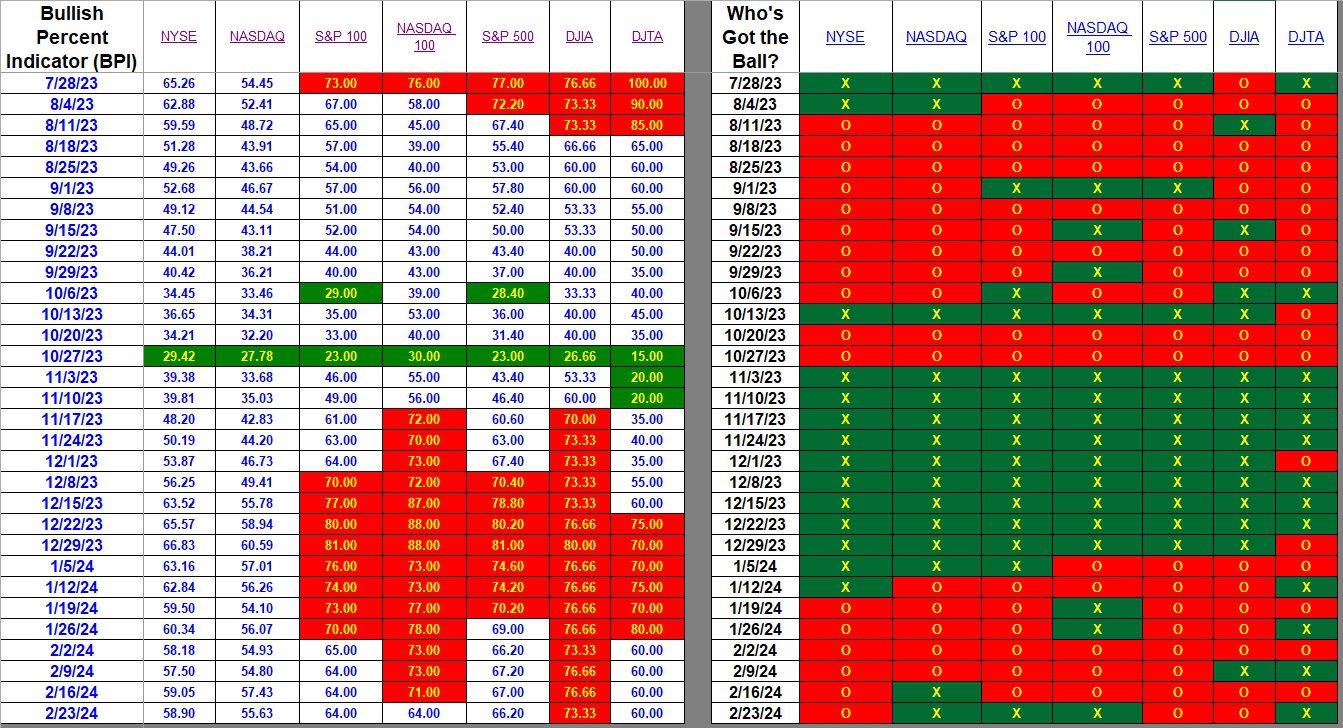

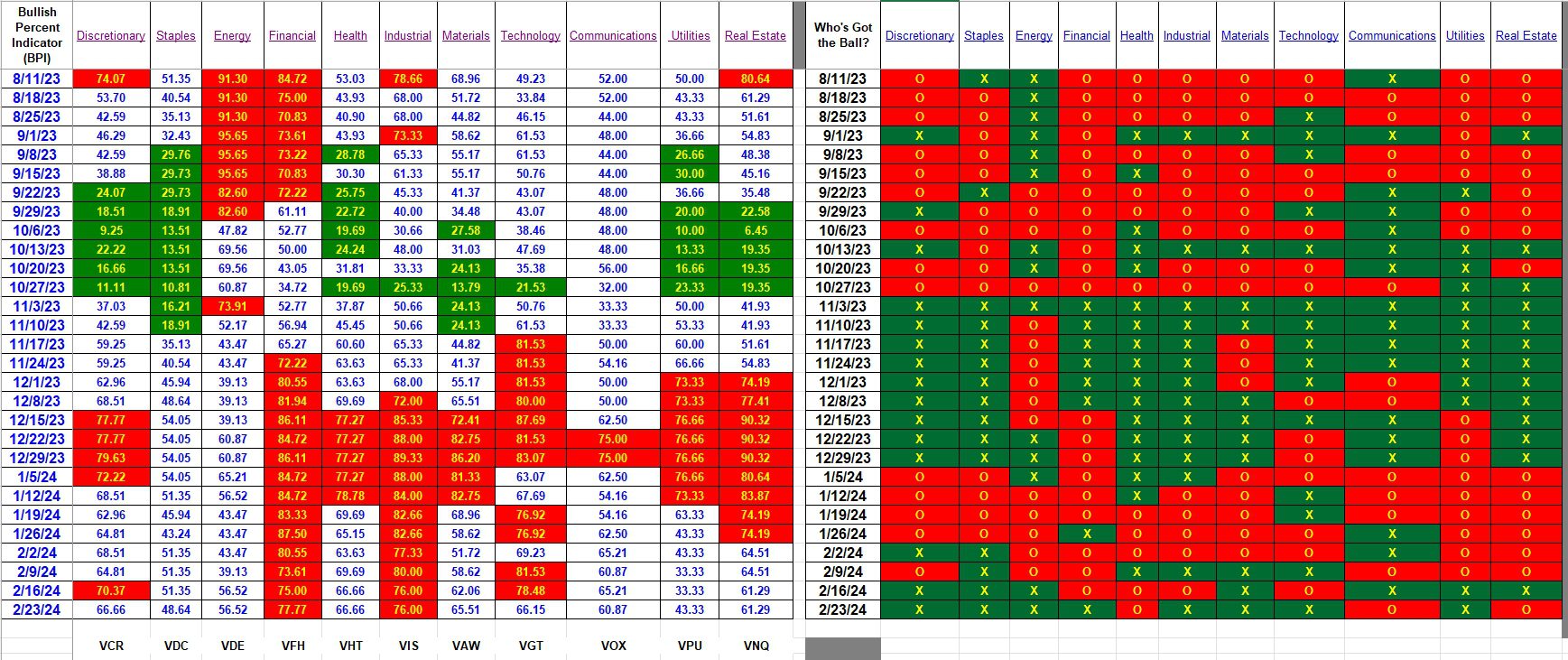

As you check the tables below, use the right-hand side where there are X’s and O’s to provide the big and quick picture. However, the more important information is gleaned from the specific percentages on the left side of the tables. The percentages drill down to provide more important details of what is happening to the U.S. Equities market.

Index BPI

While over half of the indexes are bullish, all either remained static or dropped in the percentage of bullish stocks. Three indexes (S&P 100, NASDAQ 100 and DJTA) are what I call anomalies in that each turned bullish this week, but either retained the same percentage of bullish stocks or declined in bullish stocks. This happens when the market begins weak, but ends on a strong note. Situations such as this is exactly why I prefer to pay more attention to what is happening on the left side of the table.

Sector BPI

As with the indexes, over half the sectors are bullish when we check the right-hand side of the table. Checking the percentages we find that Financial, Materials, and Utilities are the only three that improved in the number of bullish stocks within the sector. Utilities showed the greatest gain as it moved from 33.33% to 43.33% bullish.

If you are managing a Sector BPI portfolio there are no changes this week. While Financial and Industrial are overbought, I think TSLOs were either struck or are still in place for any holdings in VFH or VIS.

As I recall, sectors currently positioned in the Sector BPI portfolios are Staples (VDC) and Utilities (VPU). No action is required with either sector.

If new readers need more explanations as to how the Sector BPI portfolios are managed, post questions in the Comment section provided with each blog post.

Pass on the link to this blog to your friends and family.

Lowell

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.