Looking forward to the 2025 crop of iris.

Bullish Percent Indicator data was last published on January 10th of this year. There was little need to publish anything over the last month as no sector action impacted any of the Sector BPI portfolios. There was one day when Staples dipped into the oversold zone, but I missed that short opportunity to purchase shares of VDC for the three (Carson, Franklin, and McClintock) portfolios following this investing model. I have limit orders in to add shares of VDC should Staples drop back into the oversold zone.

Yesterday (2/7/2025) the S&P 500 dropped around one percent, but it takes more than this decline to trigger much action within the Bullish Percent Indicator arena.

This post is to bring new subscribers up to data as to how this information is used to manage the Sector BPI portfolios.

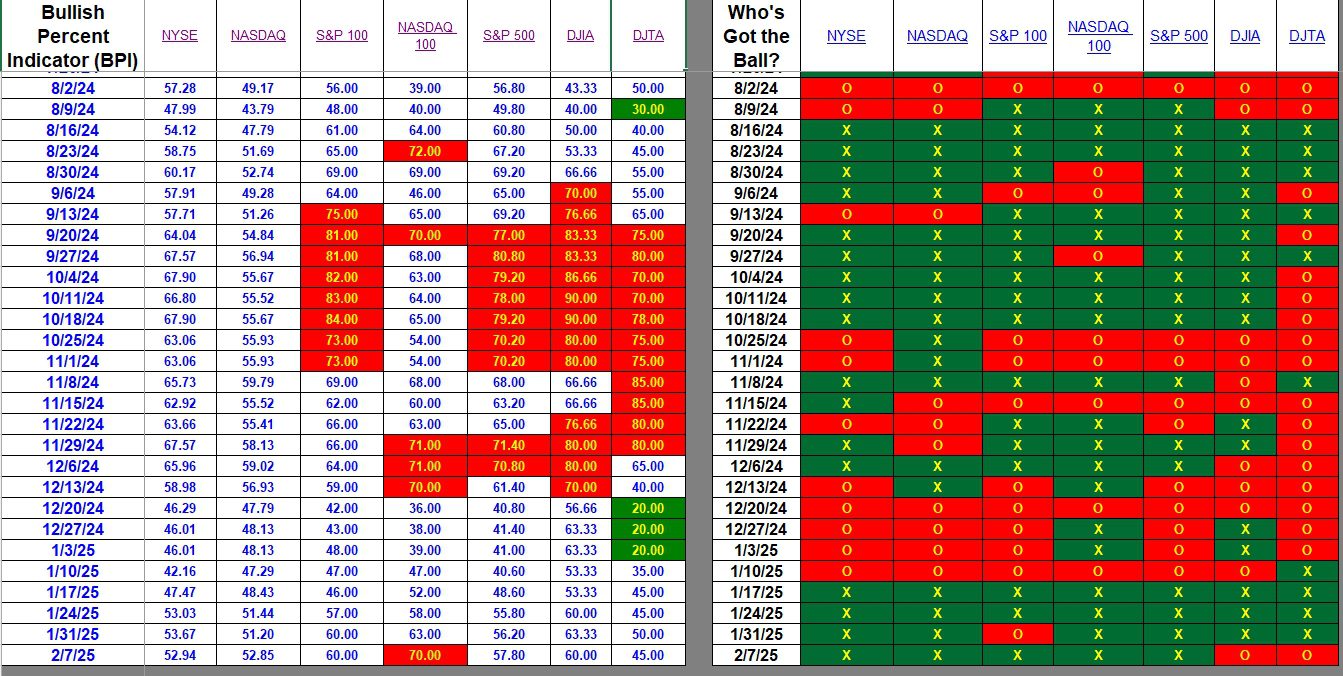

Index BPI

While there is plenty of overlap among the seven primary indexes, this information gives readers an overview as to how the broad markets are behaving. This BPI information is quite provincial in that it pertains only to U.S. Equities. None of this post relates to the international markets.

All sectors are bullish with exception of the two Dow indexes. I pay most attention to the NYSE and NASDAQ as they are broad indexes incorporating the greatest number of stocks. The NASDAQ actually increased in the number of bullish stocks. When I say “bullish” I am referring to Point and Figure (PnF) graphs. PnF graphs are a unique way to observe market movement and Exchange Traded Funds (ETFs) direction. I will not go into these types of charts as it requires a different mindset when checking in on investments. There is plenty of information on the Internet. Also look up Bullish Percent Indicators on this blog.

A 3% change is required to flip an index or sector from bullish to bearish or bearish to bullish. That is the rough percentage change required based on how I have my charts set.

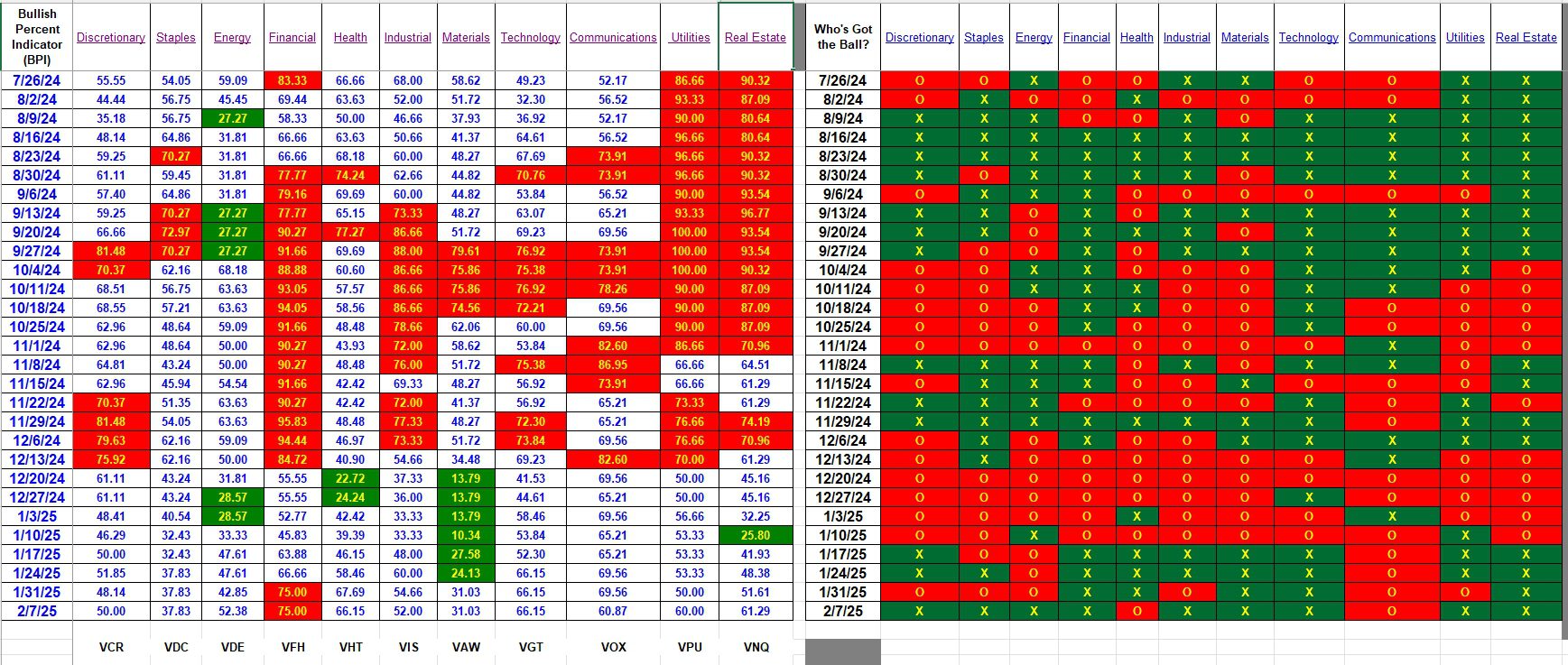

Sector BPI

In the following table the U.S. Equities Market is broken down into the classic eleven sectors. This is where we go for information when it comes to managing the Carson, Franklin, and McClintock portfolios.

- If a sector drops into the oversold zone (30% or below bullish) we purchase shares of the ETF that covers that particular sector. For example, back in December Materials dipped below the 30% bullish line. When this happened shares of VAW were purchased for the Sector BPI portfolios. We now patiently wait for the Materials sector to rise to the overbought zone or when this sector is over 70% bullish. Readers will note that the Financial sector is currently overbought.

- When a sector moves into the overbought zone we place a 3% Trailing Stop Loss Order (TSLO) on that sector ETF. Were any of the Sector BPI portfolios holding VFH a 3% TSLO would be in place. None of the three Sector BPI portfolios are holding VFH so this information is moot.

If readers will go back to the most recent Carson portfolio you will see it is holding Materials, Energy, and Health ETFs. All are currently in what is called the neutral zone. It may be many months before any reach the overbought zone. This model requires patience as do all the other ITA investment models.

The percentage to be held in a particular sector is based on the three-year volatility. The greater the volatility the higher the percentage to be held in that sector. Only in a deep recession or depression are we likely to see all eleven sectors dip into the oversold zone. So what is to be done with the remaining cash when invested in only two or three sectors at one time? This is where a special adjustment is required. We invest excess cash in the broad market and that ETF is VOO or the S&P 500. We don’t want the market running away from us to the upside so we invest in the broad market when excess cash is available.

One of the best ways to learn how the Sector BPI model works is to follow the reviews of the Carson, Franklin, and McClintock.

Two sectors, Staples and Materials are the only two sectors close to the oversold (30%) zone. Since we already hold VAW we need pay close attention to Staples (VDC).

Since launching the Sector BPI investing model some months ago, the results have been surprising on the positive side. Carson is the oldest portfolio and it was launched in November of 2022 so we have over two years of information.

Comments are always welcome. Pass this link on to your friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

No oversold or overbought changes that will impact any of the Sector BPI portfolios. Materials is oversold, but we already hold shares.

Lowell

Based on Friday’s Bullish Percent Indicator data, no changes are recommended for any of the Sector BPI portfolios. It was not a good week for U.S. Equities as every major index is now bearish with exception of the broad NASDAQ – and it declined this week by over one percentage point. The NASDAQ 100 was down two percentage points.

The DJIA took a big hit as it moved down 20 percentage points.

As for the sectors, Staples, Energy, Health, Materials, and Real Estate are bullish. The remaining six sectors are bearish.

Lowell

Still no changes in the BPI data that will impact any of the Sector BPI portfolios. Materials is oversold, but we already hold shares in that sector.

Overall, it was a weak week for U.S. Equities.

Lowell