Retired Auto Shop – Part of Forgotten Oregon

BPI Model buying guidelines. Two of the sixteen portfolios I track here on the ITA blog are now managed using the Bullish Percent Indicator (BPI) Model. They are: Carson and Franklin. Thus far there have been few buying opportunities as the U.S. Equities market is in a mini-bull phase. It may turn into a full blown bull market, but the “experts” are not predicting that to be the case. The BPI Model sell signals are quite clear. When a sector of the market moves into the over-bought zone (70% or higher BPI) we place a Trailing Stop Loss Order (TSLO) on the sector ETF. The problem on the purchase side is not so simple. The question arises, how many shares to buy, particularly when more than one sector moves into the over-sold zone (30% or lower BPI)?

The explanation below is my current thinking and I anticipate these ideas will evolve over time. There certainly will be specific decisions to make from time to time, but it helps to operate using a few basic rules.

Example Investment Quiver

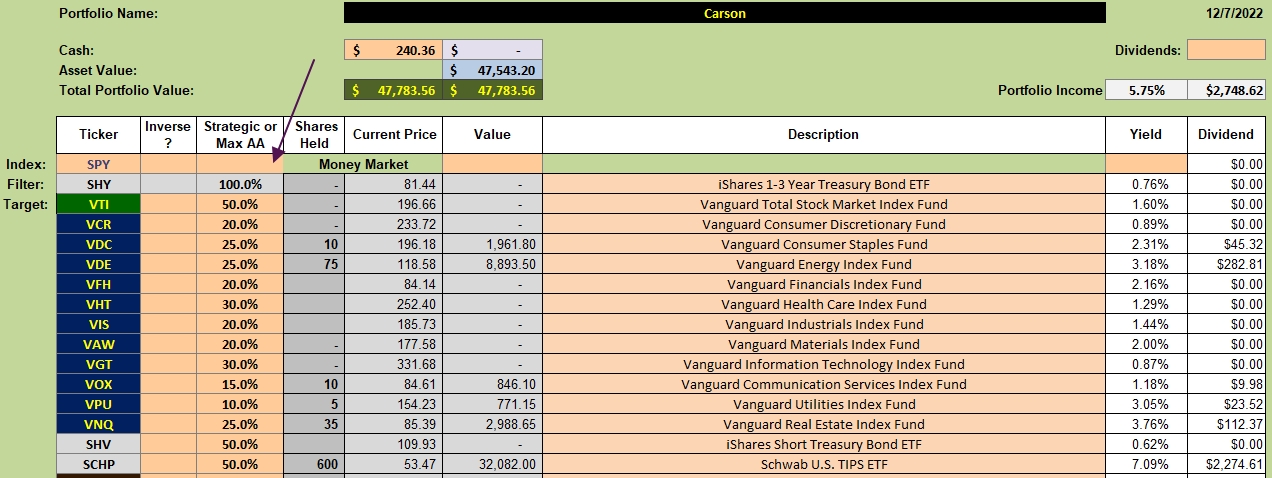

Since I’ll be checking in on the Carson this weekend and next Monday, the following investment quiver is a good starting place. The first order of business is to see if any of the current holdings represent market sectors that are over-bought. Based on the last BPI update here are the decisions facing the money manager.

- VDC is over-bought and the BPI percentage is >80% so we place a 2.0% TSLO on VDC.

- VDE is over-sold so we are faced with how many shares to add to the current 75 shares.

- VOX, VPU, and VNQ are in the “neutral” zone so we do nothing.

The purple arrow points to the maximum percentages I prefer to hold in any of the various sectors. These are my personal percentages. Your emphasis will likely differ.

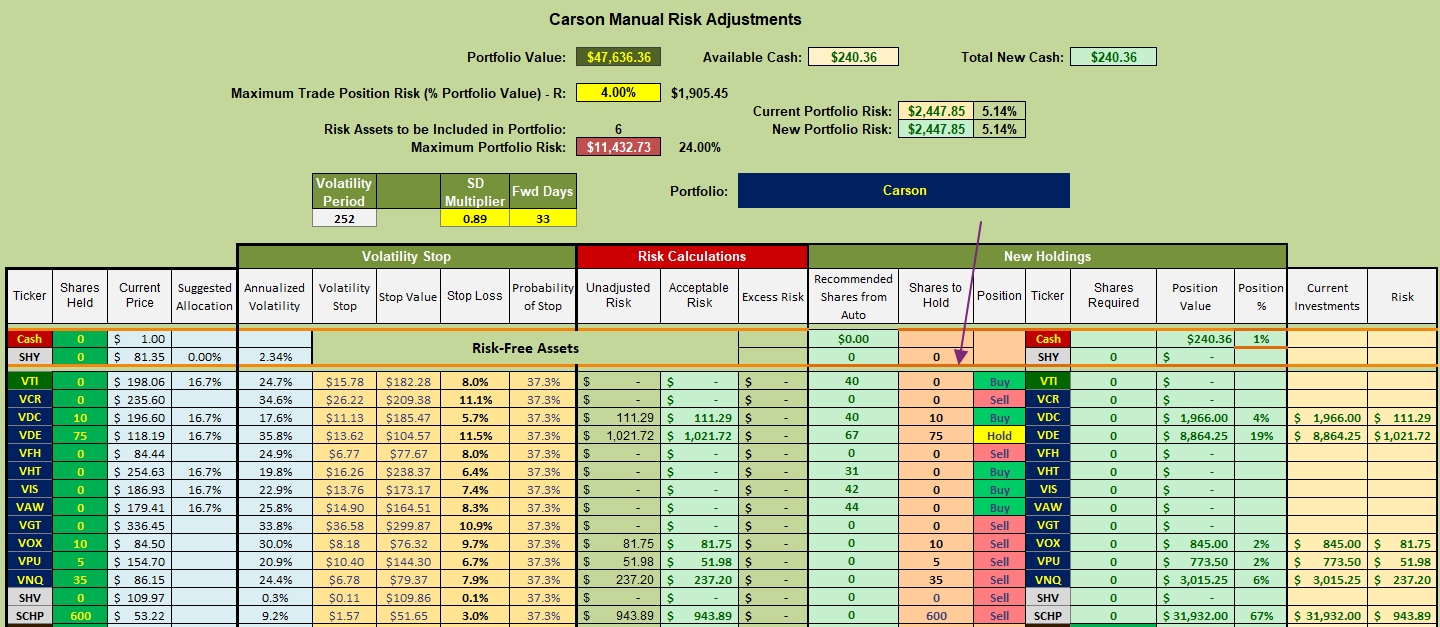

Risk Management Worksheet

The manual risk adjustment worksheet is used as a guide when recommending the number of shares to purchase.

If you check the third column from the right you will see that VDE currently holds 19% of the portfolio. Based on my asset allocation percentage limits, I can go as high as 25%. Since there is insufficient cash to add more shares to bring VDE up to 25% we need to sell shares of SCHP. It will take 25 more shares of VDE to bring the percentage of Energy up to 25%. This will require selling between 50 and 100 shares of SCHP.

When more sectors show up in the Buy zone, I’ll sell more shares of SCHP in order to purchase shares of those sector ETFs. More explanations will follow when this situation arises.

Carson Portfolio: Creating A New Investing Model

New Carson Launched: 4 November 2022

Carson Portfolio Update: 18 November 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.