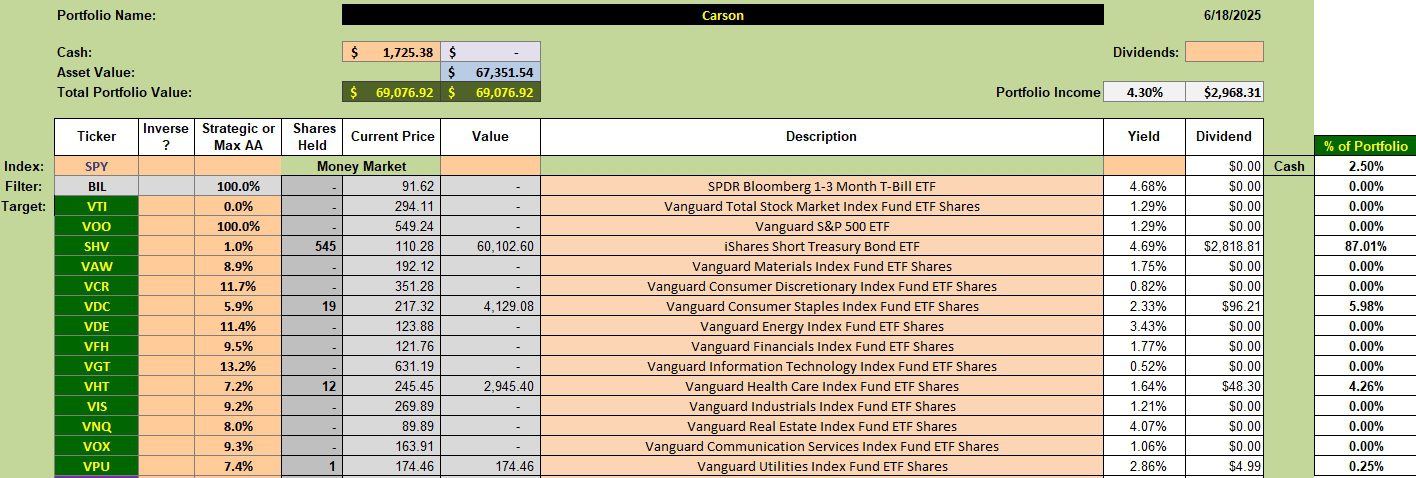

Over the last month several sectors were sold out of the Carson due to sufficient declines in the ETFs used to mirror specific sectors. Remaining in the Carson are: Consumer Staples (VDC), Healthcare (VHT), and a shard holding of Utilities (VPU). With wars and rumors of wars loaded on top of tariffs plus a no-nothing administration I’m reluctant to look to invest in VOO. In normal times I would use excess cash to purchase shares of VOO. These are not normal times so I am moving excess cash to SHV. At some point I may divide cash between VOO and SHV, but not while the Middle East is in flames.

Carson Security Holdings

Below is the conservative Carson. This makeup creates a low beta of 0.043 and in turn this causes the Treynor Ratio to “go off the chart.” More later.

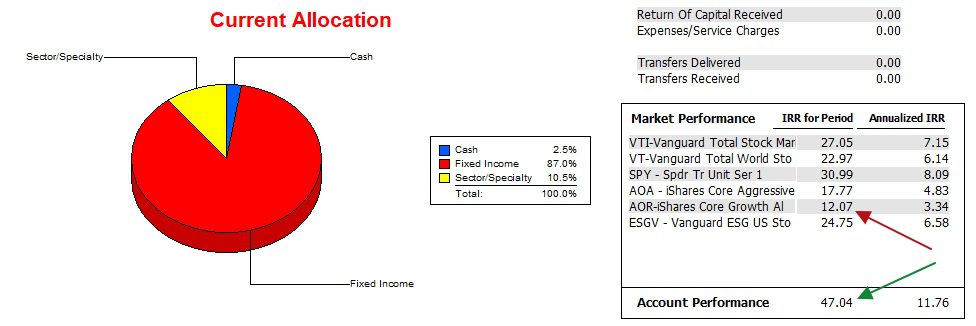

Carson Performance Data

Since 12/31/2021 the Carson continues to outperform all benchmarks, but it is giving up some ground recently due to my conservative decision making. I expect tariffs will begin to have an impact in the third and fourth quarters. If we avoid a correction over the next six months we will know we have an extremely strong economy.

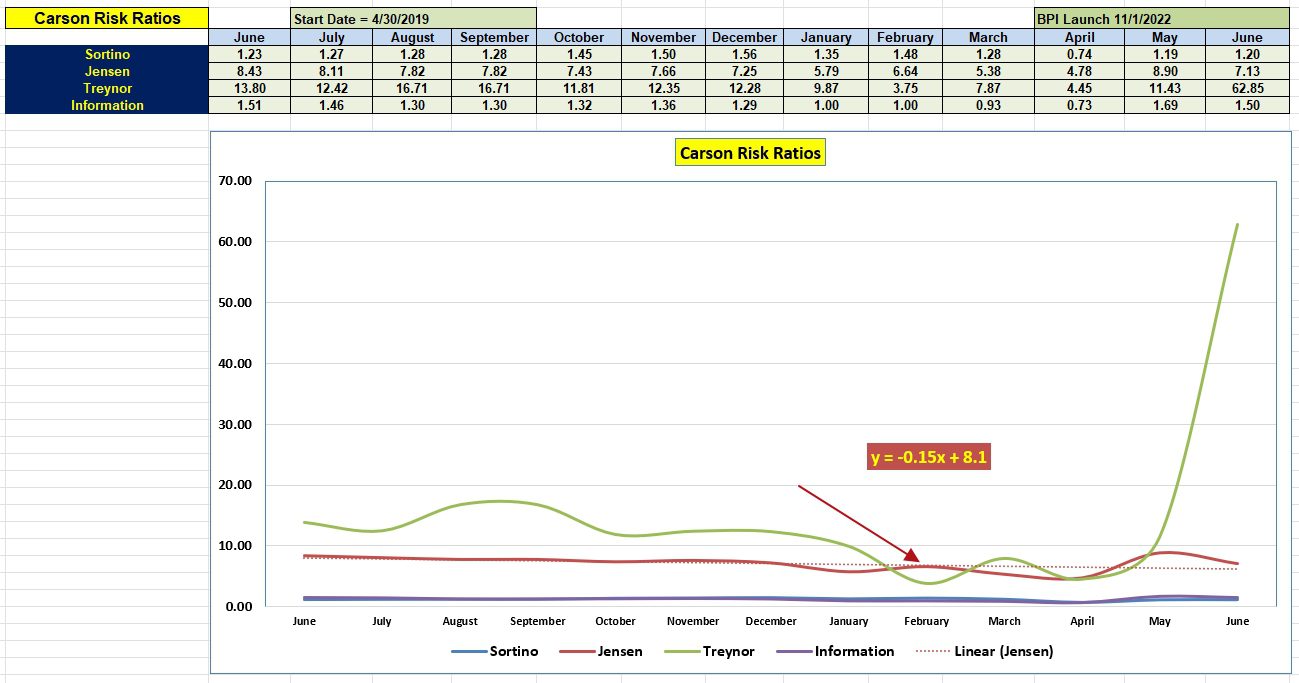

Carson Risk Ratios

Carson’s low beta causes the Treynor to rocket up. This ratio is too dependent on beta and for that reason it is my least favorite risk ratio.

The Jensen Alpha is running about average over the past year. The slope is a slight negative, but could easily move into positive territory before the end of the year.

As an aside I watch for truck traffic and containers as an indicator of economic strength. Both trucks and train cargo show signs the economy is still humming. Several 100 truck trains each day are moving north and south through our small town.

Markets are closed today due to Juneteenth.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Health moved into the overbought zone so I will be placing a TSLO under VHT.

Lowell