Painted Hills

Copernicus is the portfolio up for review this morning. If you have been reading the ITA blog for any length of time you are well aware of the simple investing philosophy behind the Copernicus. Save, invest in U.S. Equities and forget. Ride out the highs and lows of the U.S. Stock Market. The Copernicus is a portfolio designed for the young or someone who has 20 to 35 years of saving ahead. Use this portfolio model if you are a long-time investor.

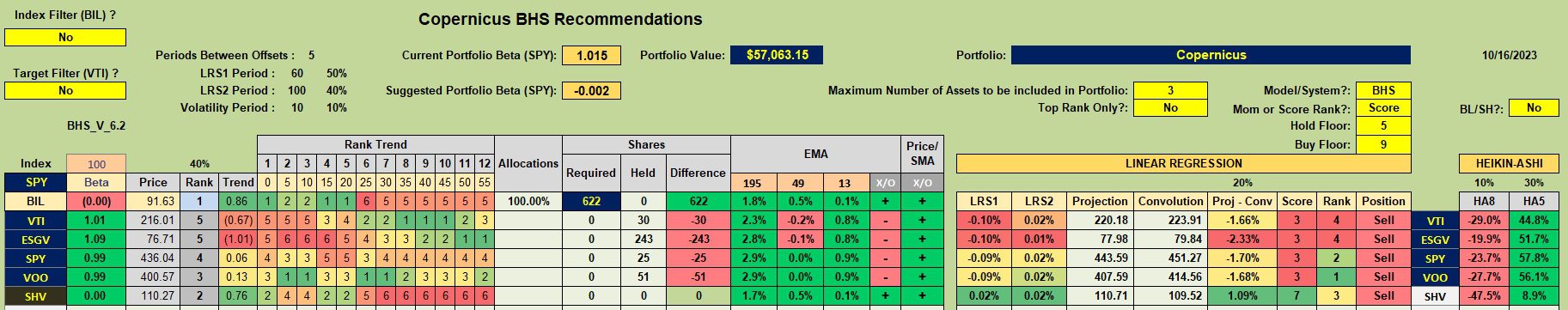

Copernicus Security Ranking Recommendation

Below is a working table from the Kipling spreadsheet. Note that in the 4th column from the right all securities are showing up as a Sell. With the Copernicus I pay zero attention to the Sell recommendations. The only way I use this particular worksheet is for ranking purposes. For example, if cash is available I’ll place a limit order to purchase shares of the highest ranking security. Right now that is VOO.

With approximately $600 in cash I have a limit order in place to purchase one share of VOO. This leaves a little over $200 in cash. What I’ve done is to place a second limit order for two shares of ESGV as VTI, SPY, and VOO are priced too high to purchase a single share of any of these ETFs. The approach is to keep cash working by investing in U.S. Equity securities.

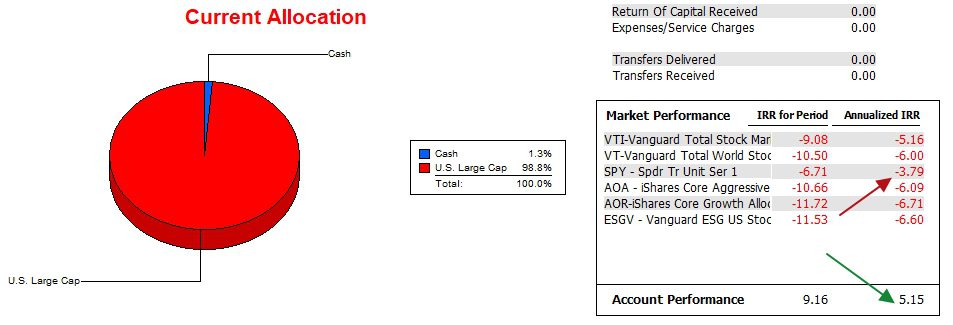

Copernicus Performance Data

Over the past 22 months the Copernicus holds a commanding lead over SPY as well as the other five potential benchmarks. The reason the Copernicus is so far ahead of SPY is due to the benefits that come from dollar-cost-averaging. During the lows of 2022 we were buying shares of SPY, VTI, VOO, and ESGV. Those purchases are now bearing fruit as the market is higher than it was at the low times in 2022.

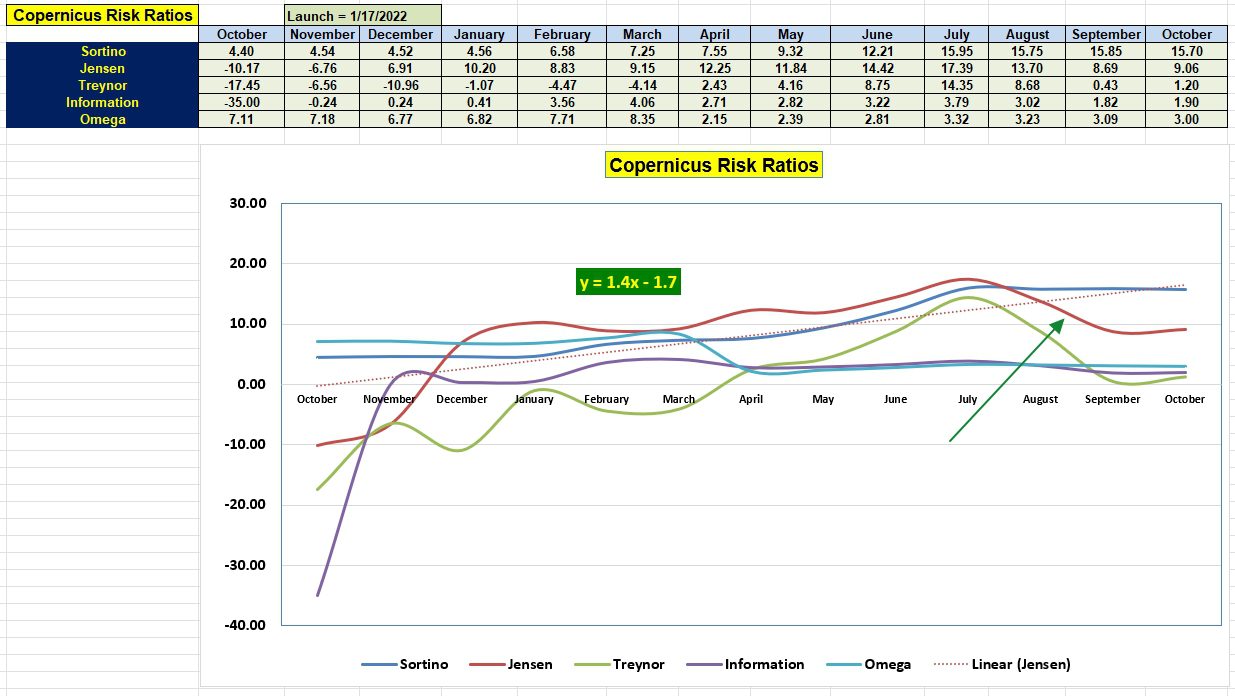

Copernicus Risk Ratios

While the Copernicus cannot match the high values of last July, both the Jensen and Information Ratios are still in lofty territory. Once we clear the low Jensen value of last October the slope of the Jensen will decline. It is going to be a struggle to maintain a positive slope for the Jensen Performance Index.

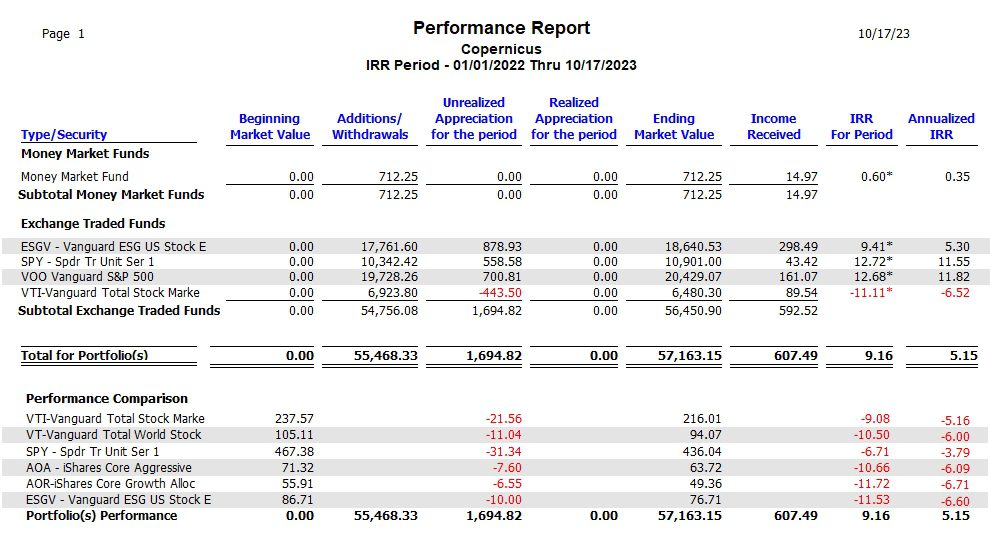

Copernicus Portfolio Overview

I edited this review and added the following performance information. Check over the table.

Copernicus Buy & Hold Portfolio Review: 18 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I added another screenshot of information. Check over the very last data table.

Lowell