Mt. Lassen in Northern California.

The Copernicus has essentially operated as a passive portfolio. Save and invest in broad market equity ETFs has been the philosophy up to this point. With an overvalued stock market what is the next move? I plan to swap SCHD with VYM and continue dollar-cost-averaging into equities. Instead of buying at market or setting limit orders close to the current price, I will set limit orders in a ladder price order at 3%, 5%, 7% etc. below the current price. This averaging in at lower prices assumes the equities market will see some sort of draw-down over the next six months. In any give year the volatility of equity holding is approximately +/- 15%. We will see some sort of draw-down over the next year if history is any guide.

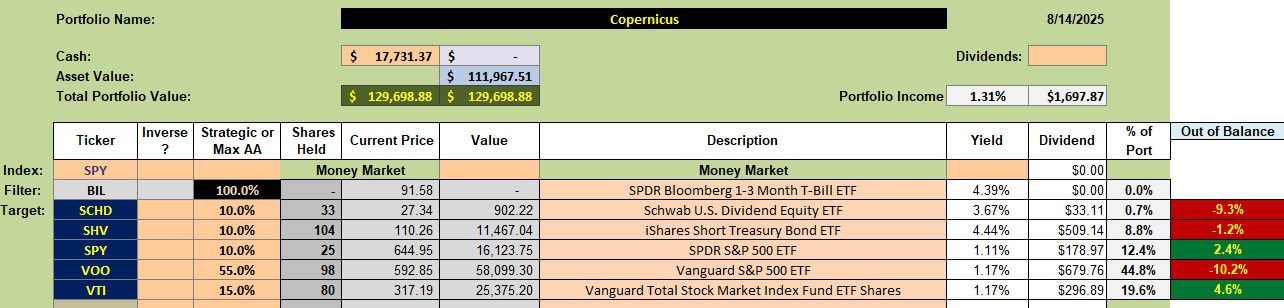

Copernicus Security Holdings

Below is the current makeup of the Schrodinger. The Schwab brokerage window for trading was not available this morning so I was not able to set any limit orders to use up the available cash. I’ll check back later today. I have a limit order in place to sell all shares of SCHD and will then purchase shares of VYM.

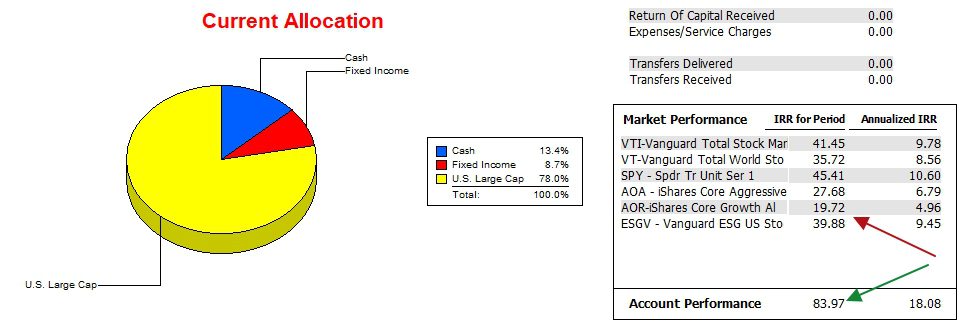

Copernicus Performance Data

Since 12/31/2021 the dollar-cost-averaging model has served the Copernicus well as it is crushing all potential benchmarks. There is nothing fancy about this management model and anyone can follow this plan. Save, invest in equities, and stick with the plan.

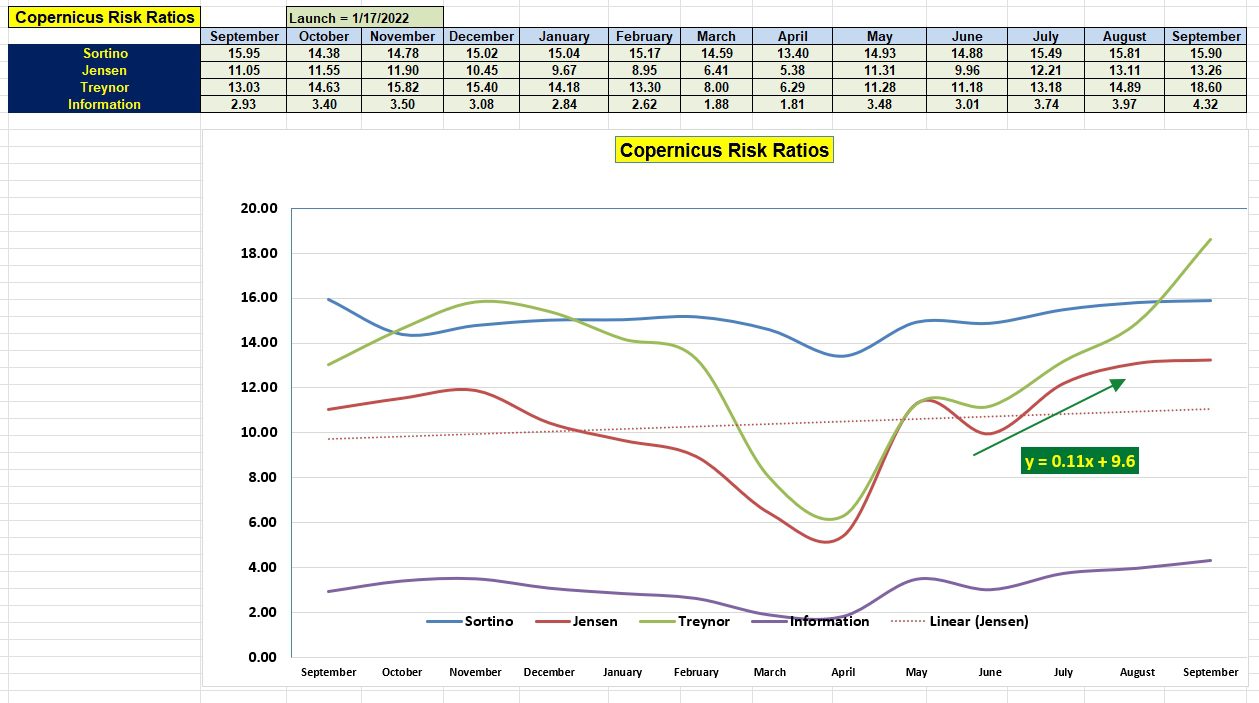

Copernicus Risk Ratios

I was a little surprised the Information Ratio gained as much as it did since the August reading and it is far above where it was a year ago. The Jensen Alpha is in “nose bleed” territory and it will be difficult to maintain this high level.

Another positive signal is the slope of the Jensen. The Copernicus is firing on all cylinders.

Tomorrow we end the week of updates with a review of the Franklin. Next week is another full week of portfolio reviews.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question