One of many falls along the Columbia River Highway.

Bethe is a rather new Asset Allocation portfolio and as such has a long way to go before the various asset classes are in balance. Asset classes that are far above their target percentages are for sale while lower volatility asset classes such as BND, BNDX, and SHV are the dividend paying ETFs I am building up toward their target percentages.

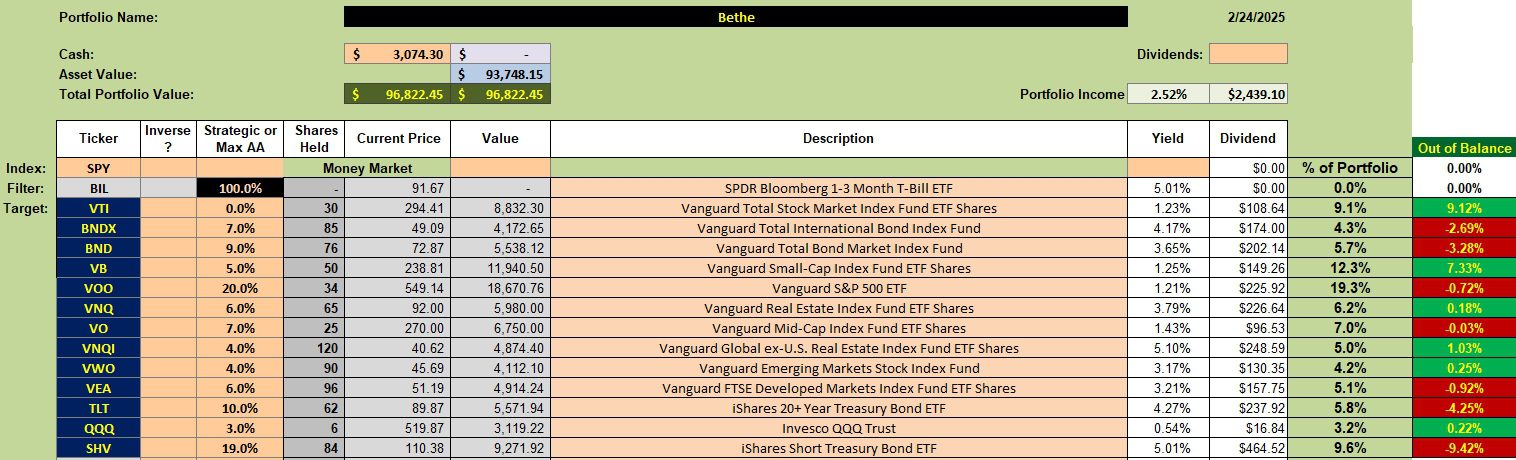

Bethe Asset Allocation Portfolio

Below is the latest portfolio breakdown for the Bethe. If you check the far right-hand column you will see the out-of-balance percentages. The goal is to bring the various asset classes into balance within the next few months or no more than two more reviews.

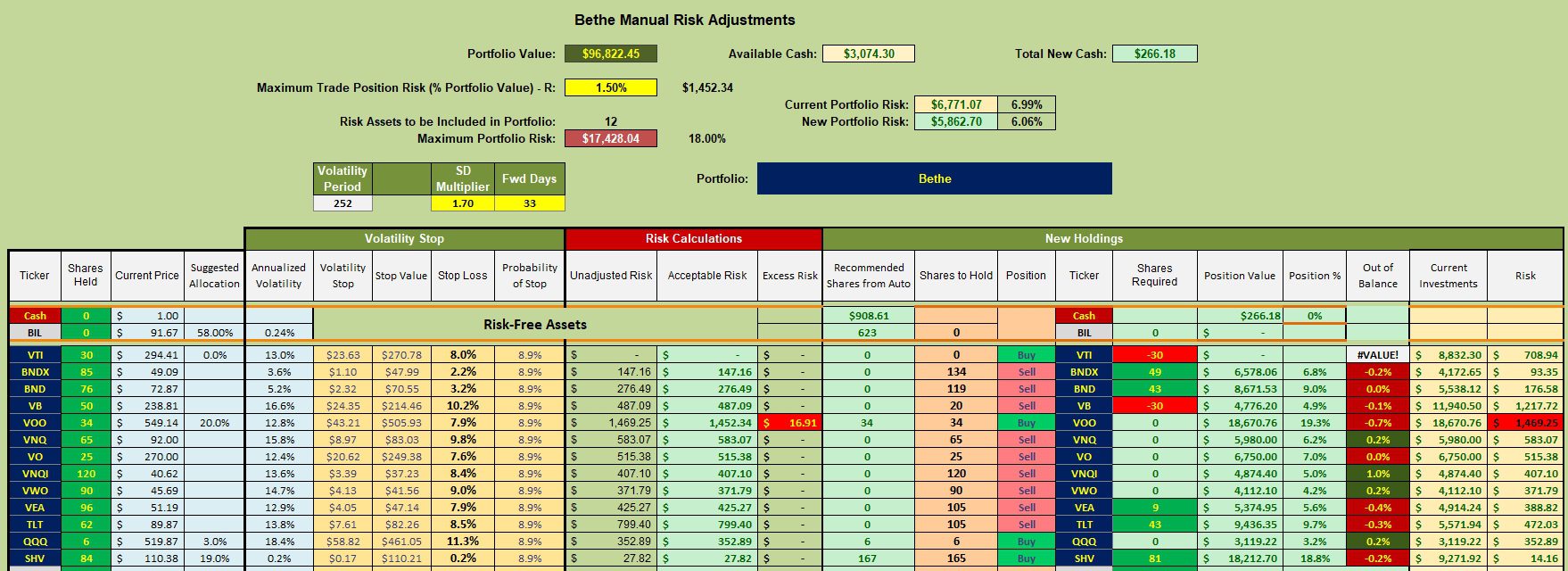

Bethe Rebalancing Recommendations

The sixth column from the right lays out the future plan to bring the Bethe asset classes into balance. Currently, only shares of VTI and VB are for sale.

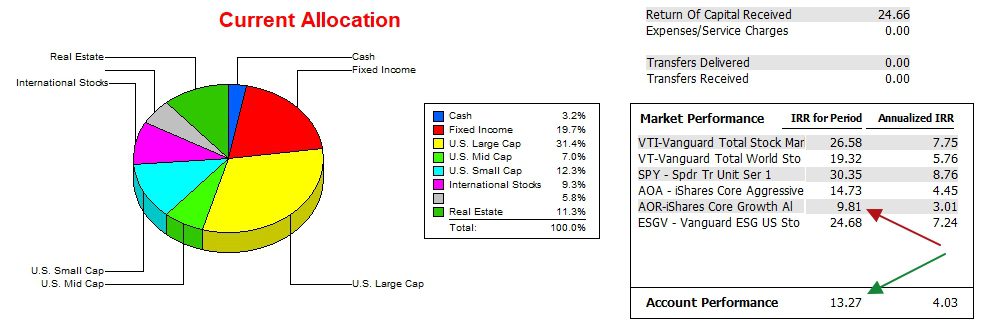

Bethe Performance Data

Since 12/31/2021 the Bethe has outperformed the AOR benchmark by approximately one percentage point when annualized.

I added ESGV to the list of potential benchmarks. One subscriber showed interest in how an ESG ETF performs vs the broad market. Over the past three years this ETF has not kept pace with the S&P 500 (SPY), but it is not far behind.

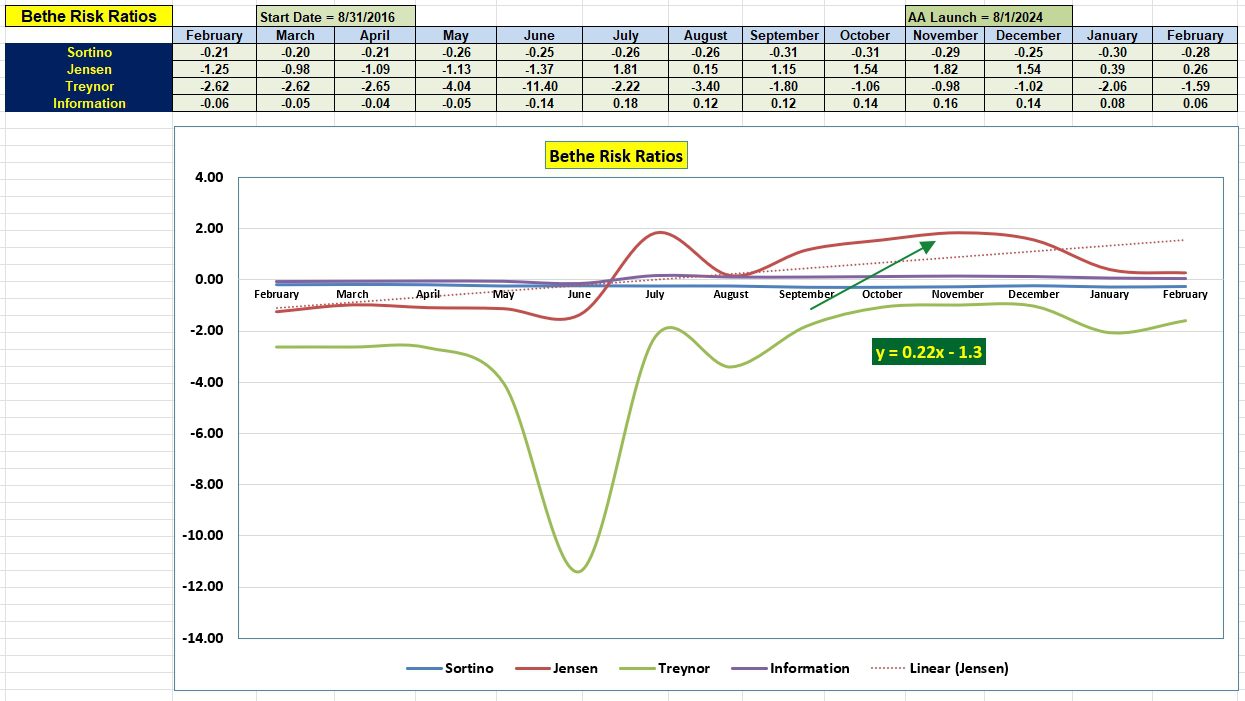

Bethe Risk Ratios

Nearly all risk measurements improved since February of 2024. By this time next year we will have a better idea whether or not the Asset Allocation investing model works in a chaotic environment.

Comments and Questions are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Thank you for adding the ESGV benchmark.

Lee,

Good to know someone is paying attention. (g)

Lowell