Longboats at AoNang Beach, Krabi, Thailand

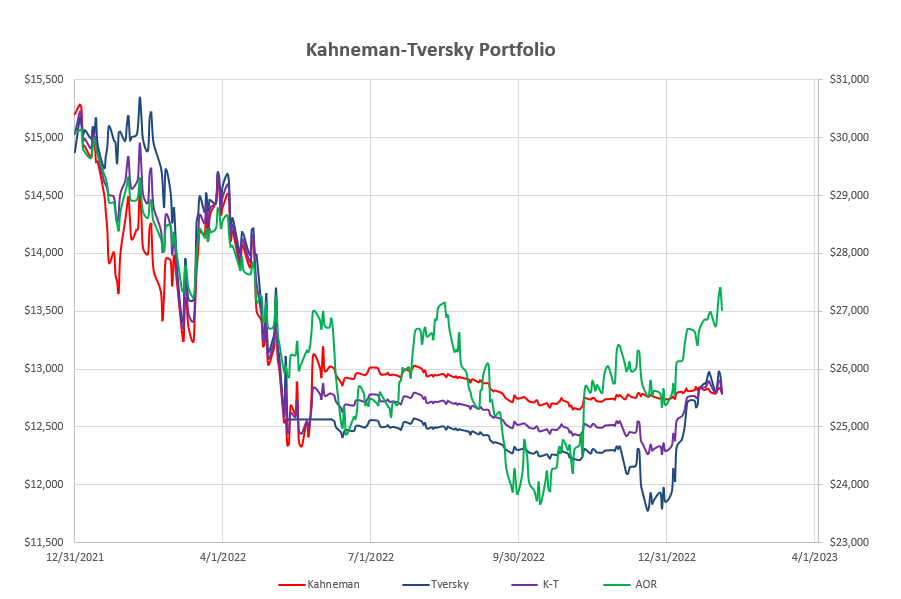

The Kahneman-Tversky Portfolio is a simple Dual Momentum Portfolio that needs little management/adjustment. It is split into two portions – one that is relatively slow in reacting to changes in market conditions – the Kahneman portion – and one that reacts a little more quickly (but may be more subject to whipsaw trades) – the Tversky portion. Performance over the past 13 months looks like this:

with very low volatility over the the past 6 months (purple line7). Although the portfolio is trailing the benchmark AOR Fund a little, some investors may be more comfortable with the low volatility (compared to the green line).

with very low volatility over the the past 6 months (purple line7). Although the portfolio is trailing the benchmark AOR Fund a little, some investors may be more comfortable with the low volatility (compared to the green line).

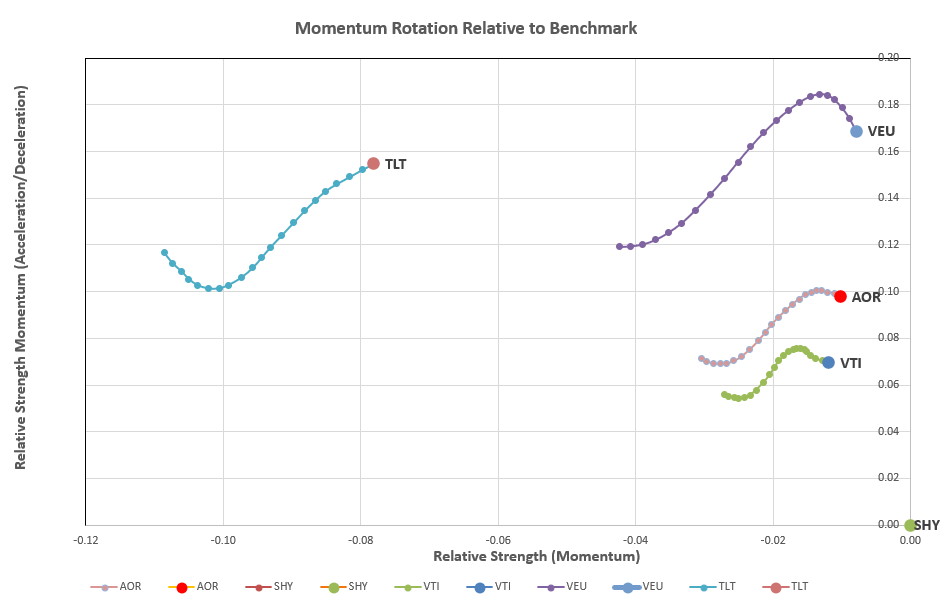

Checking the rotation graphs for the slower moving Kahneman portion of the portfolio:

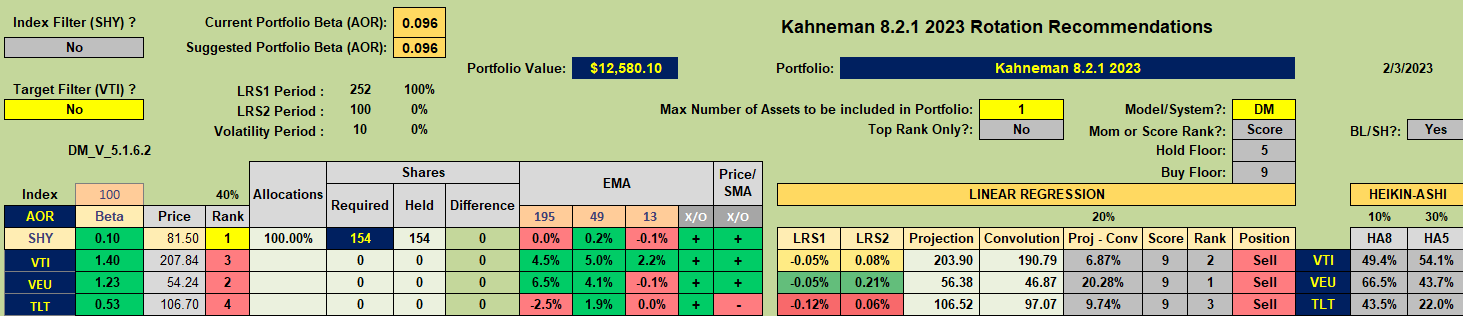

we see that no assets are currently trading with more momentum /(relative strength) compared to the reference SHY (short-term treasury) ETF. Therefore the current recommendation is to continue to hold SHY:

we see that no assets are currently trading with more momentum /(relative strength) compared to the reference SHY (short-term treasury) ETF. Therefore the current recommendation is to continue to hold SHY:

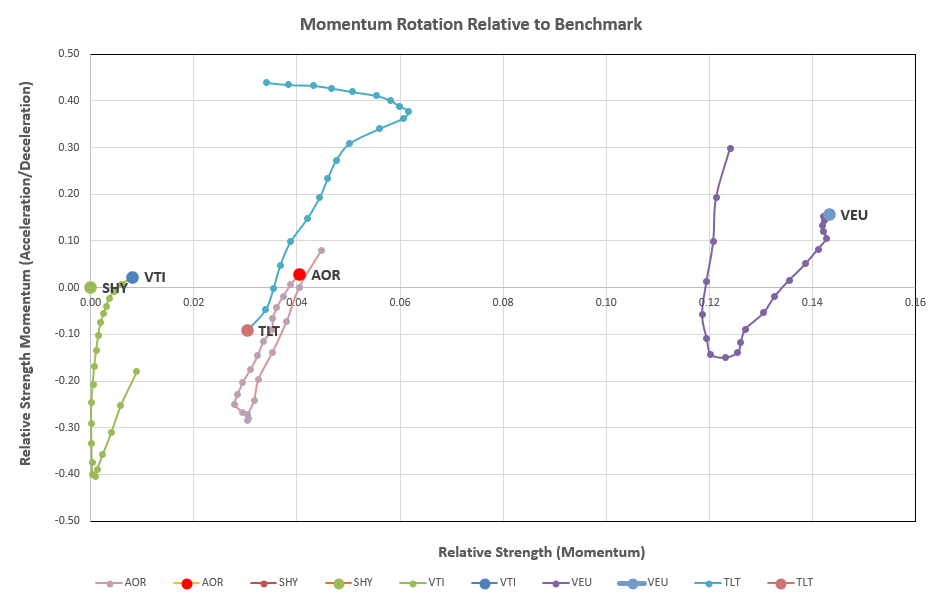

Rotation graphs for the faster reacting Tversky portion of the portfolio are shown in the following screenshot:

Rotation graphs for the faster reacting Tversky portion of the portfolio are shown in the following screenshot:

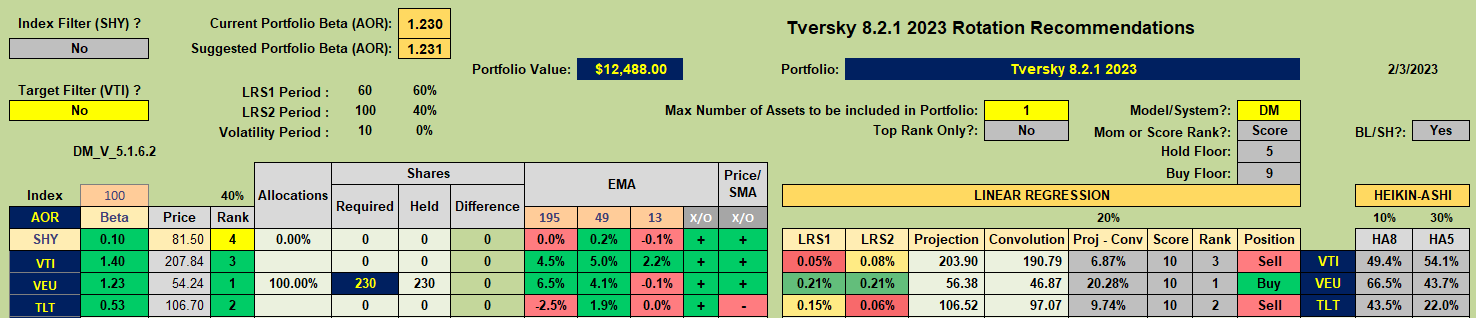

resulting in a recommendation to hold a position in VEU (International Equities):

resulting in a recommendation to hold a position in VEU (International Equities):

and so, since these are our current holdings no adjustments are again required for this portfolio.

and so, since these are our current holdings no adjustments are again required for this portfolio.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.