Orkney Islands – Primitive living below ground to stay out of the constant wind.

Sending best wishes to all readers on this Decoration Day.

Gauss is the Sector BPI portfolio up for review. This particularly portfolio is set up with an expanded investment quiver that includes developed international equities (VEA) and emerging market equities (VWO) whereas most of the Sector BPI portfolios focus on VTI and VOO as the non-sector ETFs.

Gauss Security Holdings

Below is the investment quiver and current holdings in the Gauss. VPU was recently sold out of the Gauss so we need to reinvest the $58,000 held in cash.

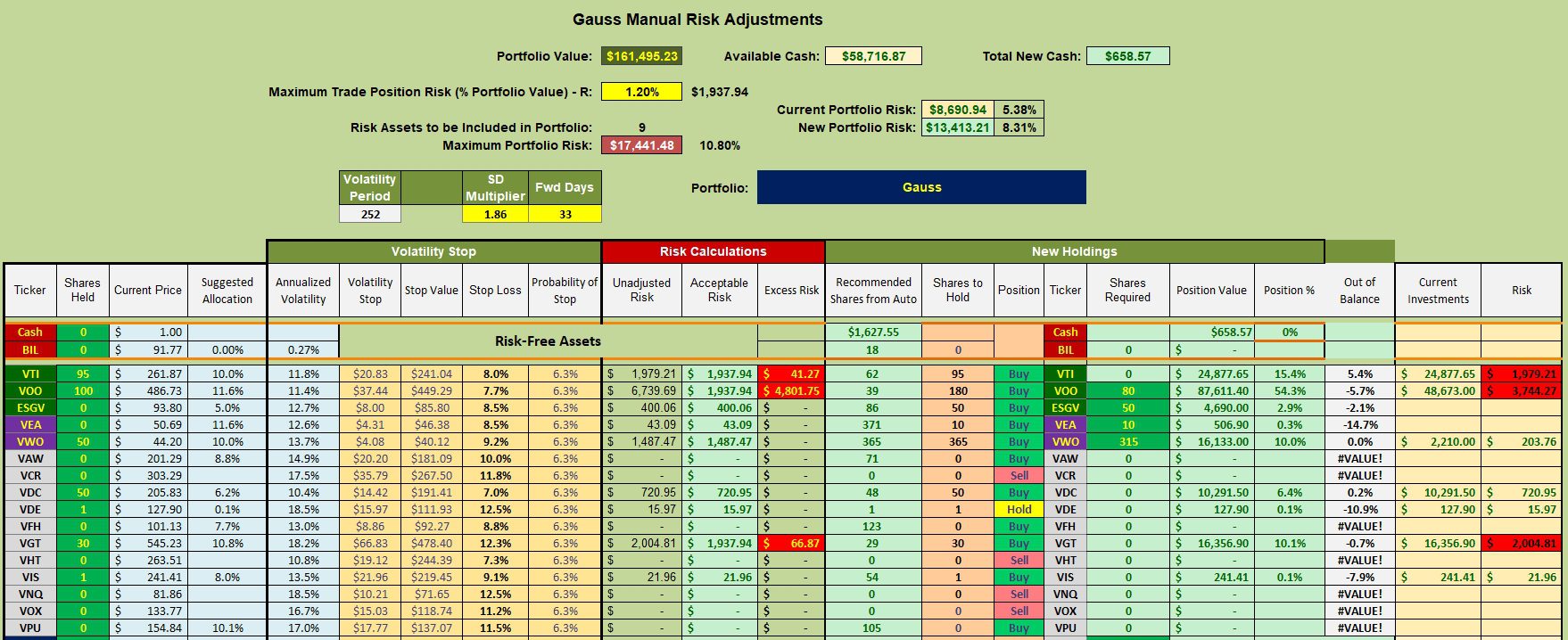

Gauss Manual Risk Adjustments

The following manual risk adjustment worksheet comes out of the Kipling spreadsheet and provides guidance as to what to do with the available cash. No sectors are oversold so no purchases are recommended for ETFs VAW down through VPU. Under these conditions we look for non-sector ETFs such as VTI, VOO, ESGV, VEA, and VWO as havens for investments. Note that all these non-sector ETFs are recommended for purchase. Since the goal of the Gauss is to outperform the SPY benchmark I will overload VOO, while also investing in ESGV, VEA, and VWO. VTI is over-populated.

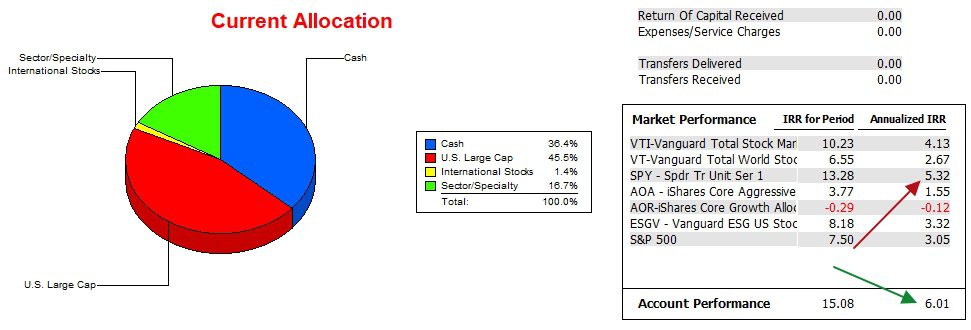

Gauss Performance Data

Since 12/31/2021 the Gauss managed to outperform the SPY benchmark by a small margin. The advantage is significantly greater for the other potential benchmarks.

Gauss Risk Ratios

I first began using the Sector BPI model with the Gauss in December of 2022 so there is nearly 1.5 years of data available. Based in the Information Ratio, the portfolio has consistently outperformed the SPY benchmark over the past year. Jensen’s Alpha is barely positive when the data extended to the third decimal place.

I’ll revisit the Gauss when more of the cash is invested in equities.

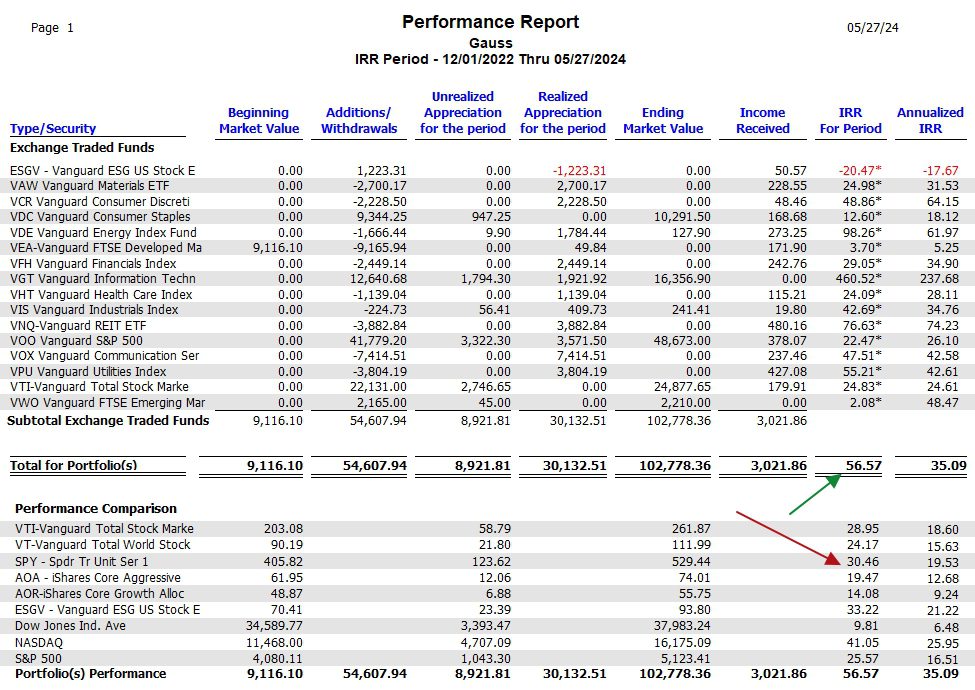

Gauss Sector Portfolio Report

The following table comes from the Investment Account Manager software. Only VEA was part of the portfolio on 12/01/2022 and it has not contributed all that much to the Gauss. Over the past 18 months the Gauss gained 56.6% while the SPY benchmark generated a return of 30.5%. The Sector BPI model is working. In general, the older or earlier I began using the Sector BPI model the better the performance.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question