Chinese New Year in Singapore – 2023, Year of the Rabbit

It’s the year of the Rabbit and we’re hopping around tentatively trying to find a direction for the markets in 2023:

I’ve updated the trend channels in the above figure, since these are somewhat discretionary, but it is not clear whether we are still in a downtrend (sitting at the top of the downtrend channel) or maybe entering a new uptrend (sitting at the bottom of the short-term uptrend channel). I cannot declare trend change (from down to up) until we take out the ~4100 high in the SPX that we hit in early December.

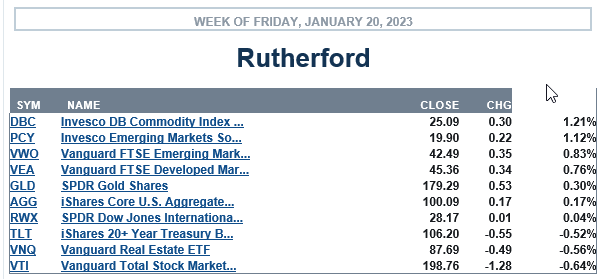

On the week, US equities were down ~1.2% and were the poorest performing major asset class:

with Commodities (DBC) and Emerging Markets (PCY and VWO) leading the way.

with Commodities (DBC) and Emerging Markets (PCY and VWO) leading the way.

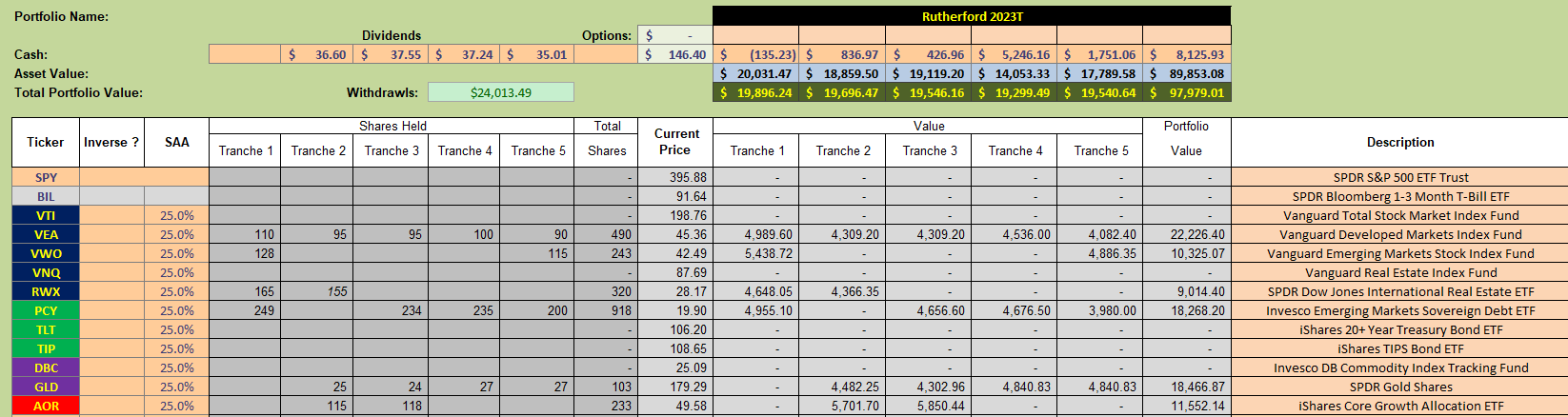

Current holdings in the Rutherford Portfolio look like this:

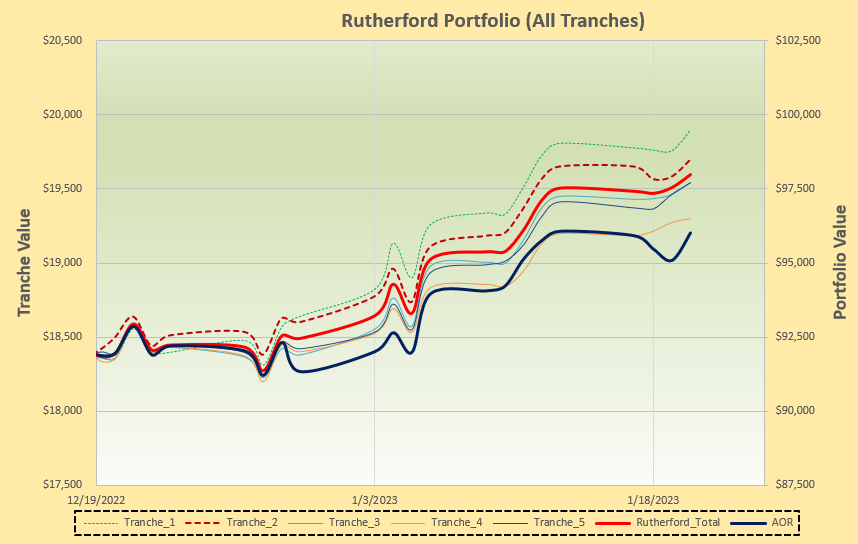

and performance like this:

and performance like this:

i.e. we are continuing to stay ahead of the benchmark AOR Fund in the early stages of the year.

i.e. we are continuing to stay ahead of the benchmark AOR Fund in the early stages of the year.

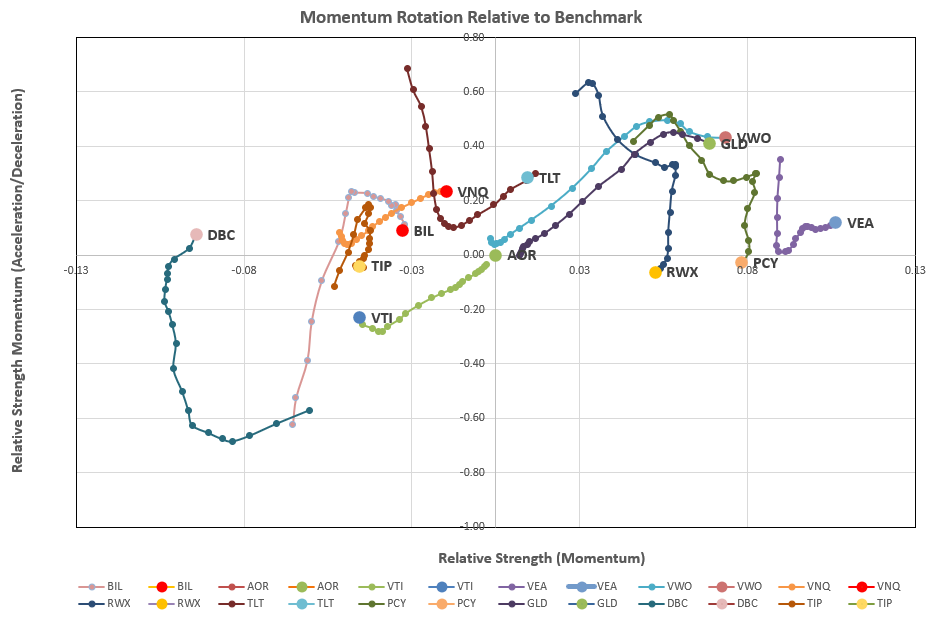

Checking the rotation graphs:

we see continuing strength in VEA and VWO although PCY and RWX are weakening in the short term (up/down movement).

we see continuing strength in VEA and VWO although PCY and RWX are weakening in the short term (up/down movement).

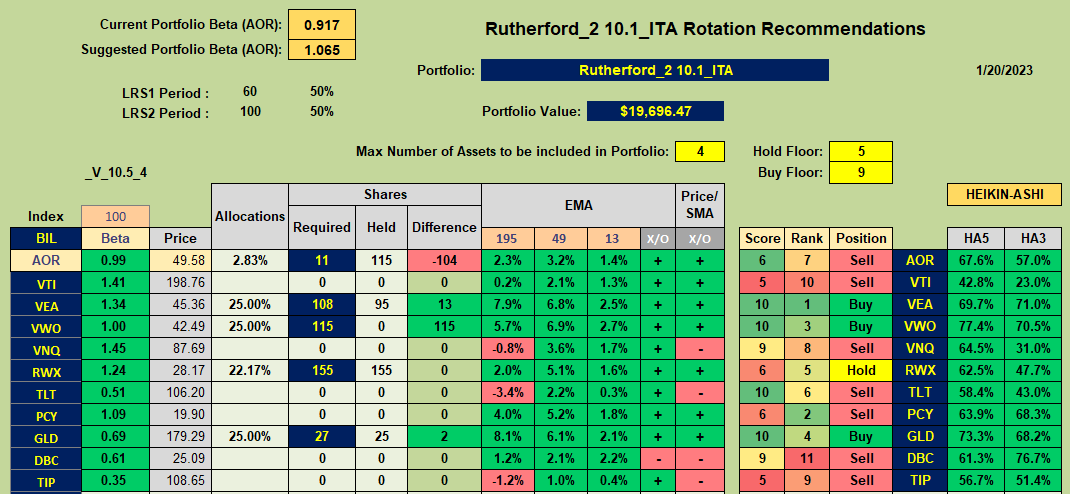

Recommendations from the rotation model look like this:

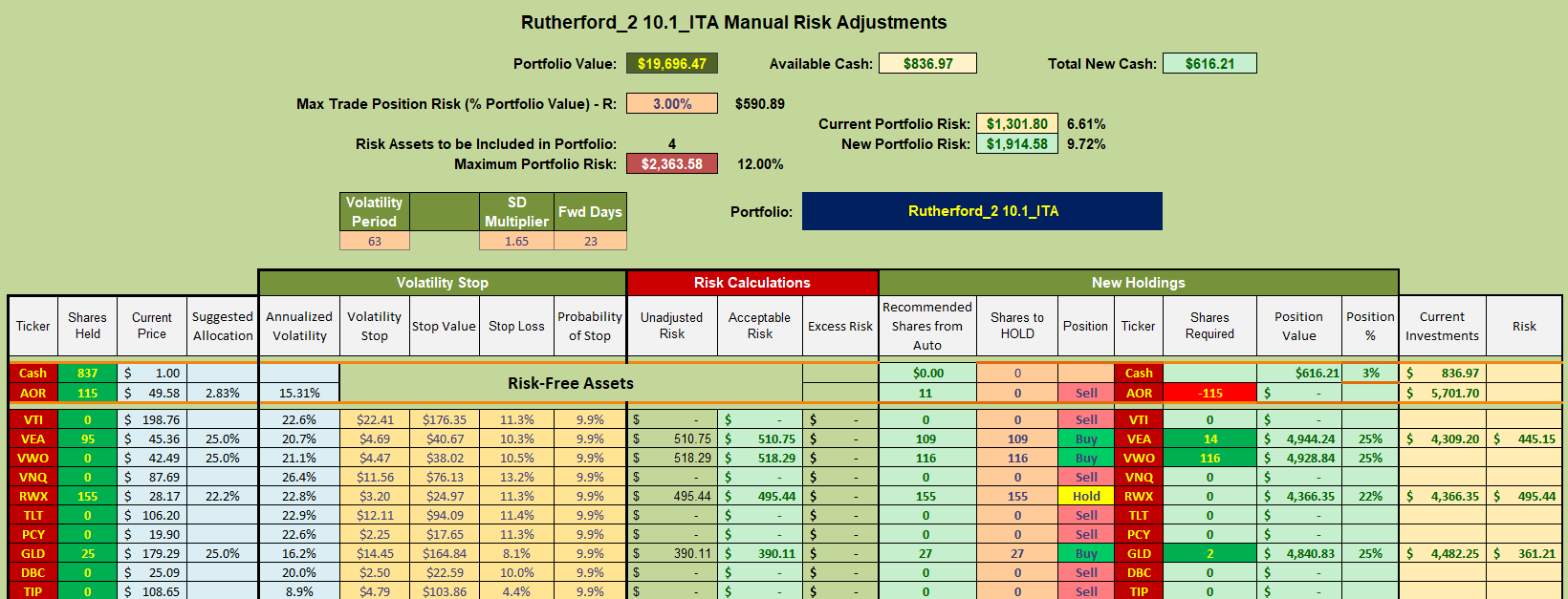

with Buy recommendations for VEA, VWO and GLD, a Hold recommendation for RWX and a Sell suggestion for AOR. Consequently I will sell the current holdings in AOR in Tranche 2 (the focus of this week’s review) and adjust like this:

with Buy recommendations for VEA, VWO and GLD, a Hold recommendation for RWX and a Sell suggestion for AOR. Consequently I will sell the current holdings in AOR in Tranche 2 (the focus of this week’s review) and adjust like this:

since it costs me nothing in commissions to Buy any of these ETFs.

since it costs me nothing in commissions to Buy any of these ETFs.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.