Botanic Gardens, Singapore

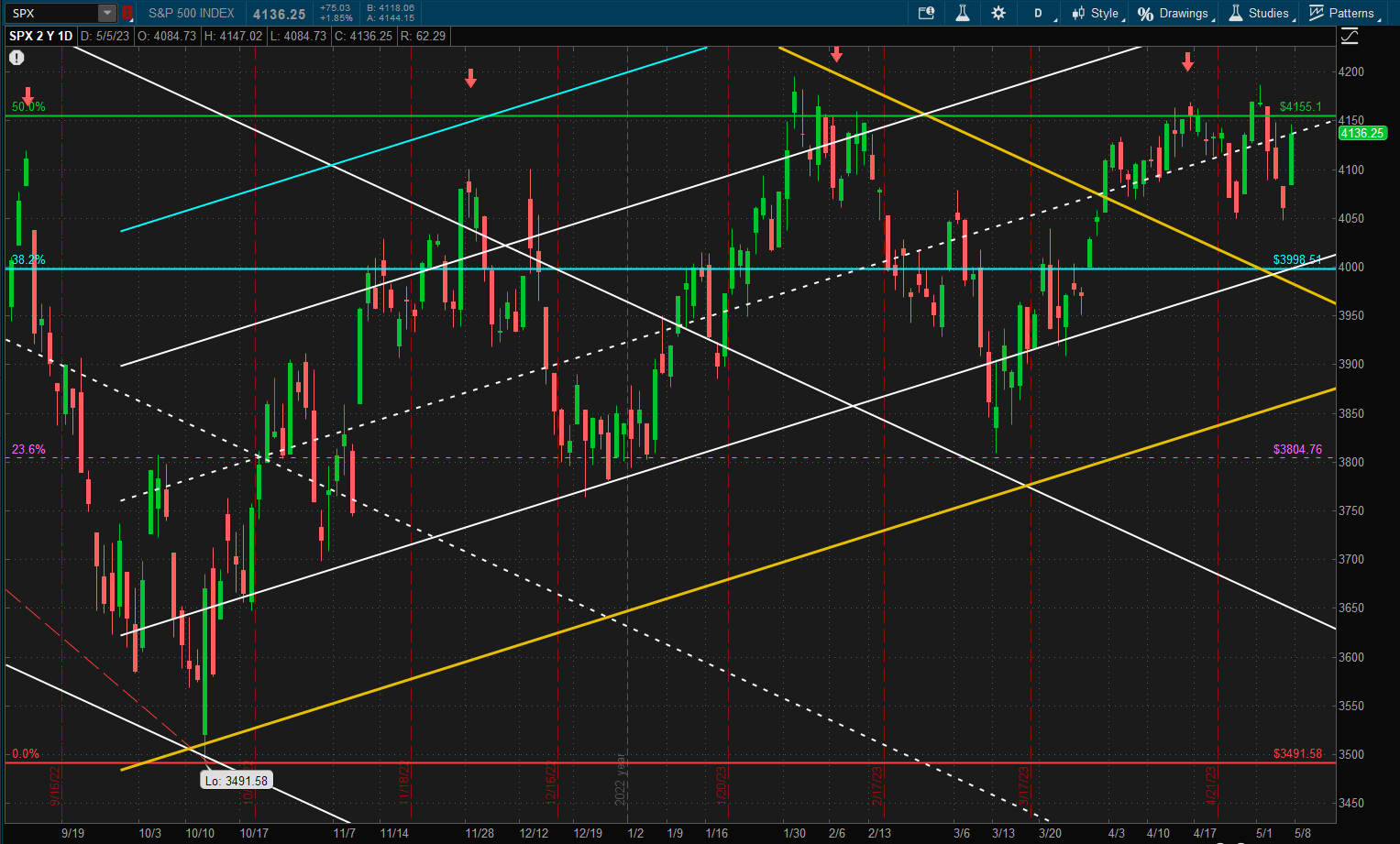

It was another relatively uneventful week in US Equities with the SPX (S&P 500 Index) continuing to bang it’s head against resistance at ~4150 and closing down slightly from last week’s close:

It is still not clear where we go from here but volatility has picked up over the past 2 weeks so we may be preparing for a breakout from the recent range very soon.

It is still not clear where we go from here but volatility has picked up over the past 2 weeks so we may be preparing for a breakout from the recent range very soon.

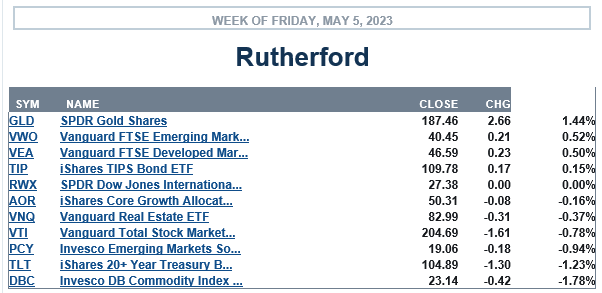

Over the past week, US Equities (as represented by the VTI ETF) showed relative weakness compared to other major asset classes:

with Gold and International Equites showing the most strength.

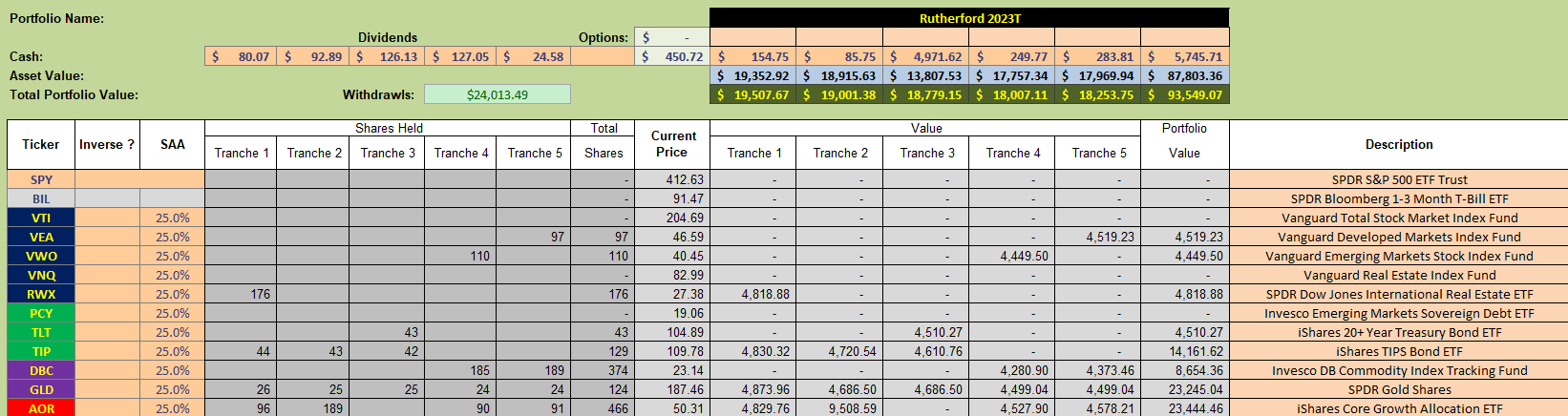

Current holdings in the Rutherford Portfolio look like this:

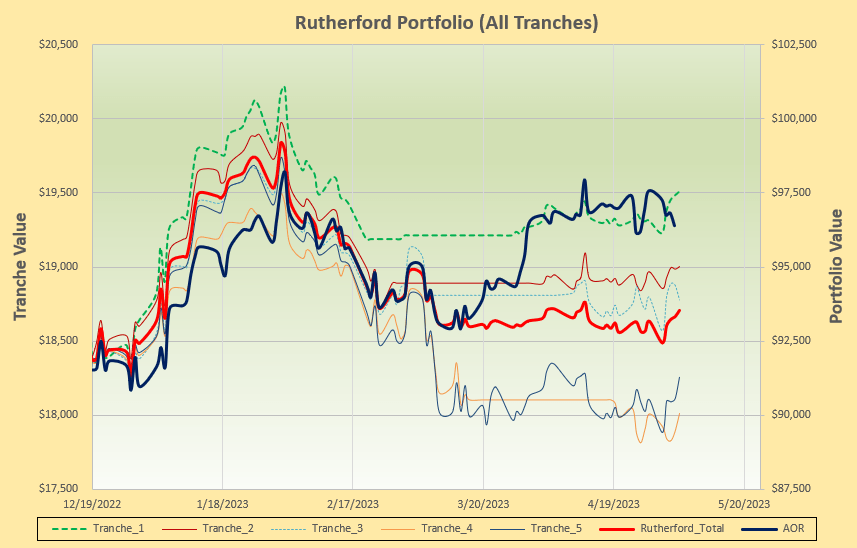

and performance of the portfolio like this:

and performance of the portfolio like this:

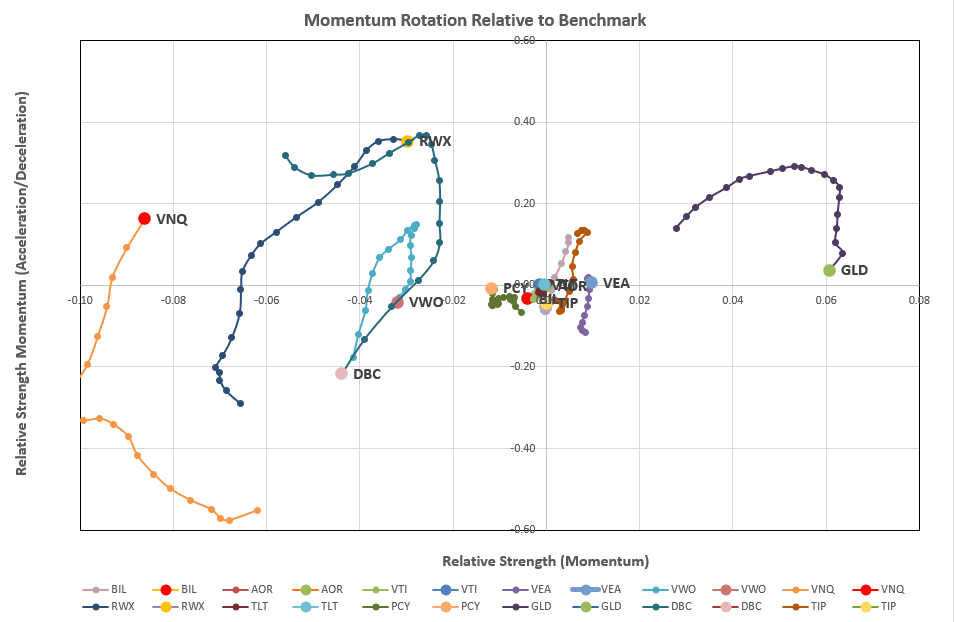

Although portolio performance is not matching the benchmark AOR fund since moving the management model to a momentum rotation system in December 2022 it did a little catching up over the past week – so we’ll check on the current rotation graphs:

Although portolio performance is not matching the benchmark AOR fund since moving the management model to a momentum rotation system in December 2022 it did a little catching up over the past week – so we’ll check on the current rotation graphs:

where we see GLD showing strong long-term strength but weakening in the shorter term.

where we see GLD showing strong long-term strength but weakening in the shorter term.

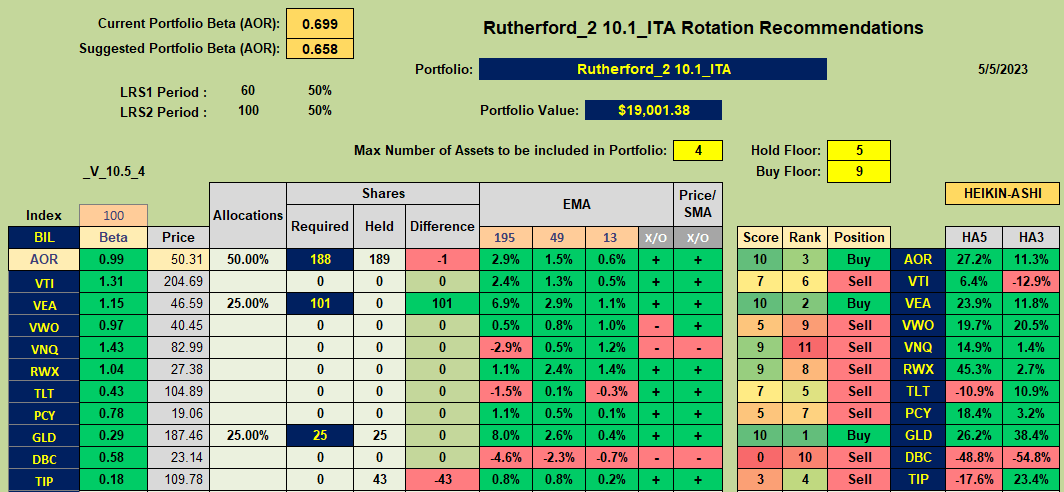

If we look at recommendations from the rotation model:

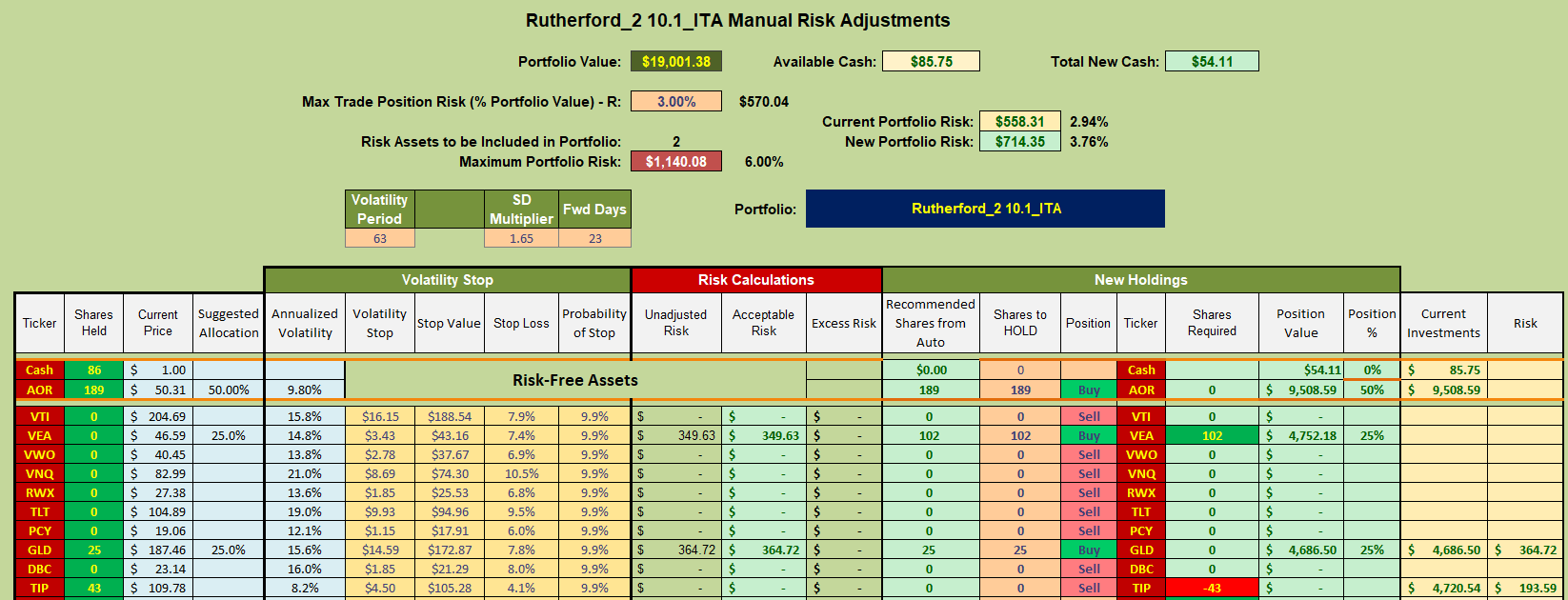

we see that GLD and VEA (Developed Market Equities) are recommended for purchase in addition to the benchmark AOR Fund. In terms of adjustments to Tranche 2 of the portfolio (the focus of this week’s review) these adjustments look like this:

we see that GLD and VEA (Developed Market Equities) are recommended for purchase in addition to the benchmark AOR Fund. In terms of adjustments to Tranche 2 of the portfolio (the focus of this week’s review) these adjustments look like this:

i.e. a simple switch from TIP (Inflation protected Bonds) to VEA.

i.e. a simple switch from TIP (Inflation protected Bonds) to VEA.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.