Napier, New Zealand

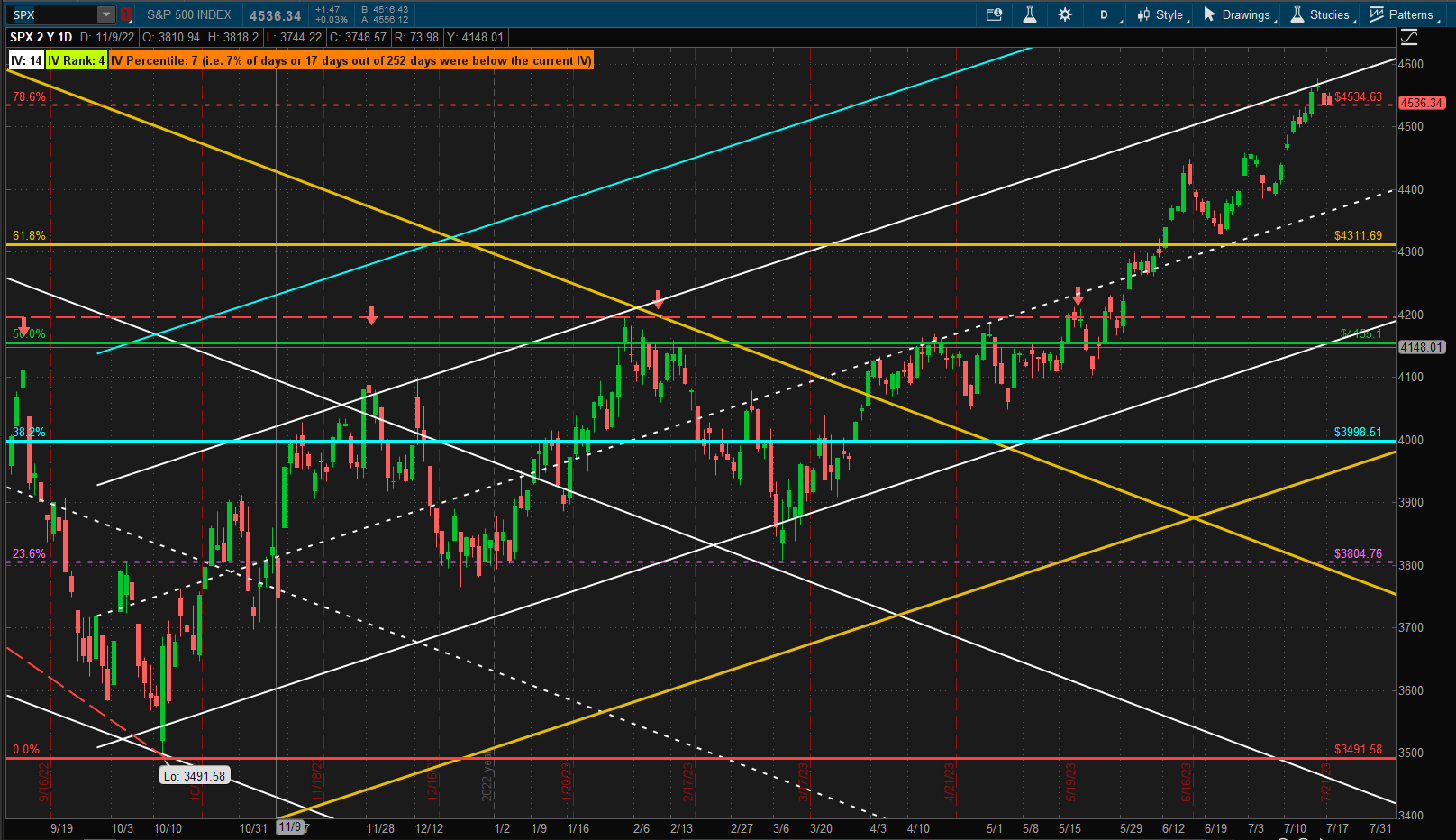

It was a relatively quiet week in the US equity markets with little change from where we were last week and still sitting at resistance near the upper 1 SD boundary of the uptrend channel

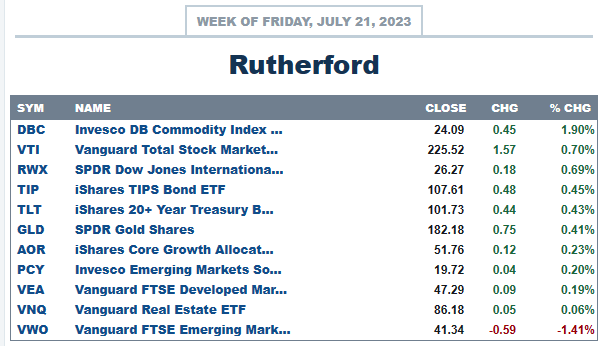

US equities was not the only major asset class with little action:

US equities was not the only major asset class with little action:

Commodities, at the top, and Emerging Market equities, at the bottom, were the only asset classes with any significant movement last week.

Commodities, at the top, and Emerging Market equities, at the bottom, were the only asset classes with any significant movement last week.

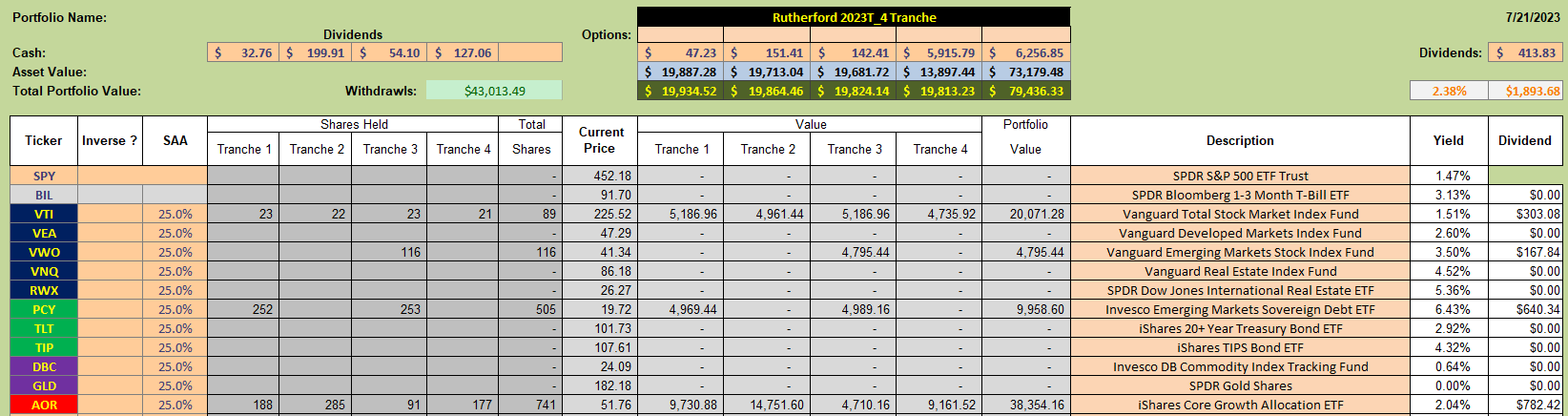

Current holdings in the Rutherford Portfolio look like this:

with Tranche 4 (the focus of this weeks review) holding positions in VTI (US Equities) and AOR (the benchmark fund). 25% of the Tranche value is held in Cash.

with Tranche 4 (the focus of this weeks review) holding positions in VTI (US Equities) and AOR (the benchmark fund). 25% of the Tranche value is held in Cash.

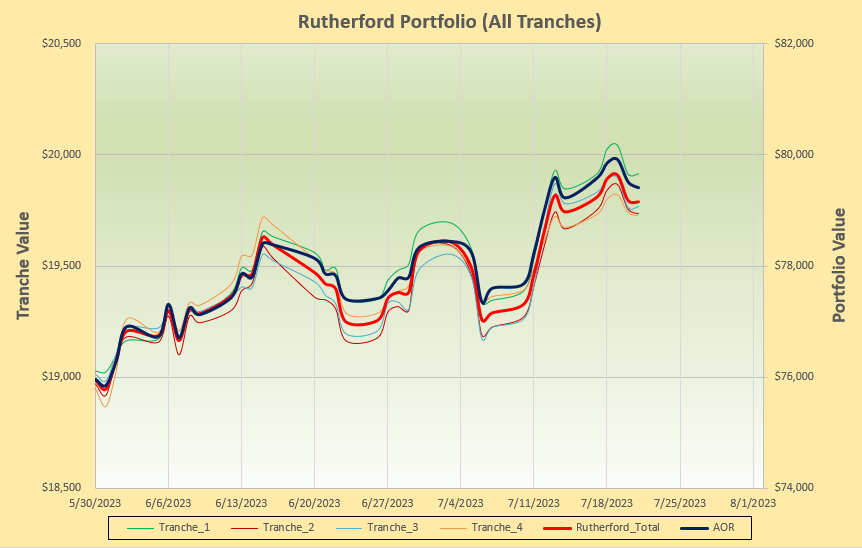

Recent performance of the portfolio is shown in the screenshot below:

where we can see that we are tracking the benchmark AOR fund fairly closely.

where we can see that we are tracking the benchmark AOR fund fairly closely.

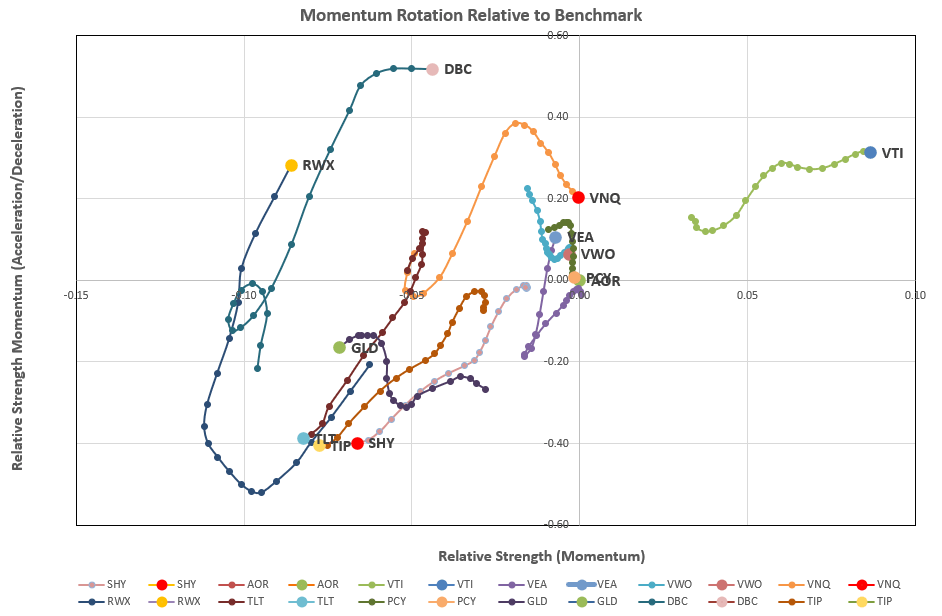

Checking on the rotation graphs:

we see VTI clearly in the lead in the desirable upper right quadrant (positive long and short-term momentum).

we see VTI clearly in the lead in the desirable upper right quadrant (positive long and short-term momentum).

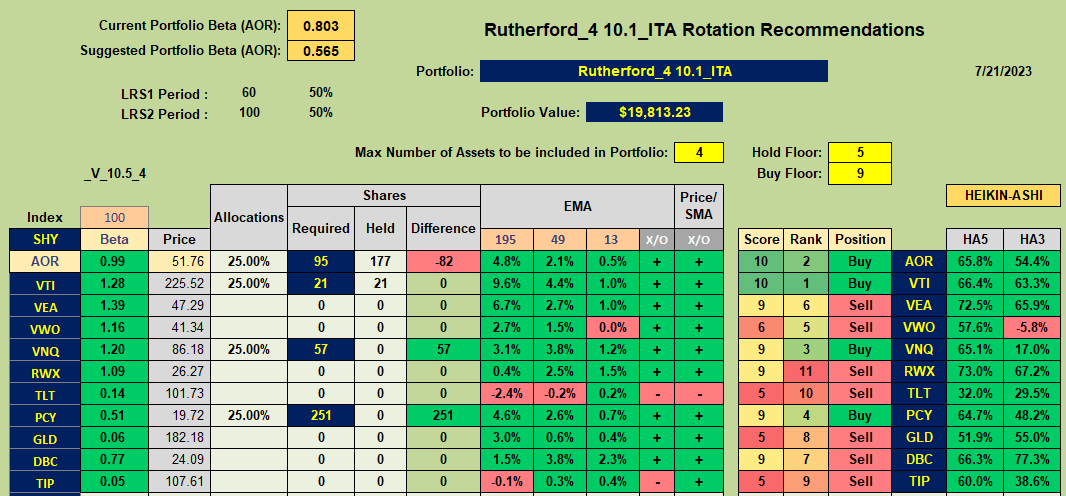

Not unsurprisingly this is reflected in the recommendations:

where it is joined by VNQ and PCY, together with AOR as the suggested assets to Buy.

where it is joined by VNQ and PCY, together with AOR as the suggested assets to Buy.

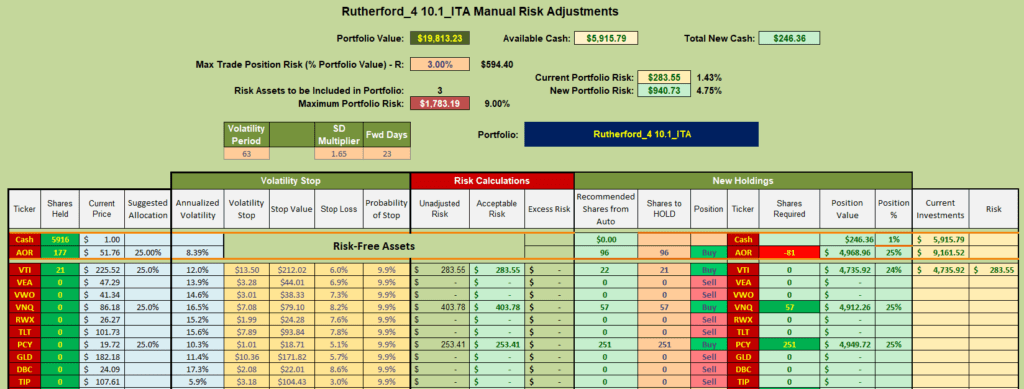

Consequently, this weeks adjustments will look like this:

i.e. a portion of the AOR holdings will be sold to free up enough Cash to allow the addition of VNQ and PCY to the mix.

i.e. a portion of the AOR holdings will be sold to free up enough Cash to allow the addition of VNQ and PCY to the mix.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.