Welcome to Bali, Indonesia

I am a little slow posting this review as I analyzed/adjusted it last week. However, it’s a simple and slow moving portfolio so the tardiness is likely not too significant.

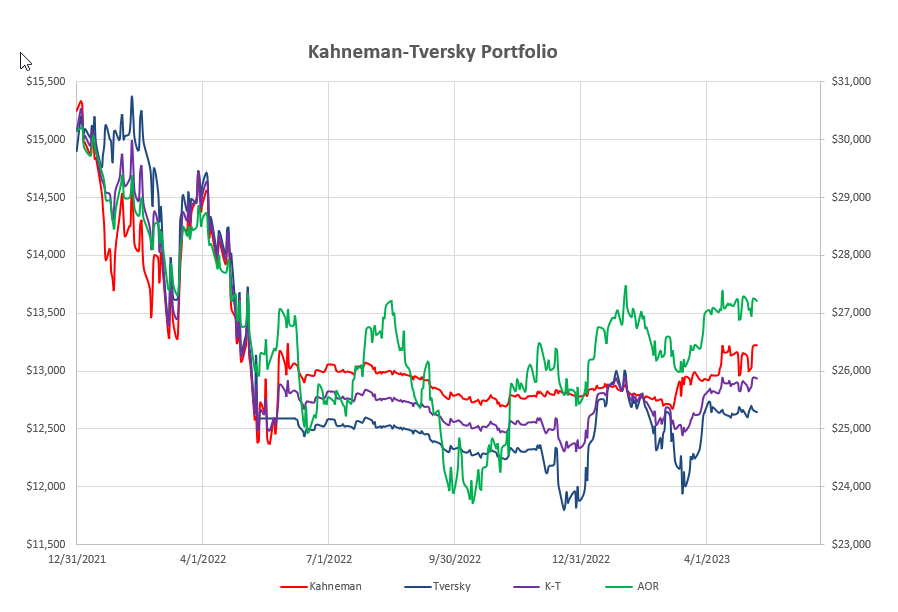

Prior to the adjustments I was holding VEA (International Equities) in the Kahneman portion of the portfolio and Cash (SHY) in the Tversky portion and performance looked like this:

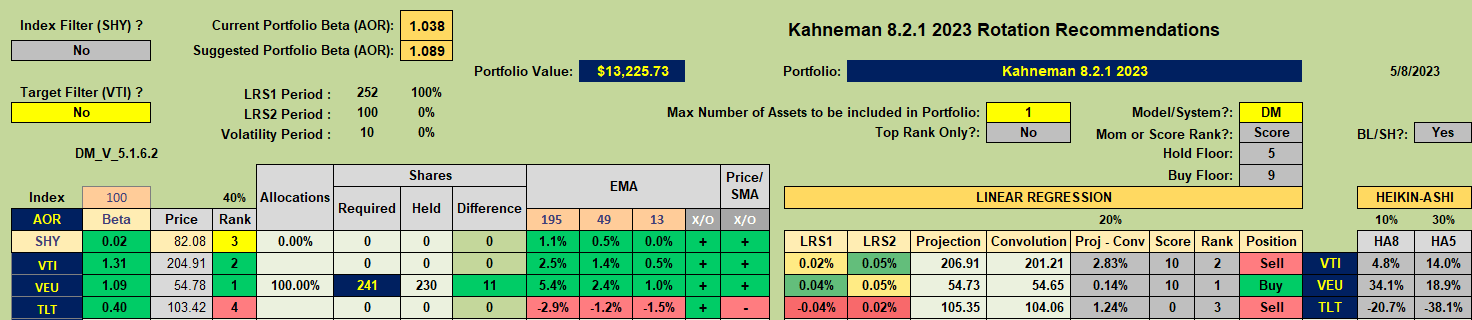

Reviewing the Kahneman portion generated the following screenshot:

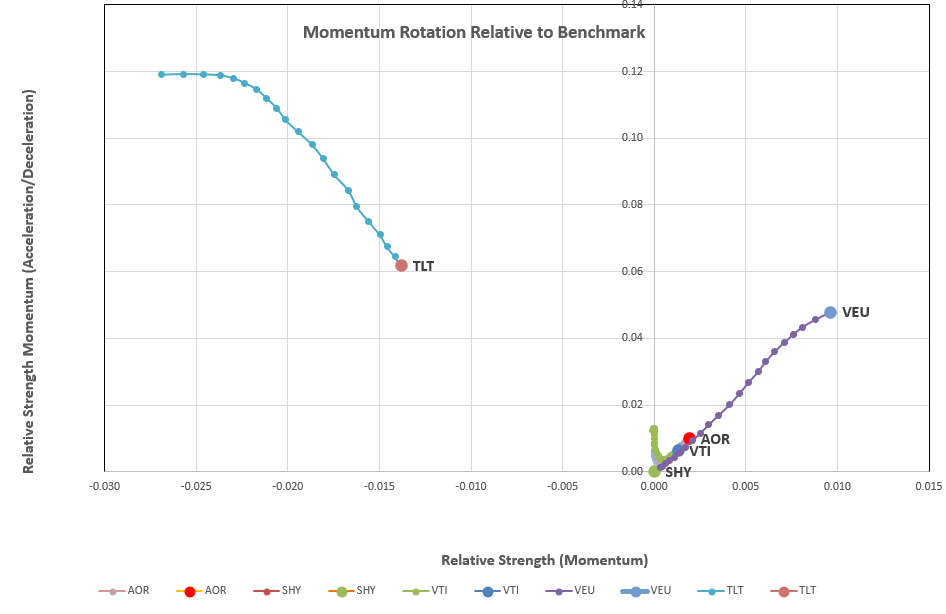

suggesting that no adjustments were necessary. Checking the rotation graphs (in anticipation of possible future changes) we saw this:

i.e. no likely change in the short term.

i.e. no likely change in the short term.

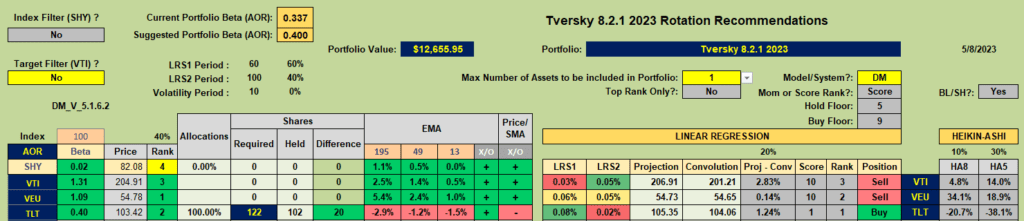

Moving on to the faster reacting Tversky portion generated the following recommendations:

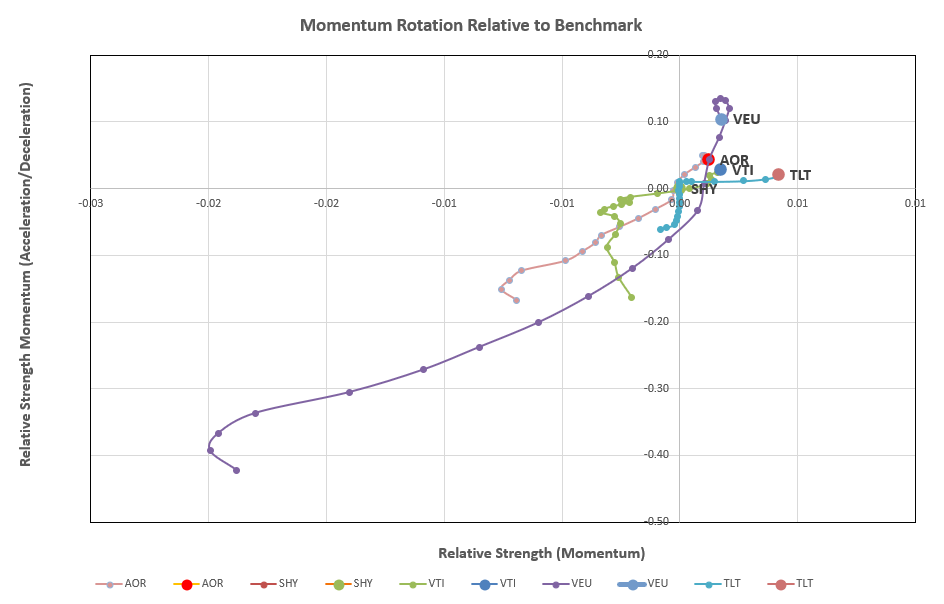

and the following graphical picture:

and the following graphical picture:

so I rotated into TLT at the beginning of last week.

so I rotated into TLT at the beginning of last week.

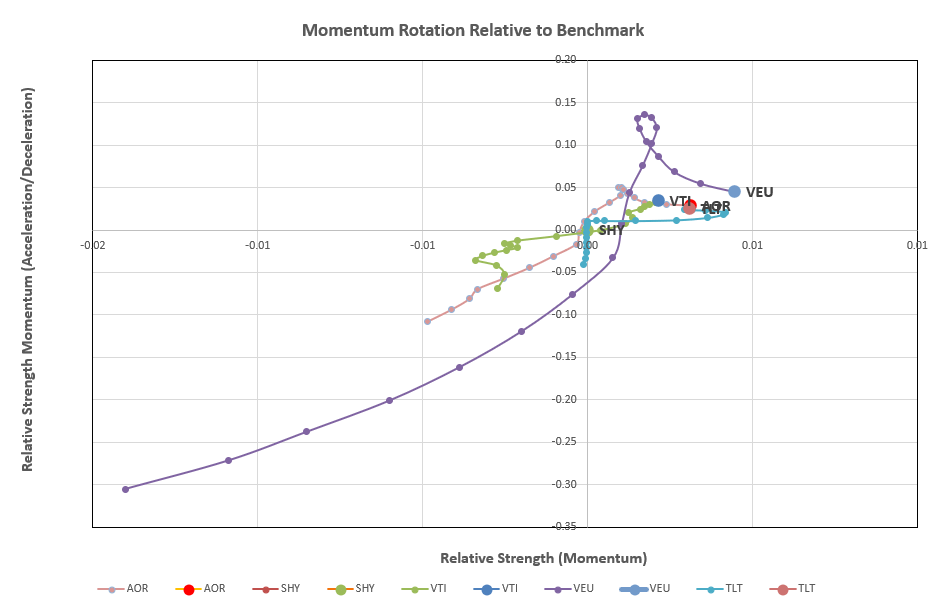

I should point out that this picture has since changed:

and VEU is now the recommended holding. However, this is a simple example of review date (timing) luck – that may turn out to be good luck or bad luck – so I’ll leave things as they are with TLT in the Tversky portion.

and VEU is now the recommended holding. However, this is a simple example of review date (timing) luck – that may turn out to be good luck or bad luck – so I’ll leave things as they are with TLT in the Tversky portion.

David

Leave a Comment or Question