Coming Storm

Several weeks passed since I last posted any Bullish Percent Indicator (BPI) data. No recommendations were forthcoming so it was not necessary to fill up the blog with useless data. That changed this week as several sectors moved into the overbought zone requiring some attention to Sector BPI portfolios. Friday’s market brought another change in Telecommunications (VOX). See below.

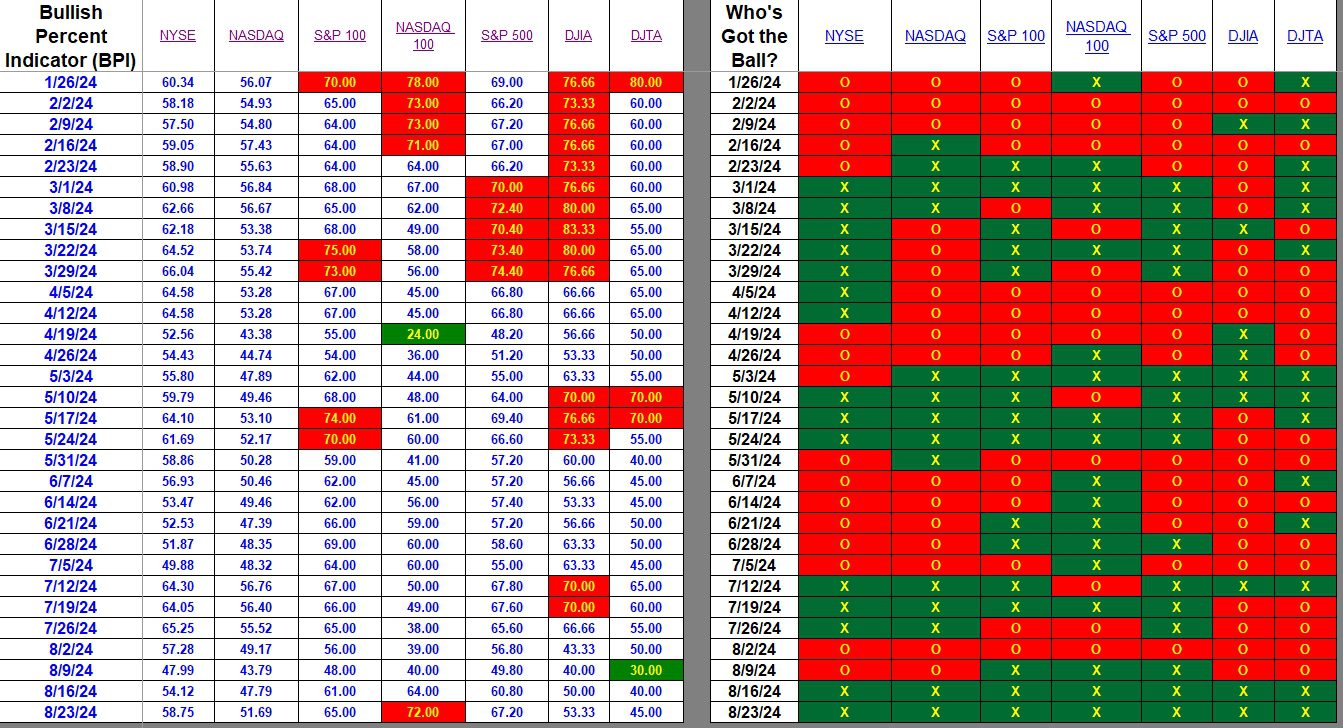

Index BPI

All seven indexes are bullish and all are showing positive trends when examining the Point and Figure (PnF) graphs. Despite the recent strong market, only the NASDAQ 100 is overbought. The two broad indexes, NYSE and NASDAQ are hovering around the 50% to 60% bullish trend indicating this is an average market anticipating an interest rate cut.

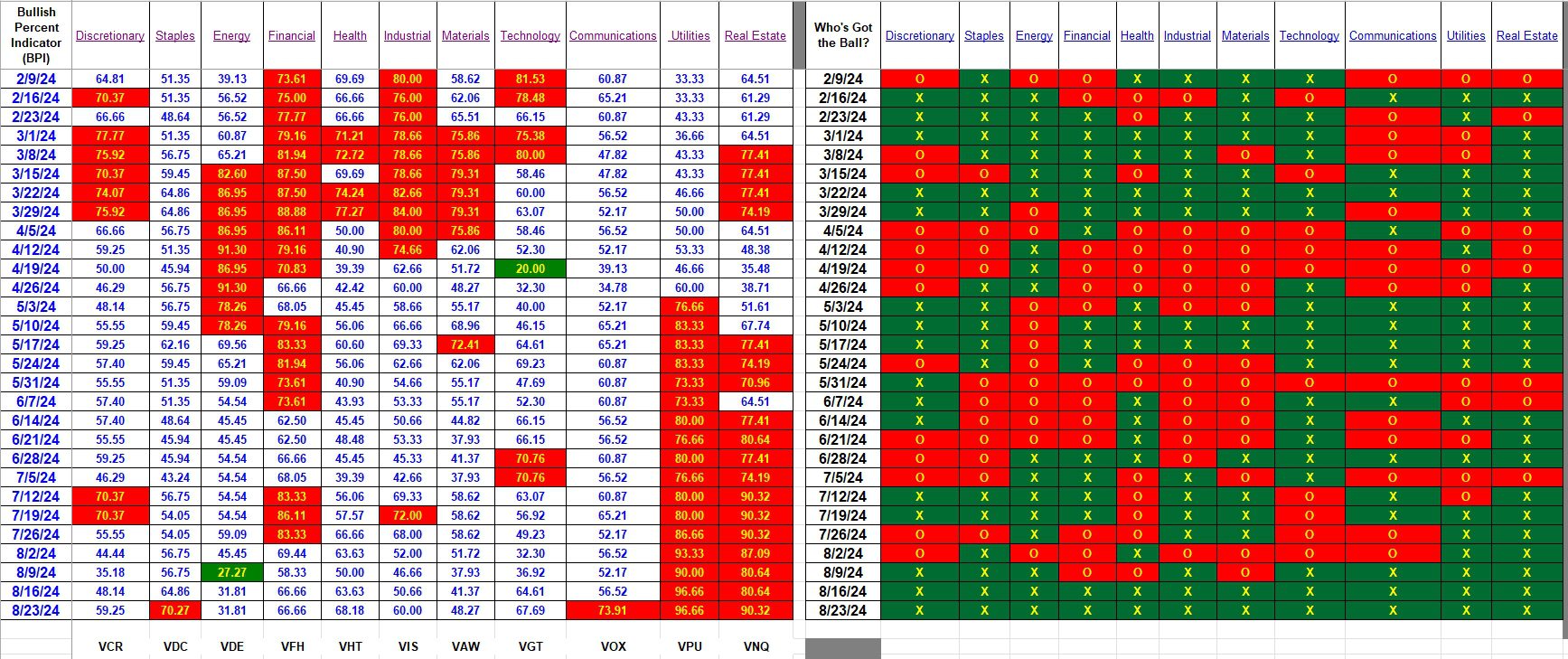

Sector BPI

As pointed out earlier this week, Staples and Technology hit the overbought zone. Technology backed off yesterday while Communications moved up into the overbought zone. Utilities and Real Estate are also overbought, but I don’t think any Sector BPI portfolios are holding either VPU or VNQ.

Trailing Stop Loss Orders of around 3% were set for VDC and VGT. Next week I need to check to see if any Sector BPI portfolios are holding shares of VOX.

The general guideline is to set a TSLO of 3% when a sector moves into the overbought zone. If one wishes to fine tune the TSLO setting and you hold shares with a broker who permits fractional TSLOs, as does Schwab, then one might follow this example. Take VOX which rounds to 72%. Instead of setting a 3% TSLO, set it at 2.8%.

Take another example of Real Estate (VNQ) where the bullish percentage is currently 90.32 or rounds to 90% bullish. If one is holding VNQ, there is a very high percentage it will move lower so set the TSLO at 1%. If a sector ends up at 84.4% bullish, set the TSLO at 1.6%.

If this is too complicated, just use the basic 3% setting when a sector moves into the overbought zone.

Explaining the Hypothesis of the Sector BPI Model

https://seekingalpha.com/article/4562329-portfolio-management-using-bullish-percent-sector-cycles

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I don’t plan to post a blog entry on BPI data for 8/30/24 as there are no major changes. No sectors are in the oversold zone, although Energy is quite close at 31.81 bullish.

Sectors that are overbought are: Financial, Health, Technology, Communications, Utilities, and Real Estate. The ITA portfolios I track either are not invested in any of these overbought sectors or TSLOs are already in place. Therefore no further action is required.

Lowell

Checking the BPI data this morning (9/7/24) no sectors are oversold so no purchase recommendations are in order. All the overbought positions where either sold or are still maintaining 3% limit orders. No action is required for the Sector BPI portfolios.

Lowell

Lowell – where can I find how to calculate the BPI Sector bullish sector data on my own.

David,

I pull the BPI data off StockCharts. More later.

Lowell

David,

You will find the answer to your question in your gmail account.

Lowell