Gemini’s version of Annapolis, Maryland.

Next to the Schrodinger Intelligent Portfolio the Copernicus is the easiest portfolio to manage as all one needs to do is save and invest in one of several U.S. Equities ETFs. Unless there is an emergency, never sell. This investment management model is specifically designed for young investors with years ahead to save and plan for retirement.

This regular saving model is known as dollar cost averaging. If possible, when the market dips as it did in 2022, save a few more dollars than normal. This way you will pick up more shares at a lower price and this will pay dividends in the future – assuming the future works out in a similar way we have experienced past history. There are likely to be rocky periods ahead such as the 1970s, Black Monday of 1987, dot-com bubble of early 2000s, real estate crash of 2008 and Covid-19 in 2019 and 2020. Ride out those rough periods by saving more during periods when there is “blood in the streets.” Keep in mind the Dow Jones Industrial Average (DJIA) was below 800 in August of 1982 and today it is hovering around 39,000.

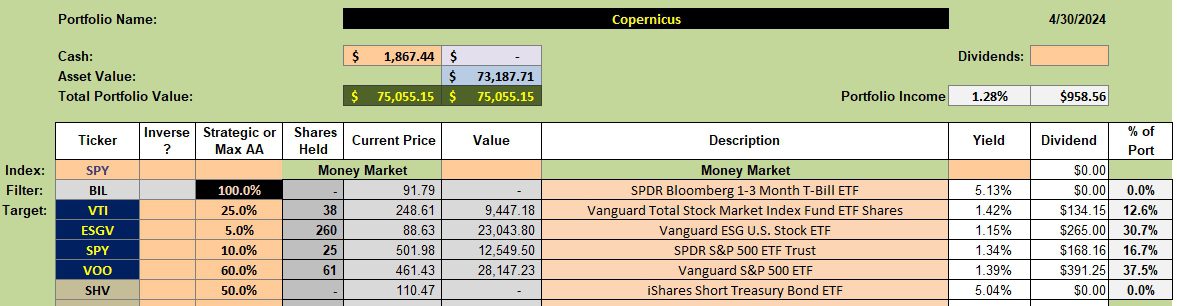

Copernicus Portfolio

The Copernicus holds four different U.S. Equity ETFs. This can be reduced to VOO and VTI as there is duplication of stocks among these four ETFs. SPY and VOO in particular are essentially made up of the same stocks.

When I began developing the Copernicus I invested too much in ESGV so it is over-weighted. Rather than sell shares and redistribute, I’ll just continue to build up VOO until it is 60% of the portfolio. The same goes for VTI, the other ETF that is far below its desired 25% of the portfolio.

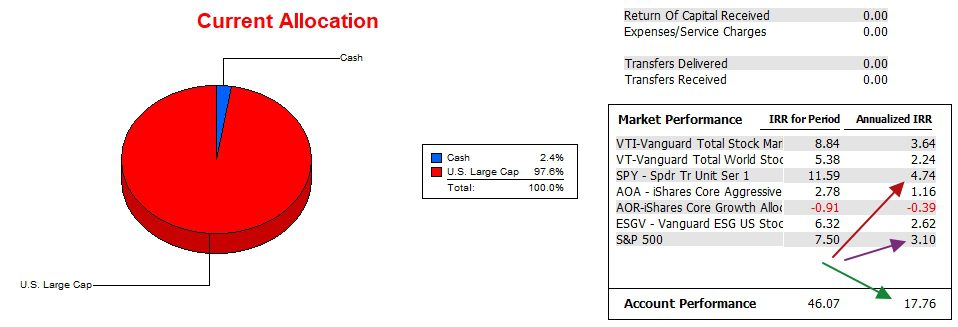

Copernicus Performance Data

Since 12/31/2021 the Copernicus far outpaced its SPY benchmark. How can this be since SPY is also a U.S. Equity? Dollar cost averaging is the answer. In 2022, when the market was depressed, I invested more dollars than normal in the Copernicus. Those dollars purchased more shares and now those additional shares are paying off and adding alpha to the Copernicus.

Of all the portfolios I track here on the ITA blog, the Copernicus is far and away the top performer. There is nothing fancy about this management model. Just let the market do its work in good and bad times.

In the following screenshot I add the performance of the S&P 500. See the purple arrow. The team managing SPY are outperforming the actual index (S&P 500) the ETF is designed to track. Since one cannot invest in the S&P 500 we choose either SPY or VOO as investment vehicles as both ETFs are designed to track the all important index.

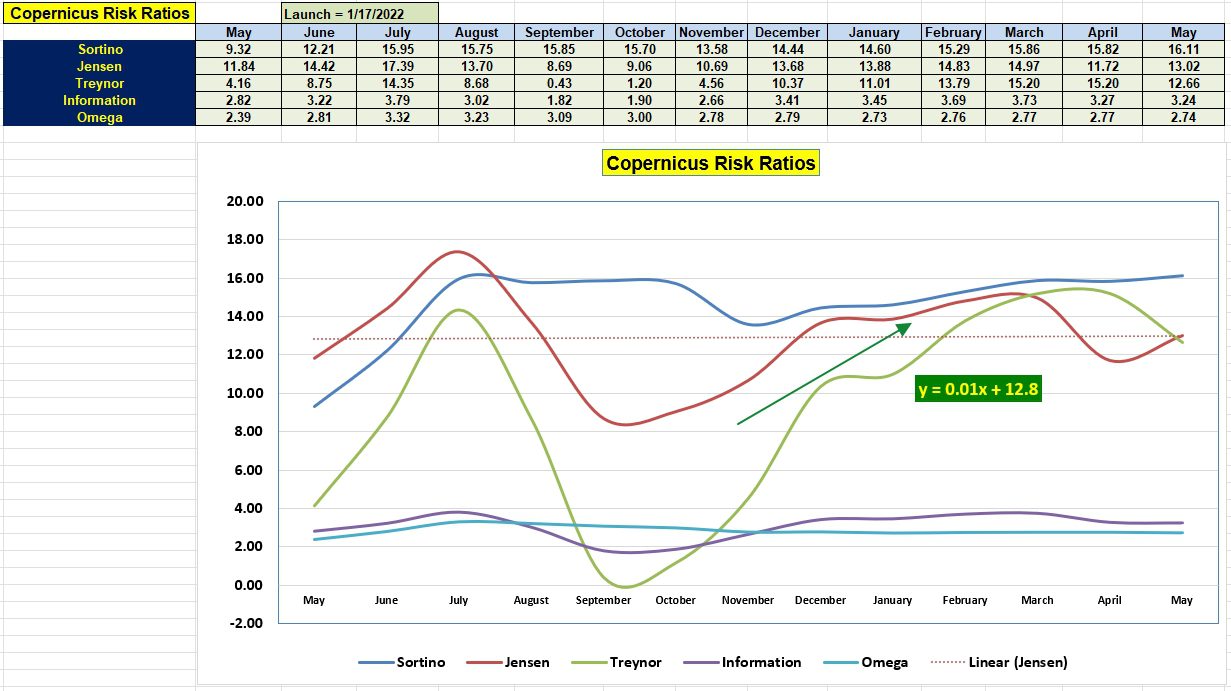

Copernicus Risk Ratios

Does the additional risk taken by investing 100% in U.S. Equities raise the risk when the numbers are crunched? Not really as the Copernicus currently holds the highest Jensen Performance Index rating of all ITA portfolios. The current value of 13 will be exceedingly difficult to maintain as it is such a high value.

If the Copernicus is too concentrated in equities and seems too risky, check out the Schrodinger, Pauling, and Huygens.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question