Santa’s Coming To Town, Christchurch, New Zealand.

The Hawking Portfolio is another portfolio that I haven’t reviewed for some time (4 months) – so it’s about time for an update.

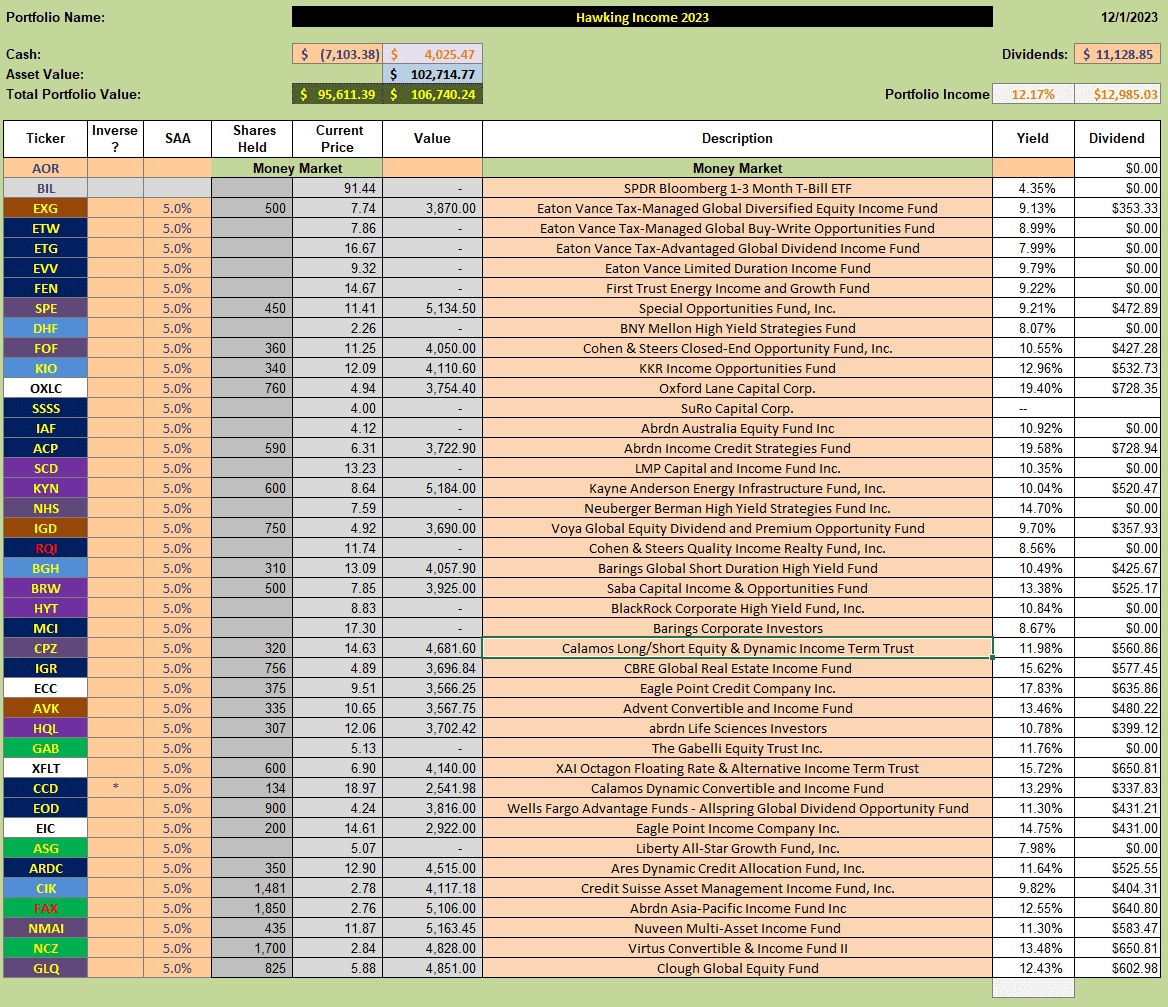

The Hawking is essentially a Buy-And-Hold portfolio built from Closed-End-Funds (CEFs) that doesn’t require much attention other than to re-invest dividends every month. Current holdings look like this:

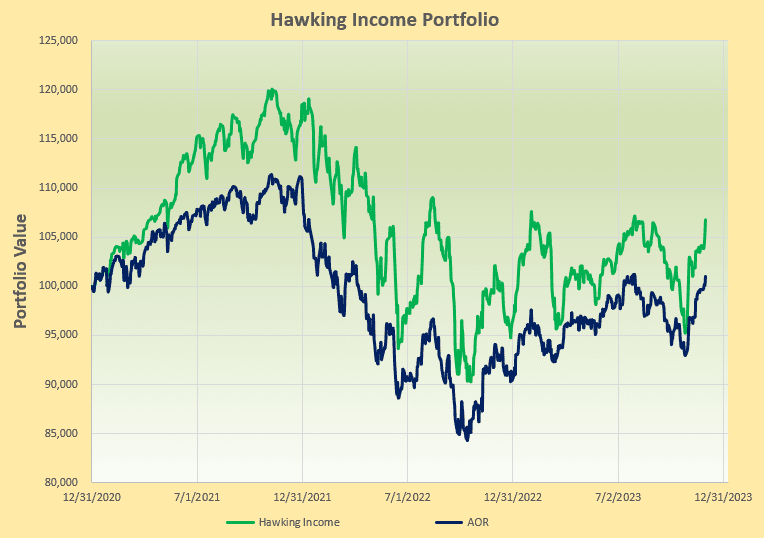

and performance, over the past 3 years, looks like this:

and performance, over the past 3 years, looks like this:

with the portfolio outperforming the benchmark AOR Fund by ~6% – so a very respectable performance over a difficult period (through the 2022 downturn)

with the portfolio outperforming the benchmark AOR Fund by ~6% – so a very respectable performance over a difficult period (through the 2022 downturn)

The portfolio is presently holding ~$4,000 in cash (from dividends) since I have been pre-occupied with other things and haven’t found the time to re-invest since the last review. I will be checking dividend/pricing to NAV values over the next few days to decide where to re-invest the money. Meanwhile, this has probably been the best performing portfolio over this 3-year period, despite the fact that volatility is a little higher than other portfolios – but the ~10% annualized dividend yield (usually paid monthly) is nice for anyone looking for income.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.