Gulf Coast walk.

“Fund expenses have a direct impact on investment returns.”

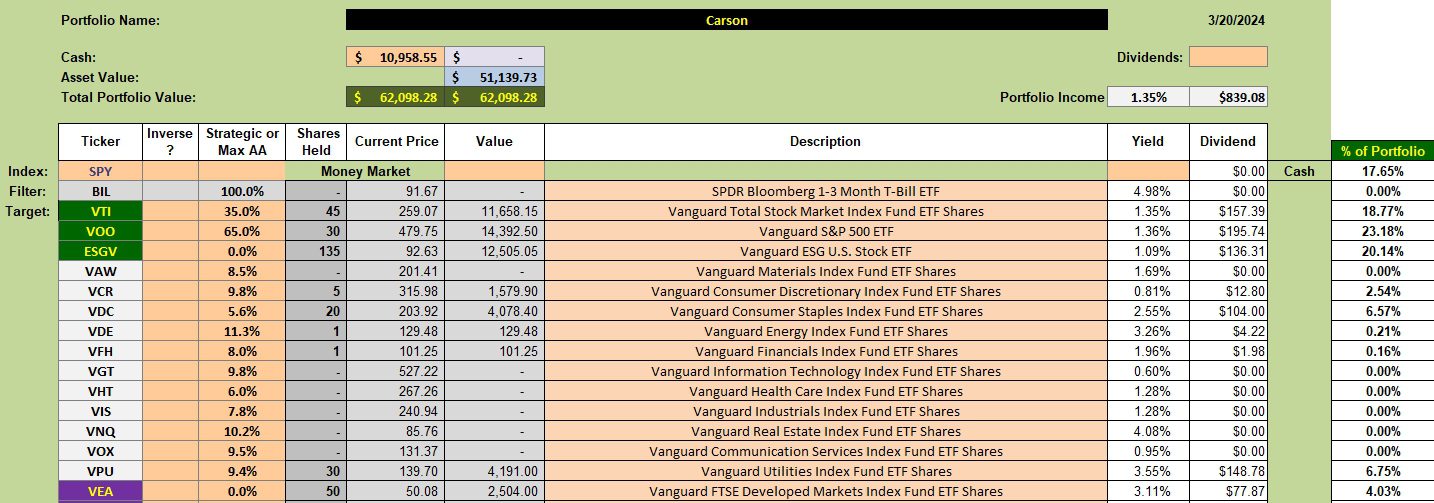

Carson, the oldest Sector BPI portfolio, is the account up for review today. With U.S. Equities pushing the upper limits no sectors are positioned in the oversold zone. In these market conditions investments focus of using available cash to populate VTI and VOO. As you may recall, adding U.S. Equity ETFs to the investment quiver was a “weakness” patch to the basic Sector BPI model. We do not want to be caught with too much excess cash when the market is trending up and we are not invested in many sectors of the market. On the other hand, it is “difficult” to invest at market highs.

Carson Security Holdings

The bulk of the Carson is invested in U.S. Equities. Eventually VEA will be sold and eliminated from the investment quiver. The same goes for ESGV in an effort to simplify the investment quiver. By focusing on VTI and VOO when sectors are out of favor, we are able to keep up with the SPY benchmark, a major goal of the ITA portfolios.

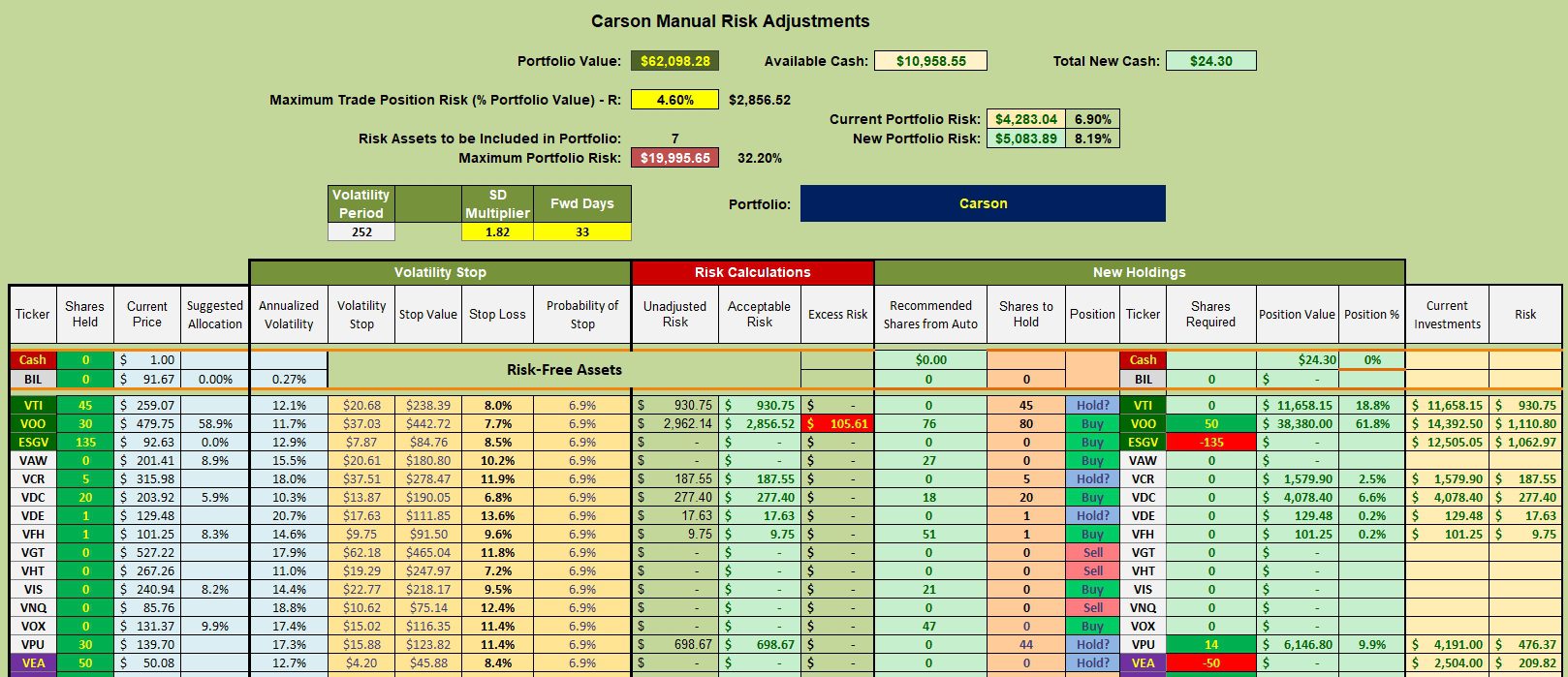

Carson Manual Risk Adjustments

Trailing Stop Loss Orders (TSLOs) are set for VEA and ESGV. Limit orders are in place to purchase more shares of VOO and VPU. The VPU order was set several weeks ago when the Utilities sector dipped into the oversold zone.

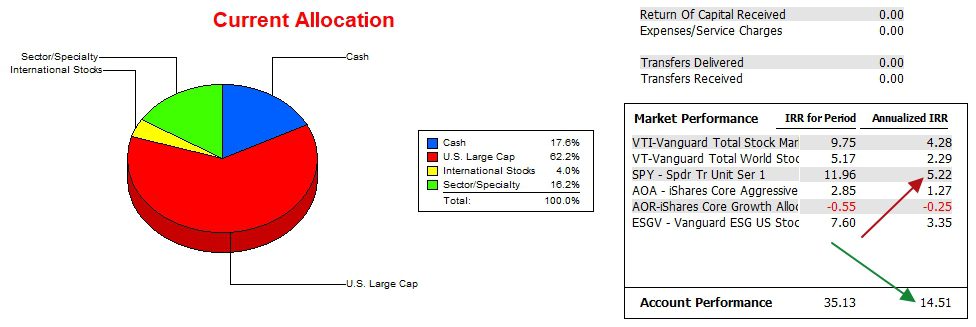

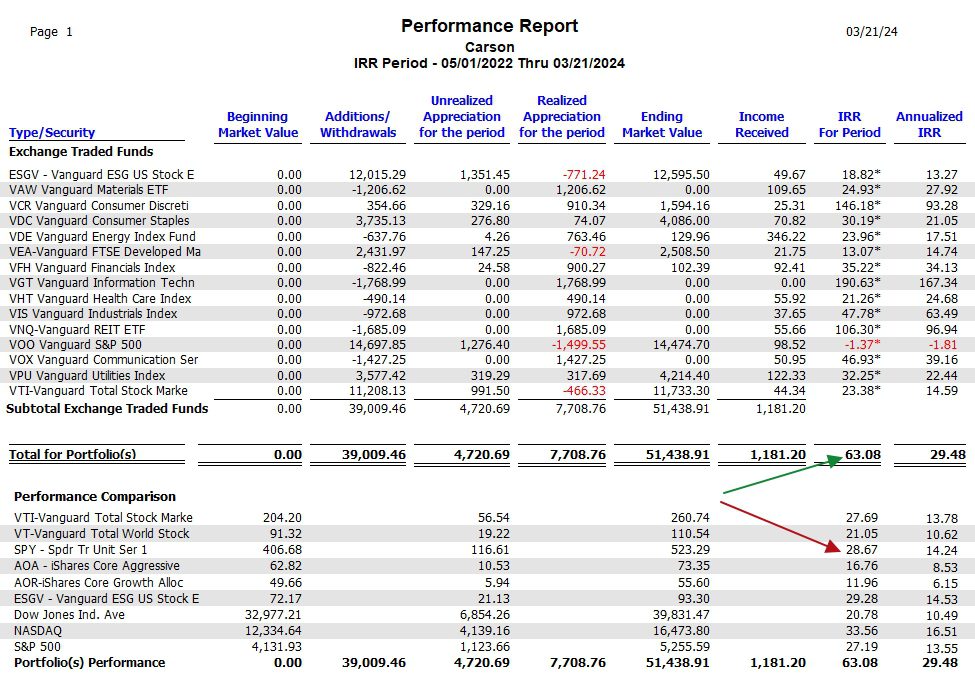

Carson Performance Data

Since 12/31/2021 the Carson has outperformed the SPY benchmark by a wide margin. The other possible benchmarks are not even close.

Check the IRR for Period percentages. This data comes from the Investment Account Manager software, a commercial product.

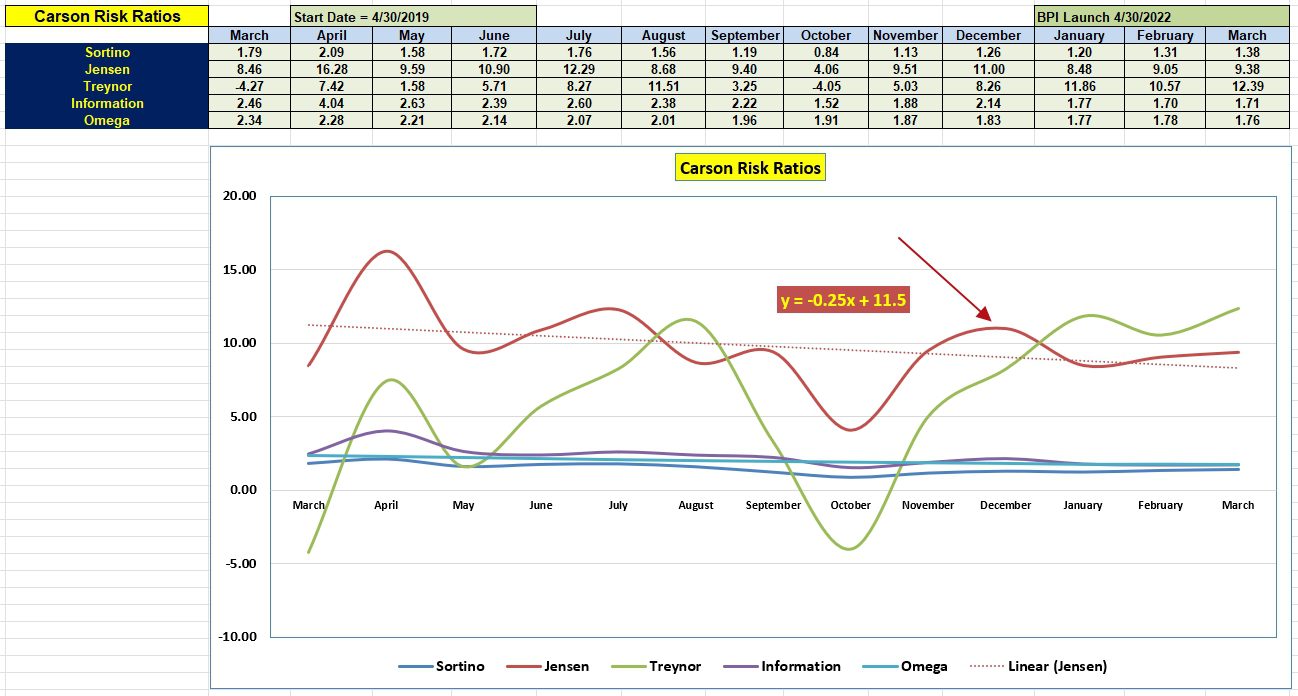

Carson Risk Ratios

When a Sector BPI portfolio is performing this well we examine the risk ratios to see how well the portfolio is keeping up with other reference standards.

- We see a slight improvement in the Sortino Ratio. The Sortino Ratio is far superior to the commonly used Sharpe Ratio as the Sortino does not penalize volatility to the upside. Investors want volatility to the upside, but not the downside.

- The Jensen Performance Index (frequently called Jensen Alpha) is doing well, but is not up to the level it was in December.

- The Treynor Ratio is the highest its been this past year. I don’t pay too much attention to this ratio as it is heavily dependent on the portfolio beta and is not modified by other risk factors. This is why I highly favor the Jensen Alpha ratio.

- The Information Ratio ticked up since February, but is lower than it was in mid-2023.

- The Omega is the least important of the five risk measurements so I give little attention to this ratio. The Omega tends to track the Sortino.

Carson Sector Portfolio Report

I launched the Sector BPI model with the Carson back in May of 2022 so we are closing in on two years of operation. Over that period the Carson has doubled the S&P 500 benchmark, a remarkable performance. This speaks well for the Sector BPI investing model.

If you are reading this far and received an e-mail notification this blog post was available, drop a comment in the space provided below. I would appreciate knowing if notifications are going out to subscribers. I know a few readers do not wish to be notified and it is possible to unsubscribe if that is your desire. Thank you in advance for your feedback.

Tweaking Sector BPI Plus Investing Model: Part II

Millikan Sector BPI Update: 20 July 2023

Copernicus Portfolio Review: 29 December 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I have received an e-mail notification stating that this blog post was available. That is my preference. Thank you! – Cristian