New bridge over Yangtze River

Carson is the oldest Sector BPI portfolio or the one providing the best information as to how well this investing model works. As yet I have not seen another website using this investing model. If ITA readers ever spot something similar, pass the link or pertinent information along.

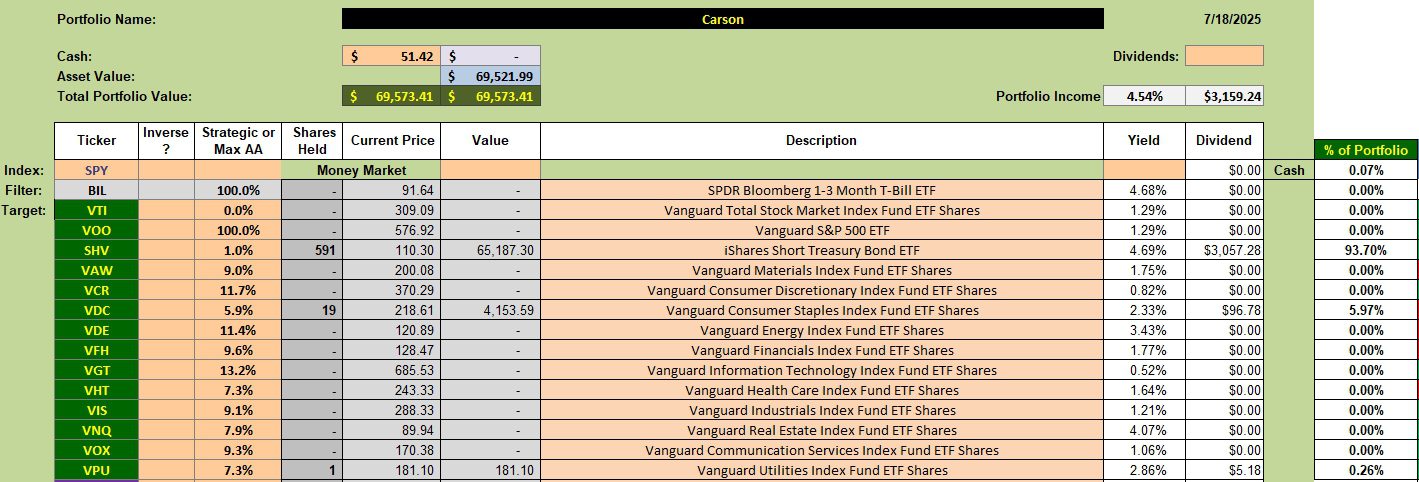

Carson Security Holdings

Health was sold out of the Carson as this sector dropped from 75.41% bullish down to 47.54%. I thought this might be a StockCharts error as I don’t recall seeing such a BPI percentage drop in one week.

I should mention that no sectors are oversold so there are no purchase recommendations. Overbought sectors are: Discretionary (VCR), Energy (VDE), Financial (VFH), Industrial (VIS), Materials (VAW), and Technology (VGT).

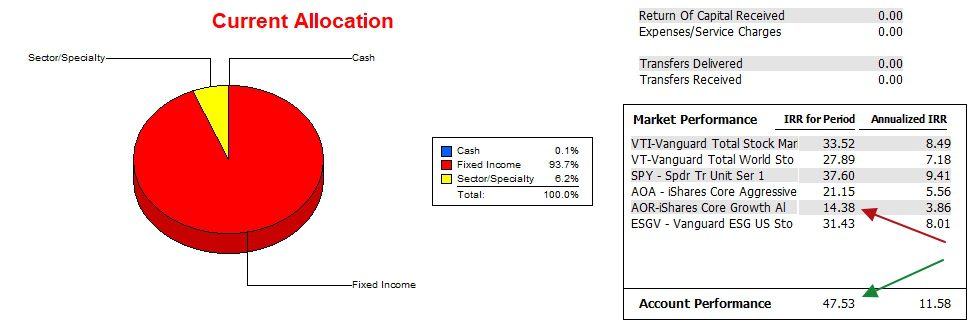

Carson Performance Data

Since 12/31/2021 the Carson has outperformed all possible benchmarks I am tracking using the commercial program, Investment Account Manager. As readers can see, the S&P 500 (SPY) provides the largest challenge and the Carson has more than met that standard.

The Carson began using the Sector BPI model in early November of 2022 so it has been operational though most of the period for which data is shown below.

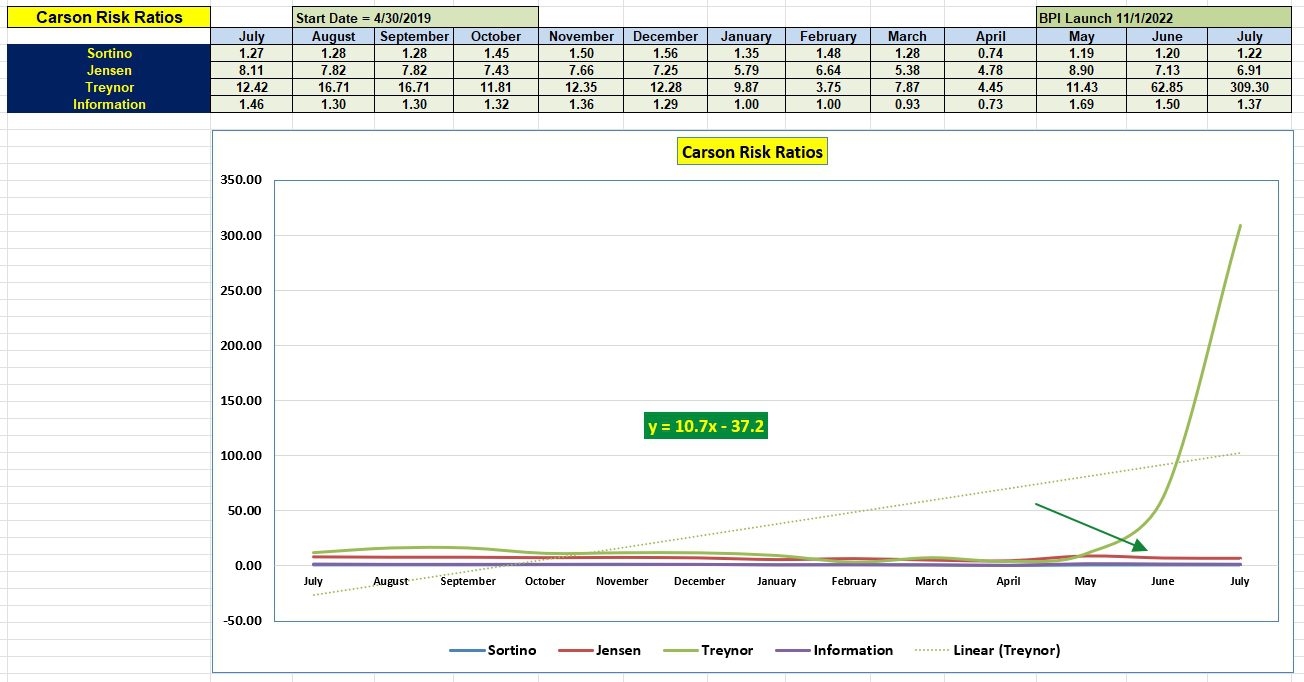

Carson Risk Ratios

The Treynor Ratio (309) needs some explanation. When the portfolio is besting the benchmark by a wide margin and the beta (0.022) is low the Treynor Ratio is highly exaggerated. The same holds true if the portfolio is lagging the benchmark. In that case the Treynor is highly negative. For this reason I pay little attention to the Treynor.

The Jensen Alpha lost ground since the June measurement, but not by too much. The Information Ratio also indicates the portfolio lost ground to the benchmark over the past month.

I think I made an error with the Jensen slope and will correct it when the portfolio is next reviewed.

Tweaking Sector BPI Plus Investing Model: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

Les Masonson, used have a website setup to follow his strategy he laid out in his book Buy – DON‘T Hold (BDH). The website is now gone, but his screen is still up at https://www.etfscreen.com/buydonthold/. The link to his blog is dead but most of the information he uses is still there. He usually uses a universe of 42 ETF’s, some sectors and some specialized. He used to update his list once a year, but since his website went off line the list has become static.

Harry,

It looks like L. Masonson uses Relative Strength to identify his ETF moves. Or did I miss something?

Lowell

Lowell,

I think he uses relative strength to rank the ETF’s but uses a combination of the $NASI Nasdaq McClellan Summation Index and MACD, the AAII sentiment survey, NASDAQ above 100-dma, and the NASDAQ MACD positive crossover for the Buy and Sell signals. Just like you when he bought he placed stop loss orders of 3 to 5 percent.

I did an experiment several times when the signal hit sell and was confirmed the next day and then bought the inverse ETF’s. It worked 7 out of 10 times – but its not for the faint of heart.