Solitude – Seaside, Oregon

There was snow on the ground when the Carson was last reviewed. Now here we are in the Spring of 2025 and it is time to update this Sector BPI portfolio. In this volatile market we are testing the proposition that sectors that hit the oversold zone will rebound faster than the broad market as measured by the S&P 500 (SPY). At least that is the idea. Since beginning this approach the model has worked, but more recently it is showing signs of weakness. Check the analysis below.

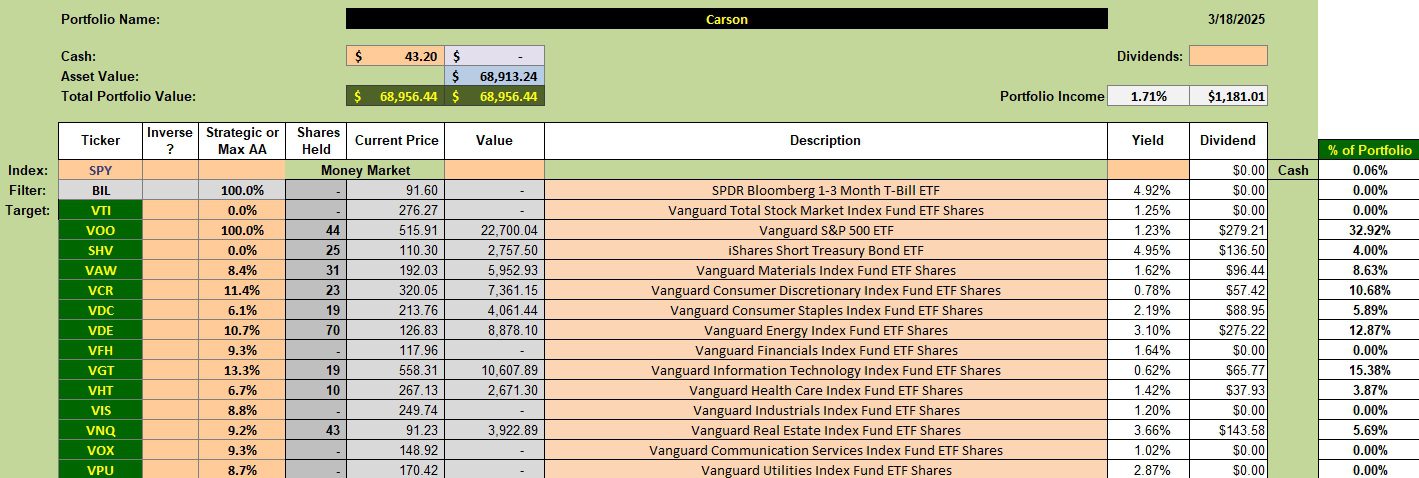

Carson Security Holdings

The Carson currently holds seven of the eleven sectors. This may be the highest number of sectors that populated any Sector BPI portfolio since launching this model about 2.5 years ago.

Readers will note that a few of the sectors are below their target percentage. This happens when a sector is held for sometime and the prices change. I could sell shares of SHV and purchase more shares of sectors still in the oversold zone. Since third quarter dividends will be paid out shortly I am leaving things as they are and will make necessary adjustments when the April review arrives.

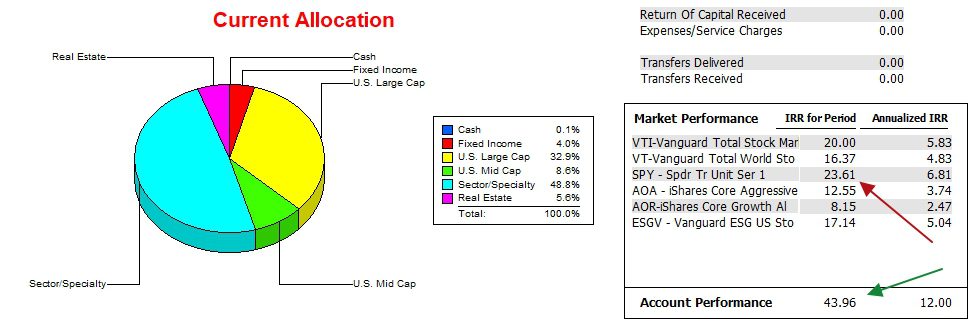

Carson Performance Data

Since 12/31/2021 the Carson has outperformed all benchmarks by a wide margin. As readers will see in the last screenshot more recent data is not as positive.

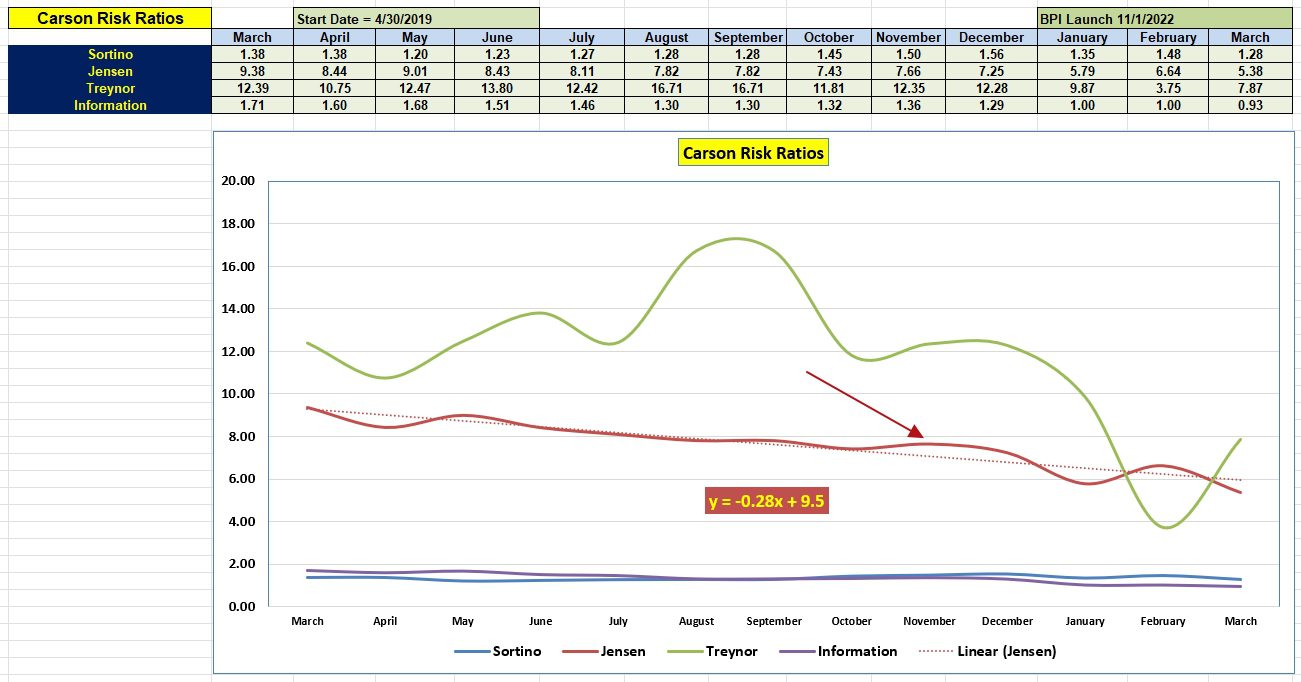

Carson Risk Ratios

Of the four risk ratios the Jensen Performance Index (also goes by Jensen Alpha) is by far the most important. Next is the Information Ratio followed by the Sortino Ratio. Each of these three ratios are in decline indicating the portfolio is having a hard time keeping up with the S&P 500 (SPY). With a reading of 5.38, the Jensen is still very high. Anything above zero is considered excellent. It is the trend that is of concern.

Comments and Questions are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question