Dahlia photographed with Lensbaby Velvet 28mm.

I could have skipped this review as there has not been any action since the last update. This blog will inform readers where the Carson portfolio currently stands and how well the Sector BPI model is working.

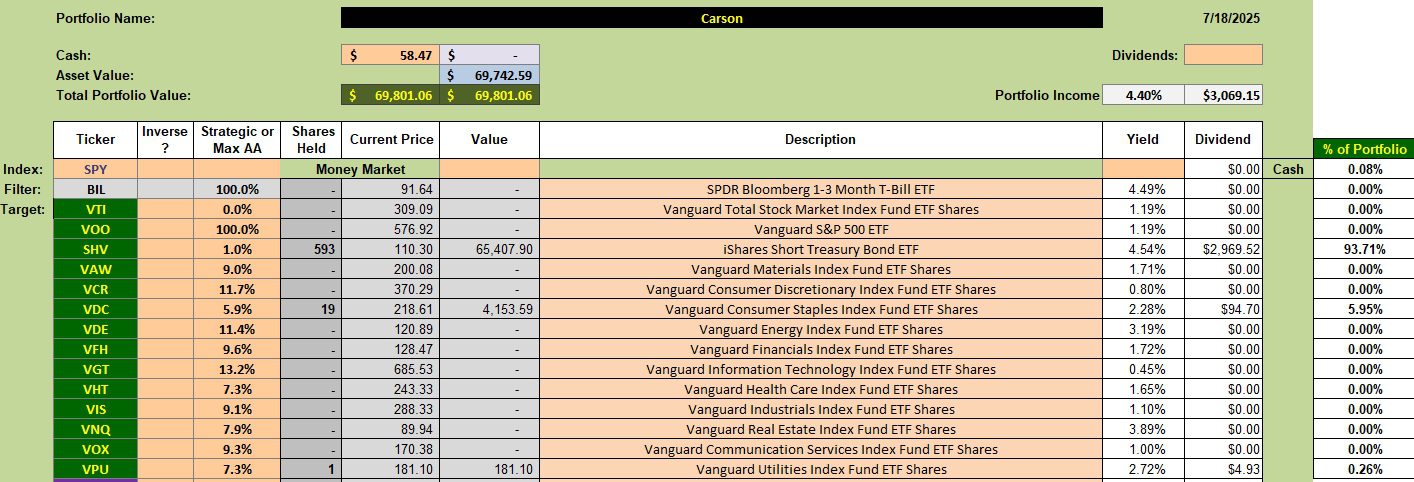

Carson Security Holdings

The bulk of the Carson is positioned in a short-term treasury, SHV. Should there be any substantial pull back I will sell shares of SHV and purchase shares of VOO. We are still waiting for one or more sectors to dip into the oversold zone.

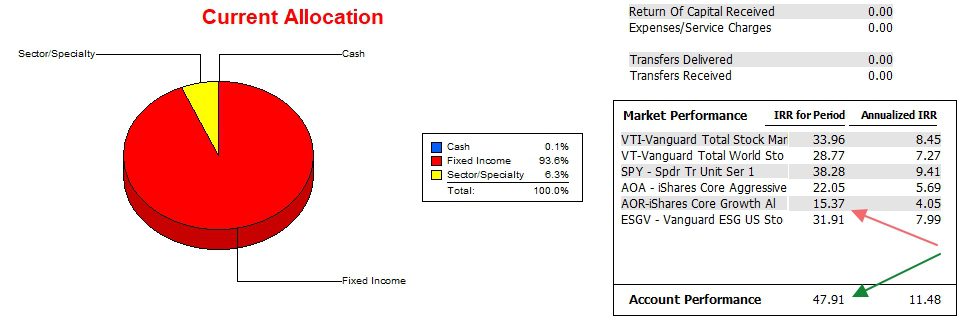

Carson Performance Data

Since 12/31/2021 the Carson is crushing all benchmarks. As expected, SPY comes closest to matching the Carson.

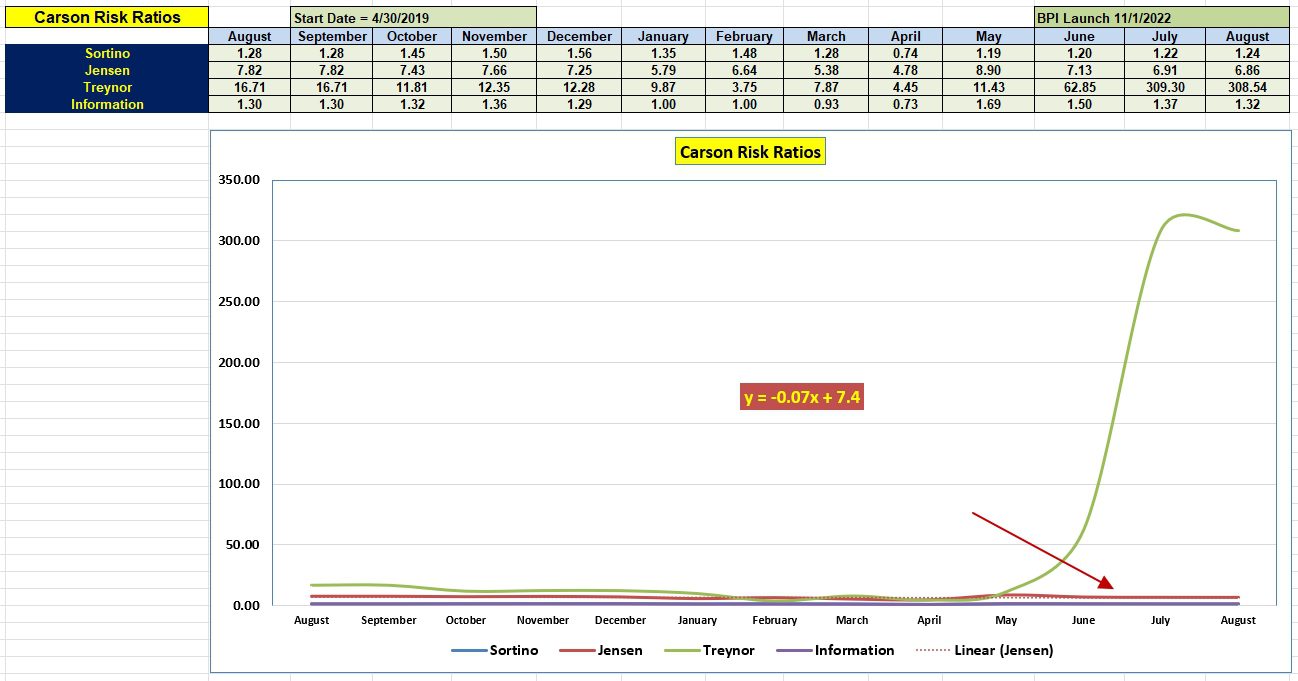

Carson Risk Ratios

Don’t pay much attention to the Treynor. This value is exaggerated when the portfolio beta is low. Of more importance is the Jensen Alpha and it has been rather steady over this past year.

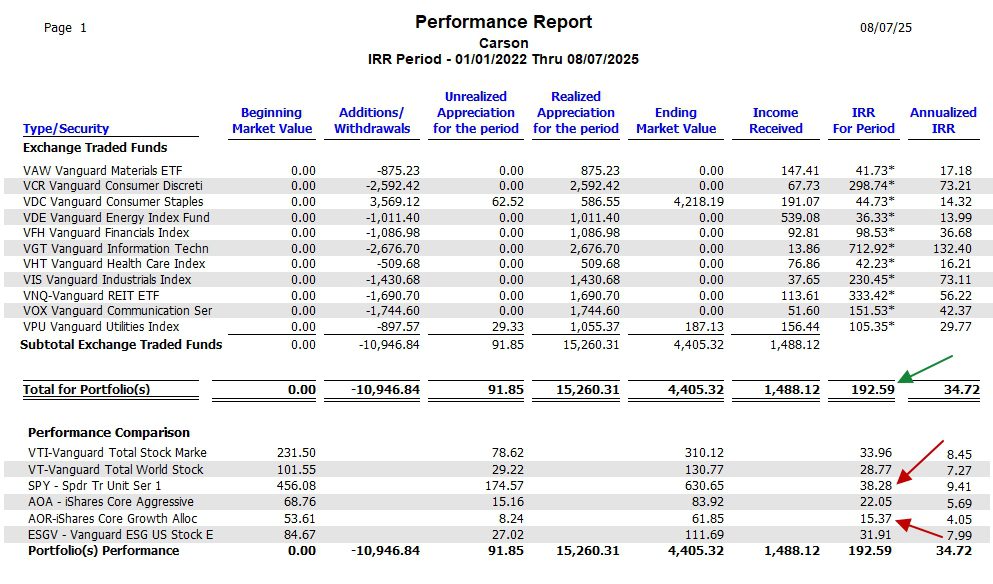

Carson Sector Performances

If one looks only at the sectors, the investment model is working very well. None of the sectors were part of the portfolio over the entire period.

When invested in SHV while no sectors are recommended for portfolio inclusion, the performance drops. The following table indicates the Sector BPI model is valid and has been working as anticipated. Perhaps even better than expected.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question