Tillicum Crossing Bridge – Portland, OR – No cars permitted.

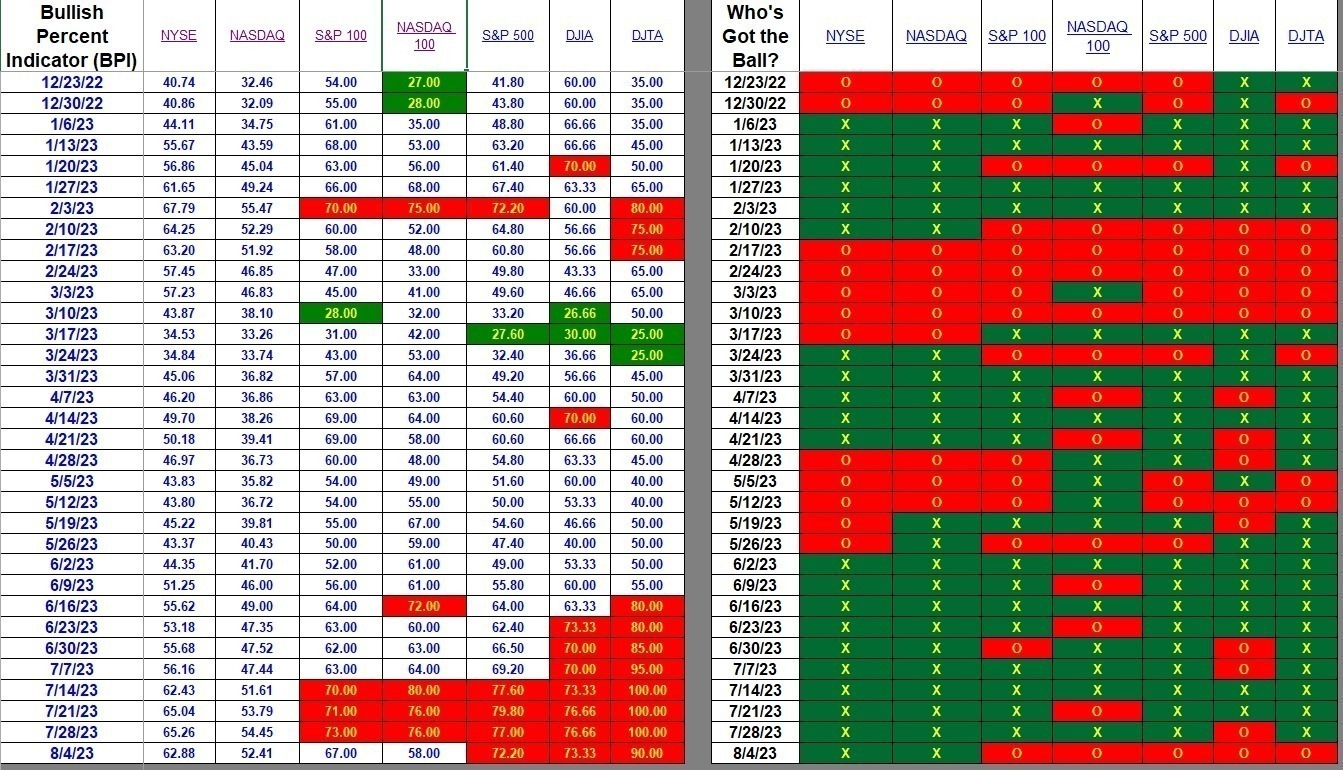

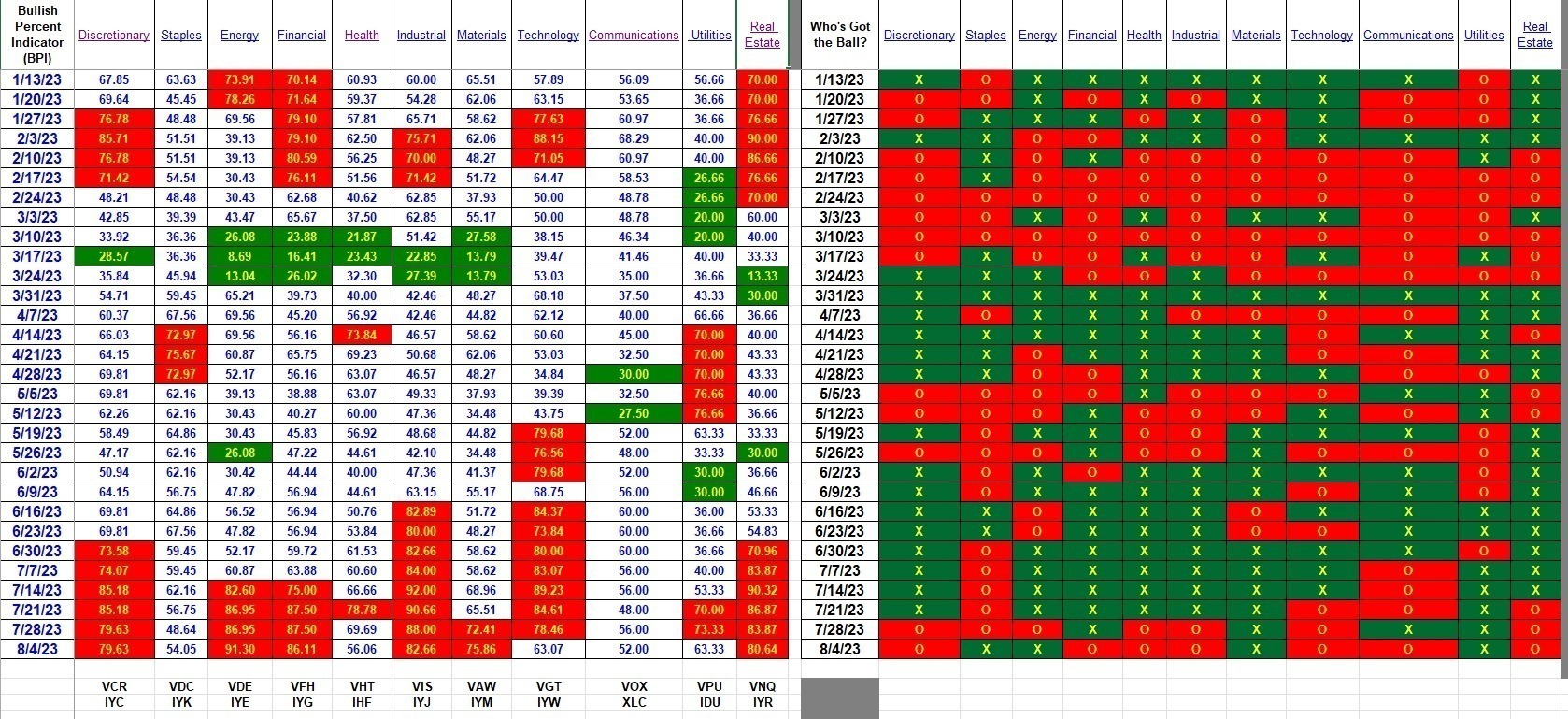

August opened with a poor week for U.S. equities. All the major indexes are down while sectors are a mixed bag. When working through the following tables, check the right-hand side (X’s and O’s) for a peek into broad market action and use the left-hand side for granular data as the percentages provide more precise information.

Index BPI

Small- and Mid-Cap stocks are still not participating to the same level as Large-Cap stocks. This is why the BPI for the NYSE and NASDAQ are lower than the S&P 500 and Dow 30. On the other hand, the NYSE and NASDAQ remain bullish since June. Look for a strong end-of-year equities market if stocks hold steady over the next three months.

Sector BPI

Six of the eleven sectors remain overbought (70% bullish or higher). No sectors are oversold so no Buy orders are recommended. Check the holdings in your Sector BPI Plus portfolio and make sure 3% TSLOs are in place for any sectors showing a red percentage background. VPU and VFH were culled from most if not all the Sector BPI portfolios I’m tracking. The 3% TSLOs were struck. I think a profit was locked in for all sales.

Available cash is invested in either ESGV, VOO, SPY, or VTI. Bonds are still out of favor. Follow all the details when the Carson is reviewed on Monday.

Explaining the Hypothesis of the Sector BPI Model – This blog post is getting a little long in the tooth as I’ve added a few new wrinkles to the Sector BPI Plus model in order to patch a few weaknesses in the model. To stay current with the model follow reviews of the following.

- Carson – To be reviewed on Monday.

- Franklin

- Gauss

- Millikan

- Bethe – New to this model and still in a state of flux or migration.

The ITA Wealth Management ( https://itawealth.com ) blog is free to all who register as a Guest. Pass the link on to family and friends. Post the link on your Facebook account or other social media. Spreading the news is appreciated.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.