Wind Surfing – Columbia River near Hood River.

The philosophy behind the Copernicus is two fold. 1) Simplicity of implementation. 2) Utilize the concept of dollar cost averaging.

Young investors will find this investing model to their liking as it takes the guess work out of investing. All one does after opening up an account with a brokerage firm such as Vanguard or Schwab is to save. One of the key benefits to this model is to save on a regular basis so as to take advantage of dollar cost averaging. If possible, increase the dollars saved when the market declines an appreciable amount. In 2022 the equities market sagged and the owner of the Copernicus continued to invest. Those 2022 dollars ended up purchasing more shares and the benefits are now seen in the performance numbers.

Copernicus Holdings

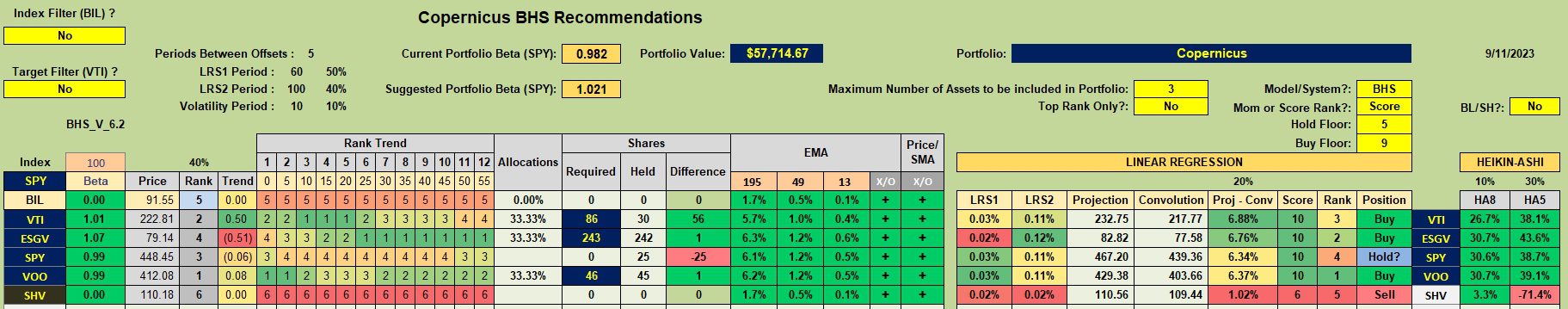

Below is the simple investment quiver and the current holdings. Note that VTI, ESGV, and VOO are recommended for purchase while SPY is a Hold? VOO holds the number one rank and I have a limit order in place to purchase more shares. ESGV ranks #2 and a limit order is also in place to add more shares. These two orders exhaust available cash.

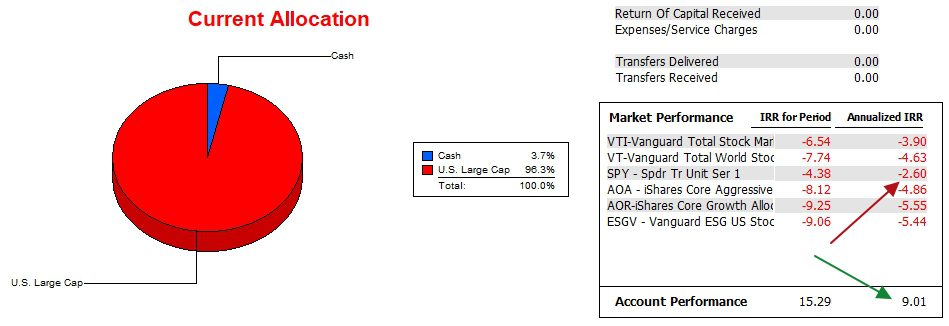

Copernicus Performance Data

Over the last 20.4 months the Copernicus is crushing all potential benchmarks. As mentioned above, this excellent performance is due to purchasing equity shares when the market was down. Those purchases in 2022 are now paying off.

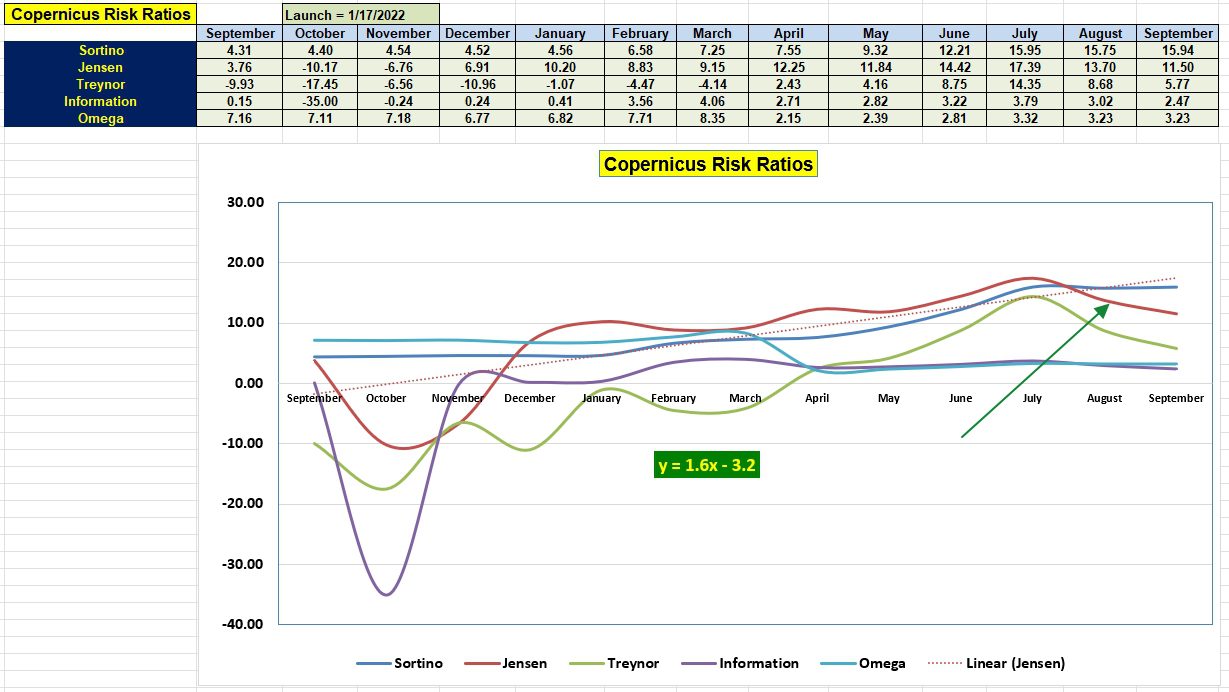

Copernicus Risk Ratios

Concentrate on three metrics.

- Jensen Performance Index or Jensen’s Alpha (11.5)

- Information Ratio (2.47)

- Slope of the Jensen Alpha. (1.6)

It will be difficult to maintain these very high values.

Copernicus Buy & Hold Portfolio Review: 18 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I should have included in the Copernicus blog post one negative. If one follows the Copernicus investing model, there is no downside protection.

If you are older and need to protect capital, do the following. Assume you add 100 shares to the Copernicus. Place an 8% TSLO under those 100 shares. Should the TSLO expire, place another 8% TSLO on those same 100 shares. Do this for every new purchase so as to provide a maximum loss on investments.

Lowell

Lowell,

In the case of expiring TSLO’s I check to see what the sell level was before the expiration and may reset the sell to a stop instead of a trailing stop. My thinking is the price may have declined from the high reached after I set the TSLO. If the decline hasn’t been very significant I’ll go with the TSLO again.

Bob W.

Bob,

Good point. I’ve thought of that myself.

Schwab TSLOs run out six months so it merits writing down the initial TSLO price.

Lowell