Newport, Oregon

As you move through this update of the Copernicus, don’t neglect to listen to the video linked at the bottom of the page. There are other YouTube videos also explaining the seven stages that align before a major market draw-down. Since the Copernicus is an equity only portfolio, how should one prepare this account for a likely market crash?

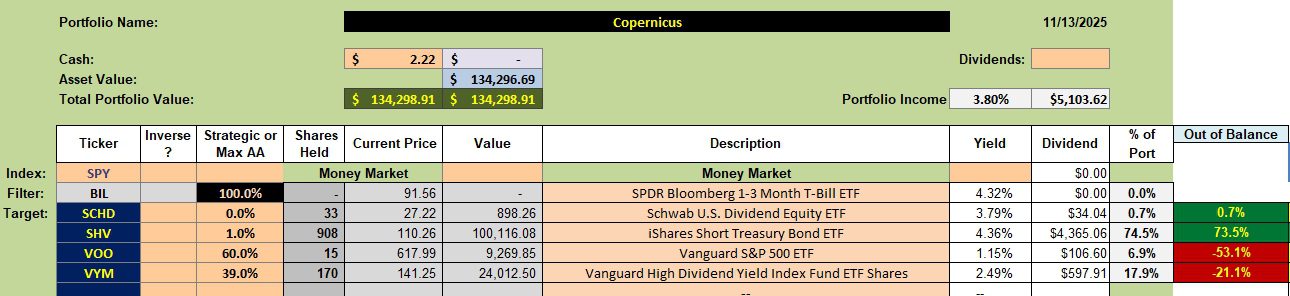

I have Trailing Stop Loss Orders in place for the equity holdings and the Copernicus is currently holding nearly 75% of the portfolio in short-term treasuries (SHV).

Copernicus Security Holdings

Below are the current holdings for the Copernicus. Trailing Stop Loss Orders (TSLOs) are in place for SCHD, VOO, and VYM. The limit orders range from 3% to 5%.

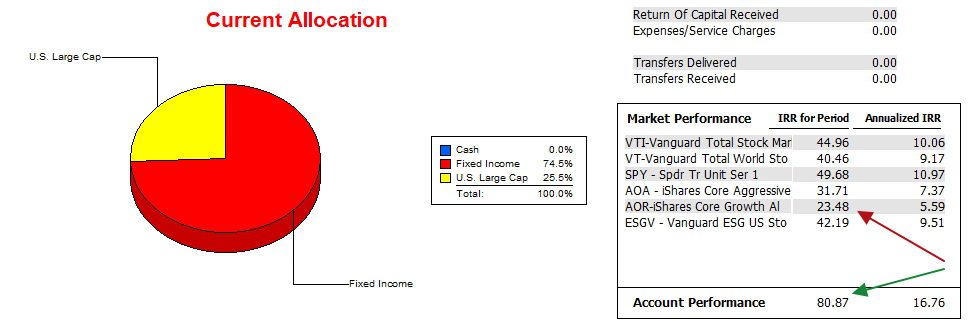

Copernicus Performance Data

Since 12/31/2021 the Copernicus has outperformed all benchmarks by a wide margin. This type of performance is unlikely to continue as I move toward very conservative asset allocation positions. Should the market trend downward the Copernicus is in a great position to perform very well. An upward market will see this portfolio stunted or limited in growth potential.

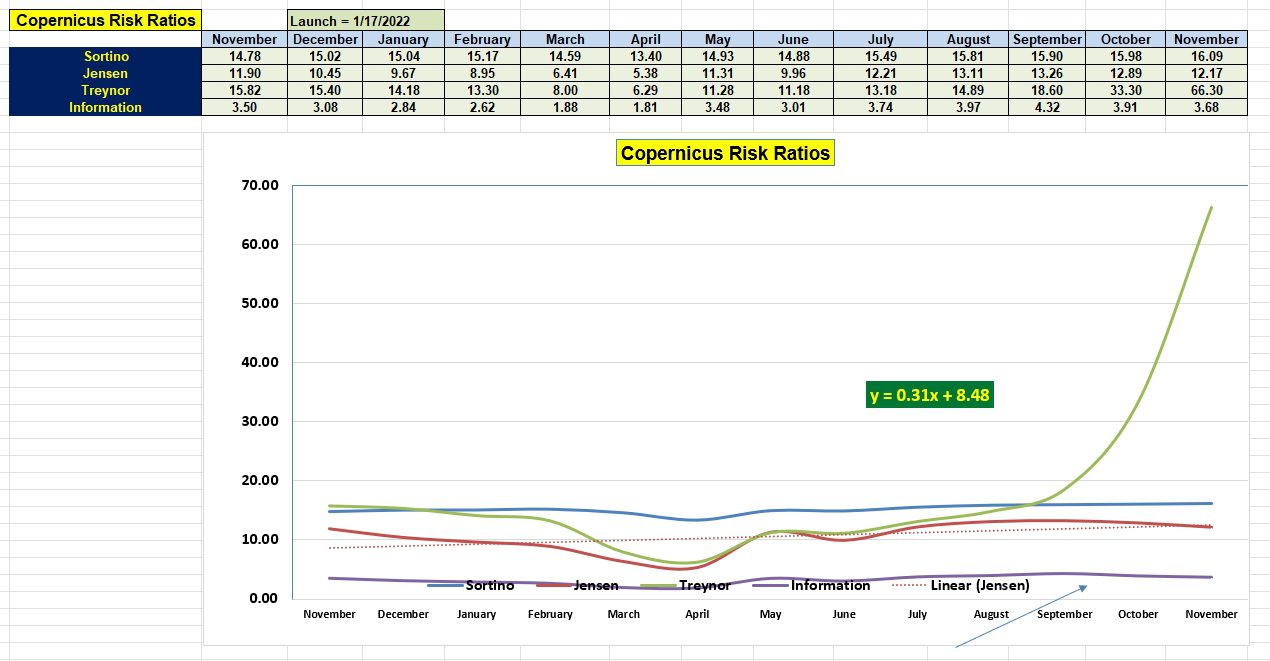

Copernicus Risk Ratios

Looking over the past year, the four risk metrics are higher today than they were a year ago, but not near the highs during the year. Until we see a market correction, the Copernicus is likely to under-perform the AOR benchmark. This is the price I am willing to pay with this portfolio in order to protect capital.

Take time to listen to the video linked below.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question