Pavilion

Early in the month is an excellent time to review portfolios such as the Copernicus and Schrodinger as both are “no-brain” portfolios in that neither require any significant decisions. One does not need a degree in Finance from the University of Chicago to manage these portfolios. While the Schrodinger is an asset allocation portfolio managed by computer, the Copernicus is an equity driven portfolio where one keeps saving in four ETFs. One could easily narrow this to one or two ETFs as there is considerable overlap in the stocks held in these four ETFs. VTI and VOO are two I would definitely keep.

Copernicus Holdings

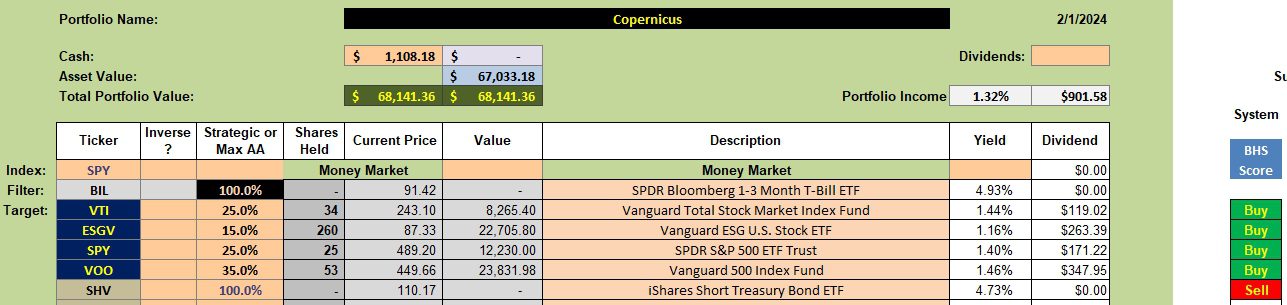

Below is the current Copernicus portfolio. The Strategic or Max AA percentages (3rd column from the left) were readjusted since the last review.

When cash becomes available I use the ranking that comes out of the Kipling spreadsheet to determine which of the ETFs to purchase. This portfolio is definitely a retirement portfolio as no selling occurs unless there is a major financial crisis.

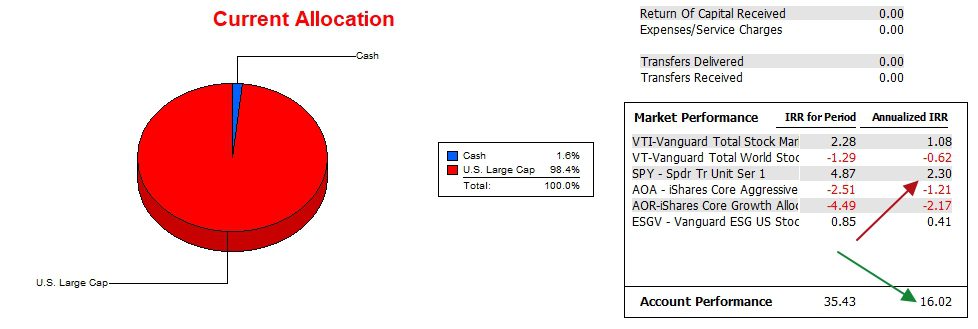

Copernicus Performance Data

Since launching the Copernicus more than two years ago the annualized Internal Rate of Return (IRR) is significantly higher than the SPY benchmark. This all equity portfolio is working despite a classification that it is a risky portfolio.

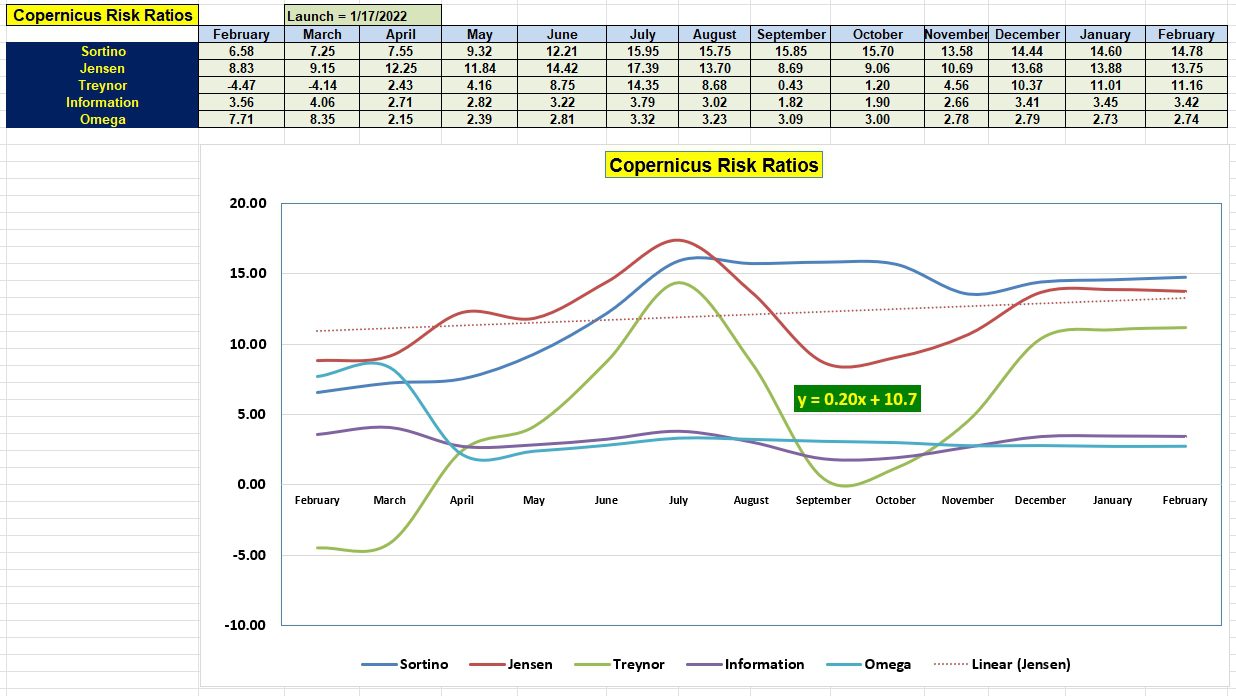

Copernicus Risk Ratios

This equity portfolio continues to defy the argument that an all-stock portfolio is risky. The numbers build a contrary argument.

The Copernicus and the Schrodinger are two portfolios I highly recommend to the young. In addition, max out your Roth IRA contributions.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.