Botanic Gardens, Singapore

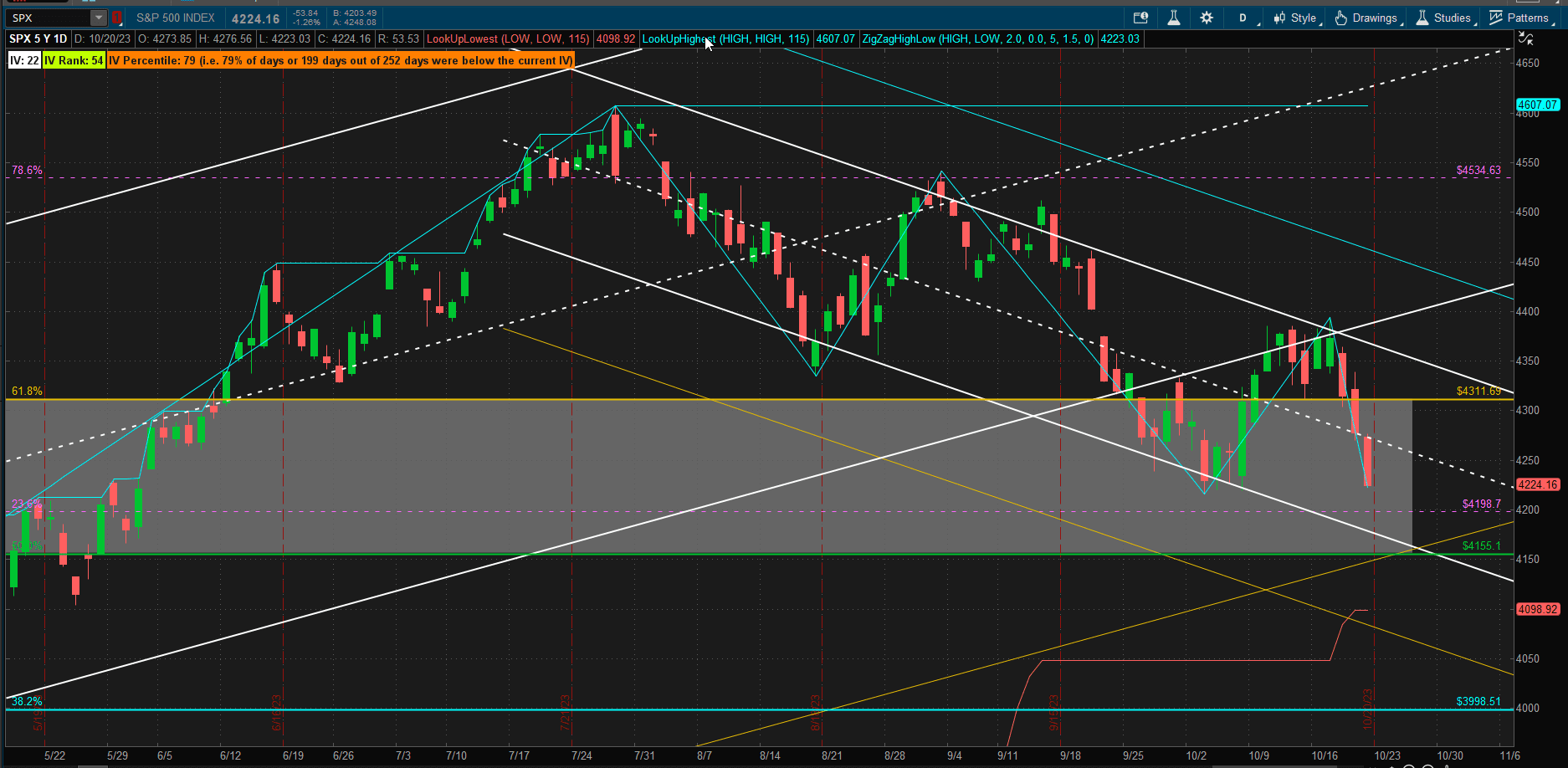

It was a bad week for equities with the SPX (S&P 500 Index) dropping ~2.5% on the week:

We are now back in the potential support zone (shaded area) near the prior pivot low at ~4200 and close to the bottom of the 2SD boundary of the longer term bullish uptrend channel. On the pessimistic side, should we drop below this potential support zone, things don’t look encouraging, with the next level of potential support coming in at ~4000.

We are now back in the potential support zone (shaded area) near the prior pivot low at ~4200 and close to the bottom of the 2SD boundary of the longer term bullish uptrend channel. On the pessimistic side, should we drop below this potential support zone, things don’t look encouraging, with the next level of potential support coming in at ~4000.

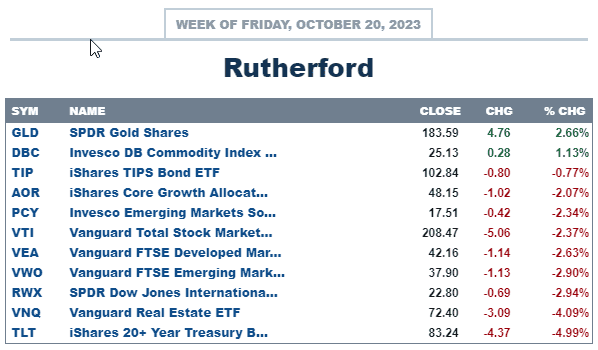

Compared with other major asset classes, US Equities came in at the centre of the pack:

with Commodities and Gold leading the way and Bonds and Real Estate bringing up the rear.

with Commodities and Gold leading the way and Bonds and Real Estate bringing up the rear.

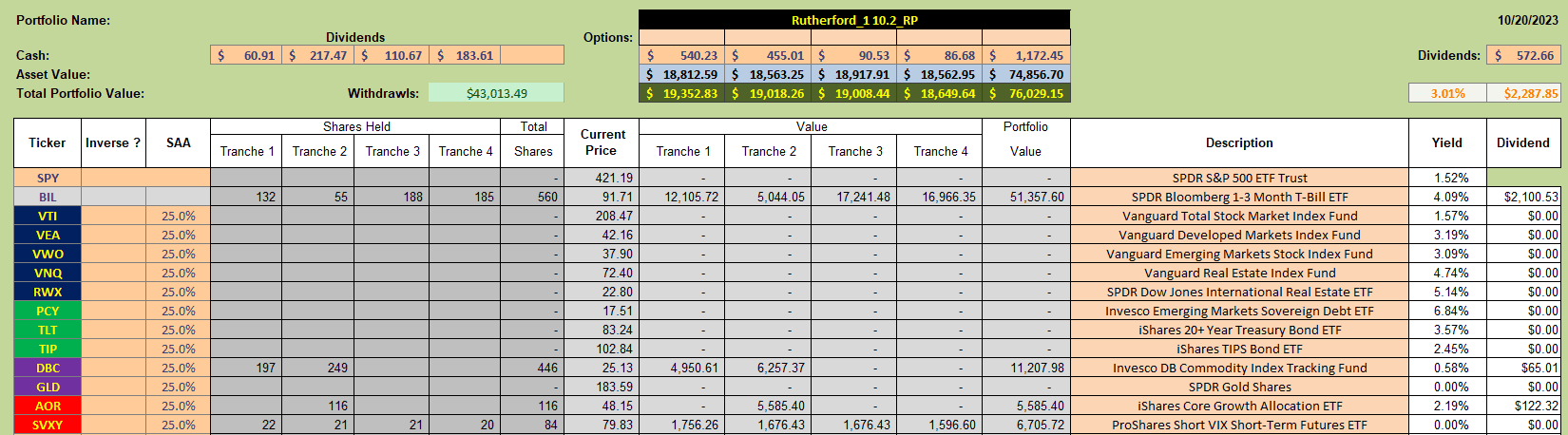

Current holdings in the Rutherford Portfolio look like this:

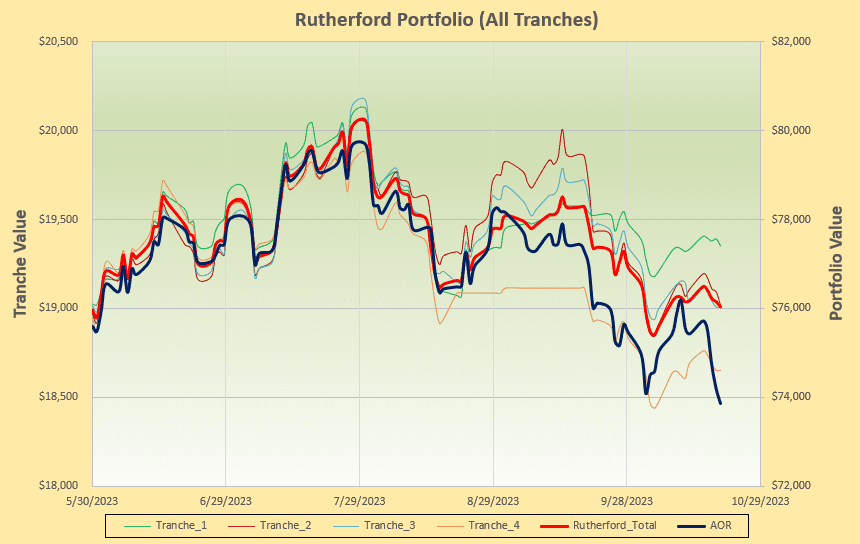

and, since the portfolio is holding a high percentage of funds allocated to Cash (or BIL, ST Treasury Notes) performance did not suffer too badly:

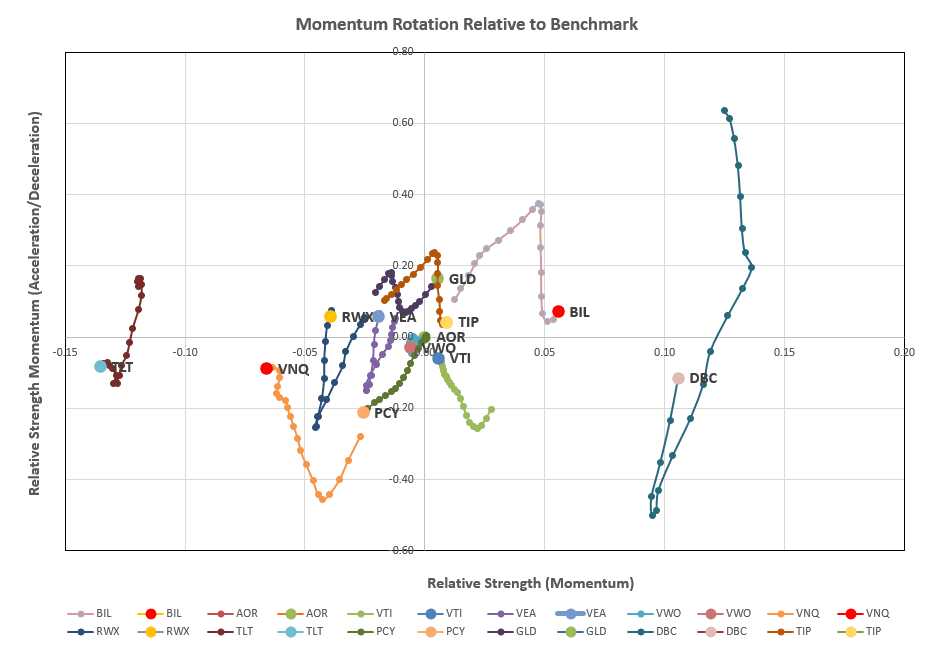

so, we’ll check the current rotation graphs:

so, we’ll check the current rotation graphs:

where we see DBC showing a short term bounce (vertical upward movement) and GLD just creeping into the desirable top right quadrant. However, on a relative basis BIL is still showing as strong – and we know this is going nowhere fast.

where we see DBC showing a short term bounce (vertical upward movement) and GLD just creeping into the desirable top right quadrant. However, on a relative basis BIL is still showing as strong – and we know this is going nowhere fast.

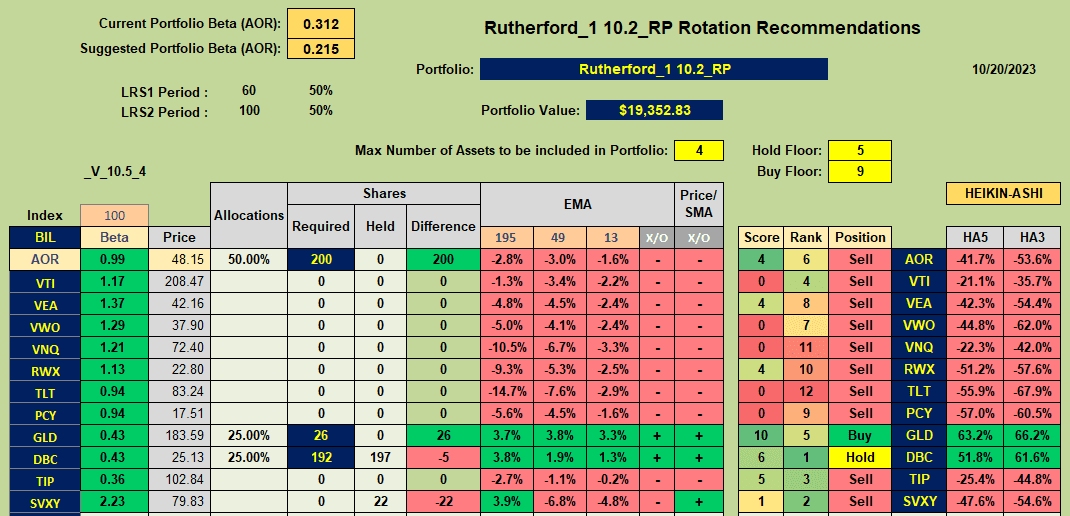

Taking a look at recommendations from the rotation algorithm:

we see a buy recommendation for GLD and a Hold for DBC with Sells for all other ETFs.

we see a buy recommendation for GLD and a Hold for DBC with Sells for all other ETFs.

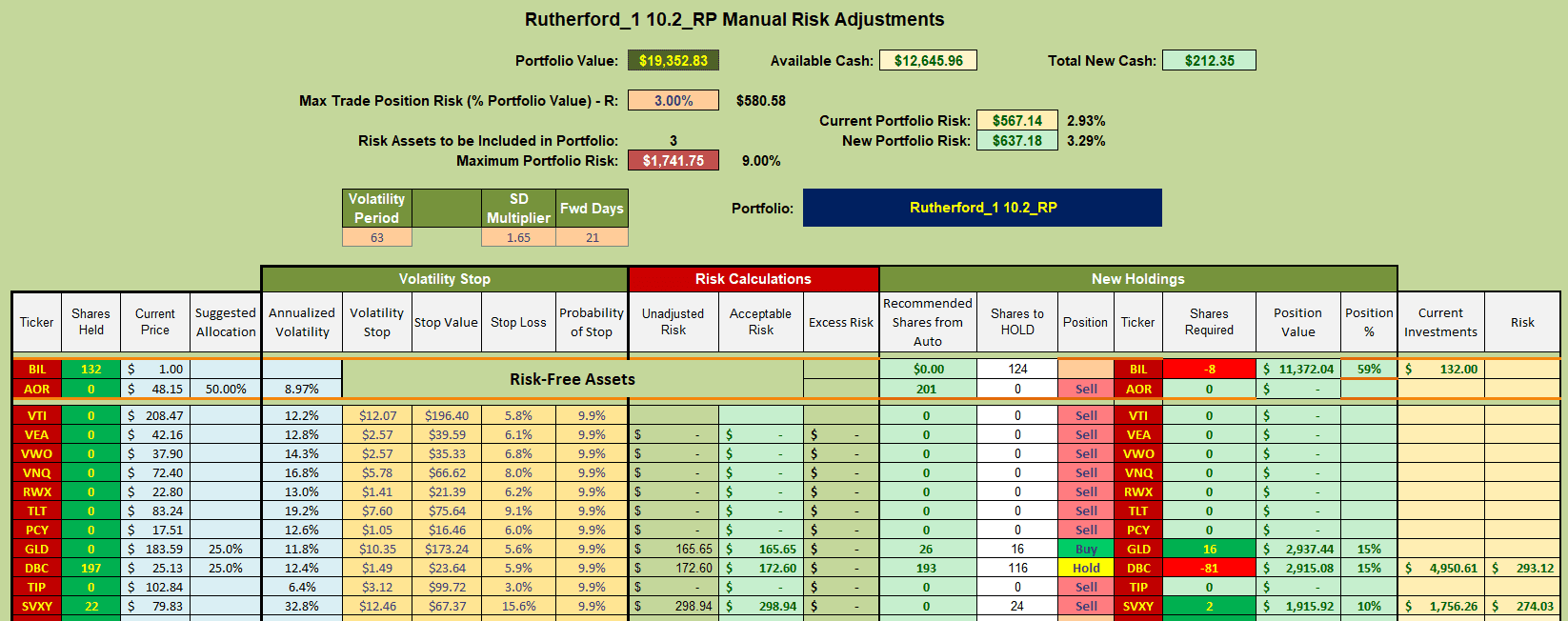

Moving to the Position Sizing Sheet the picture looks like this:

with a suggestion to reduce holdings in DBC and re-allocate funds to add shares in GLD. Since the DBC suggestion is a relatively discretionary adjustment, I will choose to keep my current holdings in DBC and sell shares in BIL (Cash) to purchase 16 shares in GLD.

with a suggestion to reduce holdings in DBC and re-allocate funds to add shares in GLD. Since the DBC suggestion is a relatively discretionary adjustment, I will choose to keep my current holdings in DBC and sell shares in BIL (Cash) to purchase 16 shares in GLD.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.