Closeup of “Human Zipper.”

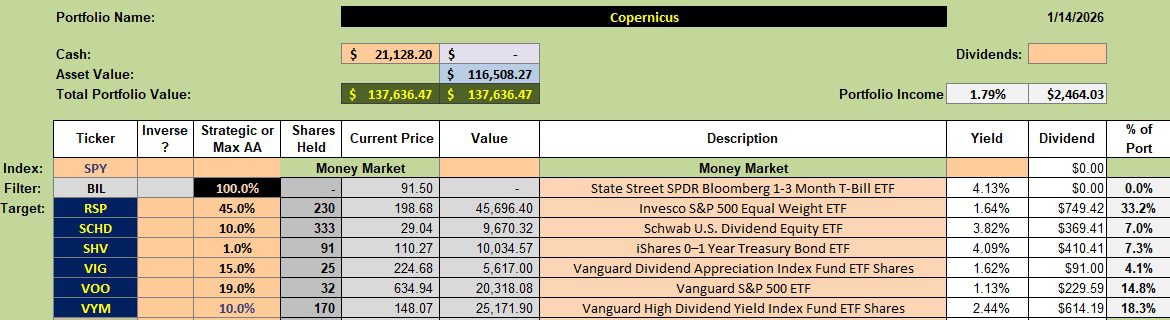

Here we are at the halfway point in January and it is time to update the top performing portfolio, Copernicus. Copernicus is an equity only portfolio where I set out to invest only in S&P 500 equities. With the market hovering at its high point diversification seemed prudent. As a result I pulled back on VOO, opened up RSP, and added some dividend oriented ETFs.

As readers are aware, VOO mirrors the S&P 500 and this is a most difficult benchmark to top year in and year out. RSP is also an S&P 500 ETF, with a major difference. While VOO is cap-weighted, RSP is an equal-weight ETF. Each of the 500 stocks in the S&P 500 is given equal weight. By going this route RSP is not as heavily invested in the mega-cap seven (7) to ten (10) stocks that are currently carrying the market to new highs.

By included dividend oriented ETFs such as SCHD, VYM, and VIG the Copernicus will generate income for the owner of this portfolio. I’m not concerned there is a high probability of overlapping stocks within these three ETFs.

Copernicus Portfolio Assets or ETFs

The following table shows the “division of labor” for each of the ETFs included in the Copernicus. Note the focus is no longer on VOO. RSP is the focus with another 35% allocated to dividend oriented ETFs.

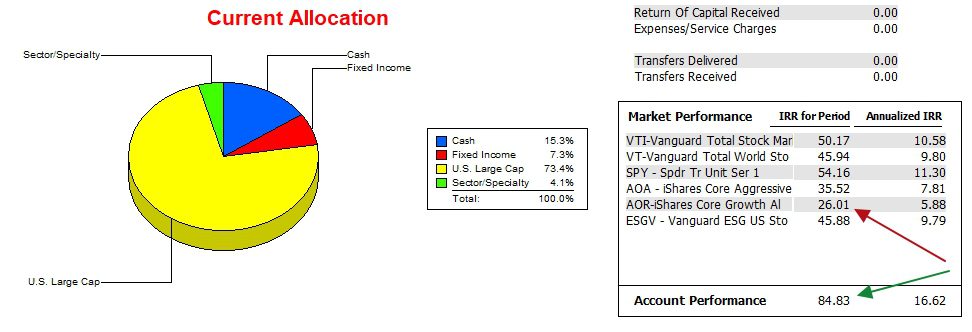

Copernicus Performance Data

Since 12/31/2021 the Copernicus has shown itself to be the top performing ITA portfolio with an annualized return of 16.6%. Much of the gain came from dollar-cost-averaging during the slowdown in 2022.

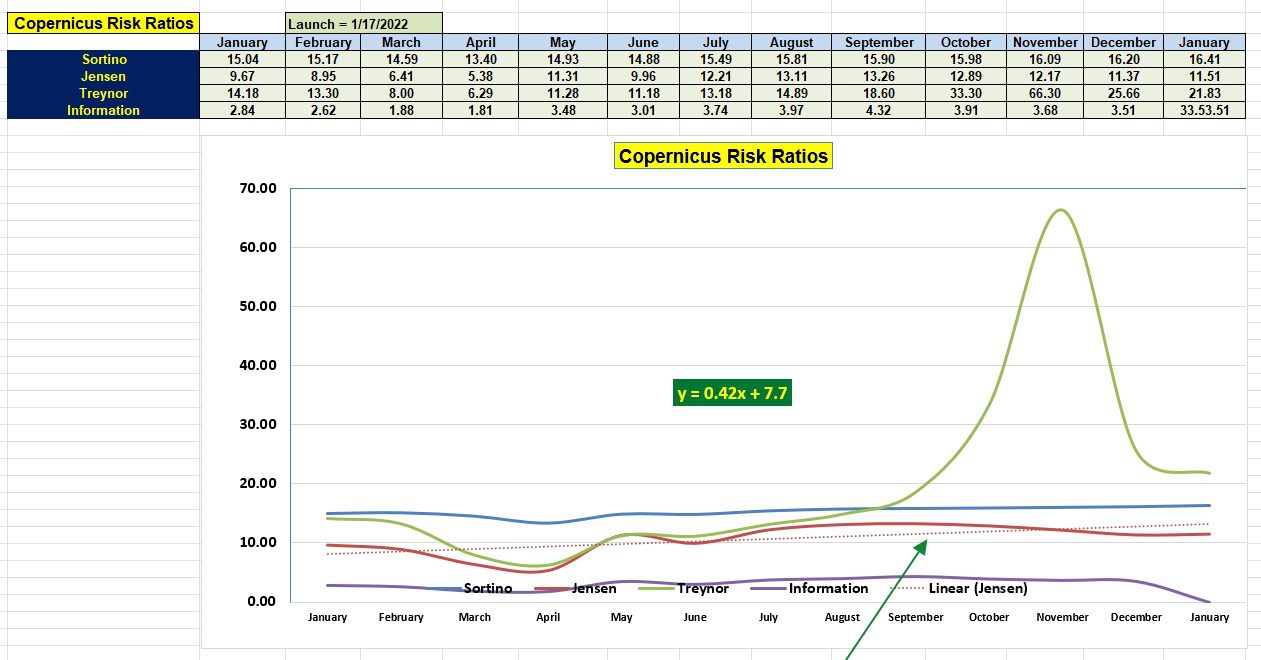

Copernicus Risk Ratios

While the IRR for the Copernicus is outstanding, how has the portfolio performed over the past year when risk enters the equation?

- The Sortino Ratio is showing steady improvement. The portfolio is gaining in value.

- Jensen Alpha: The tariff announcement in April caused the Copernicus to take a dip. We see improvement since April, but off its September high.

- The Treynor Ratio bounces around depending on the amount of cash held in the portfolio. When cash is high beta is low. A low beta elevates the Treynor. The Treynor is the least reliable risk metric I am tracking.

- Information Ratio: The January value should read 3.53 or slightly above the December number. While 3.53 is higher than the 2.84 value back in January of 2025, it is off the September high of 4.32. This means the portfolio lost ground to the AOR benchmark over the last few months. This decline was anticipated. The market moved higher as I was diversifying to RSP and several dividend oriented ETFs. These moves are away from the mega-cap stocks. Expect the Information Ratio to move lower if the mega-cap stocks continue to drive the market higher. At some point this expansion will cease.

Copernicus Portfolio Update: 14 December 2025

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Bob P.,

VIG is part of the Copernicus and I posted results before making a change for VIG. The pie chart did not “choke” in this post with VIG so I am not sure what is going on.

Lowell