Great Barrier Reef, Queensland, Australia

The Dirac Portfolio is, or will be when it is fully populated, an “income” portfolio much like the Hawking portfolio – but with an extended “quiver” of assets (~120) from which to choose. These assets might be Closed-End-Funds (CEFs), Exchange Traded Funds (ETFs) or similar e.g. Business Development Opportunity organizations (BDOs). My initial rules for selection include rules for anticipated yield from regular (monthly or quarterly) distributions (>8%) and Discount/Premium (Price relative to Net Asset Value – NAV) – this means an assessment of potential returns on market price and/or NAV. In terms of price movement I will be tracking price relative to a “mean” price and “normalizing” this to volatility by calculating a Z-Score (see original post at https://itawealth.com/dirac-portfolio-a-look-at-a-mean-reversion-strategy/). This all sounds very complicated – but really isn’t all that hard to do – the largest job is going through the large list of potential candidates for selection. Once fully populated, I do not anticipate a lot of buying/selling and the portfolio should hopefully be more of a Buy-and-Hold portfolio – although some of these assets (particularly CEFs) occasionally have “Rights” offerings to consider – in which case it is often advantageous to sell before the close of the offering and (maybe) buy back in at a later date. So the portfolio does need some regular checking even if, ostensibly, a Buy-and-Hold strategy is envisaged.

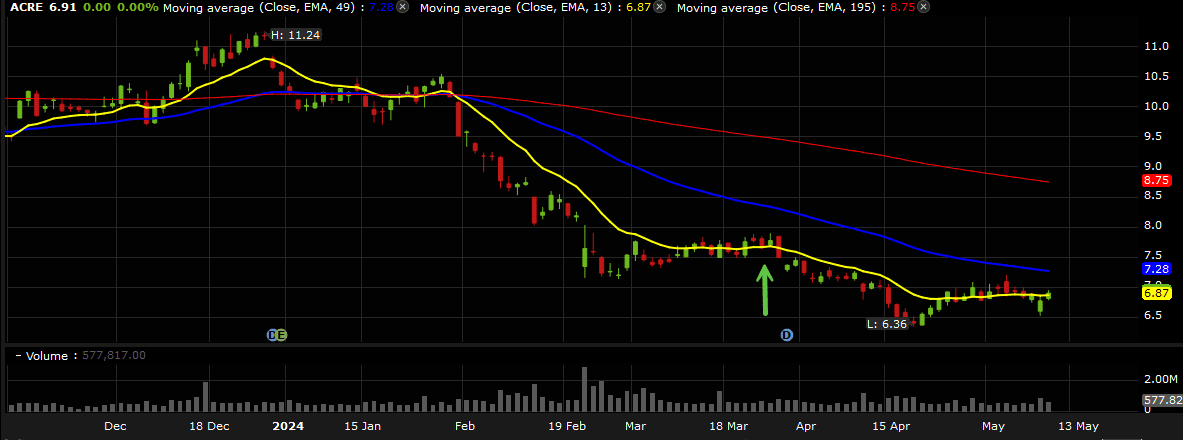

In my original post (link above) I outlined my process for the selection of the first asset to be included in the portfolio – ACRE, a Commercial Real Estate Investment Trust (REIT). I mentioned that there was risk in jumping into ACRE at the time because it was a “falling knife” resulting from the downturn in Commercial REITs resulting from Amazon’s popularity for on-line shopping and the restrictions placed on travel during the Covid-19 crisis. Since the aquisition of the fund, ACRE has, indeed, continued to drop further, although not too dramatically:

The fund was purchased just before the ex-dividend date (green arrow) and has declined ~11% from that date. Part of this decline resulted from the payment of the dividend (that was later received and compensated for that portion of the drop) and, hopefully, the ~13% current yield should cover the rest provided that we do not decline much further. In retrospect, the entry was maybe a little early but, since this is intended to be a long term hold, that’s ok with a continuation of the anticipated high yield. Obviously there is the possibility that future dividends might be cut if Net Investment Income (NII) and any possible appreciation of property values is insufficient to cover the dividend payments – but those are the risks we have to be prepared to take.

The fund was purchased just before the ex-dividend date (green arrow) and has declined ~11% from that date. Part of this decline resulted from the payment of the dividend (that was later received and compensated for that portion of the drop) and, hopefully, the ~13% current yield should cover the rest provided that we do not decline much further. In retrospect, the entry was maybe a little early but, since this is intended to be a long term hold, that’s ok with a continuation of the anticipated high yield. Obviously there is the possibility that future dividends might be cut if Net Investment Income (NII) and any possible appreciation of property values is insufficient to cover the dividend payments – but those are the risks we have to be prepared to take.

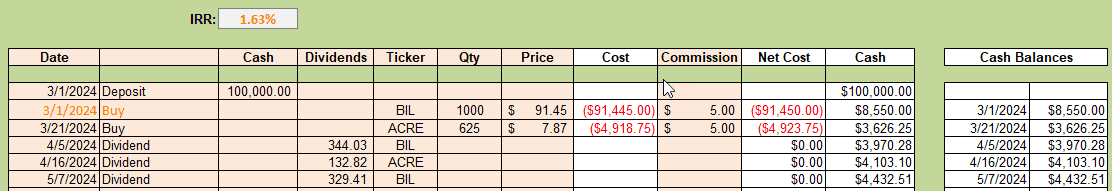

Actions/activities in this portfolio are shown in the following screenshot:

Obviously not a lot of action with most of the money in BIL (T-Bills) and dividend payments from those bills and ACRE to generate an annualized 1.63% return over the ~2 month period – not too exciting but at least it’s positive 🙂

Obviously not a lot of action with most of the money in BIL (T-Bills) and dividend payments from those bills and ACRE to generate an annualized 1.63% return over the ~2 month period – not too exciting but at least it’s positive 🙂

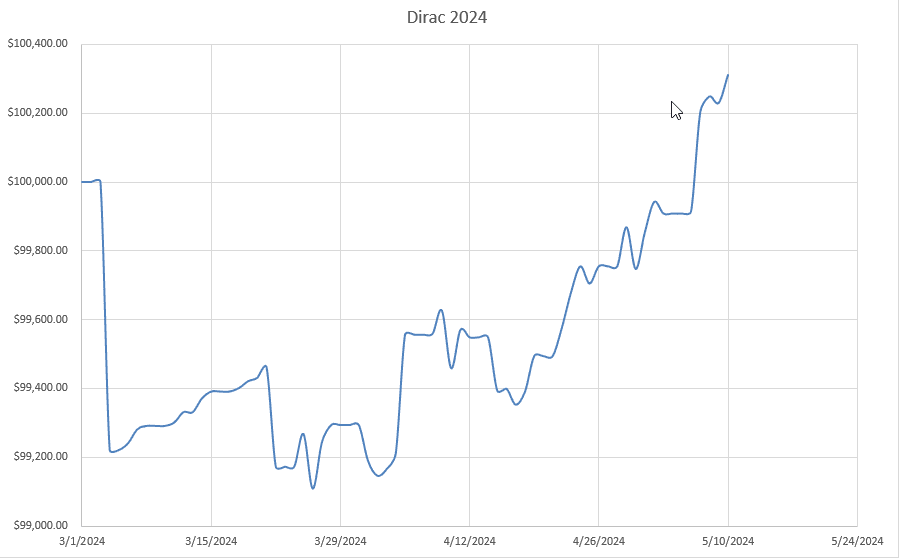

The equity curve looks like this (after some initial slippage):

At the moment I am holding a little over $4,000 in cash that I’d like to invest in a second asset but, with the markets at/near current highs, it’s difficult to find too much based on my intial rules. In my original analysis I was using a 195 period lookback to determine the exponential “mean” – and this isn’t generating too many negative Z-scores – so I’m in the process of shortening the exponential look-back period to 126, 63 or 21-day periods. This increases the sensitivity (that I would prefer to minimize – potential whipsaws) but does bring up more potential negative Z-scores. If I find something, I will update this post in the comment section – I should have gone with FSK, that I took for the Hawking portfolio, but I didn’t want to have too much duplication in too many accounts 🙂

At the moment I am holding a little over $4,000 in cash that I’d like to invest in a second asset but, with the markets at/near current highs, it’s difficult to find too much based on my intial rules. In my original analysis I was using a 195 period lookback to determine the exponential “mean” – and this isn’t generating too many negative Z-scores – so I’m in the process of shortening the exponential look-back period to 126, 63 or 21-day periods. This increases the sensitivity (that I would prefer to minimize – potential whipsaws) but does bring up more potential negative Z-scores. If I find something, I will update this post in the comment section – I should have gone with FSK, that I took for the Hawking portfolio, but I didn’t want to have too much duplication in too many accounts 🙂

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I really wanted to invest the cash held in this account in an income-generating asset – and, because I am only holding a few BDO-class shares in other portfolios I wanted to add a BDO other than FSK (held in the Hawking portfolio). I have therefore selected TCPC for inclusion in the Dirac Portfolio.

I am maybe ~1 week late getting into this position and should have bought when the Z-Score (126-day) was ~ minus 1 rather than just slightly positive as it is today:

https://www.dropbox.com/scl/fi/1ugrri4cn9cnbjqrgkie2/TCPC-2024-05-14_11-04-47.png?rlkey=f4t5ycjvflftq0qctj9ec3ch3&dl=0

and the HA candles were just beggining to turn green:

https://www.dropbox.com/scl/fi/0gf34f9bqgayj8fvzo555/TCPC-2024-05-14_10-48-33.png?rlkey=pq0huimrx1u3tgri5xicb8asx&dl=0

But this is intended to be a long-term hold position so timing shouldn’t be too important: