Bicycle repair instruction.

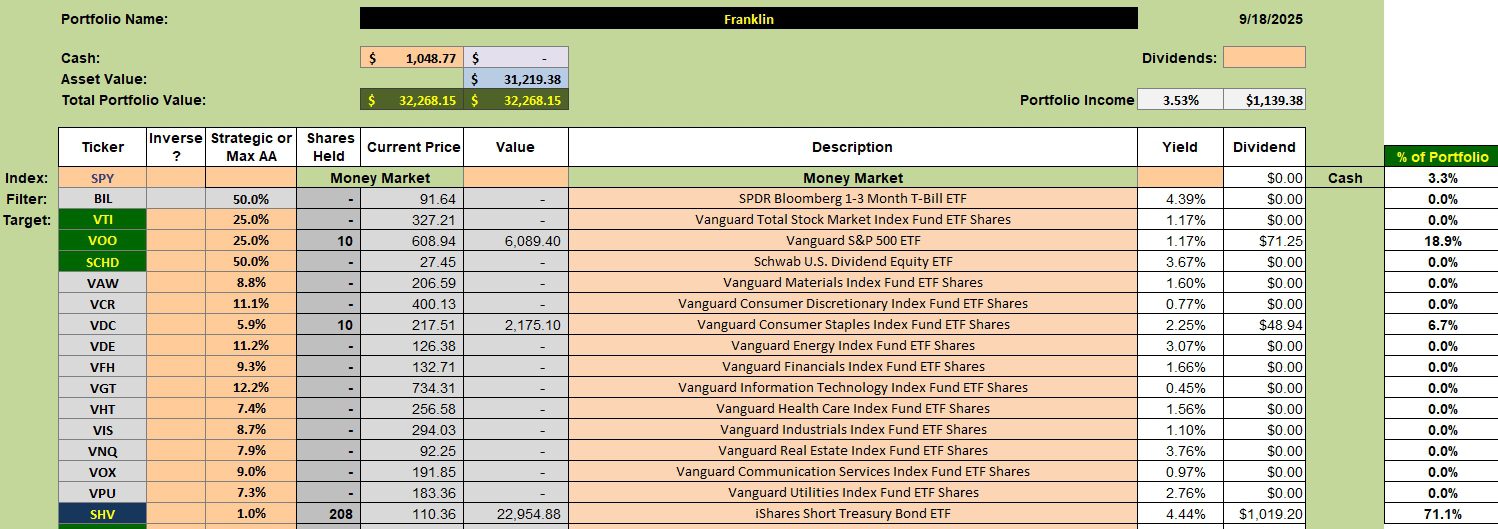

Of the 13 portfolios I track here at ITA the three Sector BPI portfolios are the most complicated to manage as they require access to Bullish Percentage Indicator graphs. I use StockCharts for this information. Last Friday the Consumer Staples sector came so close to the 30% bullish signal that I placed orders for VDC for the Franklin, Carson, and McClintock. As readers can see below, I purchased 10 shares of VDC for the Franklin, the portfolio up for review this morning.

I use a three-year volatility setting to determine what percentage to invest in a given sector. Currently, the target for Consumer Staples is 5.9% and the 10 shares of VDC place it at 6.7% of the portfolio or close enough to the target.

Franklin Sector BPI Holdings

Below are the current holdings for the Franklin. If the market were not overbought I would be investing in more shares of VOO instead of the short-term treasury SHV. Should any sector drop into the oversold zone (30% bullish or lower) I will sell shares of SHV and purchase shares in the oversold sector. Look for a BPI report tomorrow.

Franklin Performance Data

Since 12/31/2021 the Franklin has outperformed the AOR benchmark by a wide margin, but lags the S&P 500 (SPY) benchmark.

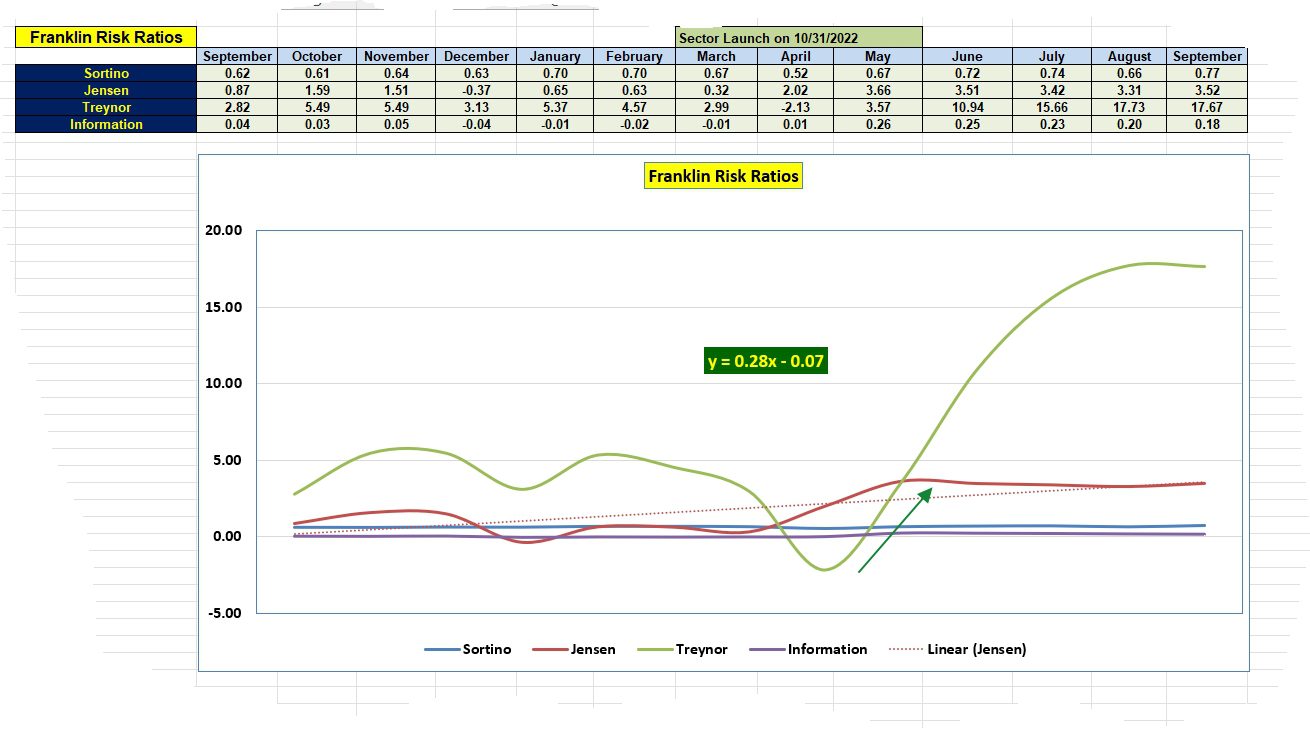

Franklin Risk Ratios

Based on the Sortino Ratio, the Franklin is at its peak in terms of total dollars. The Jensen Alpha is quite strong, but not at its high point for the year. In September of 2025 the Franklin is not keeping pace with the AOR over the last few months. It is well ahead of where it was a year ago.

The slope of the Jensen is positive, a critical measurement.

Overall, the Sector BPI investing model seems to be working quite well.

Comments are always welcome. Share this link with friends and family.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question