Statue of Robert Burns (Scottish Poet), Dunedin, New Zealand

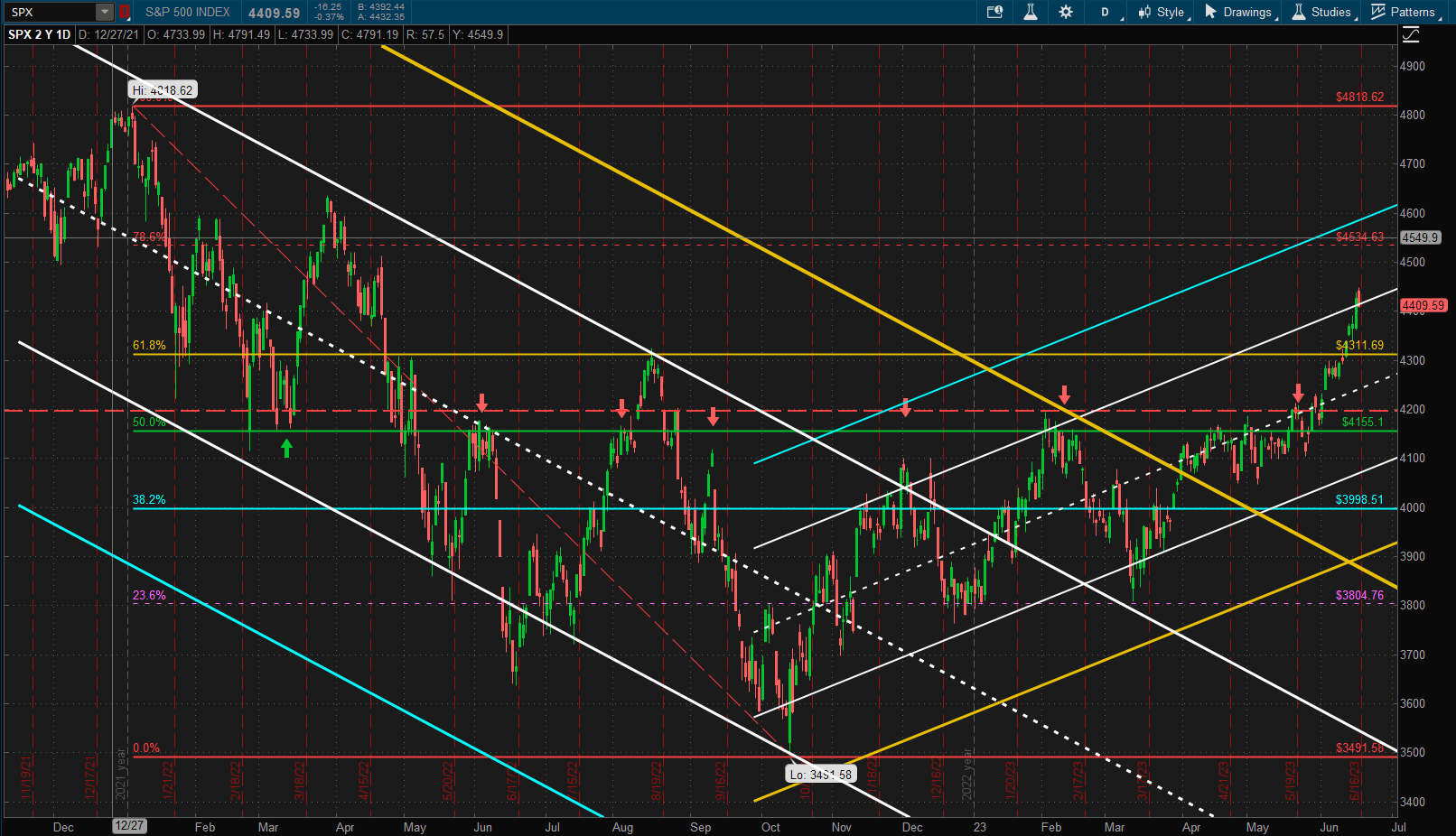

Another bullish week in US Equities with the SPX continuing it’s move within the uptrend channel and sitting at the upper 1 SD boundary – where we may see some resistance:

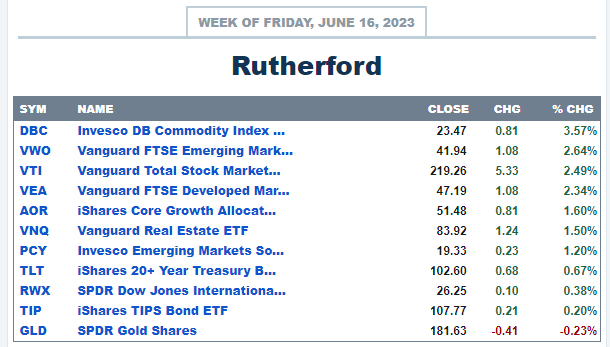

This week’s performance in US equities placed pretty near the top of the list in terms of major asset class performance, with global equities, generally, faring very well even if they were outdone by Commodities:

This week’s performance in US equities placed pretty near the top of the list in terms of major asset class performance, with global equities, generally, faring very well even if they were outdone by Commodities:

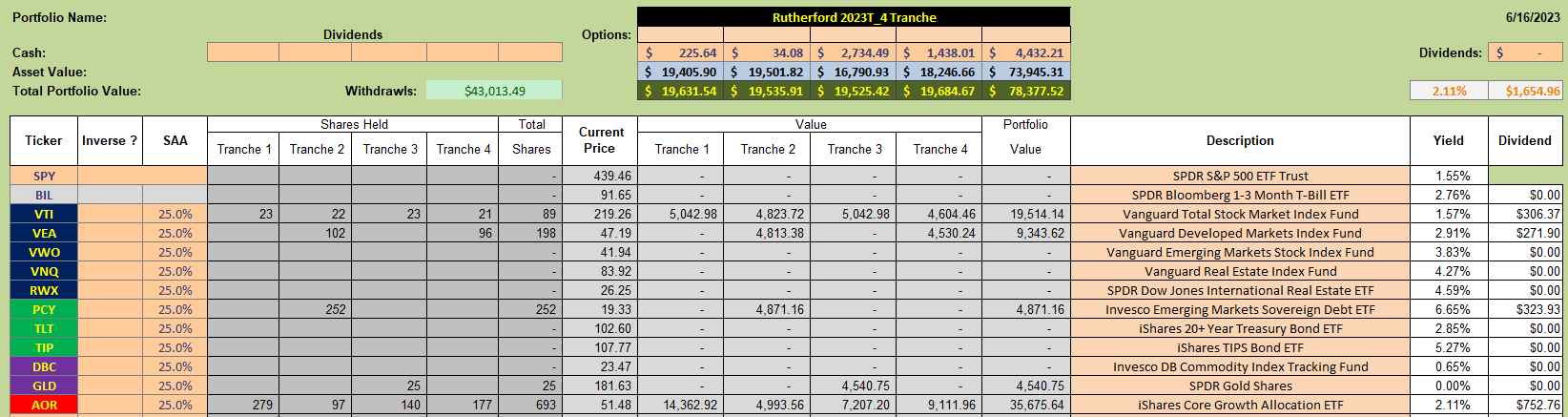

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

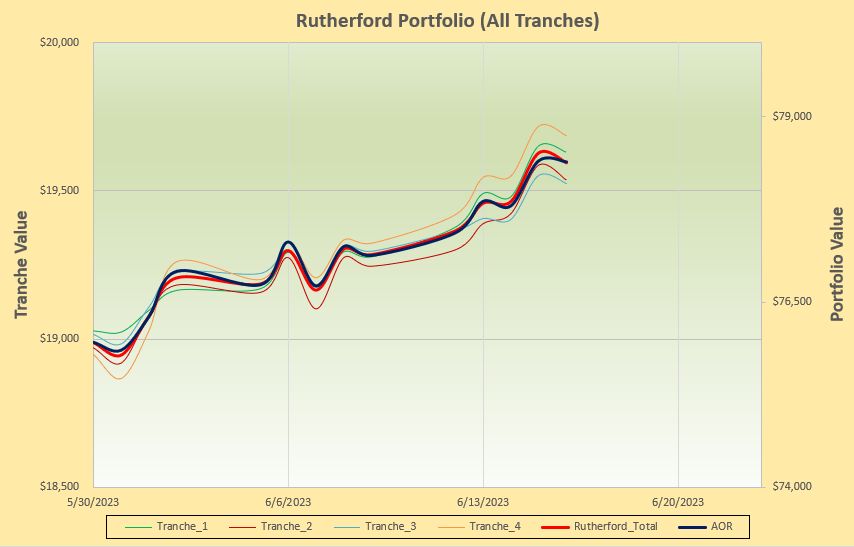

with performance to date, since moving to the 4 tranche configuration, looking like this:

with performance to date, since moving to the 4 tranche configuration, looking like this:

where we can see that we are keeping pace with the benchmark AOR fund but are continuing to see separation between the different tranches as a result of timing (review date) luck.

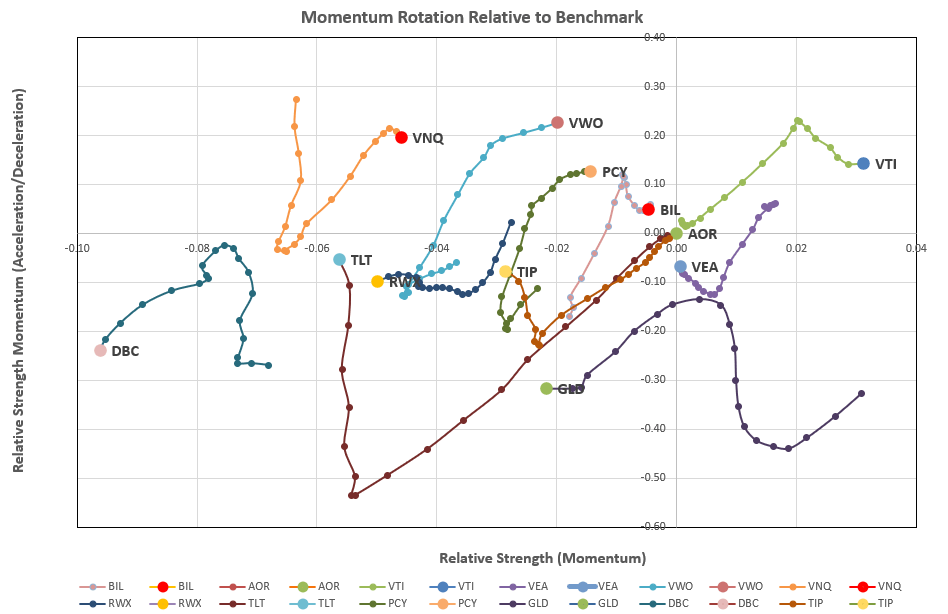

So, it’s time to check the rotation graphs and see whether there are any suggestions to make adjustments to Tranche 3:

VTI seems to be the only asset with strength in the top right quadrant with VEA dropping out in the short term and VWO and PCY rotating towards that quadrant.

VTI seems to be the only asset with strength in the top right quadrant with VEA dropping out in the short term and VWO and PCY rotating towards that quadrant.

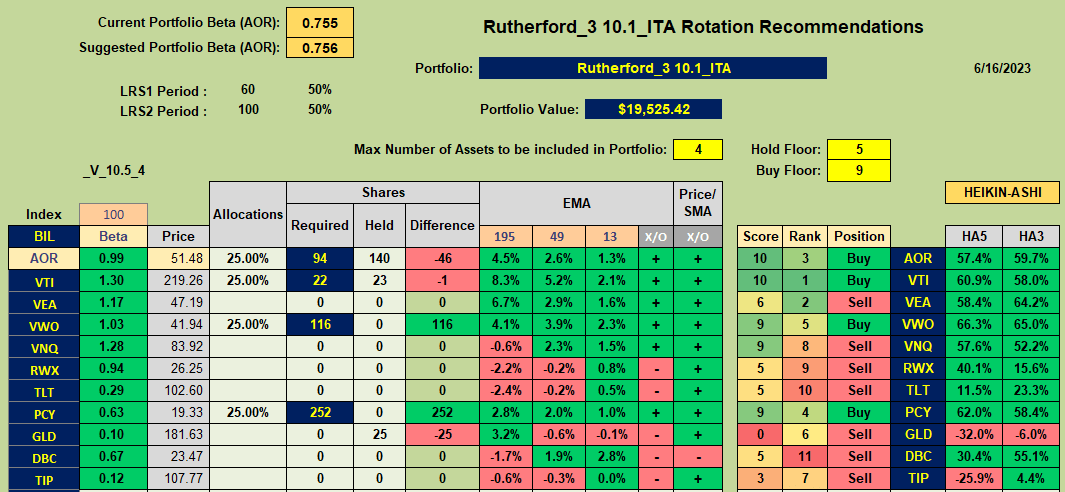

Checking the recommendations from the rotation model:

we see Buy recommendations for VTI, VWO, PCY and AOR. This means that this week’s adjustments will look something like this:

we see Buy recommendations for VTI, VWO, PCY and AOR. This means that this week’s adjustments will look something like this:

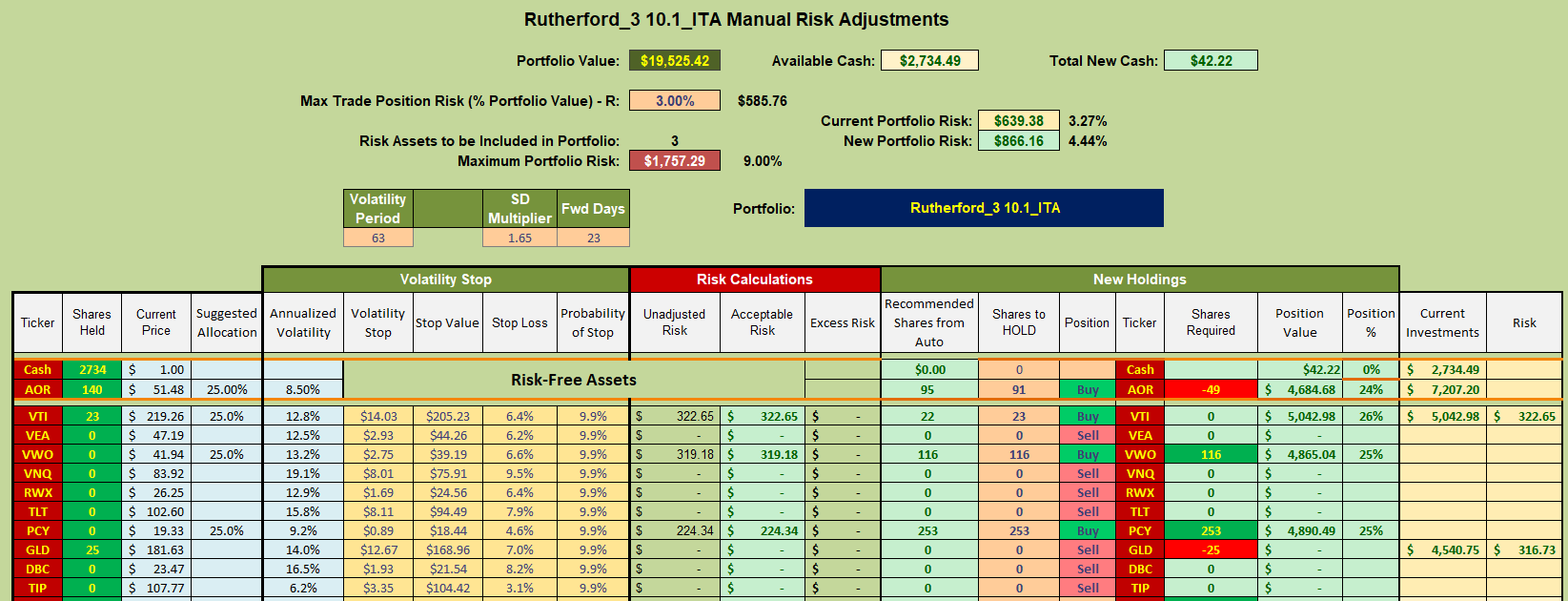

i.e. I will be selling shares in GLD and AOR and buying shares in VWO and PCY.

i.e. I will be selling shares in GLD and AOR and buying shares in VWO and PCY.

The portfolio is looking nicely diversified/balanced.

David

Leave a Comment or Question