English Door

Millikan, one of four Sector BPI portfolios, is the model up for review this morning. This portfolio previously was managed using the BHS/Relative Momentum model and was not performing as expected. I just checked and it ranked #14 based on IRR data and is now #8. There are a number of portfolios grouped close together so it is not difficult to leap over other portfolios.

I’ve been giving excess attention to the Sector BPI portfolios as I want to launch each as soon as possible. Most of these four portfolios still carry equity ETFs and the Millikan is no exception. While I think the Sector BPI model hypothesis is strong, I don’t want to be drawn into believing it is the Holy Grail or even the top model. I need to see results based on data rather than feelings. I’m anticipating numerous sectors will dip into the over-sold zone within the next six months so having plenty of cash on hand is to be desired. As I mentioned in prior blog posts, it will take several buy/sell cycles to see if the Sector BPI model is successful.

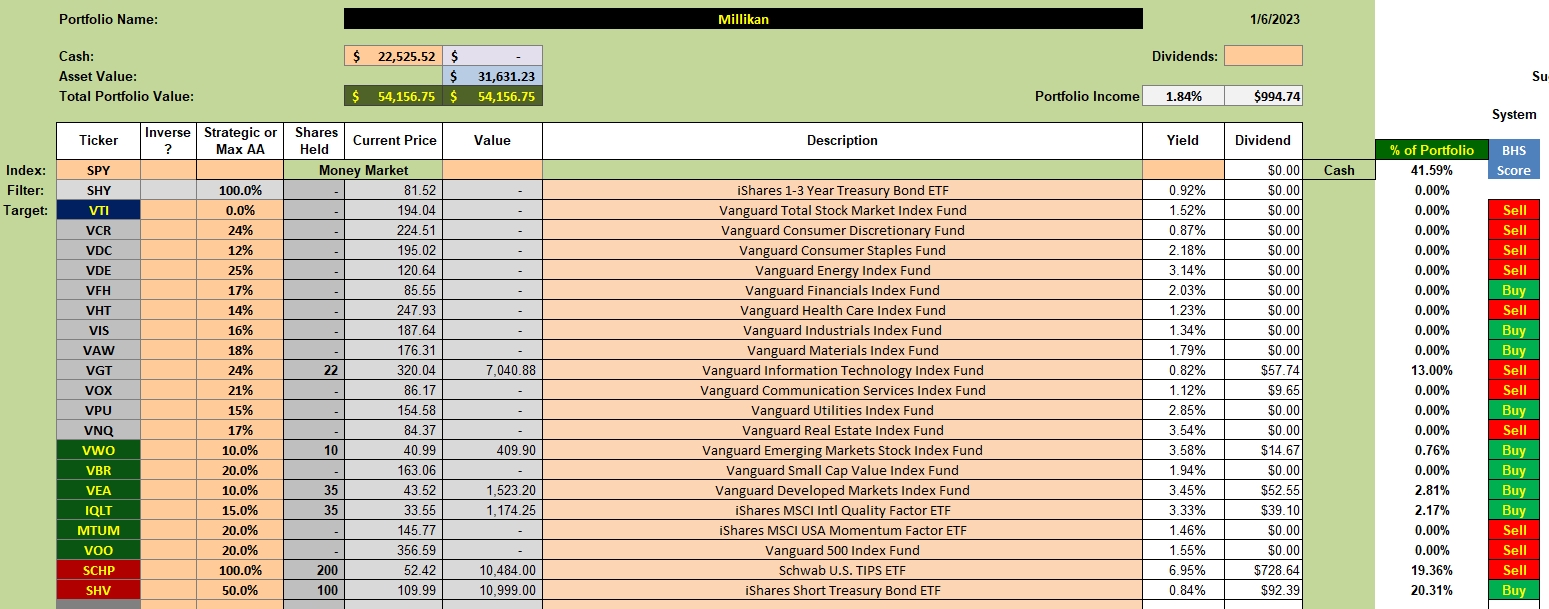

Millikan Investment Quiver of Sector ETFs

Limit orders are in place to sell VWO, VEA, and IQLT. When I last checked, no sectors were either over-sold or over-bought. This being the situation, no changes are planned for the Millikan other than to put the cash to use by purchasing more shares of either SCHP or SHV. The third option is to leave the cash in the money market.

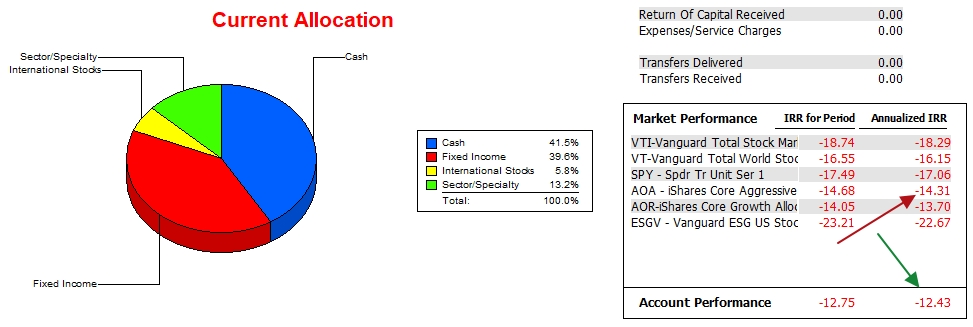

Millikan Performance Data

Over the past year the Millikan has outperformed the AOA benchmark by nearly two percentage points and all the other possibilities with exception of AOR.

A good test of the Sector BPI portfolio is whether or not the Millikan can maintain a similar lead over the various benchmarks throughout 2023.

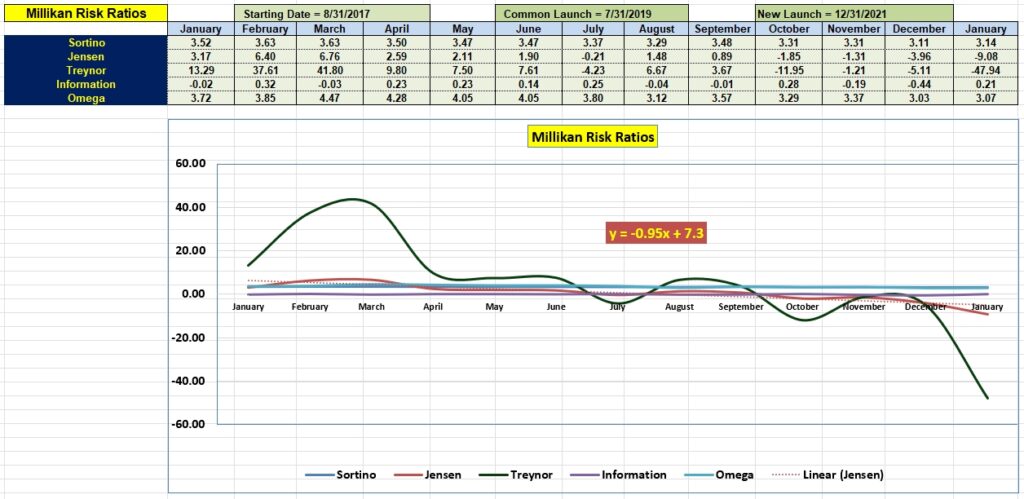

Millikan Risk Ratios

The Millikan is off to a poor start here in January if we go by the Jensen. However, note the improvement in the Information Ratio over the November and December values. The Information Ratio measures how well the portfolio is performing against its benchmark, AOA.

If you having any problems logging on, contact me at itawealth@comcast.net. I realize you will not see this information if you cannot connect. Take this down for future reference.

Hi Lowell As a psychologist, who writes books on the subject, I greatly appreciate your efforts to let data rule the roost and not your feelings.

As excited as many of us are with this new BPI plan we are particularly

susceptible to the Confirmation Bias. I’m sure your followers won’t belittle the point, so no need for me to add more at its point. Thx John

John,

As I update the Sector BPI portfolios, I’m seeing slight (very minor) gains for both returns and risk measurements. That said, I will not be satisfied until I see what happens until several Buy/Sell cycles are complete and that may well take one or two years.

I looked at performance data today and only three or four portfolios failed to outperform the S&P 500 over the past year. Despite the very poor year, at least that is one “shiny data point.”

Lowell

Thanks Lowell