Nightime in Singapore

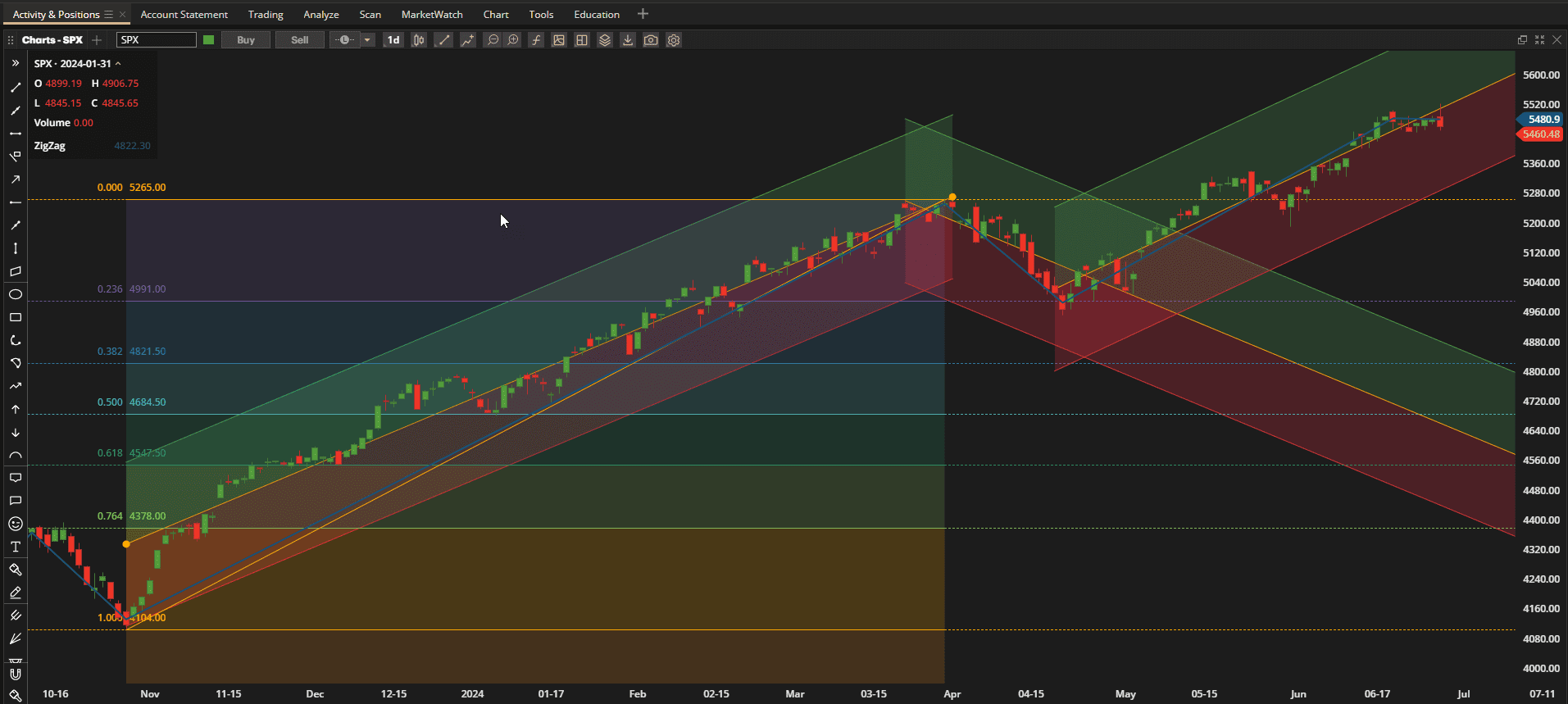

US equities, as measured by the performance of the S&P 500 Index (SPX), closed the week slightly lower than last week’s close after consolidating sideways for most of the week and battling with the 5500 resistance level. Markets were weak on Friday as investors absorbed the potential impact of Thursday’s presidential debate:

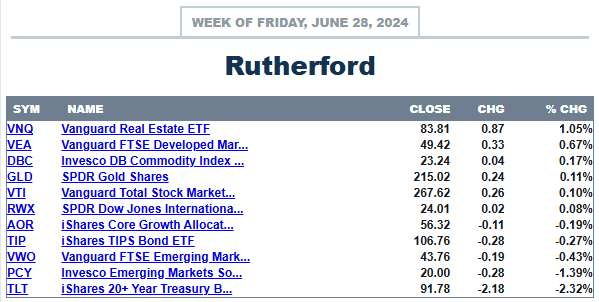

Although the SPX was lower, the broader market, as represented by VTI, performed slightly better with a small gain on the week and in the top half of the major asset classes:

Although the SPX was lower, the broader market, as represented by VTI, performed slightly better with a small gain on the week and in the top half of the major asset classes:

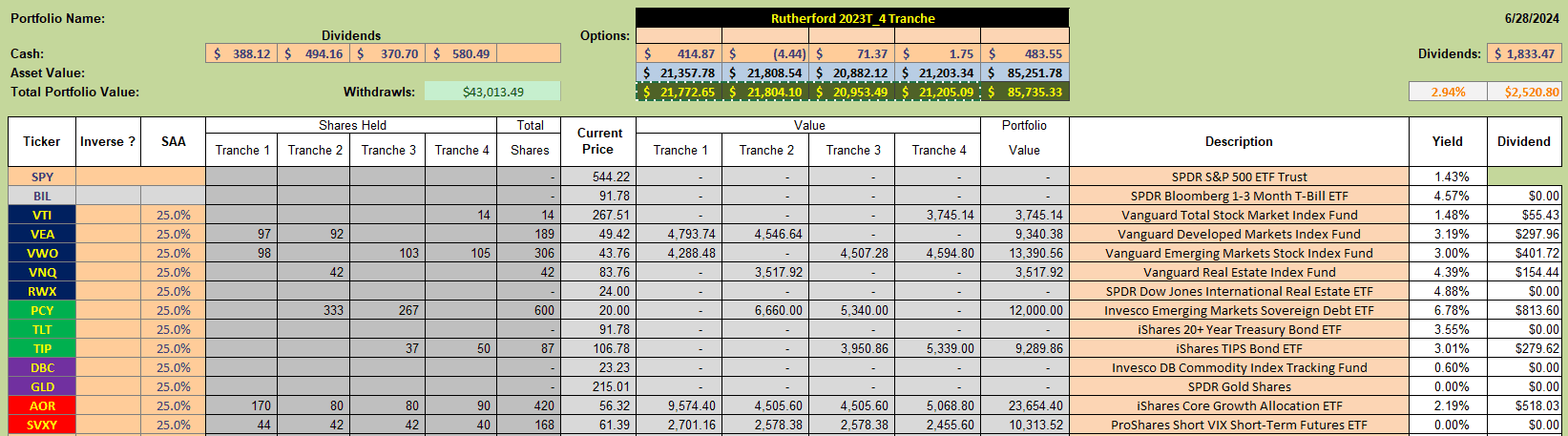

Current holdings in the Rutherford portfolio look like this:

Current holdings in the Rutherford portfolio look like this:

with Tranche 1 (the focus of this week’s review) holding positions in international equities (VEA and VWO) in addition to the benchmark AOR equity/bond fund.

with Tranche 1 (the focus of this week’s review) holding positions in international equities (VEA and VWO) in addition to the benchmark AOR equity/bond fund.

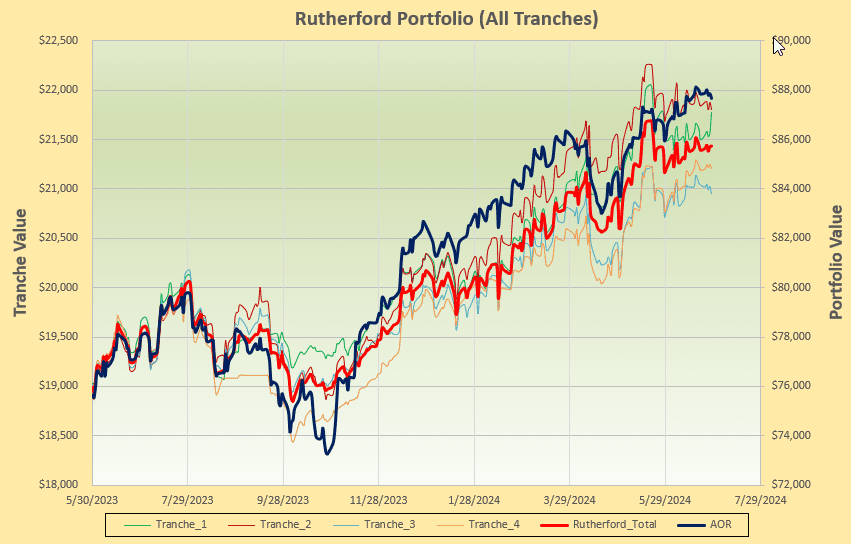

Quarterly dividends are in for those assets paying them and performance of the portfolio to date looks like this:

with a small gain on the benchmark over the past week – but still lagging over the past 12 months.

with a small gain on the benchmark over the past week – but still lagging over the past 12 months.

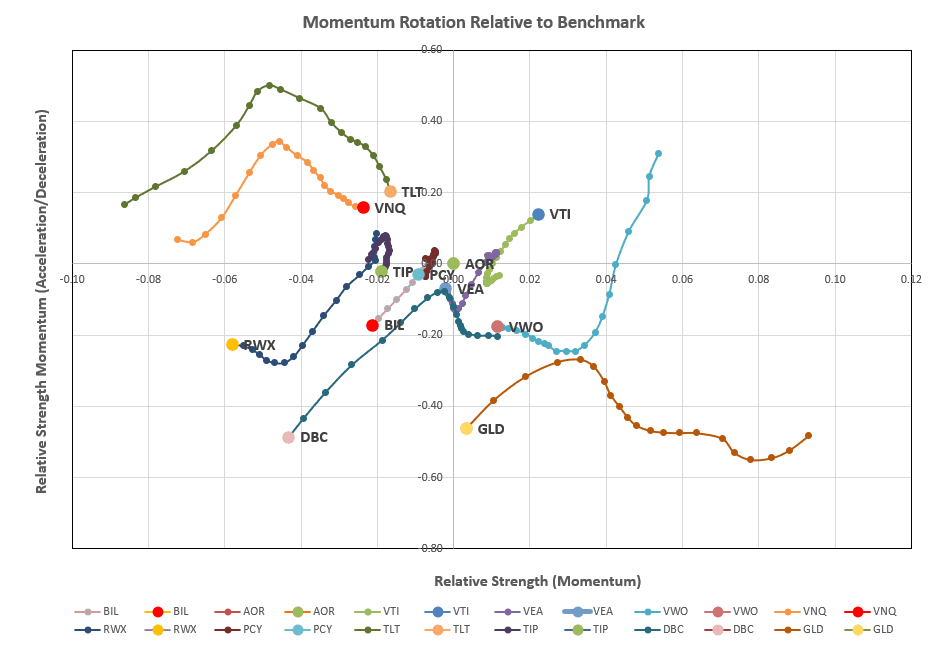

Checking the rotation graphs for an indication of potential adjustments:

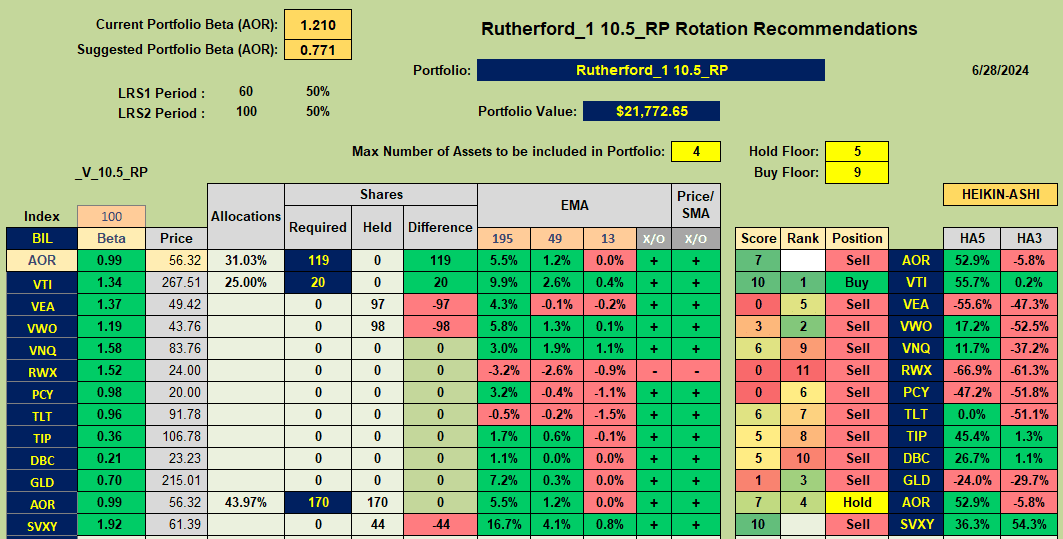

we see that only US equities (VTI) is showing strong momentum/relative strength as measured by its position/movement in the desirable top right quadrant. This is confirmed by the recommendations coming out of the Tranche worksheet:

we see that only US equities (VTI) is showing strong momentum/relative strength as measured by its position/movement in the desirable top right quadrant. This is confirmed by the recommendations coming out of the Tranche worksheet:

where VTI is the only Buy recommendation with AOR (the benchmark) a Hold.

where VTI is the only Buy recommendation with AOR (the benchmark) a Hold.

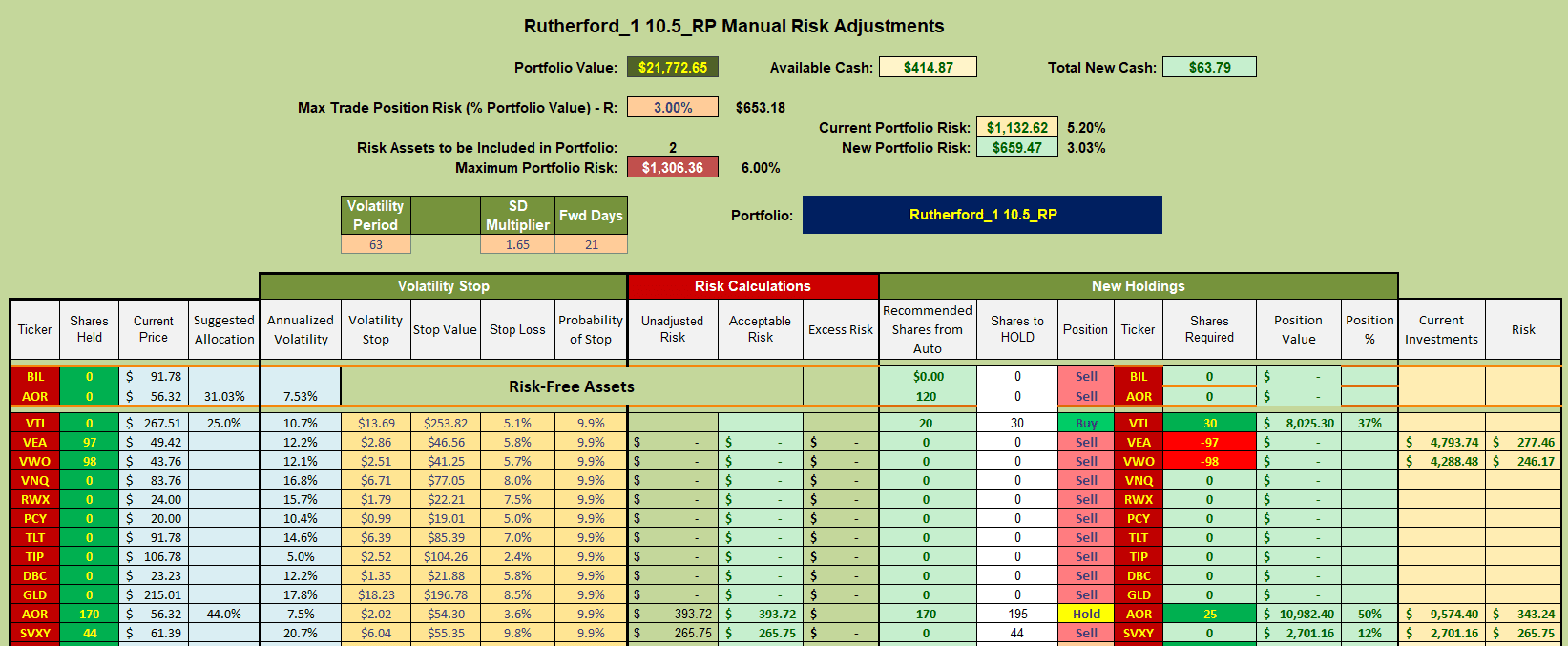

Accordingly my adjustments to Tranche 1 in the next week will look something like this:

where I shall be selling holdings in VEA and VWO and using the cash generated to rotate into US equities (VTI). Of course, this always makes me nervous with markets sitting near all-time highs, but sticking with our chosen system is necessary over the longer term. There will probably be a little cash left over to buy a few more shares in AOR, so, since I pay no commissions on my purchases, I will use any excess to add to my positions in the benchmark fund.

where I shall be selling holdings in VEA and VWO and using the cash generated to rotate into US equities (VTI). Of course, this always makes me nervous with markets sitting near all-time highs, but sticking with our chosen system is necessary over the longer term. There will probably be a little cash left over to buy a few more shares in AOR, so, since I pay no commissions on my purchases, I will use any excess to add to my positions in the benchmark fund.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question