Lunchtime at popular vineyard restaurant, Waiheke Island, New Zealand

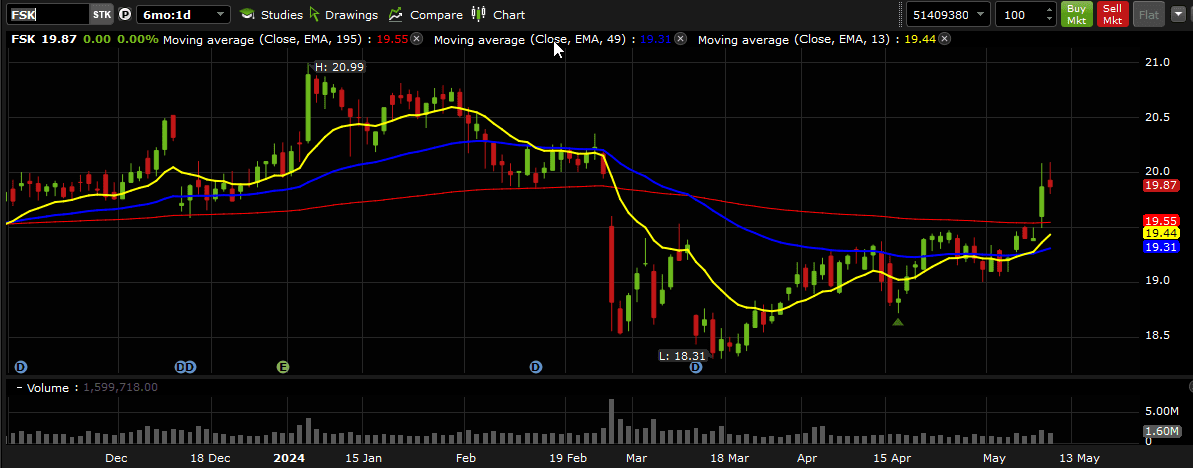

Since my last review of the Hawking Portfolio I have added positions in ACRE (Real Estate) and FSK (Business Development Organizations). Both were “falling knives” that I tried to catch, sometimes unsuccessfully (ACRES – that I will say a little more about in my review of the Dirac Portfolio later today or tomorrow) and more successfully with FSK. After purchasing shares on April 16, FSK has increased in value 5.4% and is paying a 13% (annualized) dividend on top of that:

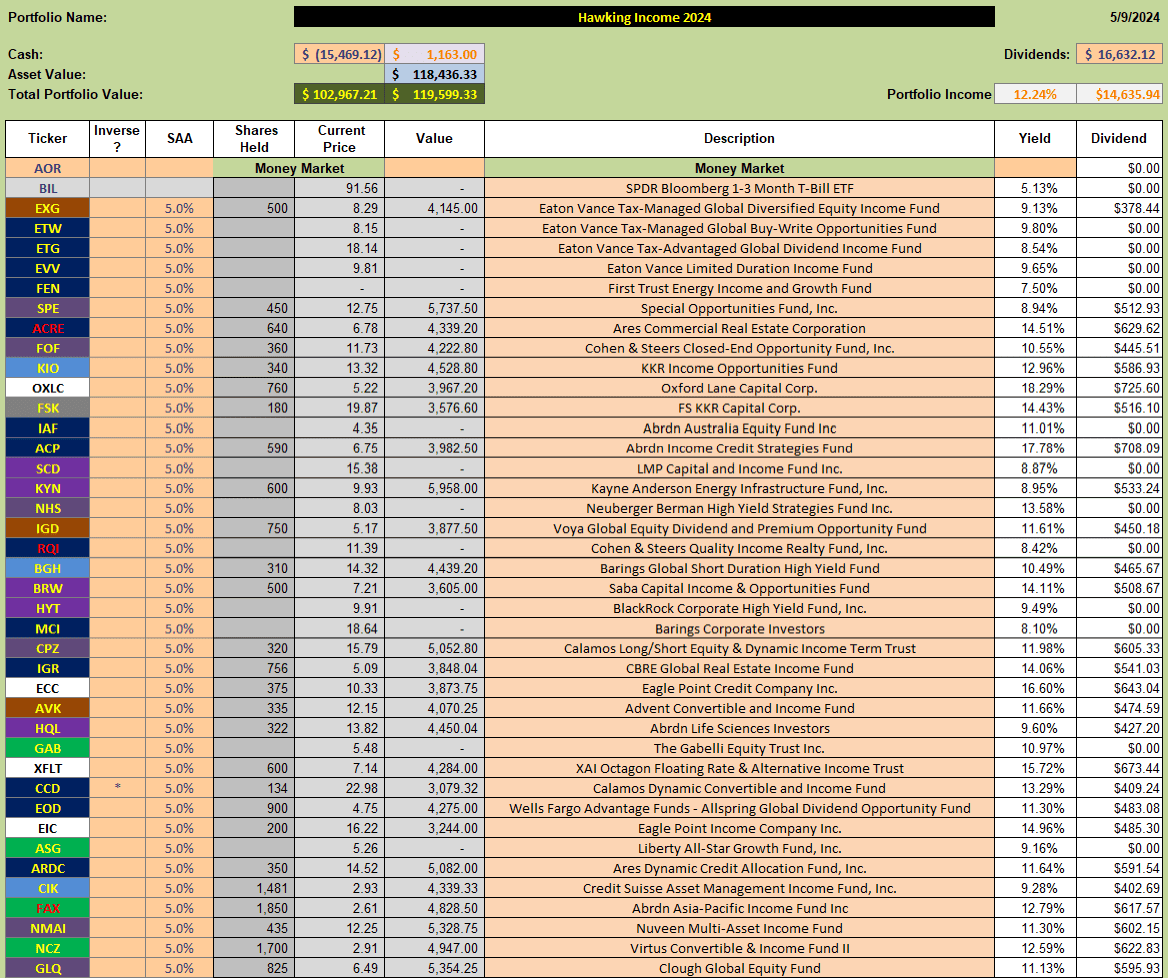

The Hawking Portfolio is currently holding positions in 27 Funds:

The Hawking Portfolio is currently holding positions in 27 Funds:

and is well diversified. The current projected annual payout/income from dividends is estimated to be ~12%.

and is well diversified. The current projected annual payout/income from dividends is estimated to be ~12%.

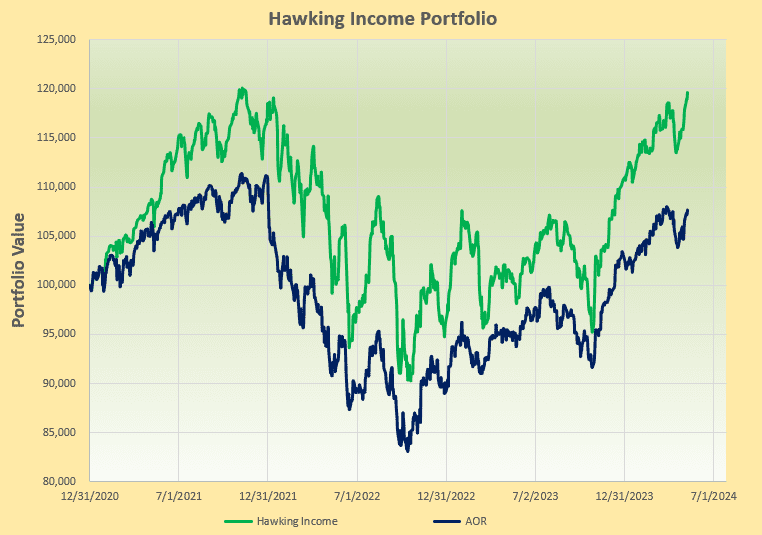

Performance to date looks like this:

well outstripping the benchmark AOR Fund. At the present time I am holding ~$1,100 in cash that could be used to add shares to existing positions or to add new positions.

well outstripping the benchmark AOR Fund. At the present time I am holding ~$1,100 in cash that could be used to add shares to existing positions or to add new positions.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

What metrics are you using to select the ETFs that make up the Hawking?

Lowell

Lowell,

This is throwing me a little since the comment/question seems to be 1 yr out-of-sequence – I suspect that it was intended to be following the most recent update – 11 May 2025. However, I’ll answer it here and hope that other readers see it 🙂

The Funds I am currently using are Closed-End-Funds (CEFs) rather than ETFs – although I also consider including ETFs, and would not exclude them, but dividends/distributions tend to be lower than those of CEFs.

I started using this “Income” approach after reading Steve Bavaria’s Posts on Seeking Alpha and his book “The Income Factory” – available from Amazon and elsewhere. There are other contributors to Seeking Alpha that I follow – with Nick Ackerman being the most significand and a few others that I will read if I have time but do not follow without additional due diligence.

Initially I focussed on Funds with high distributions that were trading at significant discounts (opportunities for “growth” returns – even if the fund were liquidated investors would receive NAV) – but I’ve since added CEFs that may not trade at discounts (even at a premium) but that may offer additional benefits due to their structure and competant management or even because they offer DRIP plans with shares below market/NAV pricing. These are the more subtle nuances that can be incorporated over time. However, whenever once invested I rarely sell unless there is a “Rights” offering – in which case (if I catch it in time) it may be better to sell after the “Rights” announcement and before the closing date of the offer and buying once the offer closes. This is because there is often selling as a result of anticipated “dilution” followed by a later “bounce” once the deal has closed. Money can be made on the “gap” being filled – but, again a subtlety. As you may recognize I hold a significant number of Funds so as to minimize risk if any single Fund should fail. Over the years I have built a database of Funds that I will check on when I have the time – but this is not weekly – or even monthly, at least on a strict basis.

To answer your other question (below) I rarely change the assets held in the portfolio and I mention these in my write-ups. I also try to report significant additions to existing positions as I re-invest dividends/distributions.

No simple answer here (although the portolio is “simple” to manage, once in place), and there is so much diversity available that portfolios aren’t supersensitive to selected holdings.

Hope this helps answer your questions – at least at a high/general level.

david

Yes, I intended the question to be linked with the May 2025 post.

You answered my questions. I too have read Bavaria’s book and he makes a compelling case for investing in high income CEFs.

Lowell

David,

Another question. How frequently do you change the ETFs? When you make a change do you mention this in the write-up?

Lowell