Waterfalls in Milford Sound, New Zealand

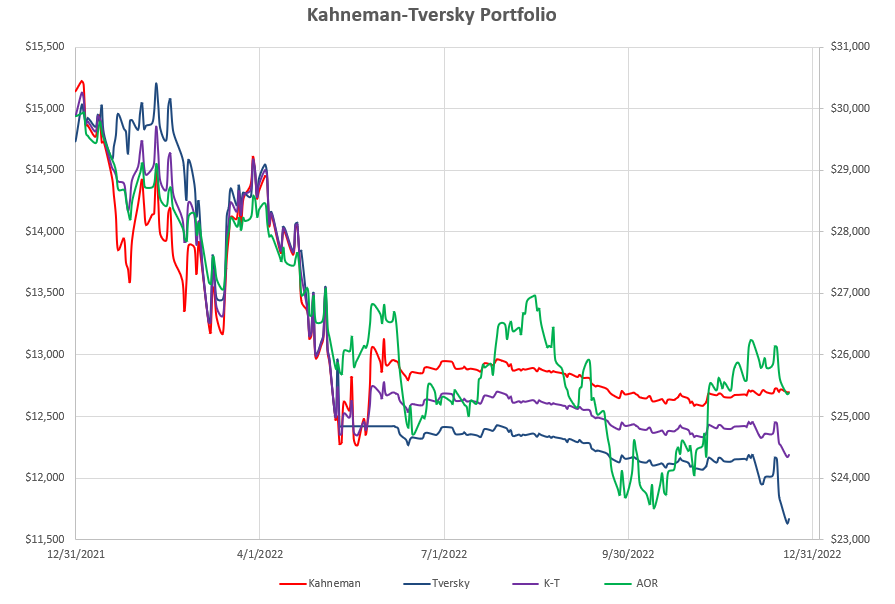

The Kahneman-Tversky Portfolio, that uses the simplest Dual Momentum (DM) model to select one asset from a basket of three, did not perform particularly well in 2022:

closing down ~18.4% on the year. While this is slightly less than the ~20% drop in value of US equities over the same period it does not beat the 15.65% draw-down experienced by the benchmark AOR Fund. Some of this is a result of timing (review-date) luck that we mention regularly on this site. For example, VEA (Developed Markets equities) has performed relatively well over the past few months but, unfortunately, it was purchased close to the highs as a result of review-date timing and this is clear in the performance of the Tversky portion of the portfolio over the past month as shown in the above screenshot. The slower reacting Kahneman portion of the portfolio performed better over the 12-month period although it underperformed the faster reacting Tversky portion over the first ~3 months of the year.

closing down ~18.4% on the year. While this is slightly less than the ~20% drop in value of US equities over the same period it does not beat the 15.65% draw-down experienced by the benchmark AOR Fund. Some of this is a result of timing (review-date) luck that we mention regularly on this site. For example, VEA (Developed Markets equities) has performed relatively well over the past few months but, unfortunately, it was purchased close to the highs as a result of review-date timing and this is clear in the performance of the Tversky portion of the portfolio over the past month as shown in the above screenshot. The slower reacting Kahneman portion of the portfolio performed better over the 12-month period although it underperformed the faster reacting Tversky portion over the first ~3 months of the year.

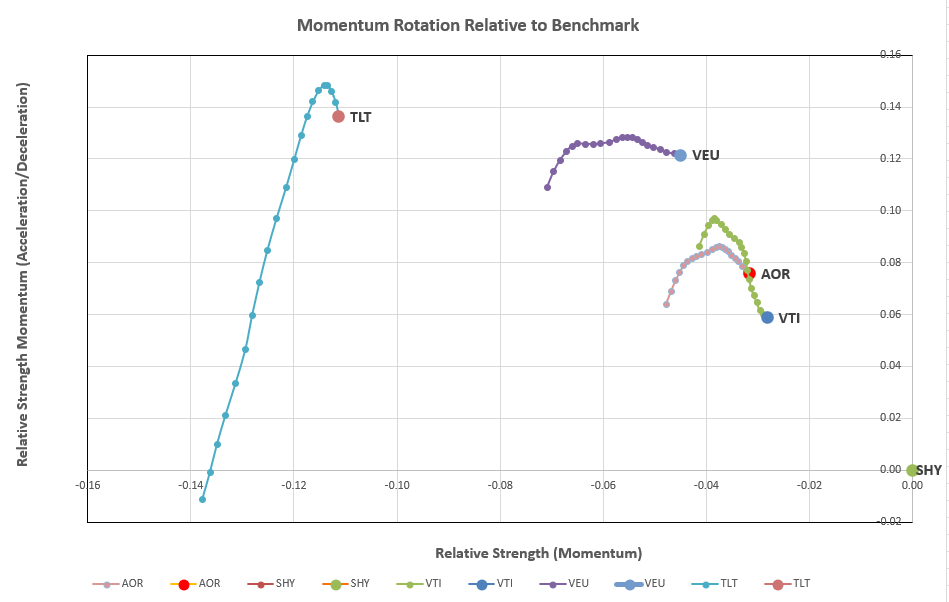

The Kahneman portion of the portfolio is a slow-to-react portfolio that uses Antonacci’s suggested 12-month look-back period:

and the rotation graphs all lie to the left of the vertical axis indicating weakness relative to SHY – or, from a practical standpoint, negative momentum. The recommendation is therefore to stay out of the active markets and this is where we presently stand (since June 2022) holding SHY in lieu of Cash:

and the rotation graphs all lie to the left of the vertical axis indicating weakness relative to SHY – or, from a practical standpoint, negative momentum. The recommendation is therefore to stay out of the active markets and this is where we presently stand (since June 2022) holding SHY in lieu of Cash:

This is a slight deviation from Antonocci’s original DM model in that Antonacci would recommend moving to Bonds. However, since I am using TLT as my Bond asset of choice, and the fact that TLT often tends to move with equities in a strong bearish market (i.e. the inverse correlation between equities and bonds often breaks down) I choose to move to Cash (SHY) if TLT momentum is negative – that it clearly is at the present time.

This is a slight deviation from Antonocci’s original DM model in that Antonacci would recommend moving to Bonds. However, since I am using TLT as my Bond asset of choice, and the fact that TLT often tends to move with equities in a strong bearish market (i.e. the inverse correlation between equities and bonds often breaks down) I choose to move to Cash (SHY) if TLT momentum is negative – that it clearly is at the present time.

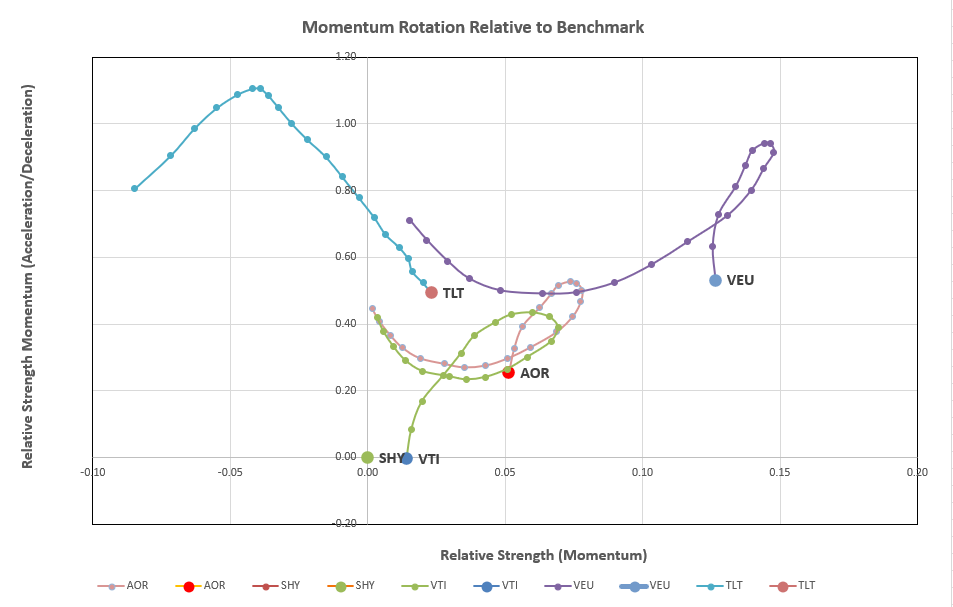

Checking on the rotation graphs for the faster reacting Tversky portion of the portfolio:

we see a lot of strange looping in the trails of the asset curves – although all are now in the desirable top right quadrant and lying to the right of the vertical axis (i.e. with positive momentum over the 60-100 day look-back periods.

we see a lot of strange looping in the trails of the asset curves – although all are now in the desirable top right quadrant and lying to the right of the vertical axis (i.e. with positive momentum over the 60-100 day look-back periods.

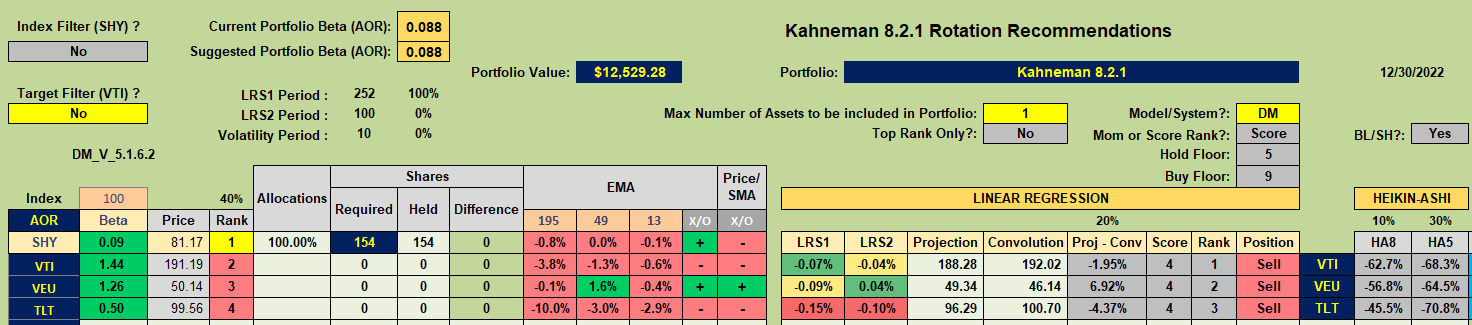

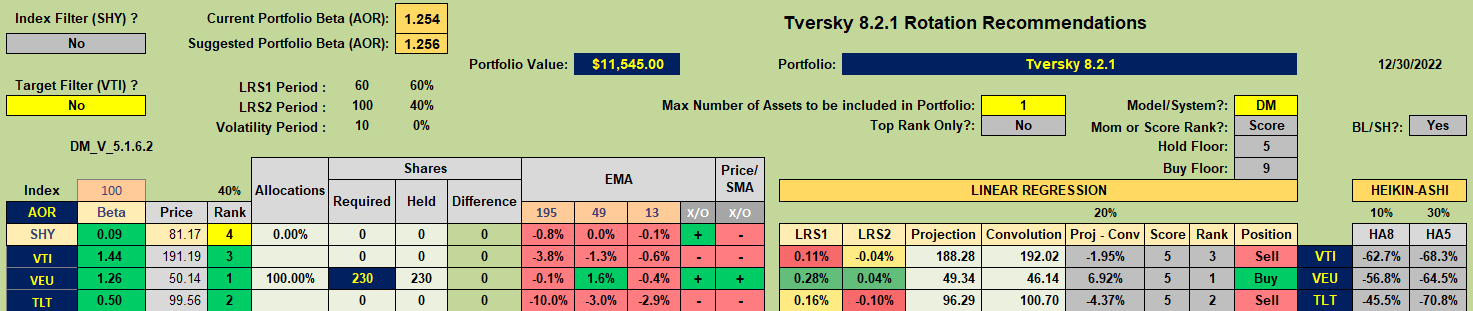

Recommendation from the DM model look like this:

with the suggestion to hold VEU – that is where we presently stand.

with the suggestion to hold VEU – that is where we presently stand.

Consequently, there are no adjustments to be made at this month’s review and we will wait to see what 2023 will bring.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.