Desolation

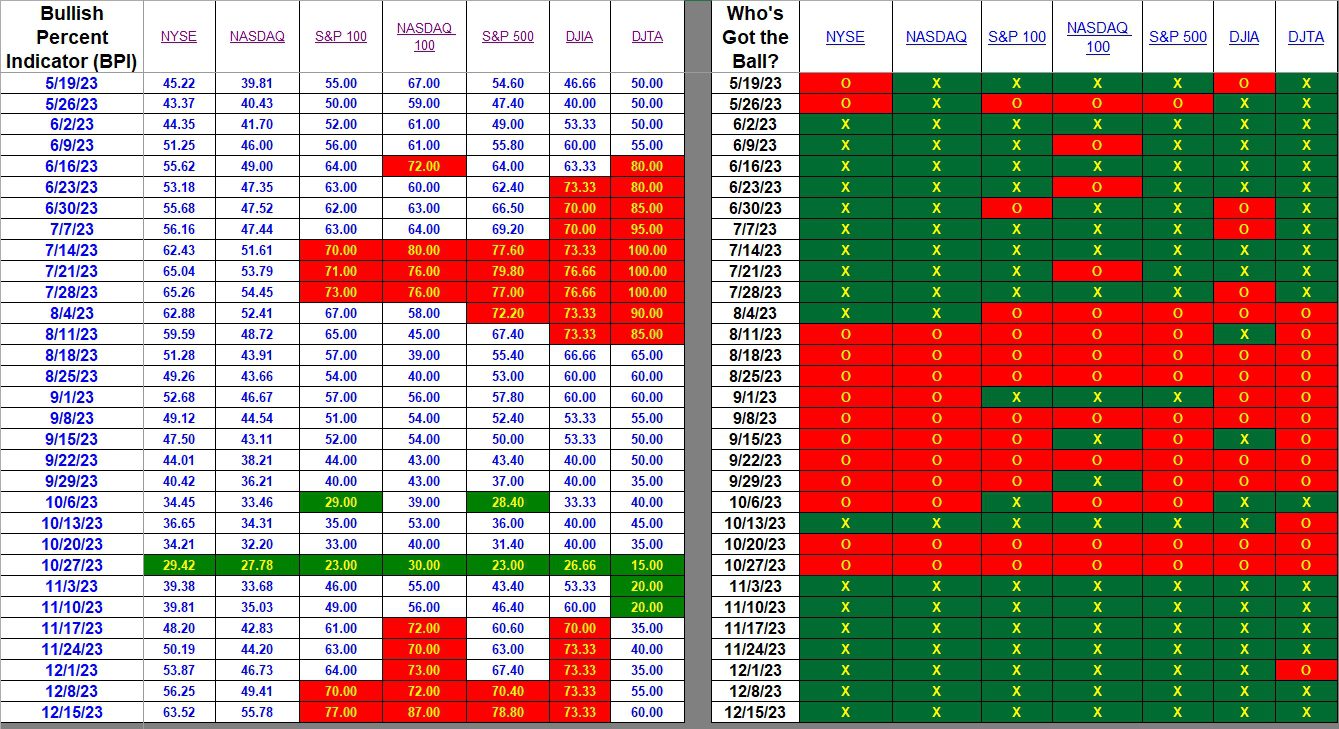

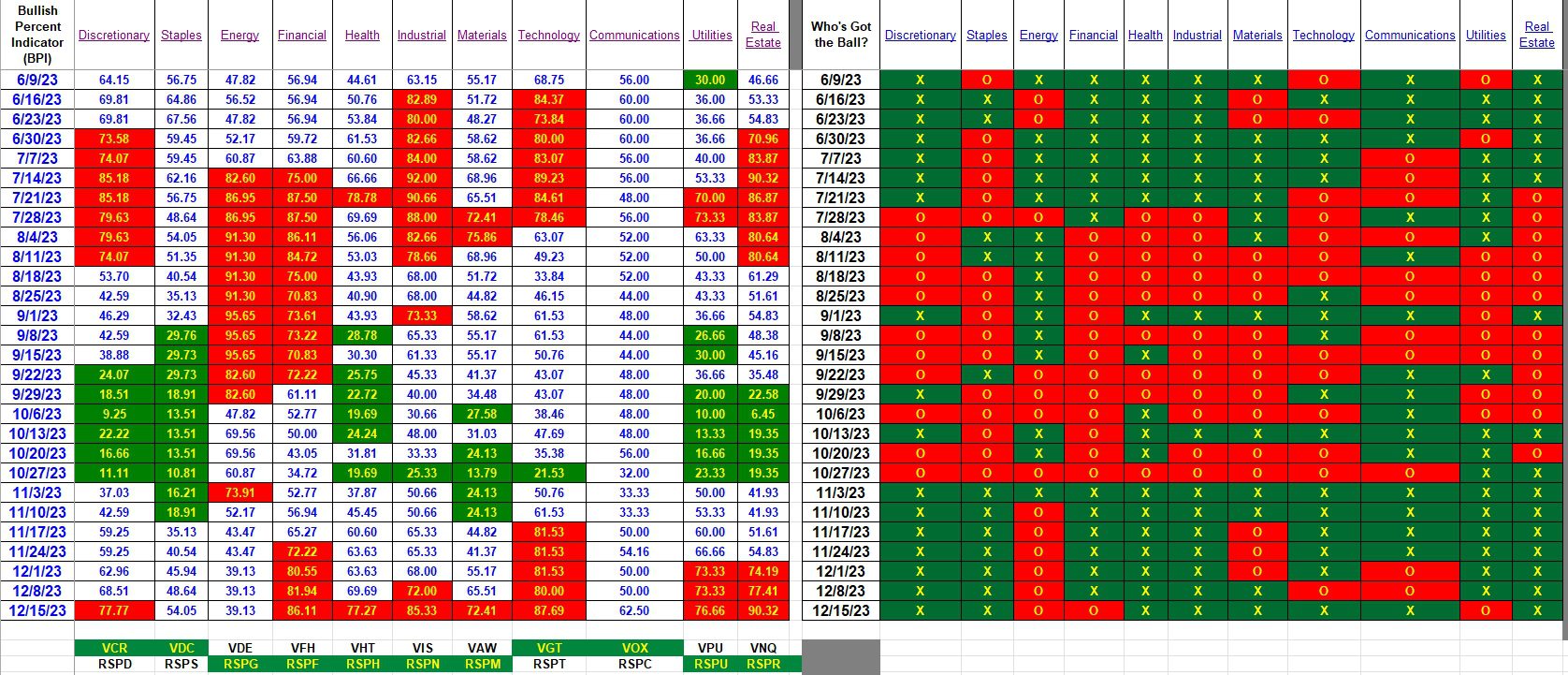

Bullish Percent Indicators (BPI) as shown in the following two tables provides a broad behavioral view of the U.S. Equities market. The second table breaks the market into its eleven different sectors and it is that data we use to manage the Sector BPI portfolios. With a few portfolios we now have one year of data. There are indications the hypothesis behind the Sector BPI investment model is working as anticipated. However, we still need to go through a few more Buy/Sell cycles before any useful conclusions are drawn.

Eight of the eleven sectors are currently overbought and one of the eight just made the move on Friday. A Trailing Stop Loss Order (TSLO) will be placed on the ETF (VAW) that carries the torch for this overbought sector.

Index BPI

All seven major index are bullish as shown by the X’s in the right side of the following table. On the left side, when a cell has a red background the index is overbought and when it is green it is oversold. Last October was a buying opportunity and we took advantage of that situation when the market dipped. Now we are in a cautionary period with the market this high.

The fact that the two broad indexes, NYSE and NASDAQ, are still hovering around the 50% bullish zone tells us the small- and mid-cap stocks are not participating in this bull market at the same level as the large- and mega-cap stocks. It is the large-cap stocks found in indexes such as the S&P 500 that are doing well.

Sector BPI

Now we come to the sectors of the U.S. Equities market. Three sectors joined the overbought group as Discretionary, Health, and Materials made the list. Check your portfolio(s) and if you are holding any of these ETFs, place your TSLOs.

If the ETFs are held with Schwab, decimal TSLOs are permitted. Here is my TSLO advice for the eight overbought sectors.

- Discretionary – 2.2%

- Financial – 1.4%

- Health – 2.3%

- Industrial – 1.5%

- Materials – 2.8%

- Technology – 1.2%

- Utilities – 2.3%

- Real Estate – 1.0%

If these TSLOs seem too “tight” then go with the standard 3.0% setting.

Explaining the Hypothesis of the Sector BPI Model

I forgot to mention that if you already have TSLOs in place, leave them be and don’t reset unless they have expired. That is unlikely with Schwab as the TSLOs are good for many months.

Lowell

All the sector ETF I believe will have some amount dividends next week. I know a number of mine go EX div. on Monday.

VNQ has the largest div and will probably be EX DIV around 12/22. Many times the price drops on the ex div day. I don’t know how that may affects the TSLO. I plan to wait until after the EX Div dates to set any TSLOs.

Bob P

Bob P.,

Good point. I recall always waiting to purchase mutual funds until after dividends were declared so as to avoid paying taxes on the dividends in addition to getting hit with the price decline.

Lowell

Bob P.,

I don’t plan to finesse the Sector BPI model as long as it is working to the investors advantage. I may loose out on a few dollars, but I want to give the model a real test over the next few year – unless it begins to falter.

Lowell

Bob P. et al.,

A number of TSLO were canceled due to declared dividends. I will need to go back in and reset those TSLOs as the portfolios come up for review.

Lowell

Lowell,

Did you cancel the TSLOs yourself, or were they canceled by the brokerage automatically?

~jim

Jim,

They were canceled automatically by the broker. Now that I recall, this is quite common at the end of each quarter. I don’t know if every TSLO was canceled, but numerous ones were.

As the portfolios come up for review I need to check and reset any TSLOs that were canceled. Canceled TSLOs are not a problem in a rising market as we are now experiencing.

Lowell

Bob P. et al.,

Something strange is going on with the dividends. As mentioned in a prior Comment, TD Ameritrade canceled all the TSLOs for ETFs where dividends were paid. That was expected and makes sense.

Schwab was different. VPU and VNQ both hit TSLOs and were sold on the 21st of December. I see the dividend was declared on the 19th, but no dividends were paid for either VPU or VNQ holdings. Dividends were paid on the 22nd for all sector ETFs held in the various portfolios.

I may request an explanation from Schwab. Does anyone have a good reason for the above action and did this happen to any other readers of this blog before I contact Schwab? Check your Schwab statement carefully.

Lowell

Lowell

I believe the difference is related to the Ex Div-date and the Pay Date.

According to Fidelty here are some examples.

Ex date pay date

VPU 12/18 12/21

VNQ 12/21 12/27

XLI 12/18 12/21

I owned XLI and sold holdings on 12/20 and received my dividends on 12/21. I did not however use a TSLO in this case. If your VPU was sold after the Ex date you should receive and dividends.

I don’t think Fidelity automatically cancels TSLOs but will verify.

Bob

Bob,

VPU and VNQ were sold after the Ex date, but need to check again. That is why I am raising the question.

Lowell

More TSLOs were canceled this morning – primarily from TD Ameritrade.

Lowell

Lowell,

I’m a bit surprised that your account(s) haven’t been transfered from TD to Schwab, yet. My Roth IRA was tranferred around a month ago. Have they given you a projected transfer date?

~jim

Jim,

TD Ameritrade/Schwab is telling me it will happen around May 10, 2024.

It will not surprise me if the TSLOs are canceled shortly before the move – assuming there are TSLOs in place.

Lowell