Lewis & Clark College Campus

While there are a few changes in the Bullish Percent Indicators this week it is unlikely any moves will impact the Sector BPI Plus portfolios. This assumes all the Buy and Sell orders are already in place.

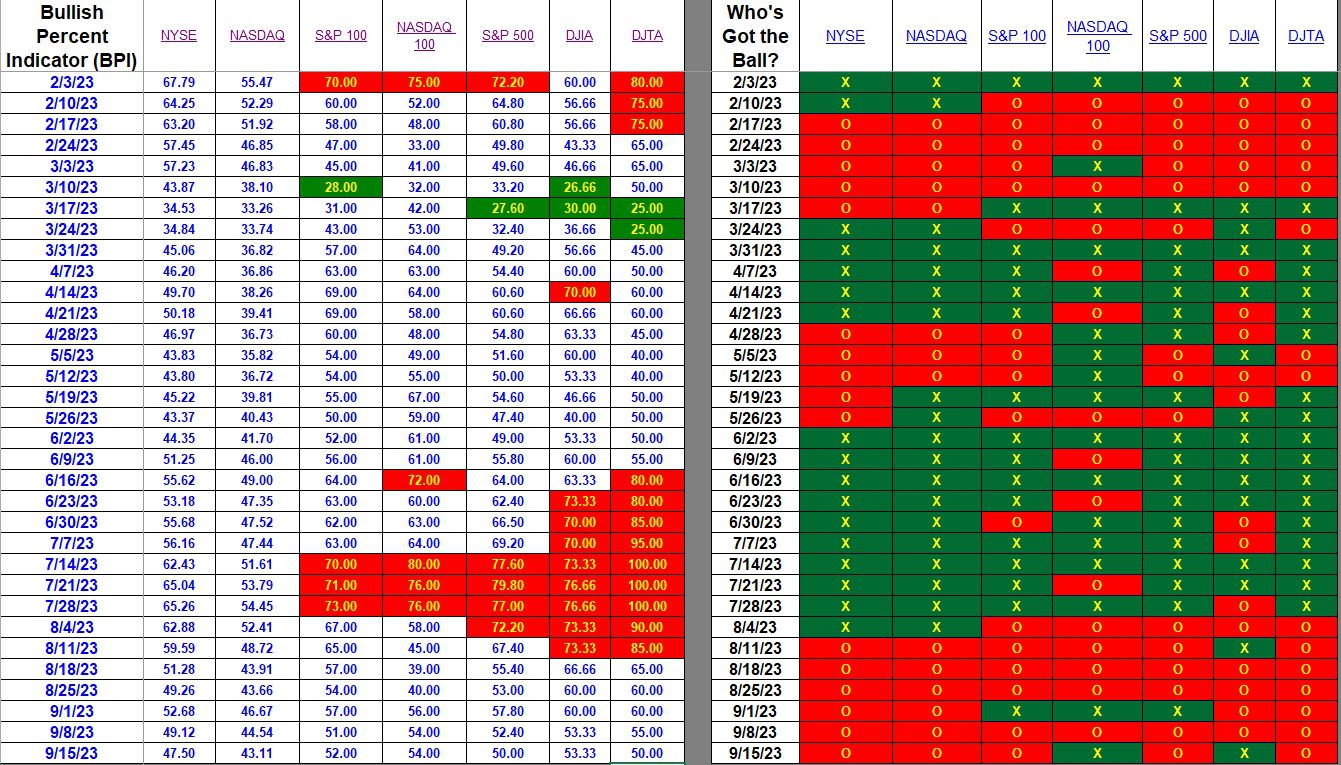

Index BPI

The NASDAQ 100 and DJIA moved from bearish to bullish indicating some large cap stocks flipped this week. When looking at the broad market (NYSE and NASDAQ) we see a rather “average” or static market. I pay most attention to the percentage of bullish stocks from these two broad indexes followed by the S&P 500 as the third most important index.

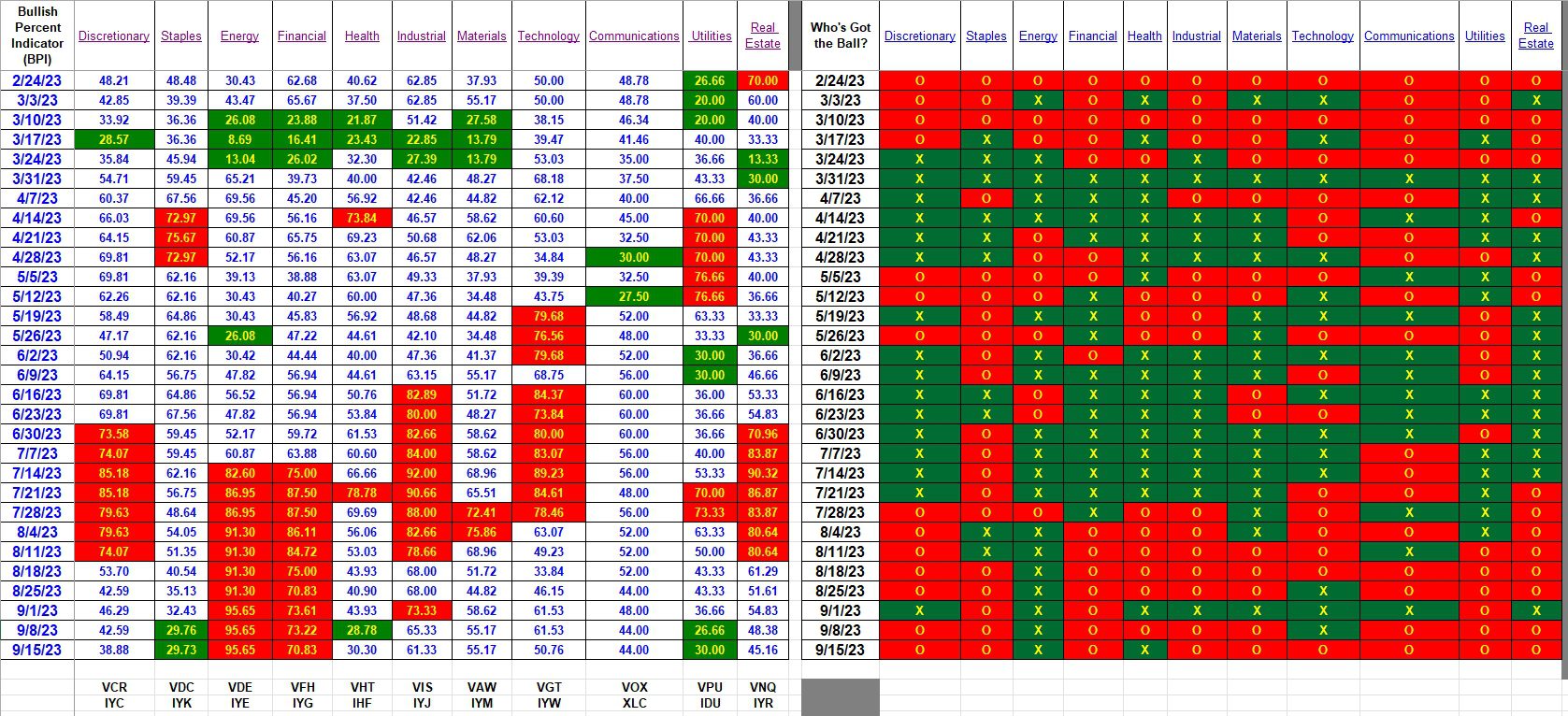

Sector BPI

Health moved from oversold to just above the Buy zone. Those investors managing a Sector BPI Plus portfolio likely are already holding shares in either VHT or IHF. Staples and Utilities are still flashing Buy signals as both sectors are still oversold. We now patiently wait for Staples, Health, and Utilities to reach the overbought zone. We have been holding Communications (VOX) for many weeks.

Explaining the Hypothesis of the Sector BPI Model

Carson Portfolio Update: 18 November 2022

If you are new to Sector BPI investing, search for these portfolios.

- Carson

- Gauss

- Franklin

- Millikan

Bethe and Bohr are new to this Sector BPI model so I would first check on the other four. Carson is the oldest Sector BPI Plus portfolio so check that one out if you are at all interested in examining this approach to portfolio management.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.