Bart Simpson features in this Wall-Art scene in Christchurch, New Zealand.

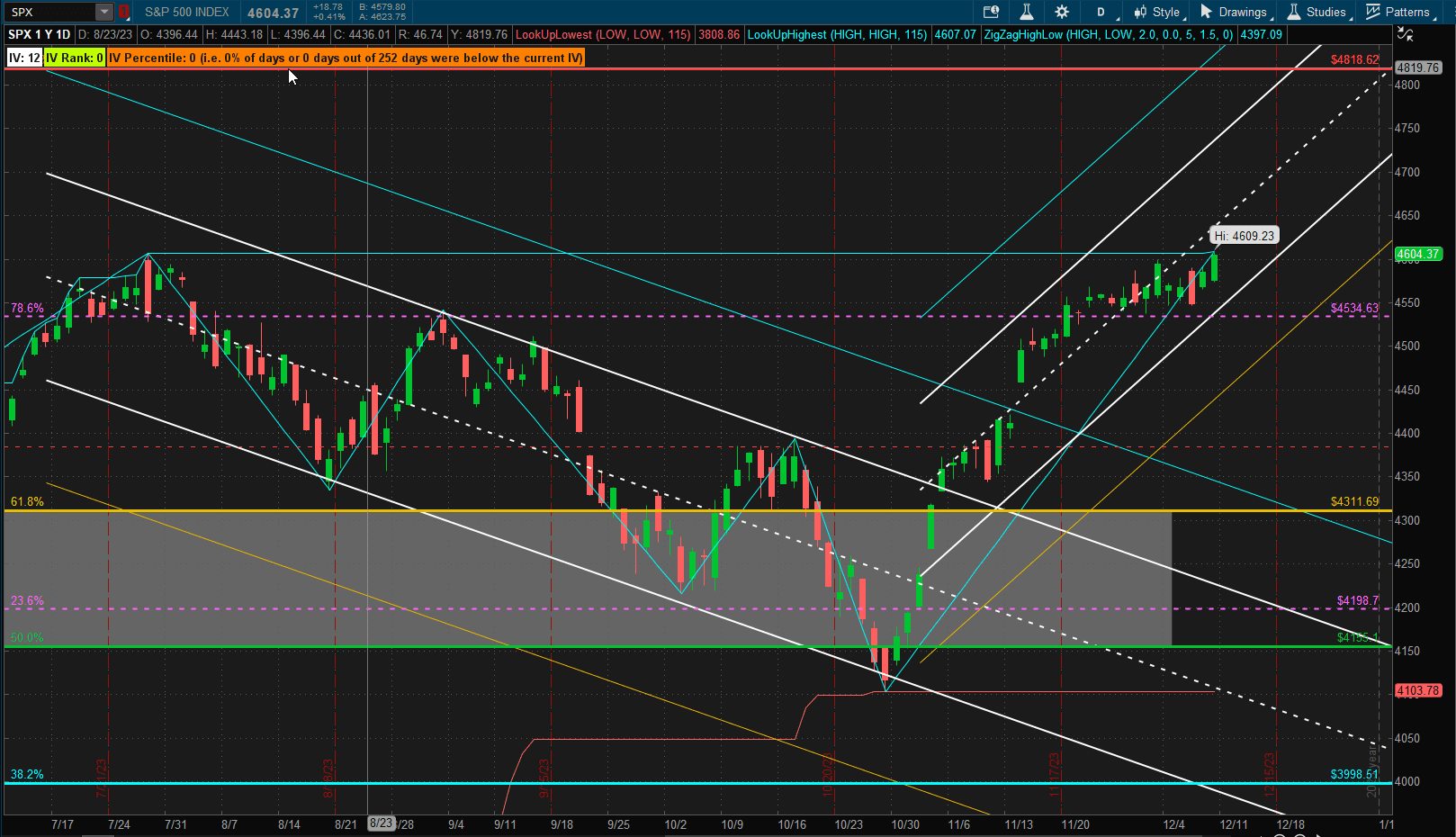

It was the second straight week of trading in a narrow (~50 point) range and below the important 4600 level in the S&P 500 US Equity index (SPX) although the index did move slightly through the prior pivot high intra-day on Friday but closed slightly below it:

we will wait to see whether Santa can pull us through this resistance next week and close above it at the end of the year. Although it has been an overall good year for US equities we are still trading below the high established before the 2022 pullback.

we will wait to see whether Santa can pull us through this resistance next week and close above it at the end of the year. Although it has been an overall good year for US equities we are still trading below the high established before the 2022 pullback.

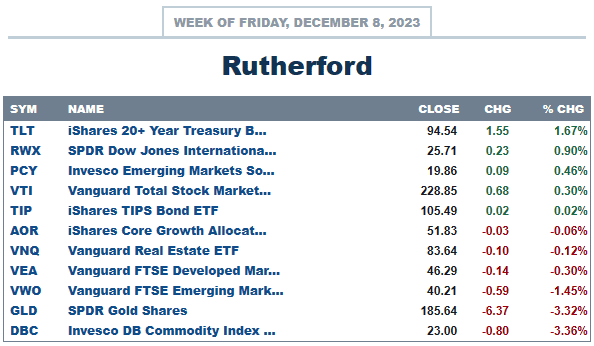

In terms of relative performance US equities came in close to the top of the asset class rankings:

although it was ouperformed by International Real Estate and Long Term Bonds.

although it was ouperformed by International Real Estate and Long Term Bonds.

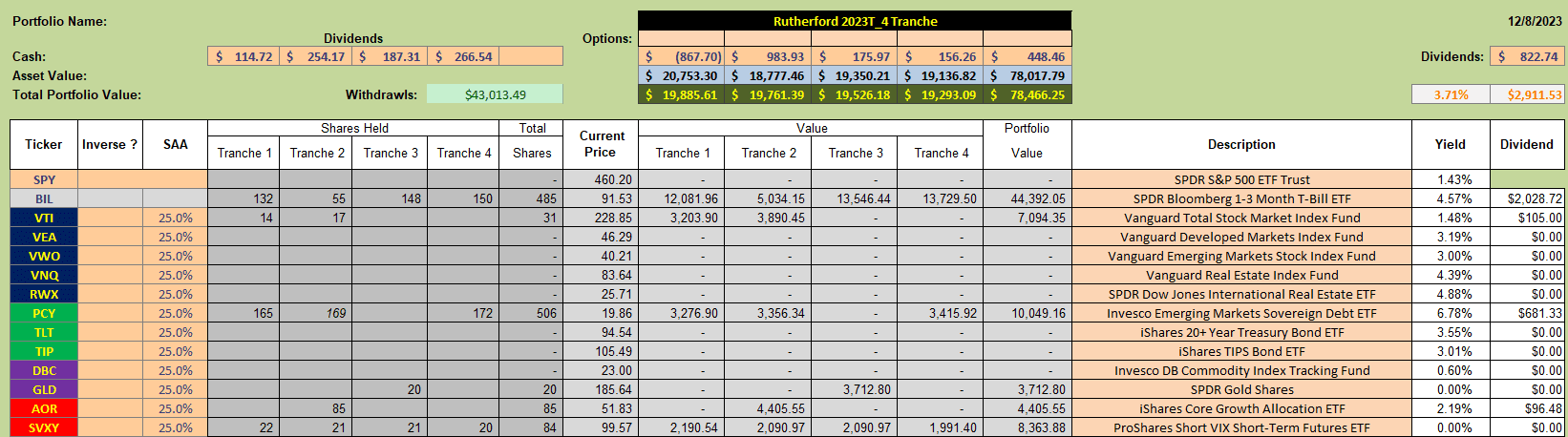

Current holdings in the Rutherford Portfolio look like this:

with performance matching the benchmark (but slightly below it):

with performance matching the benchmark (but slightly below it):

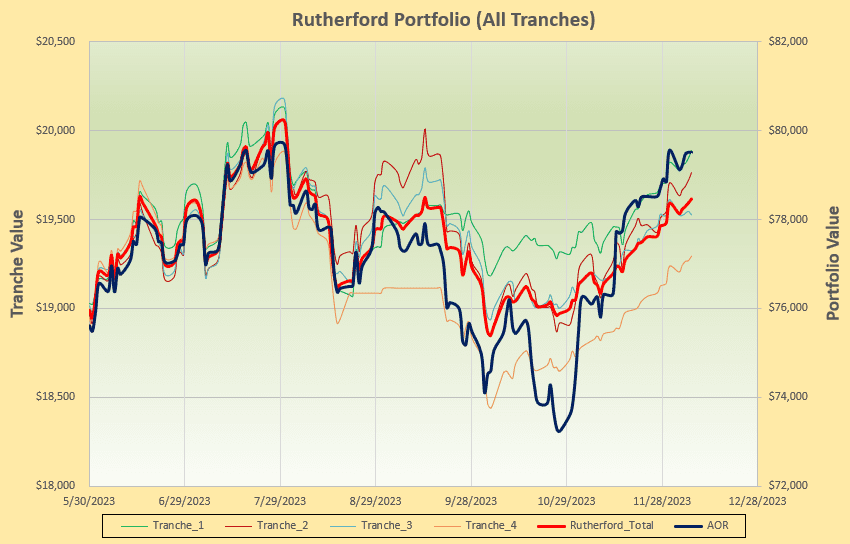

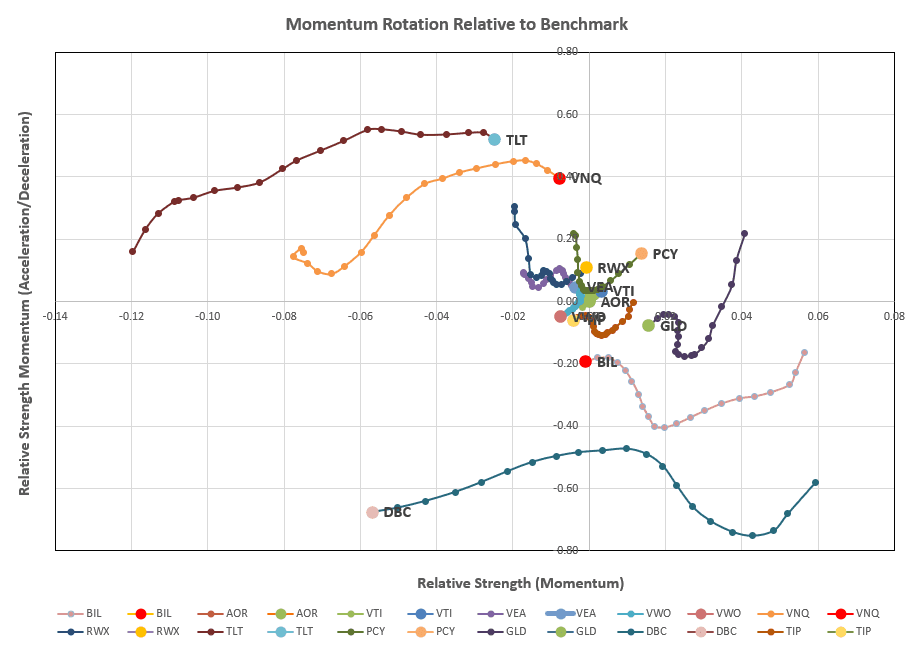

Checking on the current rotation graphs:

Checking on the current rotation graphs:

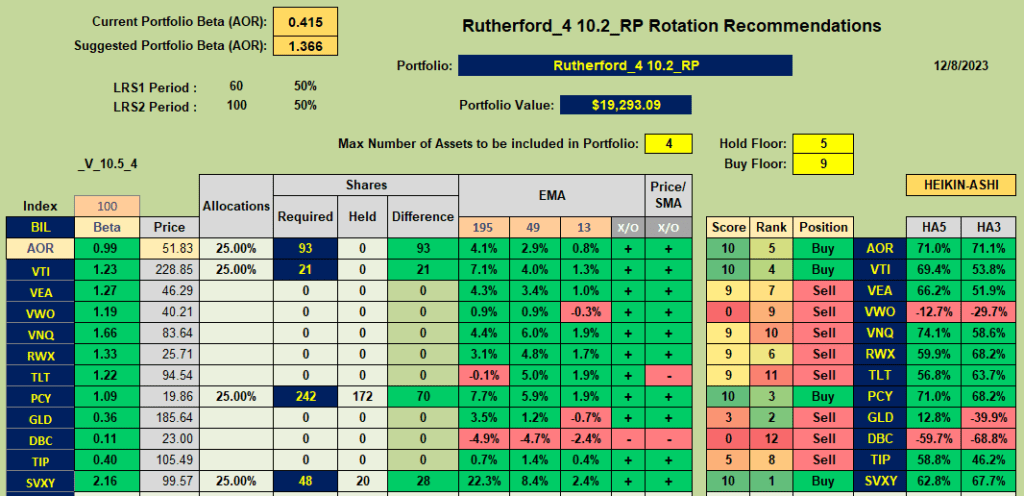

we see PCY making a strong move in the desirable top right quadrant. Recommendations from the rotation model look like this:

we see PCY making a strong move in the desirable top right quadrant. Recommendations from the rotation model look like this:

with Buy recommendations for PCY, VTI, and AOR – plus our volatility diversification ETF, SVXY.

with Buy recommendations for PCY, VTI, and AOR – plus our volatility diversification ETF, SVXY.

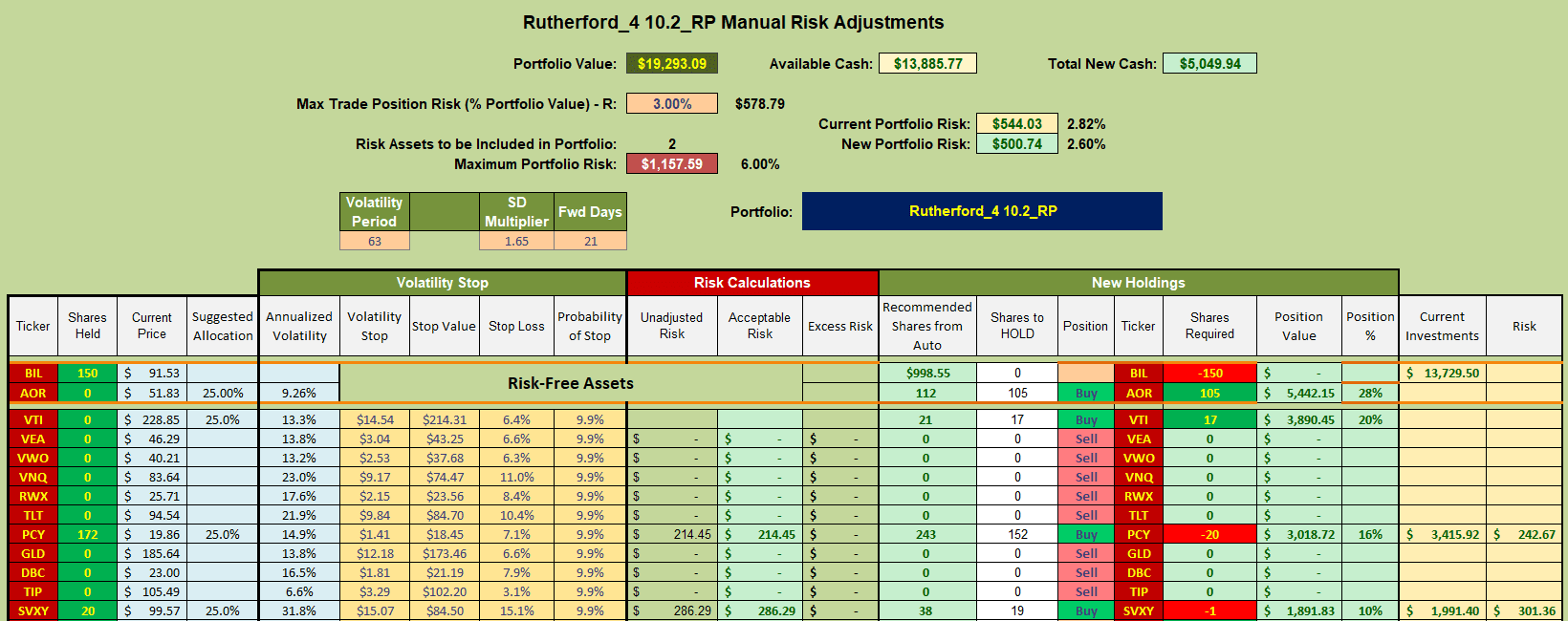

Next week’s adjustments will therefore look something like this:

where I shall be selling shares in BIL (short term T-Bills/proxy for Cash) to add positions in VTI and AOR. I will ignore the minor adjustments to PCY and SVXY to avoid trading costs.

where I shall be selling shares in BIL (short term T-Bills/proxy for Cash) to add positions in VTI and AOR. I will ignore the minor adjustments to PCY and SVXY to avoid trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.