Shrine in Lombok Harbor, Indonesia

The Kahneman-Tversky Portfolio is a simple Dual Momentum (DM) portfolio with a fast/slow (short look-back/long look-beack) twist.

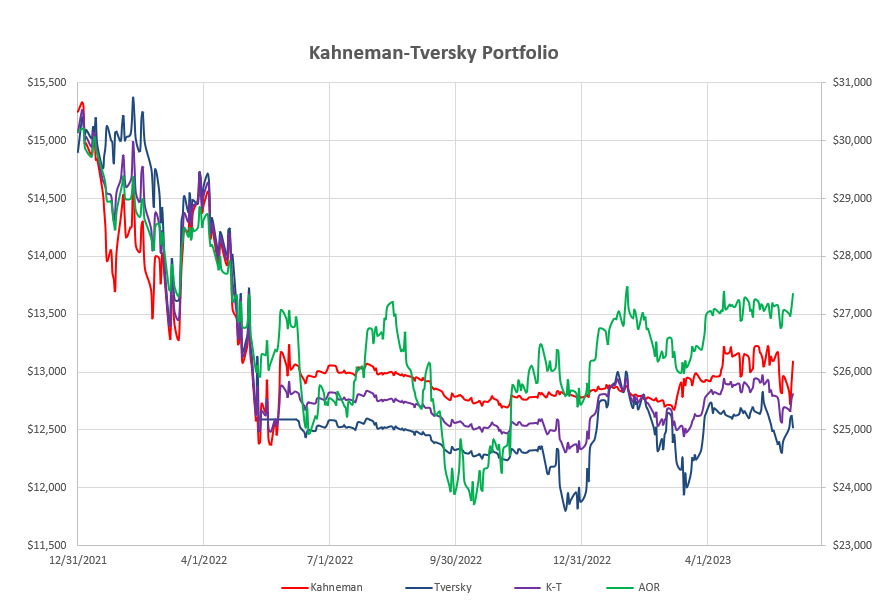

We’ll look first at the performance to date:

where we see that we are a little behind our AOR benchmark.

where we see that we are a little behind our AOR benchmark.

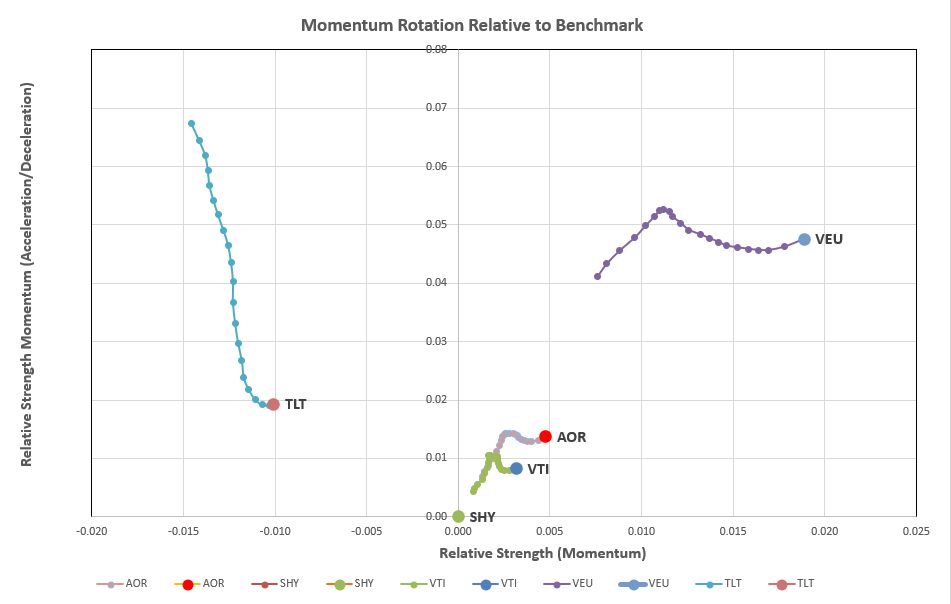

So, we’ll look first at the slow moving (Kahneman) portion of the portfolio and the rotation graphs:

I like these slow moving portfolios because the rotation graphs are much cleaner and easy to read (but not necessarily the best to project future performance). From the above we see VEU clearly ahead in both long-term momentum (furthest right) and shorter term performance (highest vertical value).

I like these slow moving portfolios because the rotation graphs are much cleaner and easy to read (but not necessarily the best to project future performance). From the above we see VEU clearly ahead in both long-term momentum (furthest right) and shorter term performance (highest vertical value).

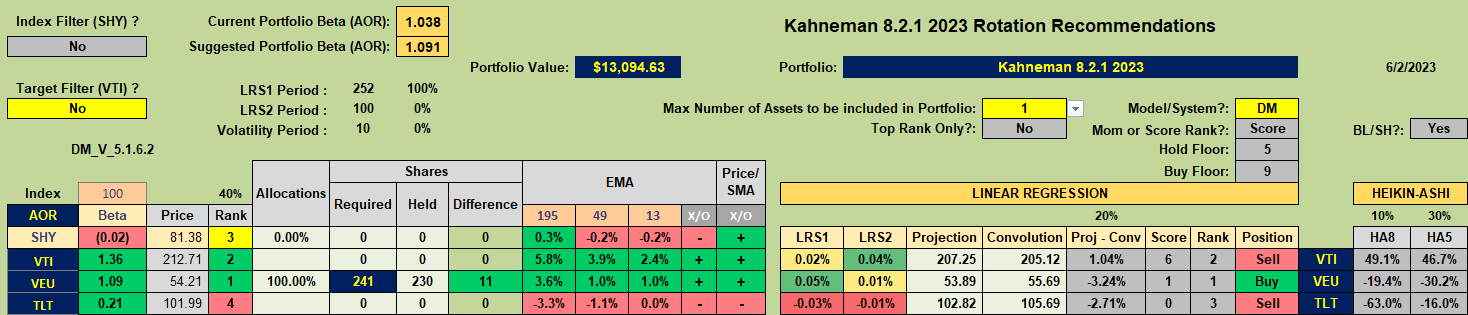

So, checking the recommendations, it comes as no big surprise that VEU is the asset of choice to hold:

Since we are already holding VEU in this portion of the portfolio no adjustments are necessary.

Since we are already holding VEU in this portion of the portfolio no adjustments are necessary.

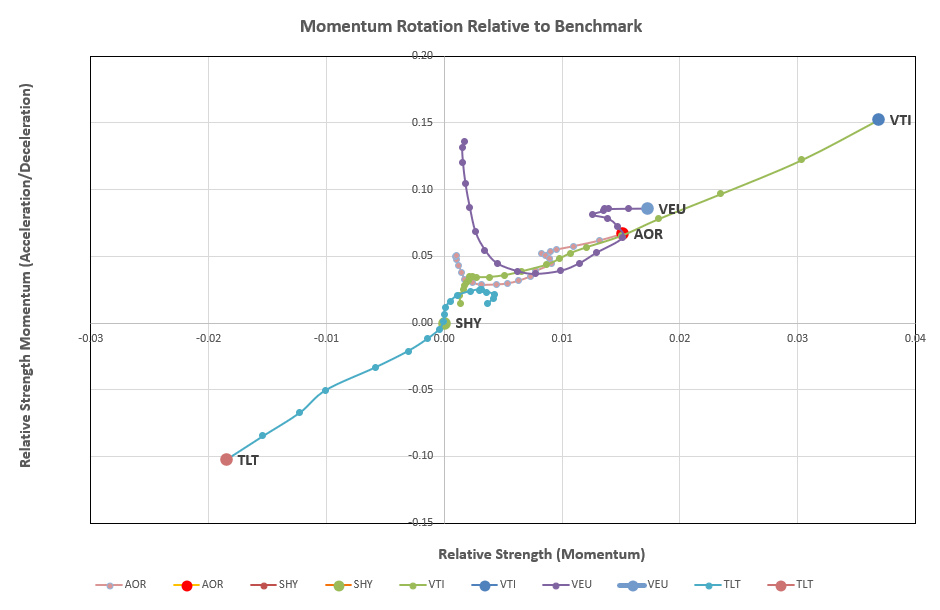

Moving to the faster moving Tversky portion we see the following rotation graphs:

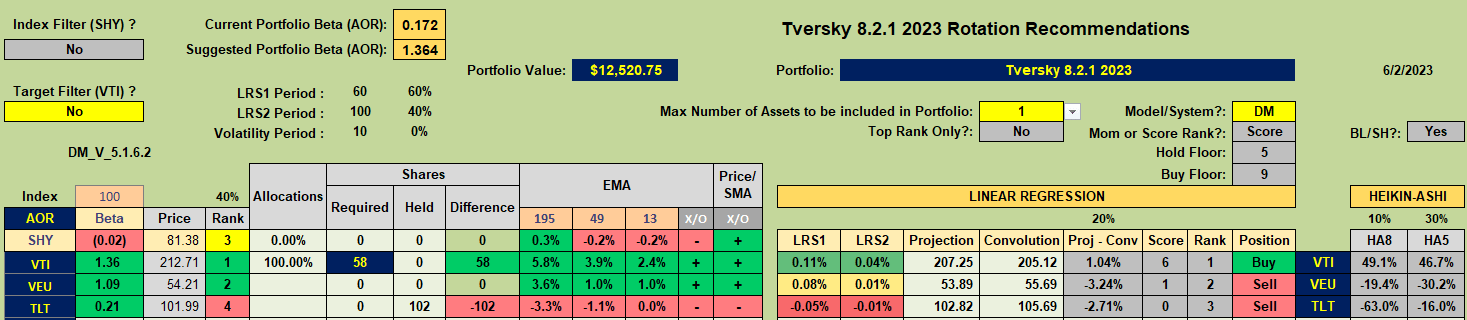

…… where we see VTI clearly taking off in the shorter term. This is reflected in the current recommendations from this portion of the portfolio:

…… where we see VTI clearly taking off in the shorter term. This is reflected in the current recommendations from this portion of the portfolio:

accordingly, my action this month will be to sell holdings in TLT and to use the proceeds to buy shares in VTI.

accordingly, my action this month will be to sell holdings in TLT and to use the proceeds to buy shares in VTI.

Timing/review date luck was a big factor in affecting portfolio performance here since the recommendation at the last (official) review was to hold TLT – however, just a few days after the review date the recommendation was to move to VTI. However, although I was watching this, I stuck with the “Plan” and held on to TLT. Discipline is desirable, but not always easy to exercise – had this been a larger portfolio I’m not sure that I would have held on to TLT – but that would reflect my personal (emotional) beliefs, rather than following an automated “plan”.

Obviously, I will be moving from TLT to VTI next week (when we will probably see a pullback in US equities 🙂 ).

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.