Canby Snowman

McClintock is the Sector BPI portfolio up for review this morning. The three Sector BPI portfolios are investment models unique to the ITA blog. For more information on this model, go to the Categories menu found in the right sidebar and look for Sector BPI.

While we frequently wait for months between Buy and Sell signals, we have had some action recently and this past week Information Technology (VGT) moved into the overbought zone. As a result I placed a 3.0% Trailing Stop Loss Orders (TSLOs) under VGT. If the price of VGT moves higher the sell price will rise. We have a floor under VGT should the market move lower as it is doing today.

The Sector BPI investing model is basically a reversion-to-the-mean approach to investing. We now have sufficient history with this model to move it out of the hypothesis stage and consider it a workable theory of investing.

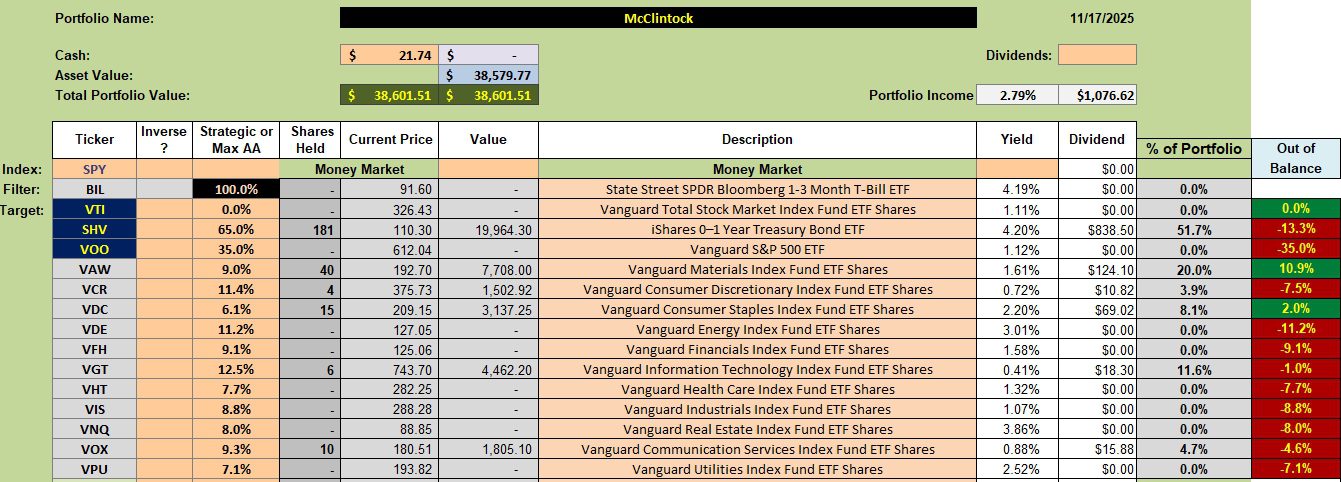

McClintock Sector ETF Holdings

Below are the current holdings for the McClintock. As readers can see, VAW and VDC are well above target, likely due to recent price increases since these ETFs were purchased. VOX and VCR are below target, likely for similar reasons as a result of price movement since they were first purchased.

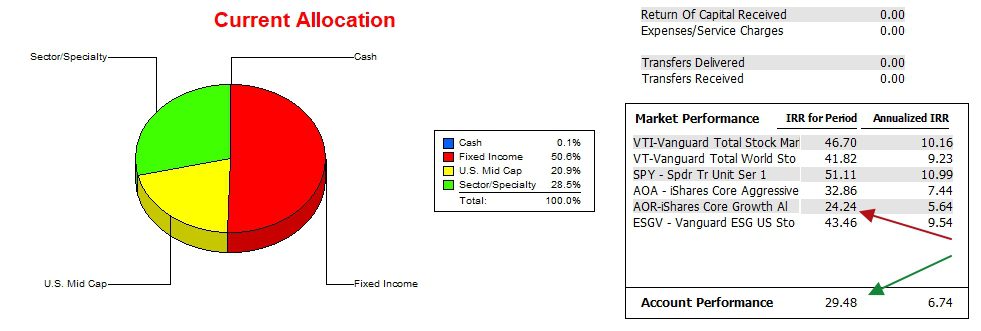

McClintock Performance Data

Since 12/31/2021 the McClintock has outperformed the AOR benchmark, but lags the S&P 500 by a wide margin. 50% of the portfolio is held in SHV just waiting for one or more sectors to drop into the oversold zone.

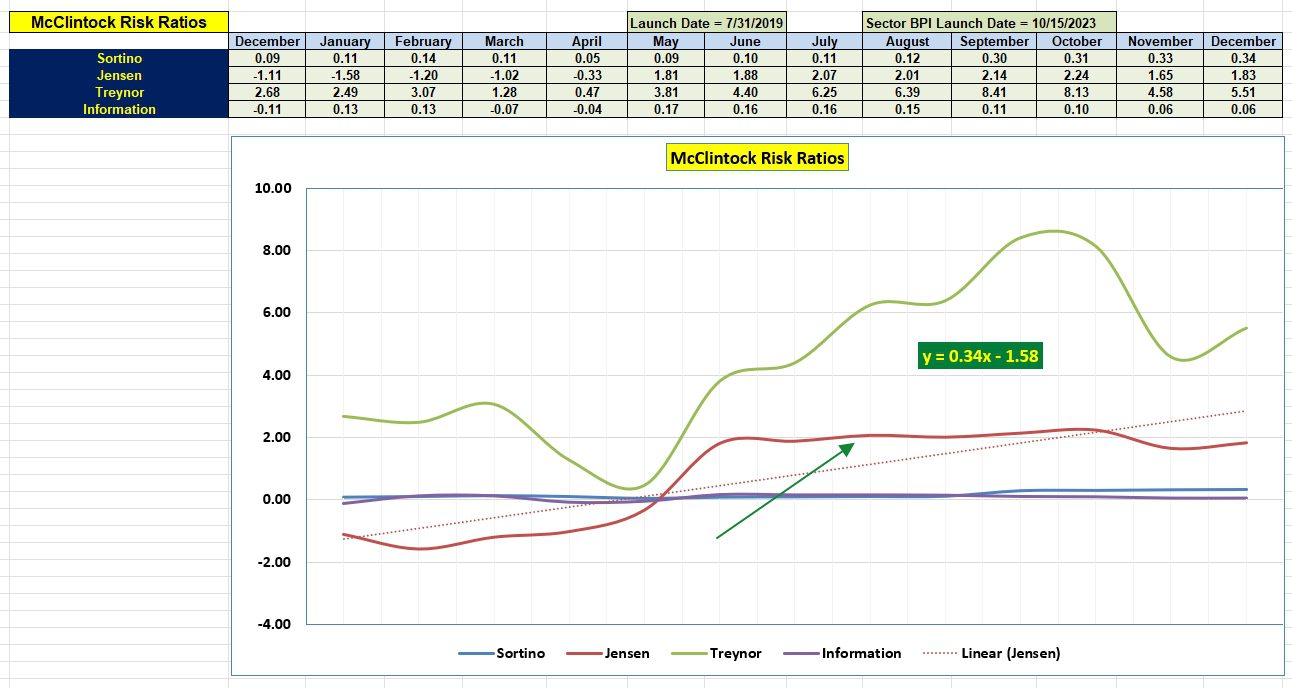

McClintock Risk Ratios

How is the McClintock performing when risk enters the equation? The Jensen Alpha or Jensen Performance Index is the best source to answer this question. Currently the slope of Jensen is positive and the value is above zero – both very positive signals.

Note that each of the four risk measurements are well above where they were a year ago. This is also positive for the McClintock portfolio.

McClintock Sector BPI Portfolio Review: 9 October 2025

Later this week the Millikan, Copernicus, Huygens, and Kepler are scheduled for an update. This week and next week are busy as I am setting up all portfolios for 2026. One of the goals for the new year is to reduce transactions so as to control taxes. The three Sector BPI portfolios (Carson, Franklin, and McClintock) will operate as normal regardless of taxable events do to buying and selling.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question