End of season dahlia from Swan Island Dahlias

Little has changed since the recent recommendation to purchase shares in Consumer Staples. VDC is the Exchange Traded Fund (ETF) that covers this sector of the U.S. Equities market. I recently purchased 15 shares of VDC as Consumer Staples dropped below the 30% Bullish Percent Indicator line. If you are a new ITA reader or subscriber, three portfolios follow the Sector BPI investing model. They are: Carson, Franklin, and McClintock. All are named after women scientists.

If you wish to learn more about this investing model, go to the Category section in the right-hand sidebar and search Bullish Percent Indicators and/or one of the three portfolios.

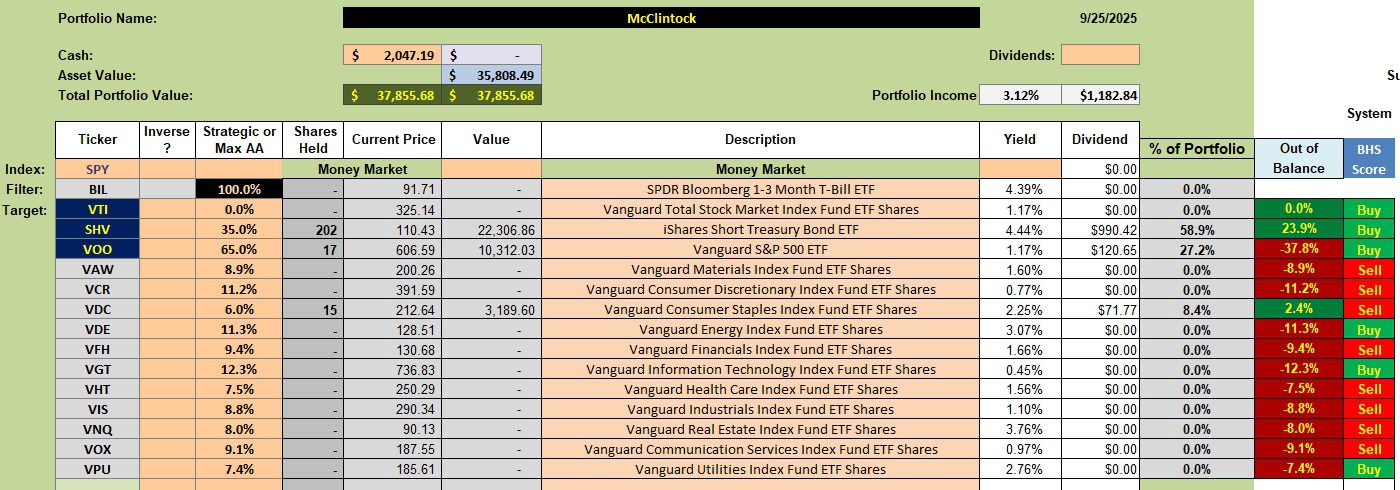

McClintock Sector Portfolio Holdings

ITA readers will find the current makeup of the McClintock below. SHV is a holding position to earn a bit more interest while we patiently wait for other sectors to drop into the oversold zone.

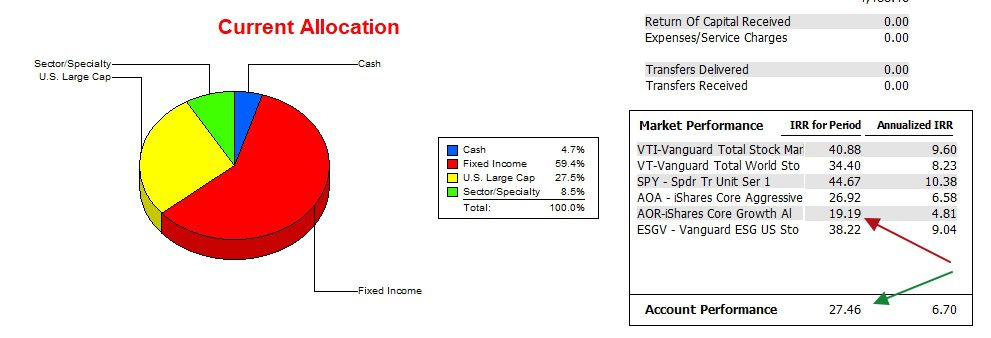

McClintock Performance Data

Since 12/31/2021 the McClintock has outperformed the AOR benchmark, but lags all benchmarks that are oriented towards all equity holdings. VOO, VTI, VT, and ESGV are the examples.

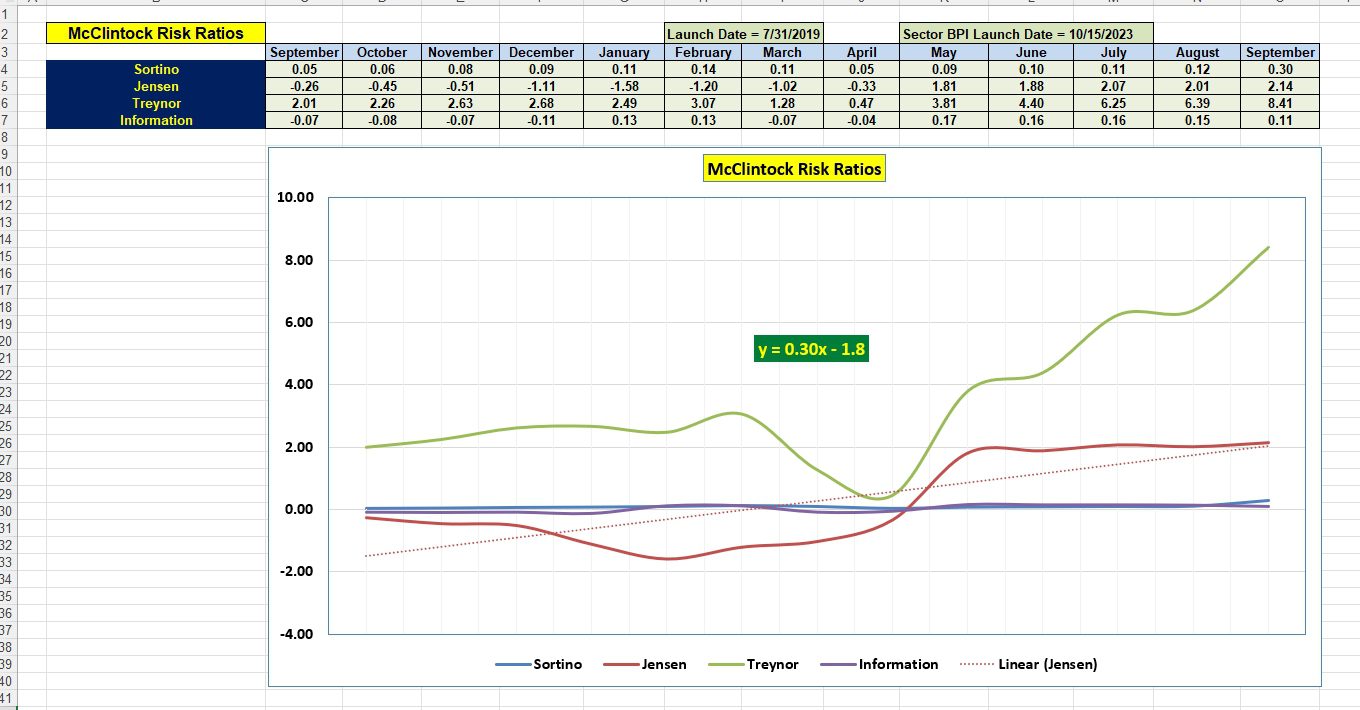

McClintock Risk Ratios

Over the past year the Jensen Performance Index has steadily improved. In September we lost a little ground to the AOR benchmark, but are well ahead of where we were a year ago.

All risk ratios are above where they were a year ago.

Comments are always welcome.

Changes are coming to the Millikan portfolio so pay attention when that announcement hits ITA.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question