Cutsforth Market Produce

The Millikan portfolio is the other Sector BPI portfolio I am switching to a simplified asset allocation investment model. It will likely take a few more reviews before the portfolio is in balance.

The current beta is 0.71. When in total balance the beta should drop below 0.5 indicating it is a very conservative portfolio.

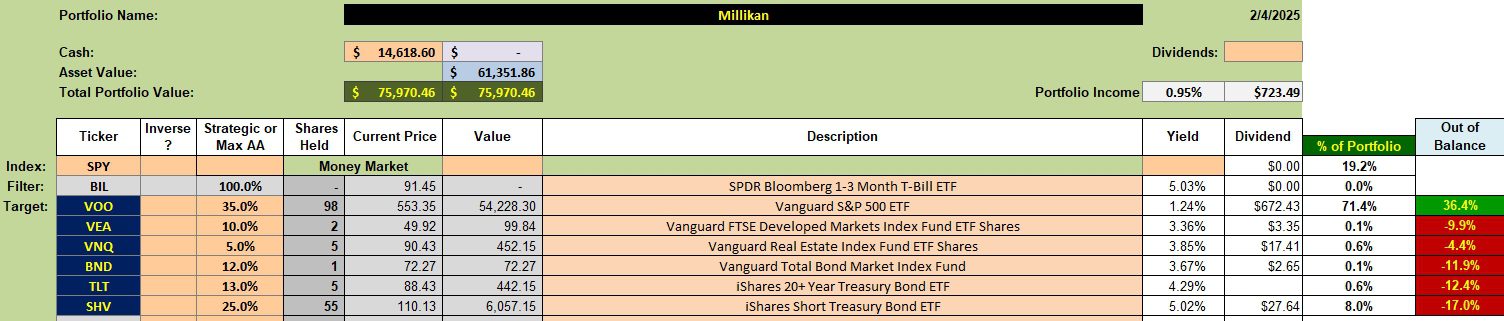

Millikan Asset Allocation Portfolio

As currently structured the Millikan is over-weighted in U.S. Equities and under-weighted in all other asset classes. Limit orders are in place to move the portfolio toward the Max AA percentages found in the third column from the left.

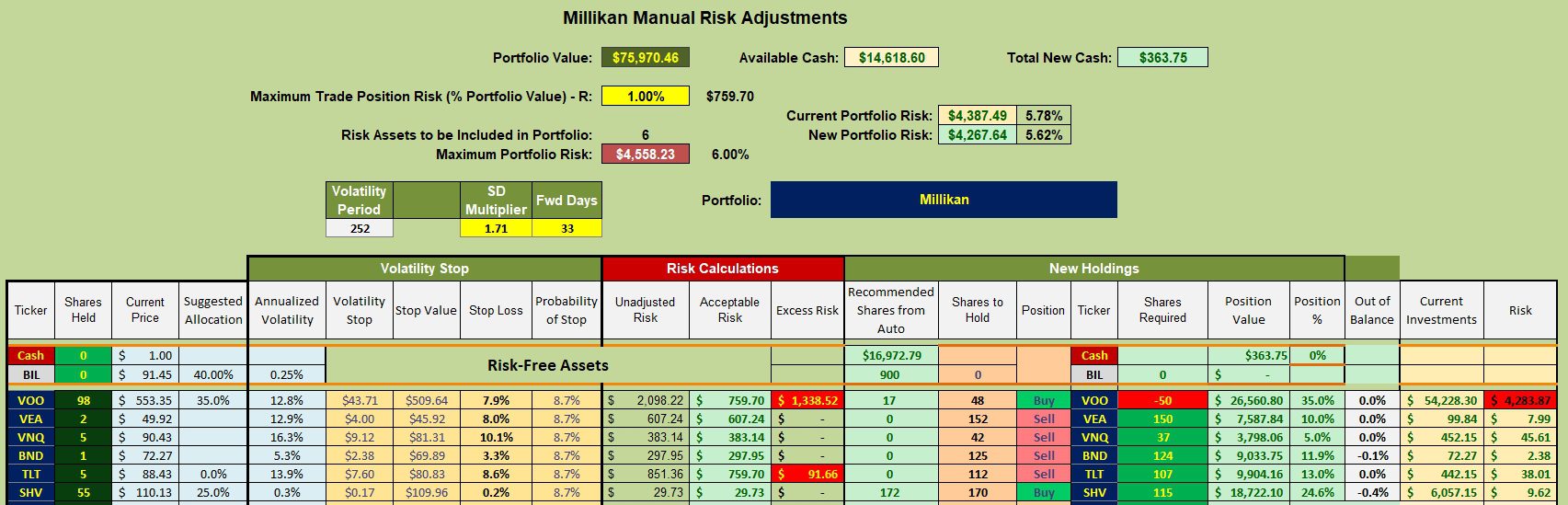

Millikan Rebalancing Recommendations

Due to the move to a simplified asset allocation model the Millikan is in a state of rebalancing. The goal is to gradually fill the asset classes to match the shares shown in the Shares to Hold or the 9th column from the right.

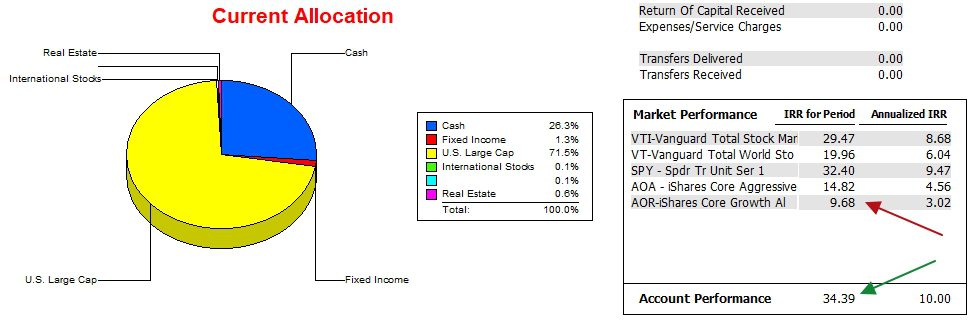

Millikan Performance Data

Since 12/31/2021 the Millikan has been a strong performer. Over this period it outperformed all five potential benchmarks. Now that it is an asset allocation portfolio the benchmark is AOR.

Once shares of VOO are sold the Millikan should operate as a tax efficient portfolio. The dividends will be taxed as ordinary income, the one drawback to this investment model.

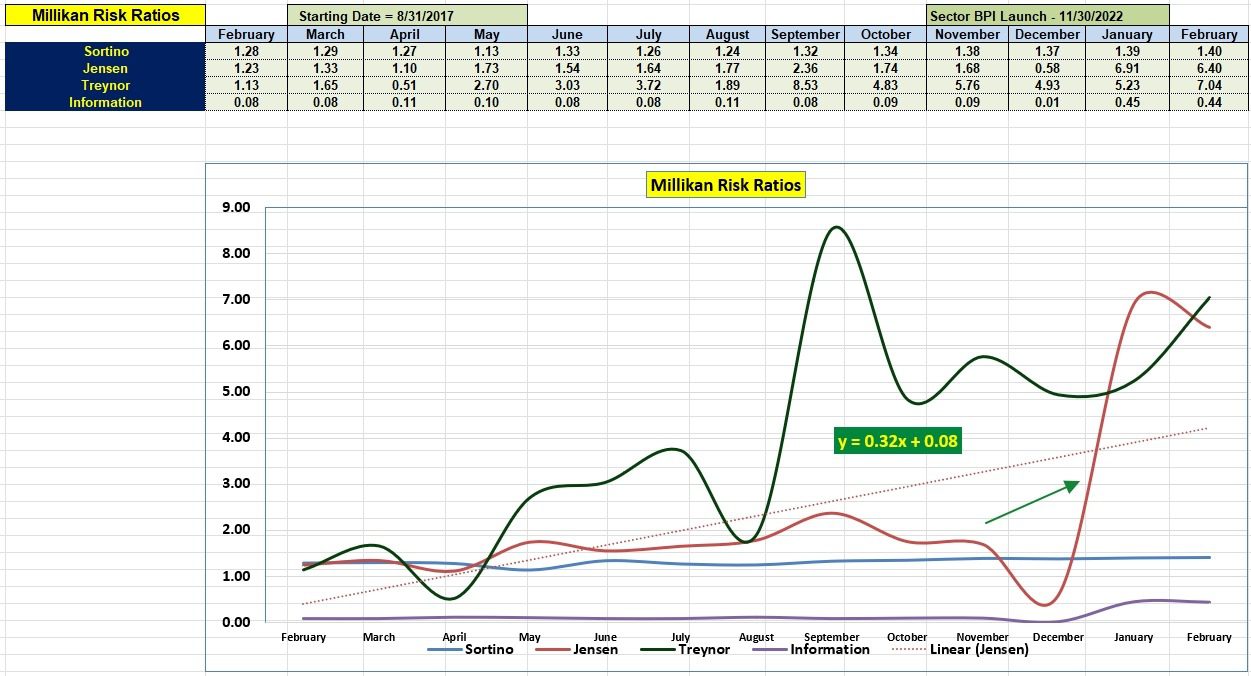

Millikan Risk Ratios

It will be another year before this data table is useful. We need at least that much time to see what the trend will be for the Jensen Performance Index, or sometimes known as the Jensen Alpha.

Pay attention to the Jensen and Information Ratios as those are the two most important of the four risk measurements.

Comments are always welcome.

Millikan Sector BPI Portfolio Review: 6 September 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question