Chinese Garden

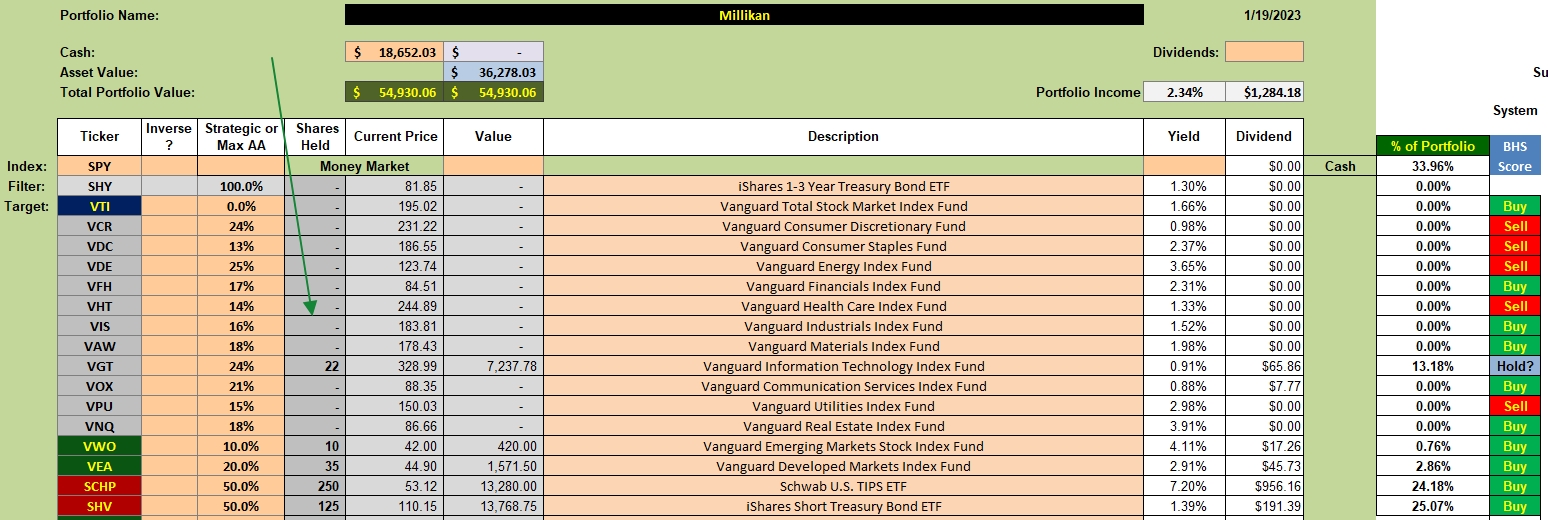

Millikan is one of the newest Sector BPI Model portfolios. As a result, you will see two “holdover” securities, VWO and VEA, still part of the portfolio. I have 3% TSLOs set for both ETFs so it likely will not be too long before both are sold out of the Millikan.

The black cloud hanging over the stock market is the threat or battle over lifting the debt ceiling so the U.S. Treasury can pay off past debts. As we near crunch time we can expect the value of the market to decline and this in turn will provide buying opportunities for those who hold cash. The Millikan is one such portfolio as this portfolio is light on equities and heavy in cash, treasuries, and TIPs.

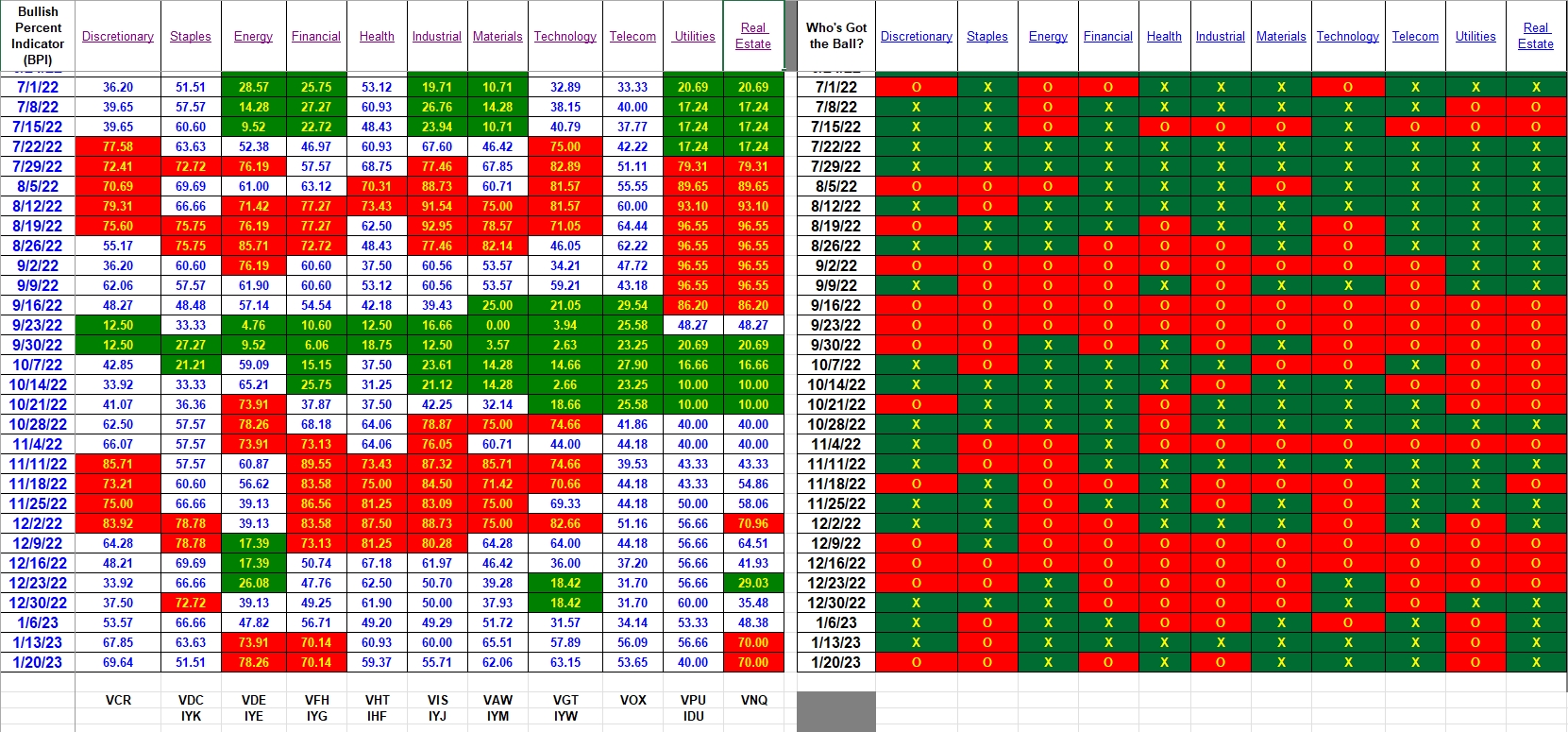

Sector BPI

Below is the Bullish Percent Indicator data as of 1/19/2023. Using the left side of the table we see where there are no Buy signals. Sell recommendations or a time to make sure 3% TSLOs are set for Energy, Financial, and Real Estate are identified. The only sector currently held by the Millikan is Technology so no action is required this morning.

Millikan Sector Holdings

As mentioned above, the Millikan holds one sector and that is Technology. The BPI for Technology (VGT) resides in the “neutral” zone so we do nothing with the Millikan portfolio.

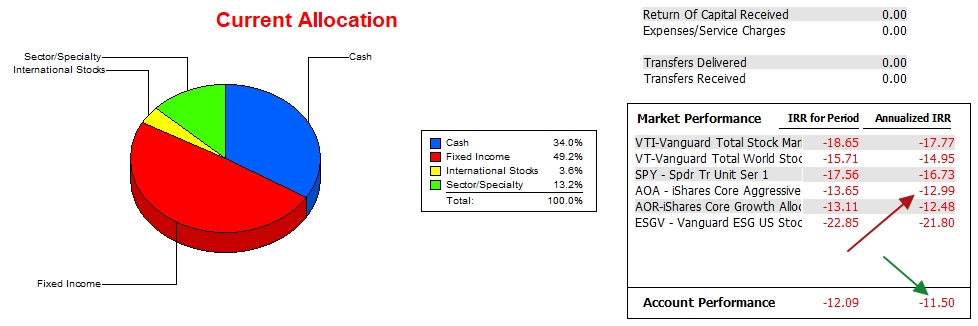

Millikan Performance Data

Over the past year plus three weeks, the Millikan outperformed all the listed benchmarks. The primary reference for the Millikan is AOA. The Millikan holds a small 1.5 percentage point lead over AOA and a much larger margin over the S&P 500 (SPY).

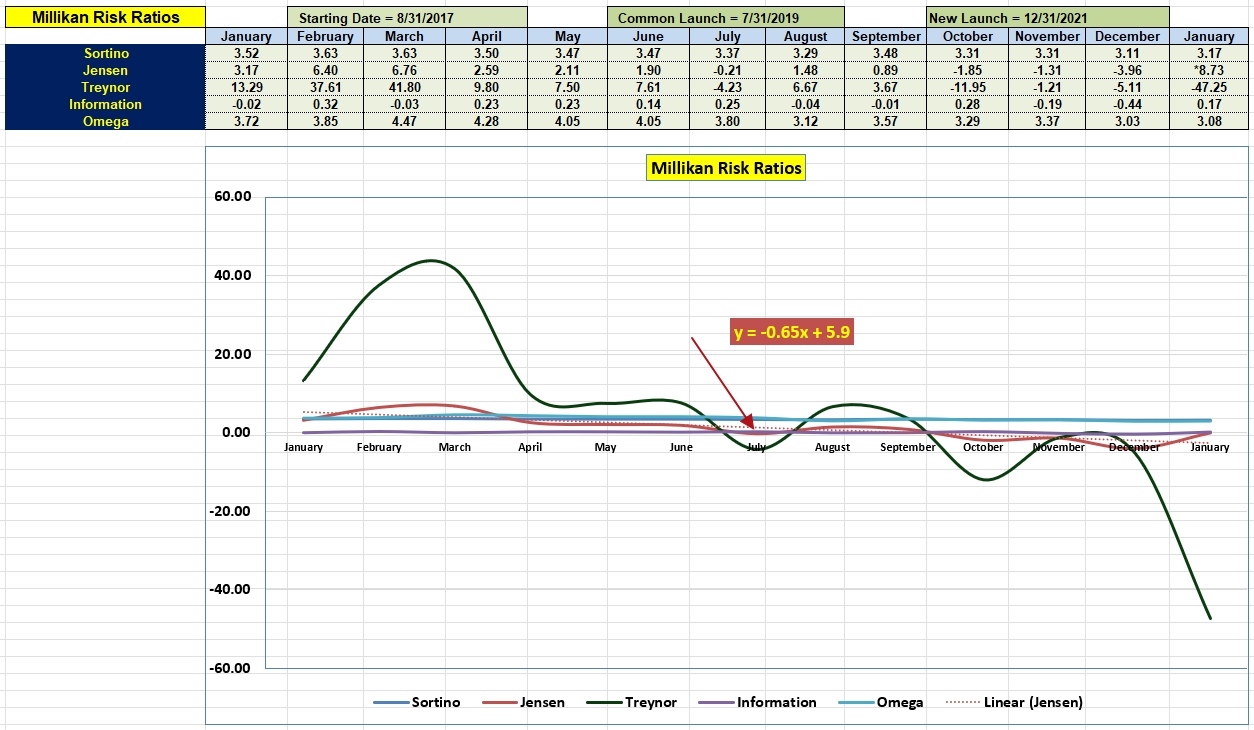

Millikan Risk Ratios

Correction. The * in front of the January Jensen should be a negative sign.

Expect a difficult market over the first six to nine months as the country works to lower inflation and muddles through the debt limit crisis. A recession looms on the horizon for two reasons. First, the economics or poor congressional decisions might create one. Second, when there is so much talk about a possible recession, just the discussion will make consumers skittish and the economy will slow down as a result. Call it self-fulfilling prophecy. The Millikan is well positioned to take advantage of a recession as are all the Sector BPI portfolios.

The ITA blog is now free to anyone who registers as a Guest. Once registered, I will elevate you to the Platinum level so you see more of the blog.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.