Movie Set

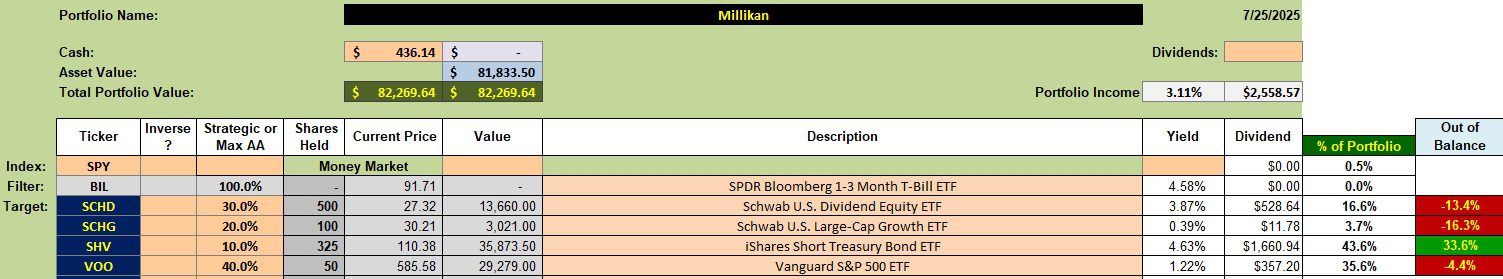

Millikan is one of several Asset Allocation portfolios, but with a narrowly defined set of securities. Currently I am playing it safe as this is an over-heated market. Playing it safe means that I am overloading the portfolio using the short-term treasury SHV. Should the market decline I will slowly move back into VOO and then pursue SCHG and SCHD.

Millikan Security Holdings

Below are the current securities and the percentages held in the Millikan. Thus far this limited set of securities are performing quite well.

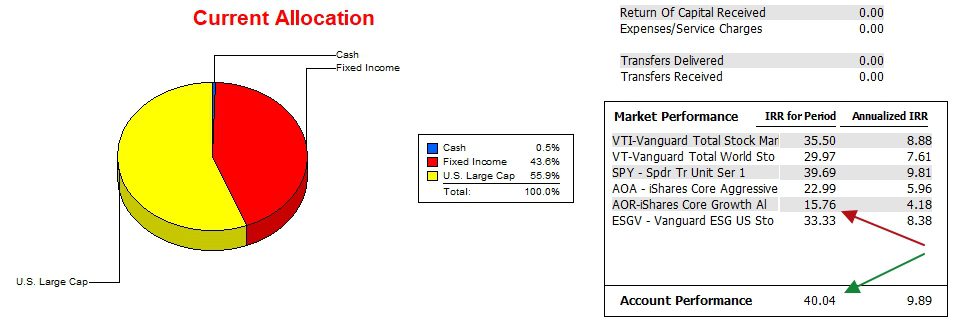

Millikan Performance Data

Since 12/31/2021 the Millikan has outperformed all six benchmarks tracked using the Information Account Manager software. The edge over the S&P 500 is slight and can really be considered a “photo finish.” Once more, we see how strong the S&P 500 (SPY) is during all types of markets.

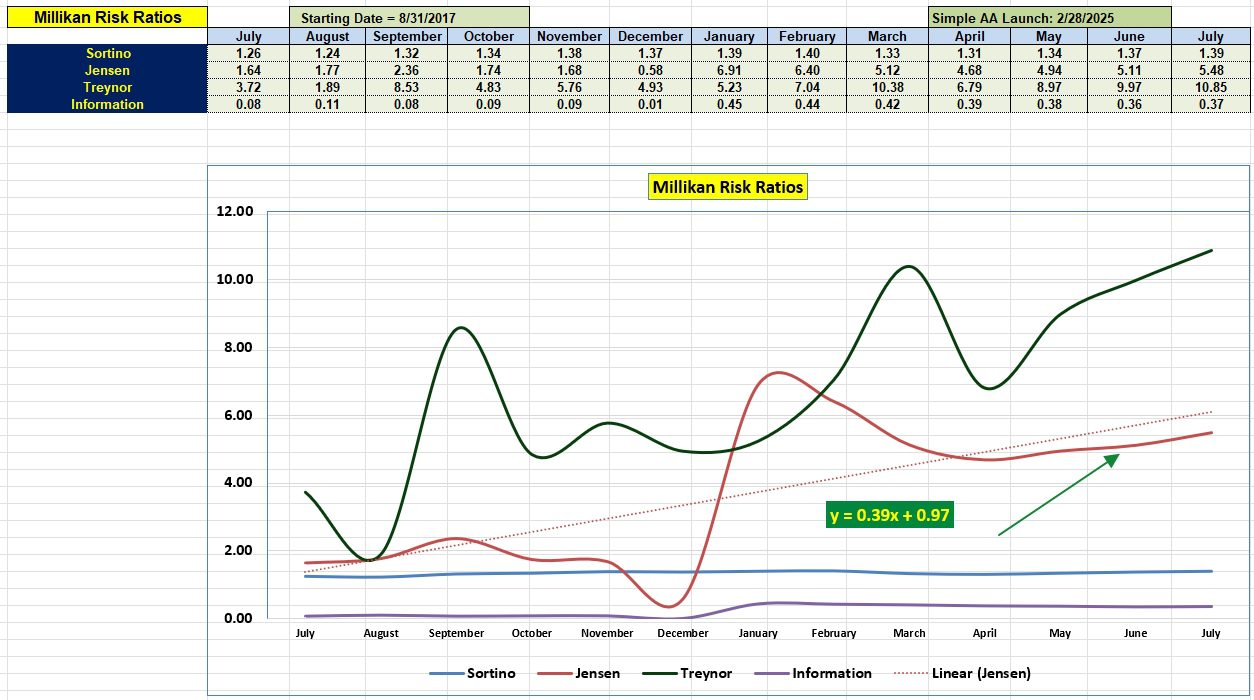

Millikan Risk Ratios

Is this focused portfolio a high risk account? The data indicates it is somewhat conservative when one checks how well the portfolio has performed with this new approach. Launched in late February of this year the Sortino has held even and the Jensen has consistently been quite high.

The Information Ratio indicates the Millikan lost ground to the AOR benchmark since last January, but is still quite strong.

Expect the slope of the Jensen to remain positive until January of 2026.

Millikan Sector BPI Portfolio Review: 10 May 2024

Millikan Sector BPI Portfolio Review: 6 September 2024

Questions To Ask Your Money Manager

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question