Cowboy – Statue located in underground “city” in Pendleton, Oregon

Within the last few weeks I set up the Carson and Franklin to operate as Sector BPI portfolios. Over the next few weeks the Millikan and Gauss will join the original two. The Millikan and Gauss are laggards and not performing as well as expected. That is the motivation for the change.

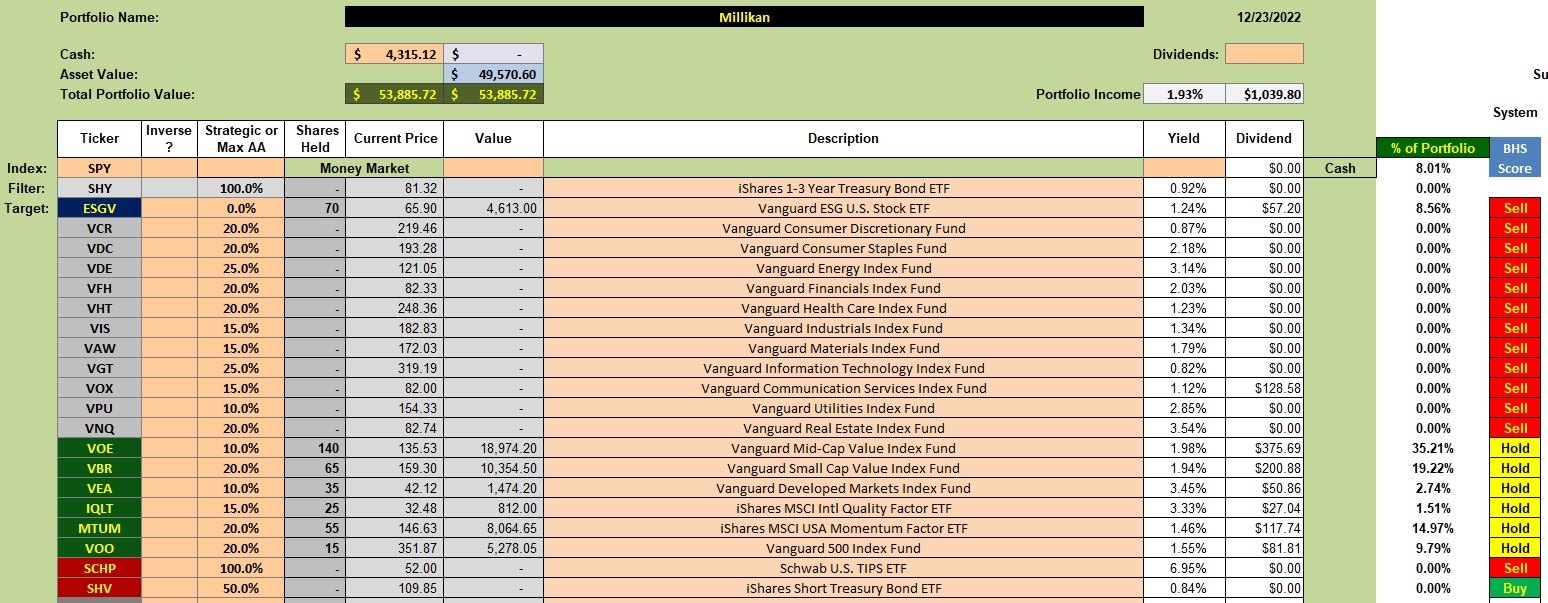

Millikan Investment Quiver

In the following table ITA readers will notice the current holdings in the Millikan portfolio and the availability of the sector ETFs as this portfolio begins its migration from a Relative Strength Model portfolio over to the Sector BPI Model. Here is how I’m handling the migration.

- TSLOs of 3% to 4% are set for the current holdings. I considered setting the limits higher to make sure to sweep up the fourth quarter dividends, but I’m sticking with the original TSLO plan.

- Limit orders are set to purchase a few shares of Energy (VDE), Technology (VGT), and Real Estate (VNQ). Since cash is limited, until equity ETFs are sold, money to purchase sectors is limited.

- Once the TSLOs are struck the cash will be used to fill the maximum percentage of the over-bought sectors. Should the BPI recommendations change when new cash is available, I’ll follow the BPI rules. When matching the maximum percentages I round the number shares to the nearest five (5) shares. If this is somewhat confusing, I’ll clarify as the Sector BPI portfolios are reviewed.

Use the magnifier in the upper right-hand corner and search for Carson if you wish more information on the Sector BPI Model.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.