Scene near one of the entrances to Yosemite National Park.

February is here and it is time for the crocus to bloom in Oregon. Early in any given month is an excellent time to review the Schrodinger as no decisions are required. This is a Save & Watch style portfolio that Schwab calls their Intelligent Portfolio model.

Schwab currently requires an initial investment of $5,000 to open up an Intelligent Portfolio account. After answering a few question the account is open and all the owner needs to do is add new money and watch the portfolio grow.

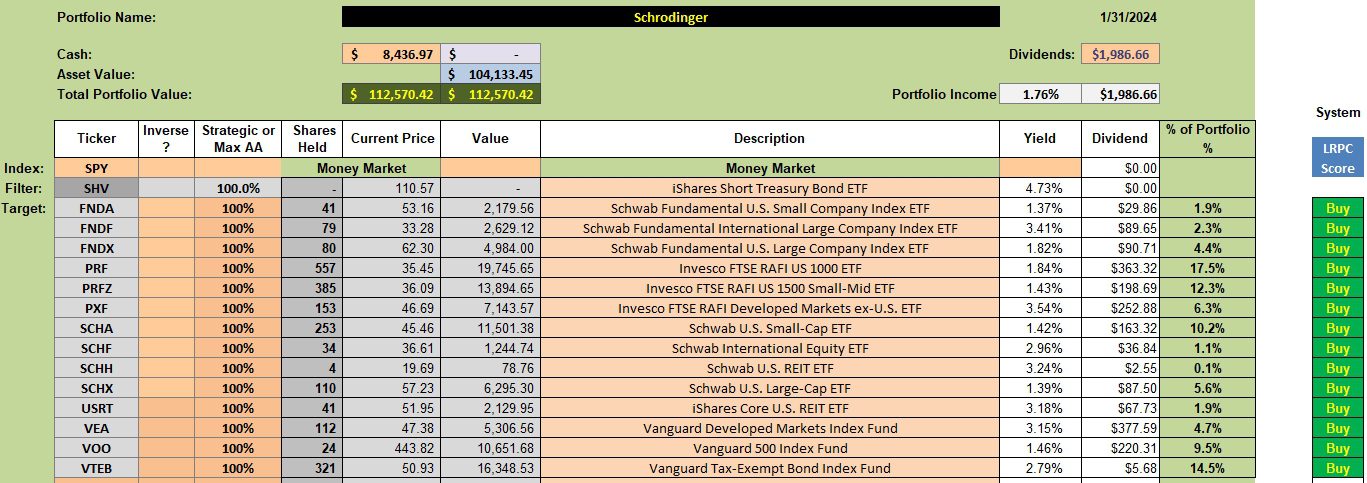

Schrodinger Holdings

Below is an example Intelligent Portfolio. There are times when the asset allocation is somewhat puzzling. As a general rule, if a security is not 3% or more of the total portfolio it has little impact on performance. Two REIT ETFs (SCHH and USRT) are too small a percentage of the total portfolio and as such are close to “useless.”

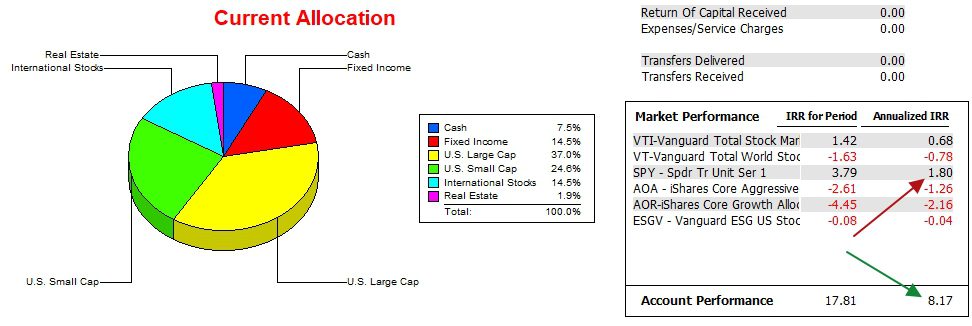

Schrodinger Performance Data

Over the past 25 months the Schrodinger opened up a significant lead on the SPY benchmark. The Schrodinger consistently ranks in the top quartile of all the ITA portfolios tracked on this blog. That is an excellent record.

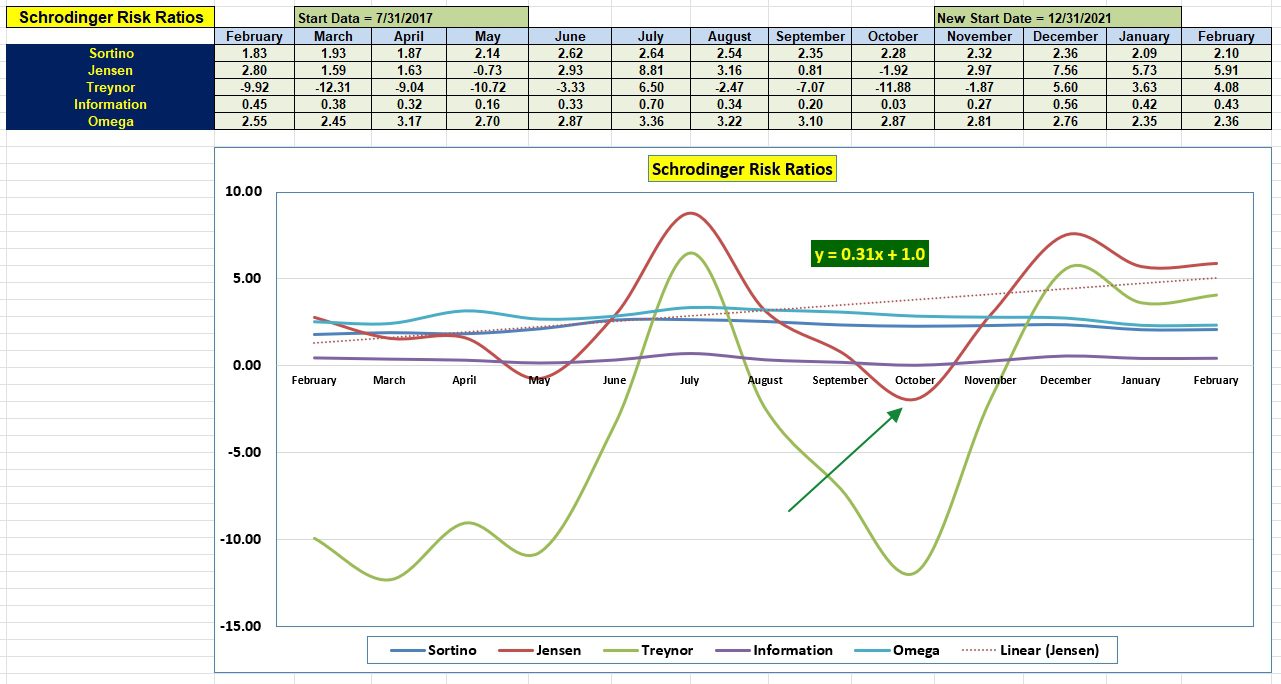

Schrodinger Risk Ratios

Don’t pay too much attention to the February 2024 data as this information is only a few hours old. Pay more attention to the slope of the Jensen Performance Index (0.31). Based on the Information Ratio the Schrodinger topped the SPY benchmark every month over the past year.

I highly recommend the family portfolio include at least one Schrodinger style portfolio.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.