Viaduct Harbor, Auckland, New Zealand

As I have mentioned in recent reviews of the Rutherford Portfolio I have to take money out of this retirement account so, following last week’s review of Tranche 5, I have “retired” Tranche 5 and adjusted the other 4 tranches to $19,000 each – or a total portfolio value of $76,000. I will continue to use the rotation model to manage this portfolio and will review each tranche every 4 weeks rather than every 5 weeks as in the past. I will continue the weekly reviews as I rotate through the 4 tranches.

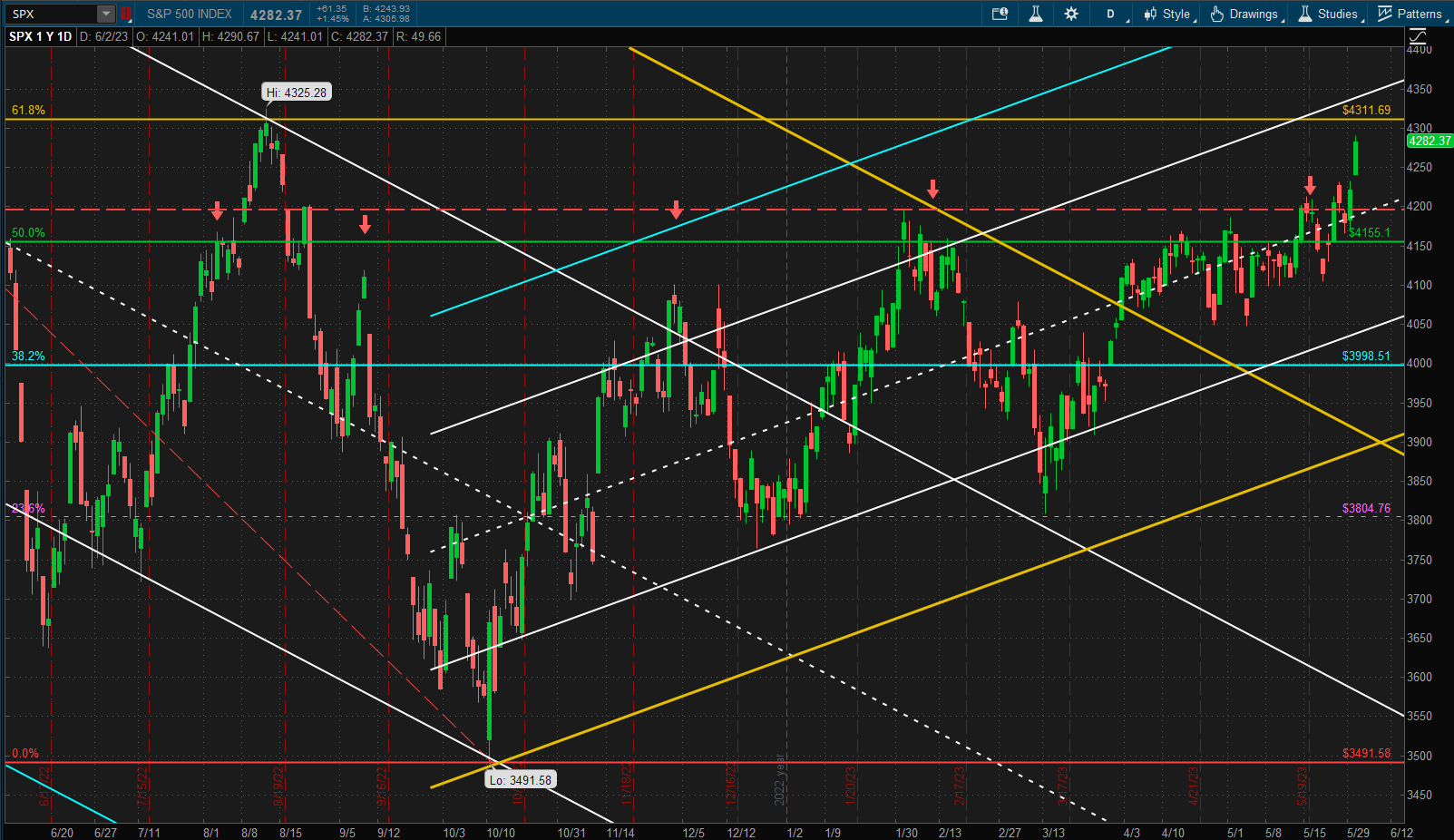

As usual I will start this review with a look at the performance of US equities over the past week:

where we can see that we have finally managed to break through the 4200 resistance zone that we have been struggling with for the past 12 months. It looks as though we can finally declare that we are now in a confirmed uptrend – although we can still maybe expect to find a little more resistance at ~4300, the 52-week (12 month) high reached last August, before seeing clear air overhead.

where we can see that we have finally managed to break through the 4200 resistance zone that we have been struggling with for the past 12 months. It looks as though we can finally declare that we are now in a confirmed uptrend – although we can still maybe expect to find a little more resistance at ~4300, the 52-week (12 month) high reached last August, before seeing clear air overhead.

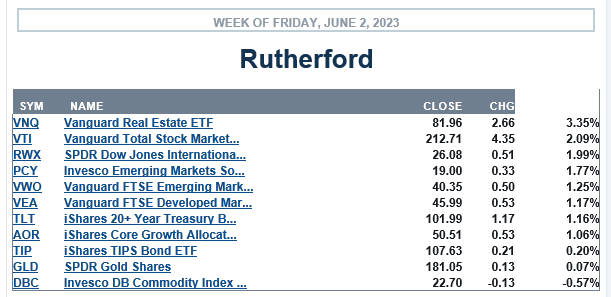

This week’s strong performance places US equities near the top of the parformance list of the major asset classes:

with Real Estate (both US and International) also showing strength. Only Commodities showed losses on the week.

with Real Estate (both US and International) also showing strength. Only Commodities showed losses on the week.

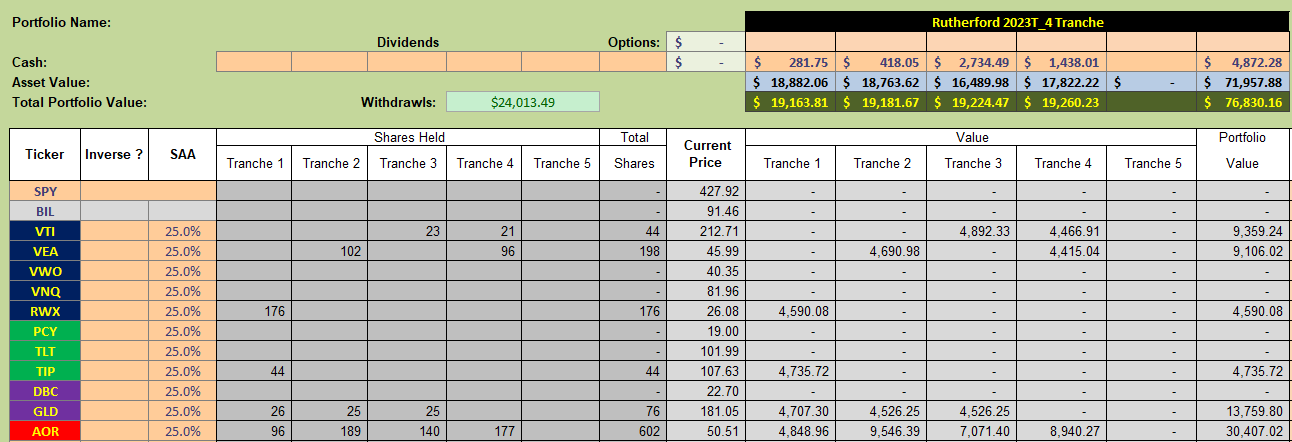

Let’s take a look at current holdings in the 4 remaining tranches of the Rutherford Portfolio:

where we see a pretty well balanced allocation of funds between the different asset classes.

where we see a pretty well balanced allocation of funds between the different asset classes.

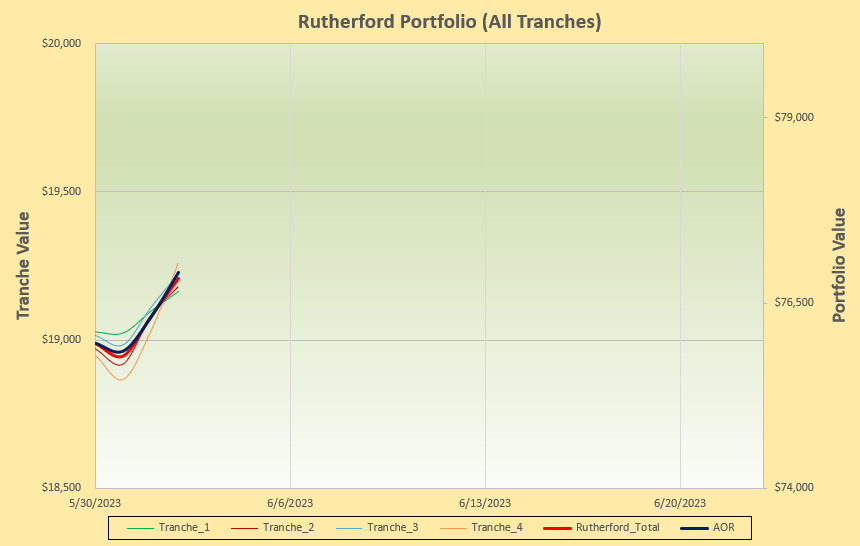

In terms of performance there isn’t a lot to see at present due to the rebalancing:

but at least it doesn’t look as though we’ve missed out too much relative to the benchmark AOR Fund.

but at least it doesn’t look as though we’ve missed out too much relative to the benchmark AOR Fund.

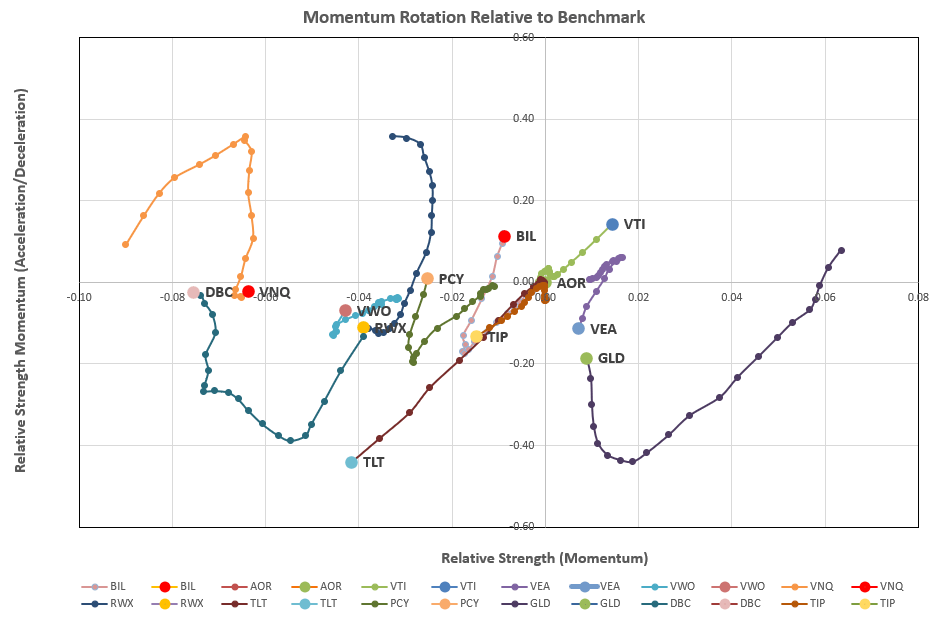

We’ll take a look at the rotation graphs:

where we see VTI (US Equities) firing nicely into that desirable top right quadrant. So we’ll check on the recommendations from the rotation model:

where we see VTI (US Equities) firing nicely into that desirable top right quadrant. So we’ll check on the recommendations from the rotation model:

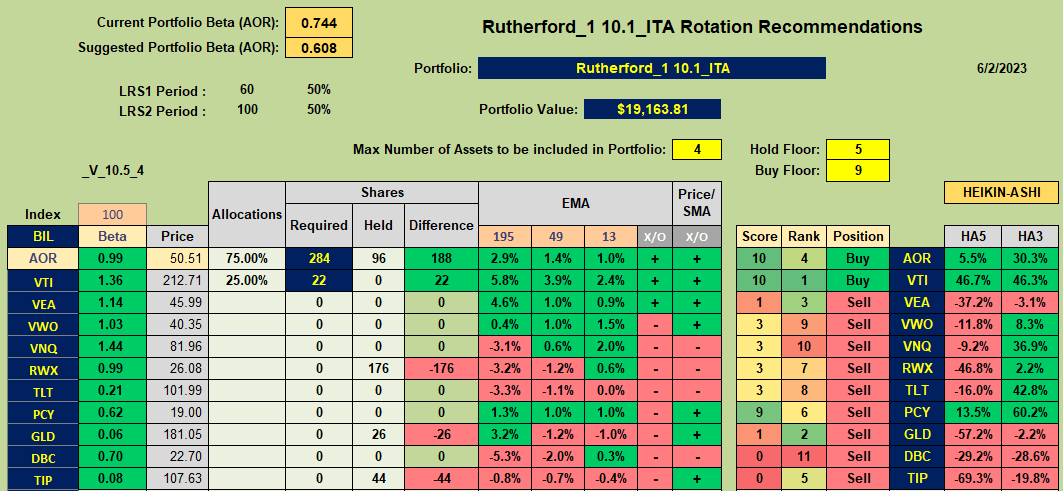

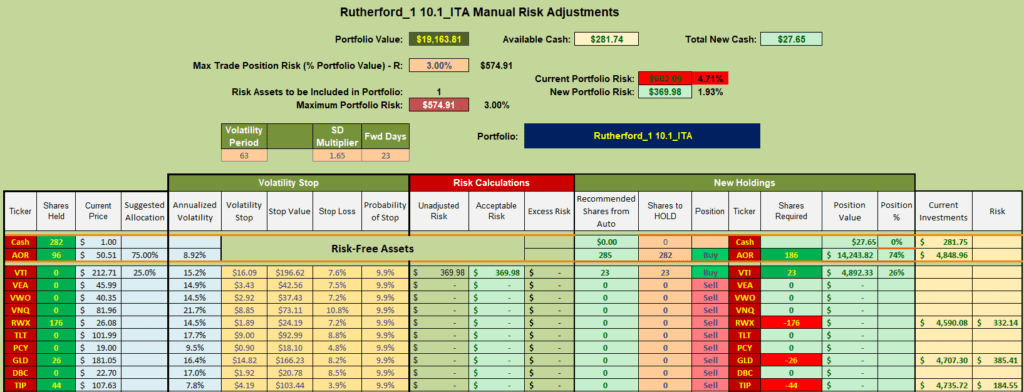

that confirms the Buy recommendation for VTI and also for AOR, the benchmark fund. RWX, GLD and TIP, currently held in Tranche 1 (the focus of this week’s review), are all recommended Sells. Adjustments for this week therefore look like this:

that confirms the Buy recommendation for VTI and also for AOR, the benchmark fund. RWX, GLD and TIP, currently held in Tranche 1 (the focus of this week’s review), are all recommended Sells. Adjustments for this week therefore look like this:

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.