American War Memorial, Cambridge, England

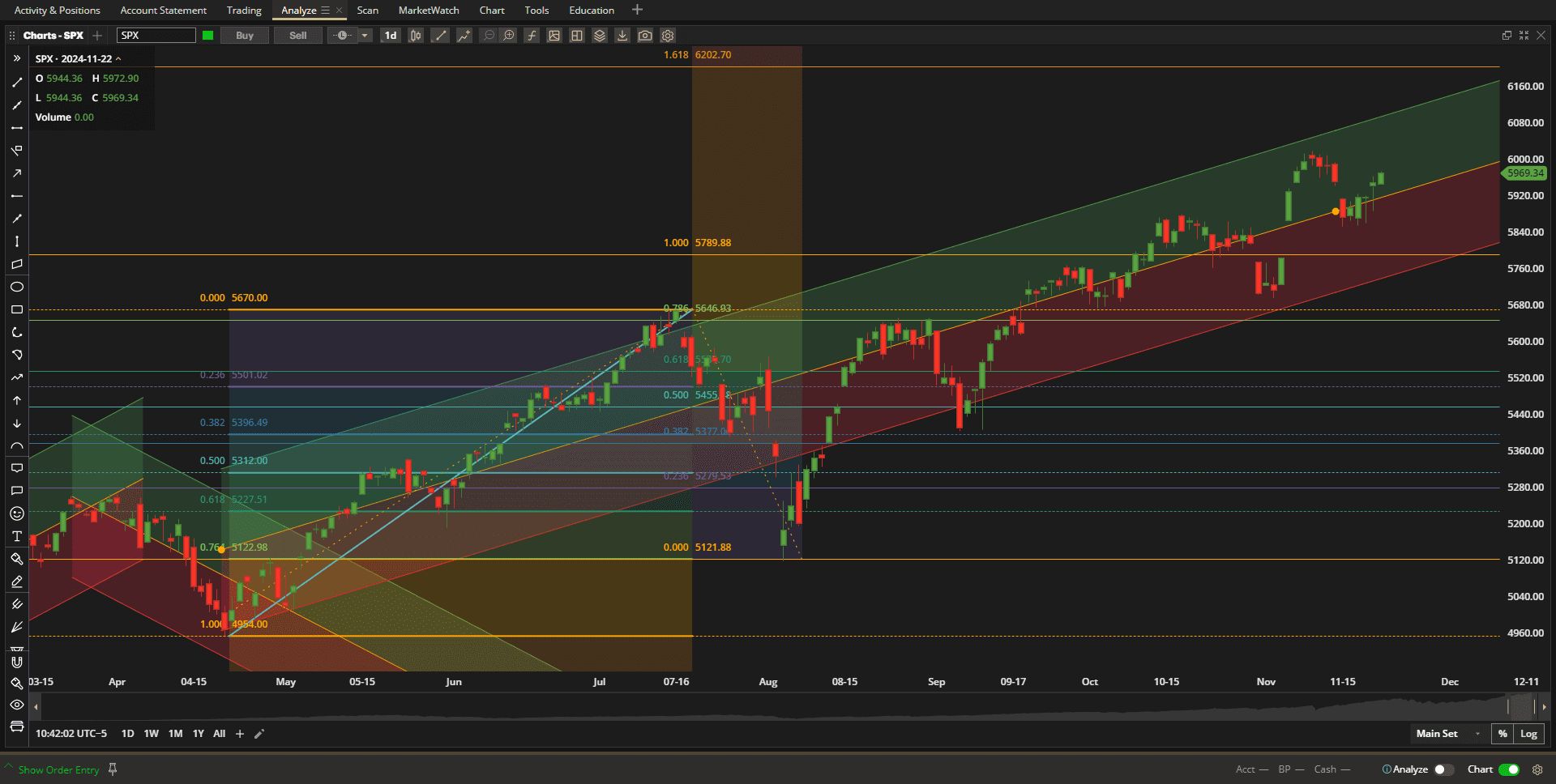

US equities recovered from last week’s pullback and bounced to test the 6000 level in the SPX (S&P 500 Index):

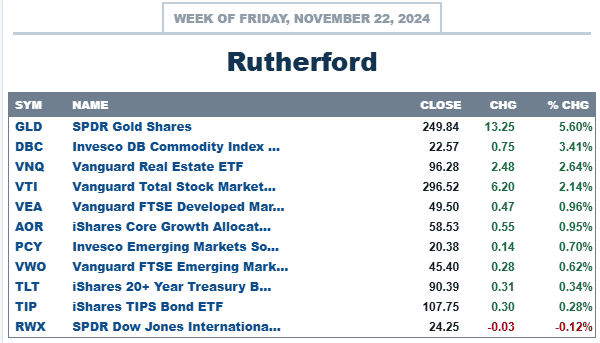

Prices were up ~2% from last week’s close and this placed US Equities near the top of the asset classes in terms of relative oerformance, although beaten out of the top spots by Gold and Commodities that were very strong:

Prices were up ~2% from last week’s close and this placed US Equities near the top of the asset classes in terms of relative oerformance, although beaten out of the top spots by Gold and Commodities that were very strong:

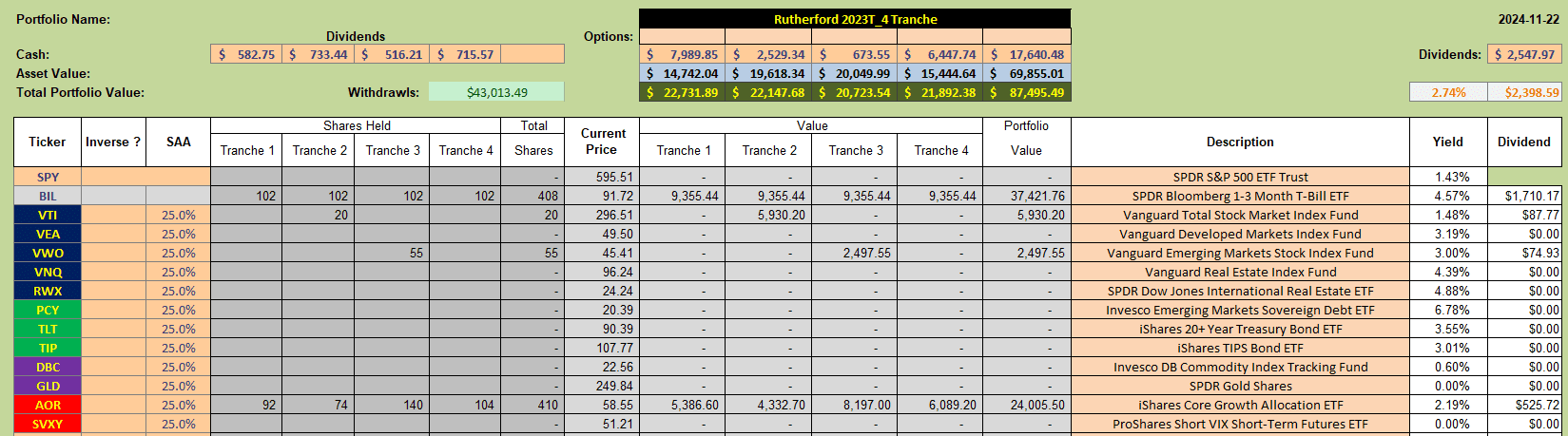

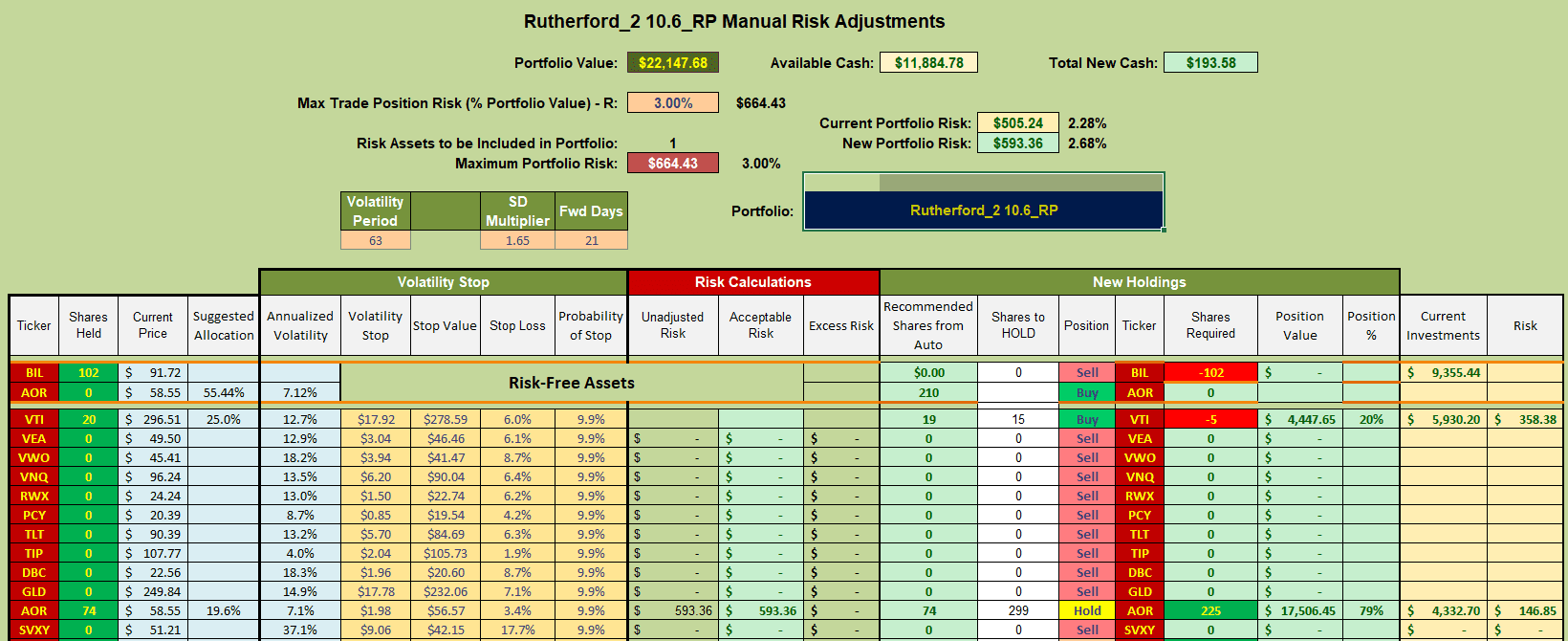

As I am winding down the Rutherford Portfolio in order to manage it in a different way, current holdings look like this:

As I am winding down the Rutherford Portfolio in order to manage it in a different way, current holdings look like this:

with major holdings in the benchmark AOR Fund and Short-term T-Bills (BIL) and small holdings in US Equities (VTI) and Emerging Market Equities (VWO).

with major holdings in the benchmark AOR Fund and Short-term T-Bills (BIL) and small holdings in US Equities (VTI) and Emerging Market Equities (VWO).

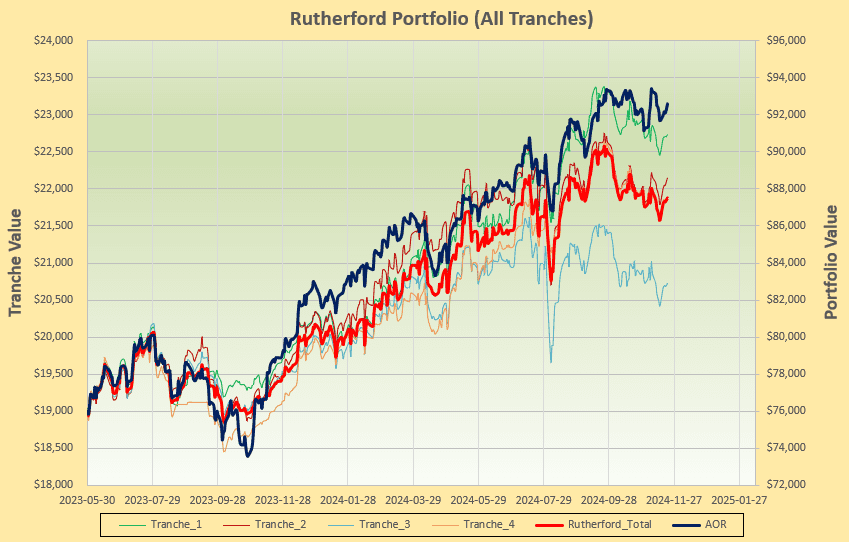

Recent performance has looked like this:

and has lost out to the benchmark as a result of the high BIL (Cash) holdings.

and has lost out to the benchmark as a result of the high BIL (Cash) holdings.

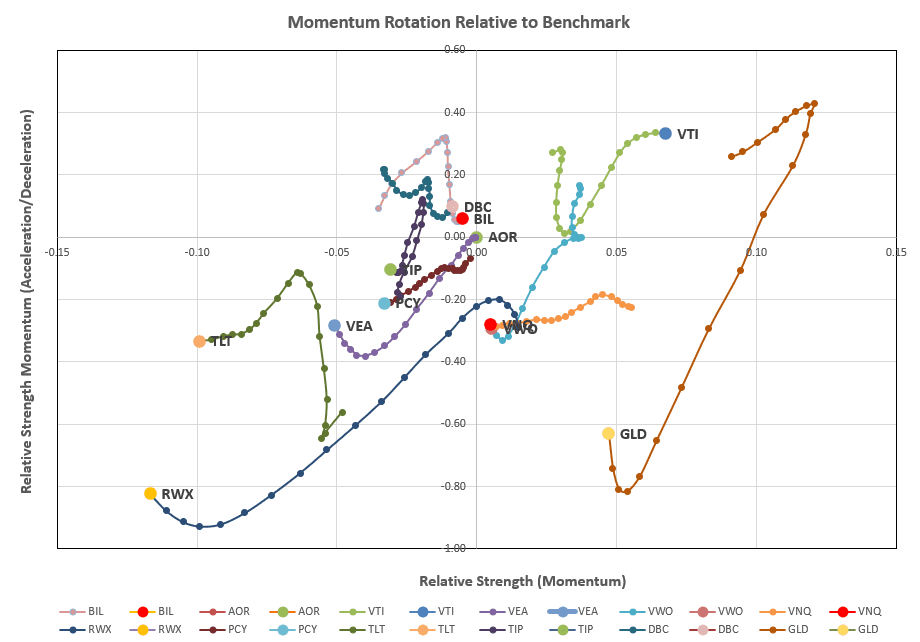

Checking to see if any adjustments are required in Tranche 2 (the focus of this week’s review) we see the following rotation picture:

with GLD showing a short-term turn-around following a strong 2-week decline and VTI strengthening steadily in the top right quadrant.

with GLD showing a short-term turn-around following a strong 2-week decline and VTI strengthening steadily in the top right quadrant.

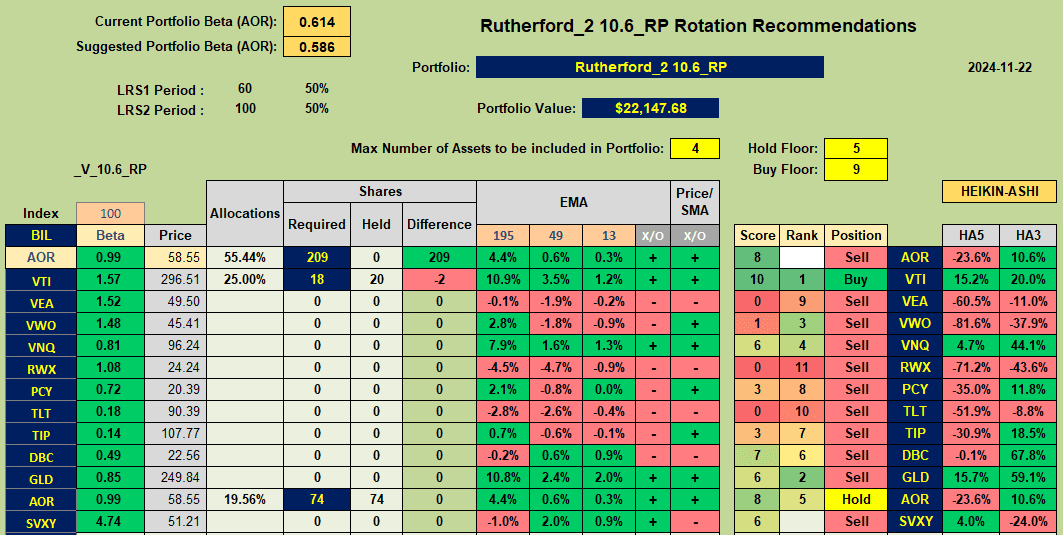

Recommendations from the rotation model algorithm look like this:

with a Buy recommendation for VTI and a Hold recommendation for AOR. Since these assets are currently held in Tranche 2:

with a Buy recommendation for VTI and a Hold recommendation for AOR. Since these assets are currently held in Tranche 2:

I shall not make any adjustments this week so as to avoid trading costs.

I shall not make any adjustments this week so as to avoid trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question