Double Rainbow (2nd image to right of primary rainbow)

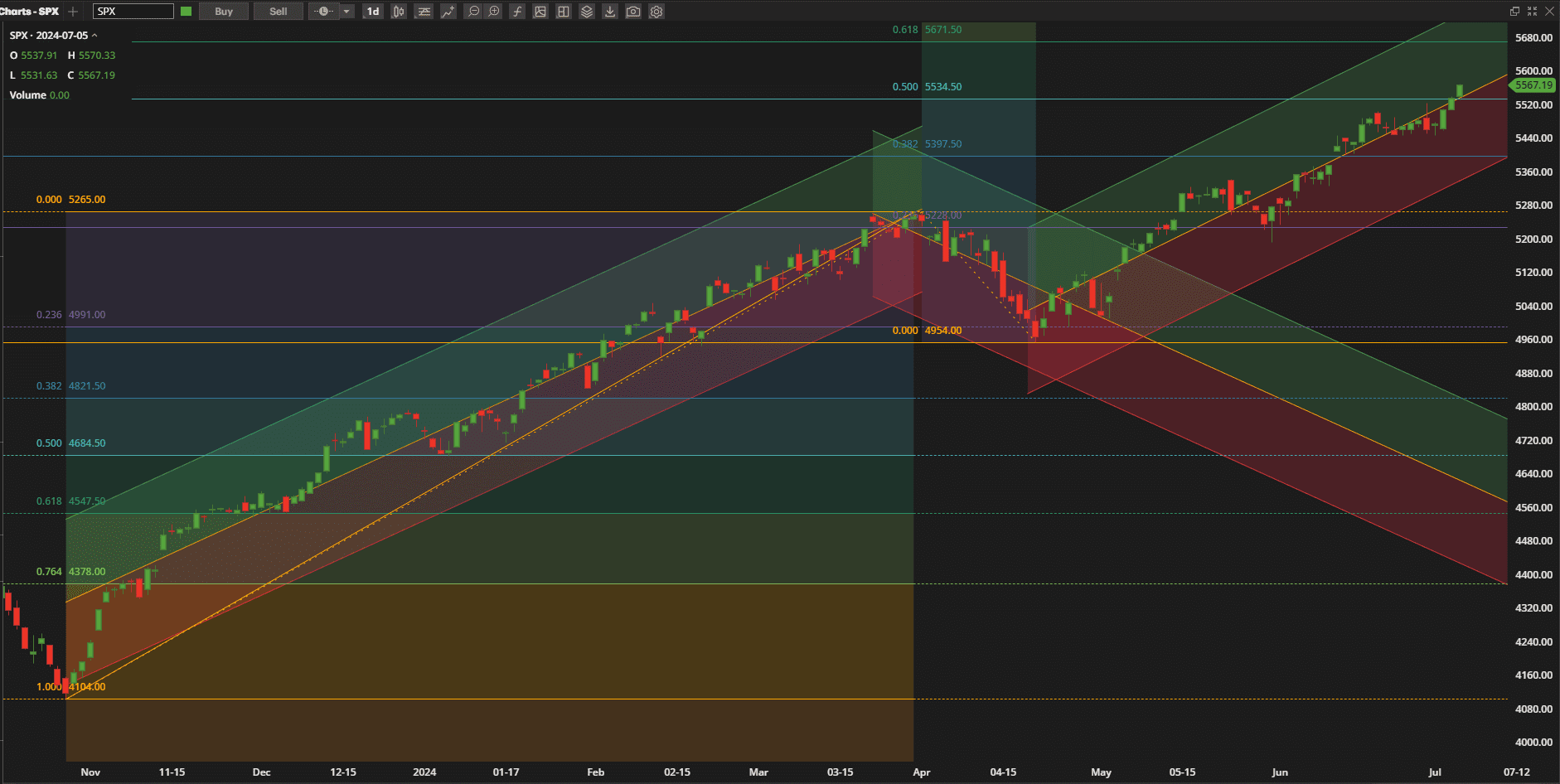

Another bullish week in US Equity markets and another week with new all-time highs – the momentum continues:

We finally broke through the ~5500 level in the SPX (S&P 5oo Index) that also corresponded to a ~50% extension of the prior (Nov 2023 – April 2024) bullish move from the lows of the mid-April pullback. It is always difficult to predict/project where trends might end but the next possible area of resistance might be at the 61.8% extension level or ~5670.

We finally broke through the ~5500 level in the SPX (S&P 5oo Index) that also corresponded to a ~50% extension of the prior (Nov 2023 – April 2024) bullish move from the lows of the mid-April pullback. It is always difficult to predict/project where trends might end but the next possible area of resistance might be at the 61.8% extension level or ~5670.

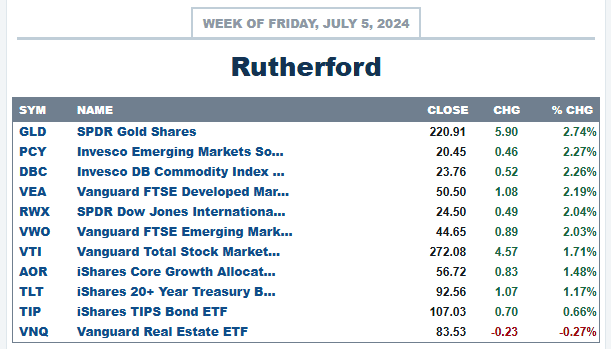

Despite this continued strength in US equities other major asset classes showed stronger performance over the past week:

with VTI falling in the lower half of the list.

with VTI falling in the lower half of the list.

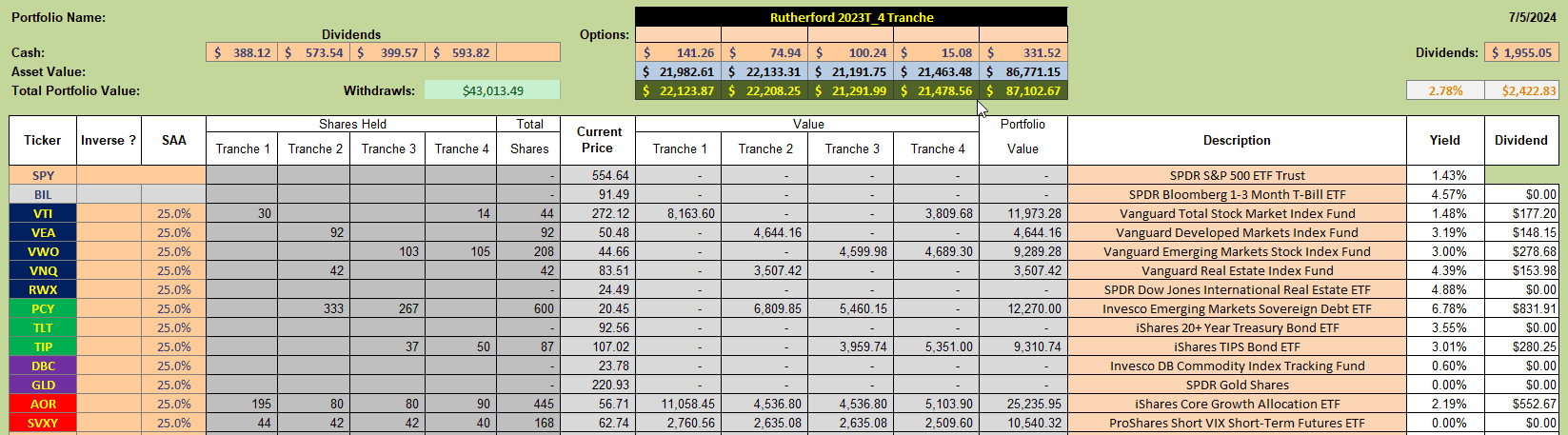

Current holdings in the Rutherford portfolio look like this:

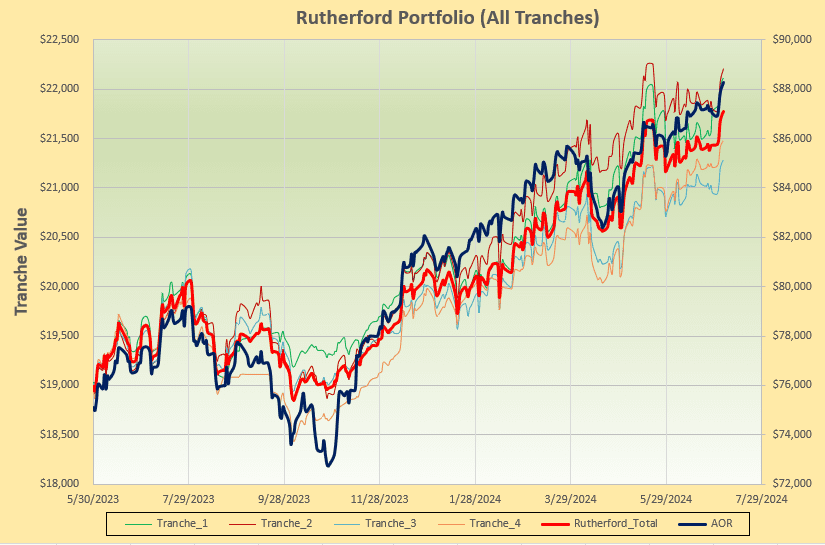

with recent performance:

with recent performance:

showing the portfolio slowly catching up to the benchmark AOR Fund.

showing the portfolio slowly catching up to the benchmark AOR Fund.

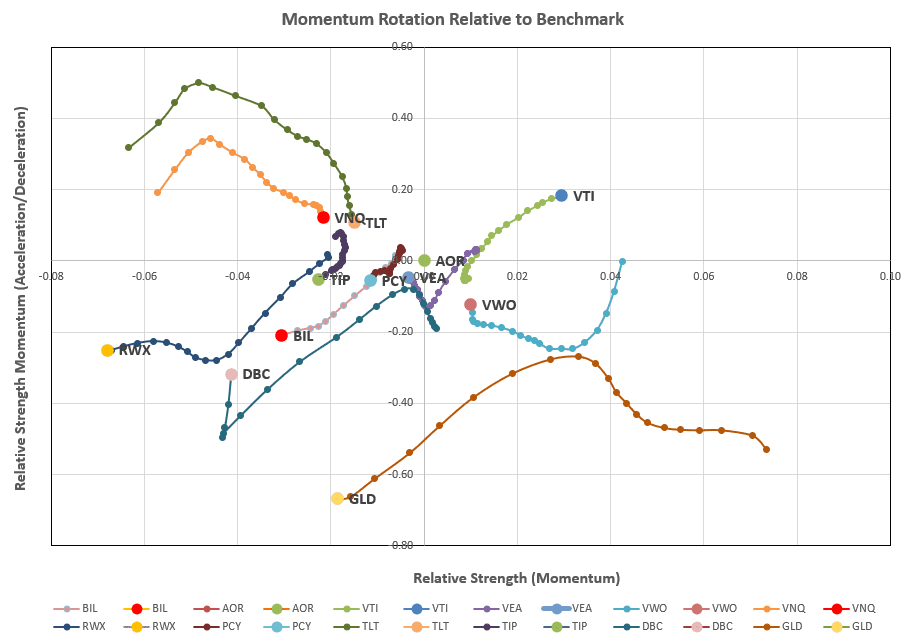

Tranche 2 (the focus of this week’s review) is holding positions in VEA (Developed Market equities), VNQ (US Real Estate), PCY (Emerging Market Bonds) and the benchmark AOR Fund in addition to a ~10% allocation to the inverse volatility SVXY ETF. Checking the rotation graphs:

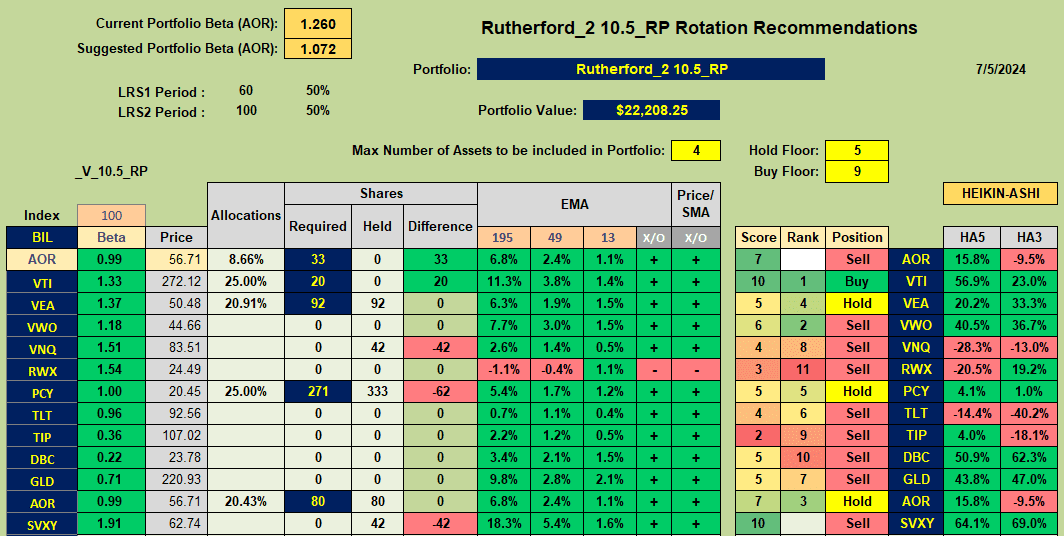

VTI remains the strongest looking performer (positive movement in the desirable top right quadrant) – so it is not surprising to see the following rankings and recommendations when looking for possible adjustments:

VTI remains the strongest looking performer (positive movement in the desirable top right quadrant) – so it is not surprising to see the following rankings and recommendations when looking for possible adjustments:

VTI shows as a recommended Buy with VEA, PCY and AOR as holds. VNQ gets a Sell recommendation as a result of weaker relative strength.

VTI shows as a recommended Buy with VEA, PCY and AOR as holds. VNQ gets a Sell recommendation as a result of weaker relative strength.

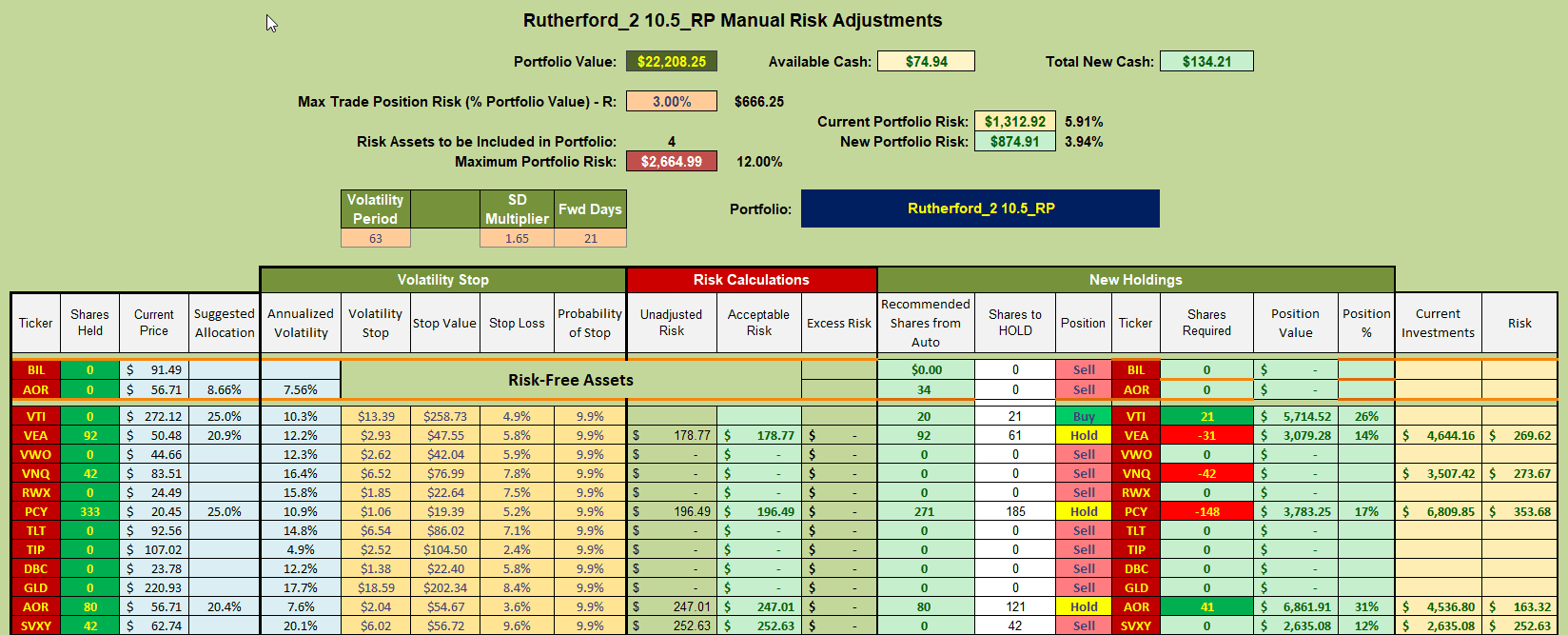

Accordingly, this week’s adjustments will look something like this:

where I shall be selling holdings in VNQ and using the funds to buy shares in VTI. I will not bother to make minor adjustments to other holdings.

where I shall be selling holdings in VNQ and using the funds to buy shares in VTI. I will not bother to make minor adjustments to other holdings.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.