Sunset over the Pacific Ocean (Australia)

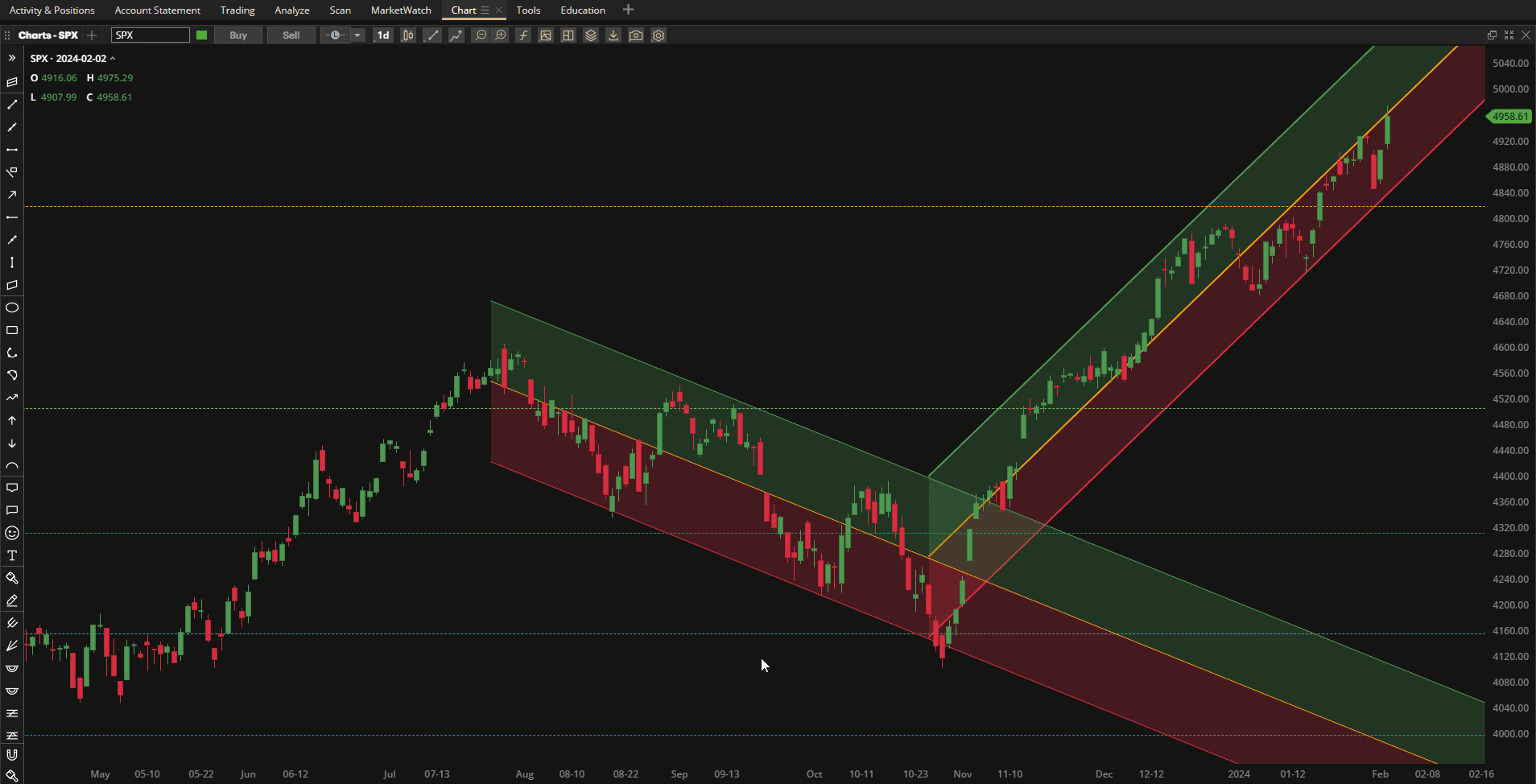

It was a relatively volatile week in the US equity markets last week with a bit of a scare on Wednesday but, in the end, the markets ended up a little over 1% from last week’s close:

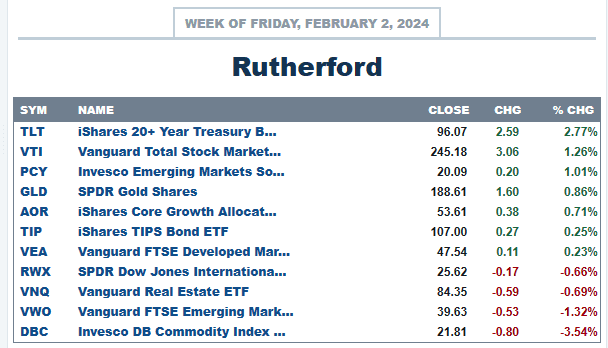

This placed US equities near the top of the list of major asset classes in terms of performance, although, maybe surprisingly, US treasuries doubled those returns:

This placed US equities near the top of the list of major asset classes in terms of performance, although, maybe surprisingly, US treasuries doubled those returns:

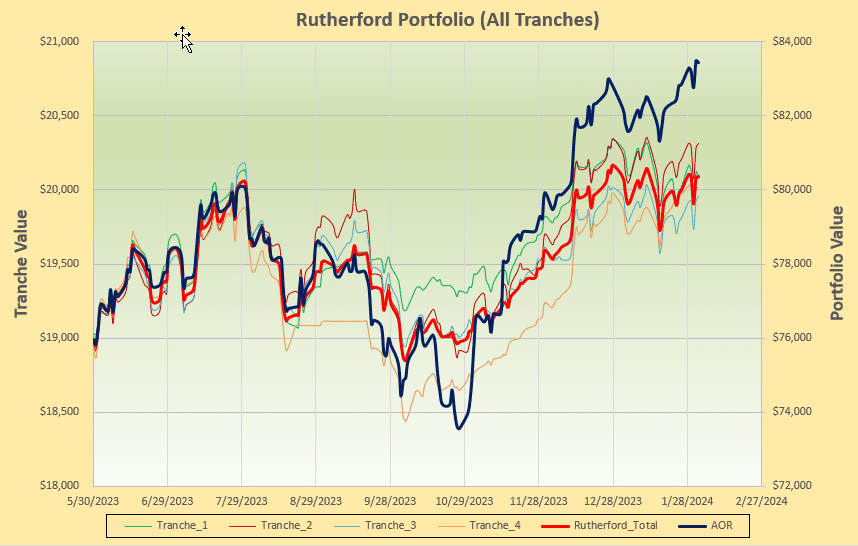

In terms of portfolio performance (I have now caught up on intended adjustments) the Rutherford portfolio looks like this:

In terms of portfolio performance (I have now caught up on intended adjustments) the Rutherford portfolio looks like this:

so, we have underperformed the benchmark slightly (maybe due to my failure to make adjustments – but more likely to a weakness in the algorithm being used). When I have a little more time, I plan to revisit this algorithm since I still have not been able to take advantage of rotation analysis when it seems obvious that there should be something to be gained from so doing.

so, we have underperformed the benchmark slightly (maybe due to my failure to make adjustments – but more likely to a weakness in the algorithm being used). When I have a little more time, I plan to revisit this algorithm since I still have not been able to take advantage of rotation analysis when it seems obvious that there should be something to be gained from so doing.

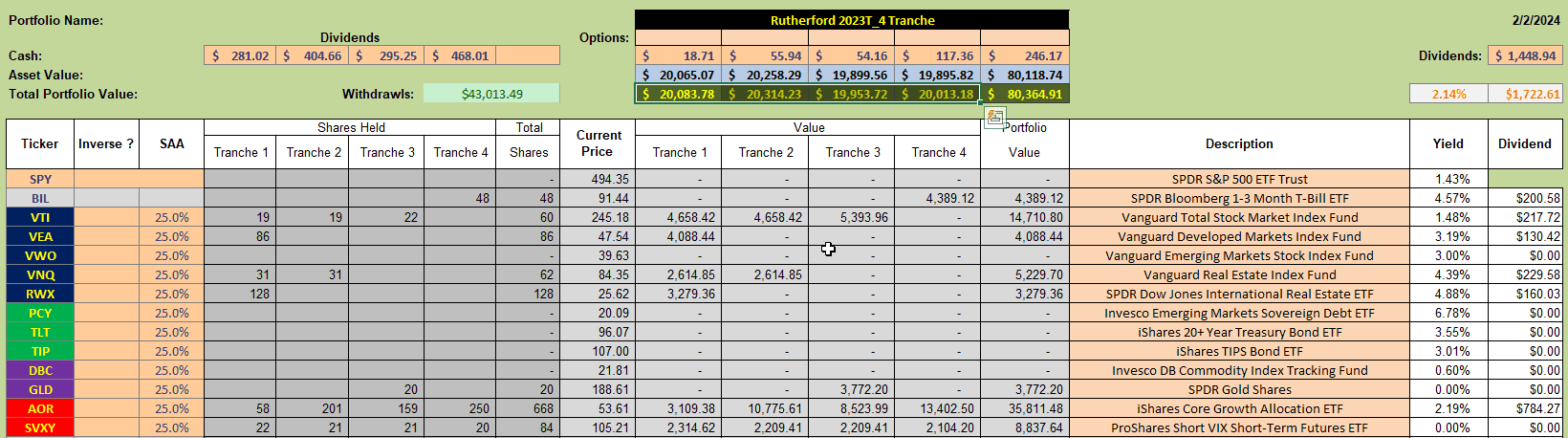

After my (catch-up) adjustments, holdings in the Portfolio look like this:

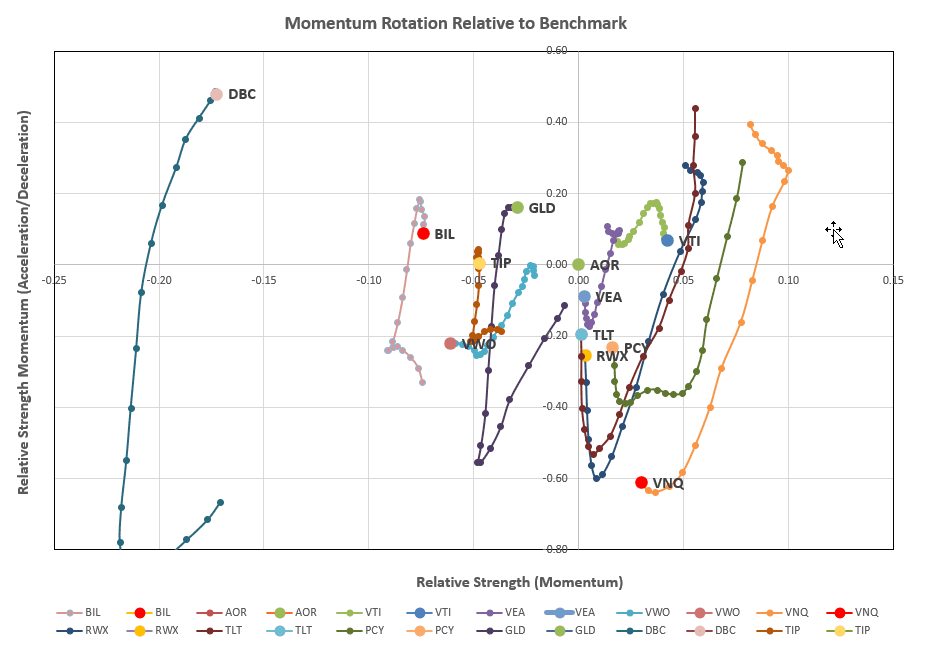

with a relatively strong bias towards equities. So, we will check on the rotation graphs to see if any adjustments may be called for in Tranche 4 (the focus of this week’s review):

with a relatively strong bias towards equities. So, we will check on the rotation graphs to see if any adjustments may be called for in Tranche 4 (the focus of this week’s review):

Here we see that only VTI remains in the desirable top right quadrant albeit with weakening momentum (downward vertical movement). On the other hand, most of the other asset classes are showing relative short-term strength (upward vertical movement) and maybe heading for that quadrant sometime in the future.

Here we see that only VTI remains in the desirable top right quadrant albeit with weakening momentum (downward vertical movement). On the other hand, most of the other asset classes are showing relative short-term strength (upward vertical movement) and maybe heading for that quadrant sometime in the future.

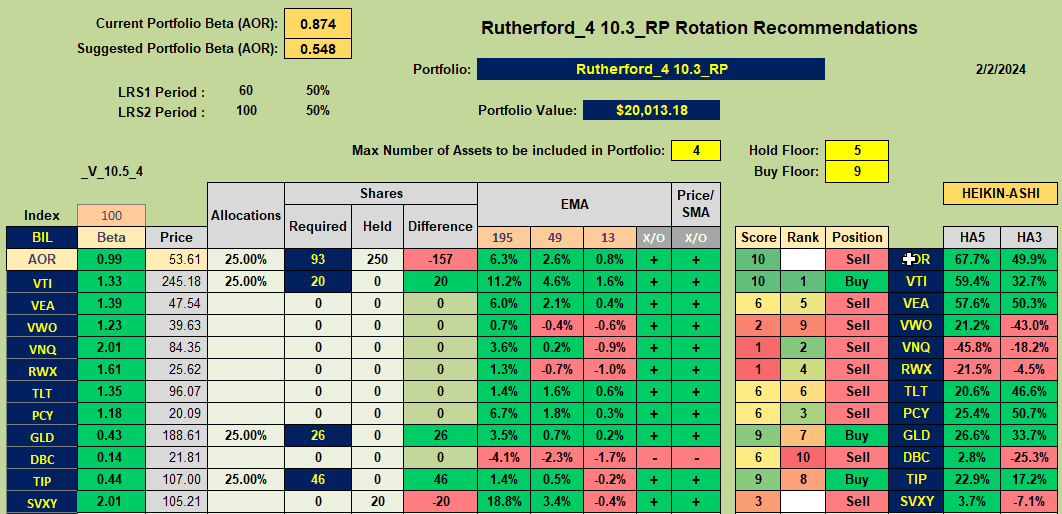

Let’s see what recommendations come out of the rotation algorithm:

and we see Buy recommendations for VTI (not surprisingly), GLD and TIP with Sell recommendations for everything else.

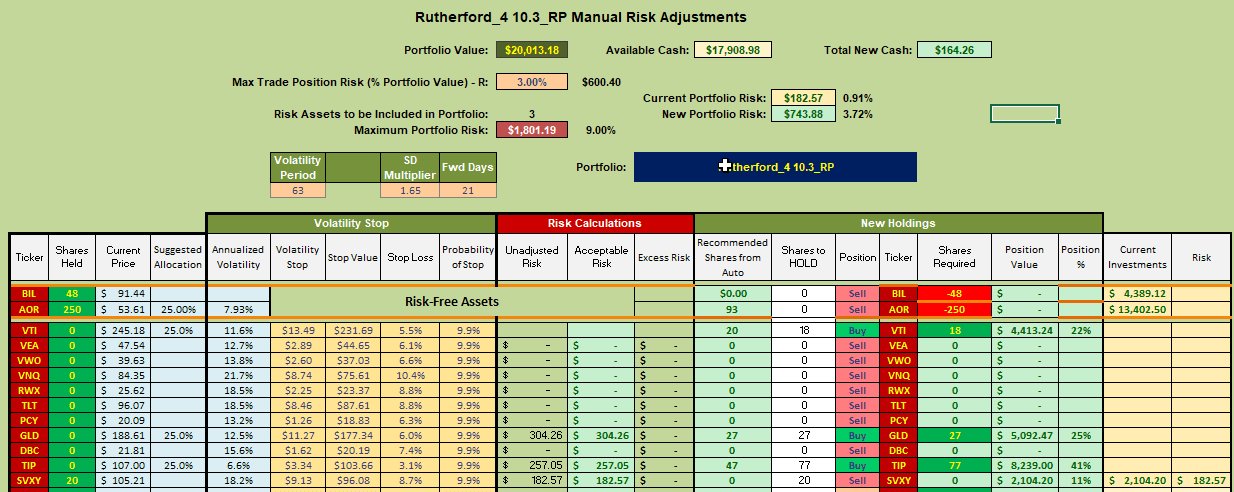

Following these recommendations, adjustments for next week look something like this:

where I shall be selling current holdings in BIL and AOR (since 100% of available funds will be allocated to funds expected to perform better than AOR – the benchmark) and buying new positions in VTI, GLD and TIP.

where I shall be selling current holdings in BIL and AOR (since 100% of available funds will be allocated to funds expected to perform better than AOR – the benchmark) and buying new positions in VTI, GLD and TIP.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.